Summary:

- The company reported solid Q3 2024 earnings on November 13, but investor sentiment remains cautious due to interest rates rising in Brazil.

- Long-term investment in Nu Holdings remains compelling, driven by its robust business model and growth potential in the Latin American online banking sector.

- Nu Holdings’ credit expansion strategy and solid financial performance underpin my continued buy rating despite short-term market volatility.

FG Trade

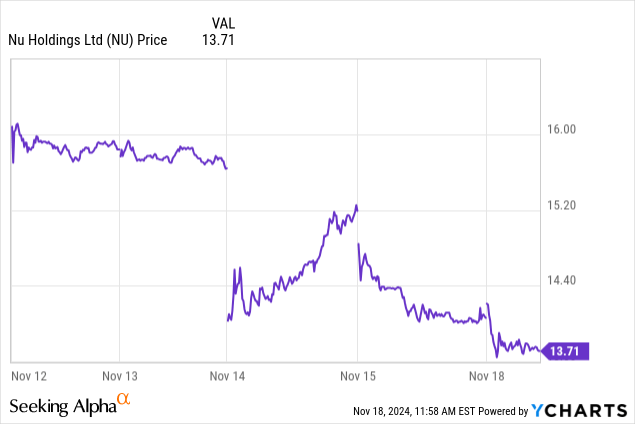

I have recommended Nu Holdings (NYSE:NU) five times over the last three years. My best-performing recommendation is from October 8, 2023, and it is up 89% compared to the S&P 500’s (SPX) 37% rise. My last recommendation is my worst-performing recommendation, a 5% loss compared to the S&P 500’s 5% rise. The company recently reported its third-quarter 2024 earnings on November 13. It missed revenue expectations, compounding the market’s increasing worry over the Brazilian economy, which has sapped much investor enthusiasm for investing in the stock. When Nu Holdings opened on November 14, it gapped down 9% and has yet to recover fully.

Although worries over the Brazilian economy are legitimate, the long-term reasons for investing in this Brazilian online bank remain the same. Nu Holdings has a large total addressable market in financial services in Latin America, but it has barely scratched the surface of penetrating the region. For instance, Statista estimates the 2024 Net Interest Income (“NII”) in the South American Banking market to reach $308.00 billion. Nu Holdings’ trailing 12-month (“TTM”) NII is $6.4 million, which means it has only captured 2% of the South American banking NII market share. The company has a first-mover advantage by becoming Latin America’s first digital-native banking platform in 2013. It has become very disruptive to legacy financial institutions in Latin America through its customer-centric focus and digital-first approach. Nu Holdings is taking market share in Brazil, Mexico, and Colombia.

This article will discuss Nu Holdings’ credit expansion and the risks in the Brazilian economy. It will also review the company’s recent earnings report, its valuation, and why I still maintain a buy on the stock.

Nu Holdings credit expansion in an uncertain Brazilian economy

Since the economy emerged from the pandemic downturn, Nu Holdings has become more aggressive in expanding its credit offerings. It has increased the number of credit cards issued and expanded into categories like personal loans and other innovative credit products.

Nu Holdings created a credit service in 2022 named Pix no Credito, which allows customers to use their credit card limit to make instant payments (Pix) and pay for them in installments. The Central Bank of Brazil introduced the Pix instant payment system on November 16, 2020. It is similar to FedNow (Created by the U.S. Federal Reserve) and Zelle (created by private U.S. banks). Outside of using it to send money to send and receive money with friends and family, users can use Pix to pay bills and taxes, make e-commerce or point-of-sale purchases, and withdraw money. When users use Nu Holdings Pix no Credito, the entity collecting the payment receives the total amount, while the sender can choose to make the payment in installments to Nu Holdings. The company also expanded credit for its customers in 2022 by allowing them to use their credit cards to pay boletos (bills) without using their regular credit limit. Chief Financial Officer (“CFO”) Guilherme Lago said the following about the Pix and Boletos strategy on the second quarter 2024 earnings call:

Interest-earning installment balance now represents 28% of our total credit card portfolio, up from 26% last quarter. Once again, this growth was fueled by the successful expansion of our PIX and Boleto financing products. This type of financing offers an attractive risk-adjusted rate of return, enabling us to further expand the monetization of our credit card business while meeting important customer needs.

Since 2020, the company’s credit expansion has driven revenue growth. Management’s decision to expand credit was the correct one. Nu Holdings’ largest market, Brazil, is in the middle of a post-pandemic economic expansion better than the lackluster growth before the pandemic. The following comes from Deloitte’s latest assessment of the Brazilian economy:

Brazil’s economy has performed better than expected: Real gross domestic product grew by an annualized 5.9% between the first and second quarter of the year and was up 2.8% from the previous year. The strong performance came despite relatively disappointing output in the agricultural sector, which fell 3.2% year on year. Consumer spending and business investment were notably strong in the second quarter. Economic growth appeared robust in the third quarter as well. Monthly real GDP was up 4% from a year earlier in August, while the central bank’s economic activity index was up 3.9%. The September composite purchasing managers’ index—a forward-looking indicator of economic health—increased to 55.2, which indicates strong economic growth.

When an economy grows rapidly, banks can thrive. However, dark clouds are on the horizon. Inflation has become problematic, and the Brazilian Central Bank has turned hawkish and raised interest rates. If the Brazilian Central Bank maintains higher interest rates for too long, consumer spending could decline, negatively impacting Nu Holdings’ lending and credit card operations. Additionally, a more restrictive monetary policy could increase Nu Holdings’ cost of capital, hindering its growth and profitability.

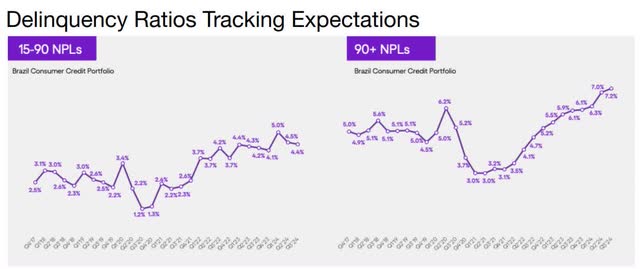

Another concern investors need to monitor is that more loans turn sour in a rising interest rate environment. The 15-90 (days) NPLs (non-performing loans) chart will loosely forecast 90+ NPLs, considered bad debts unlikely to be repaid. If a bank gets too many 90+ NPLs, revenue growth and profitability will falter amid other negative repercussions, such as losing investor confidence and declining stock prices. Wall Street pays particular attention to 15-90 NPLs because it portends terrible days ahead if that number trends upward too rapidly.

Nu Holdings Third Quarter 2024 Earnings Release.

So far, 15-90 and 90+ NPLs have trended upward within management’s acceptable parameters. Currently, management thinks the increased revenue and profits justify the credit expansion and counter the risk from rising NPLs. Still, as we will discuss further, management has become slightly more cautious.

Nu’s leading indicator, the 15-90 NPLs, continued decreasing from the 5.0% peak in the first quarter to 4.4%, meaning fewer people are falling behind on their loan payments—a positive trend. At the same time, the 90+ NPL ratio increased 20 basis points (“bps”) sequentially to 7.2%. Still, this number should come down in future quarters, following the declining trend of 15-90 NPLs.

However, management has recently become slightly more cautious about pressing the pedal to the metal on credit expansion. In the third quarter 2024 earnings call, CFO Lago included the following language (emphasis added):

Interest-earning installments [Pix and Boleto financing products] remain steady at 28% of our total credit card portfolio, aligning with expectations shared last quarter. While demand for our peaks financing products remains strong, we have intentionally slowed the pace of eligibility expansions to more closely monitor performance over the coming quarters. If the portfolio continues to perform well, we may resume growth in the near term. Our focus is on gathering additional data to ensure our credit models remain resilient. The demand for this product is very clear and we are strategically managing supply to safeguard credit quality and maintain portfolio resilience.

In other words, the company is pressing the brakes a bit on further credit expansion until it gets data showing that the Brazilian Central Bank’s raising of interest rates won’t put Nu in the wrong position if it expands credit further. Existing and potential Nu Holding investors must monitor the Brazilian economy and the company for signs of decline. Brazil and Latin America, in general, are notorious for their instability and economic conditions declining rapidly, which makes Nu a higher-risk investment than comparable online U.S. banks like SoFi Technologies (SOFI).

Solid third-quarter 2024 results

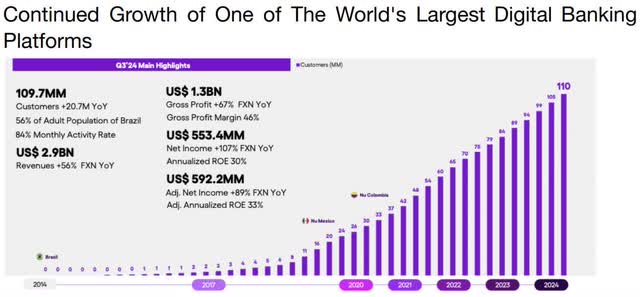

Nu’s customer base grew 23% over the previous year’s comparable quarter, reaching 109.7 million. Its monthly active user (“MAU”) rate, defined as monthly active customers divided by total customers, rose 80 bps to 83.6%. The MAU rate is the company’s engagement rate, something the company is increasingly focusing on. CFO Lago said during the earnings call, “This represents the 12th consecutive quarter increase in activity rate, underscoring our ability to consistently provide a compelling value proposition to our customers.”

Nu Holdings Third Quarter 2024 Earnings Release.

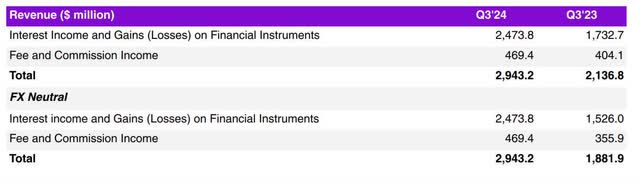

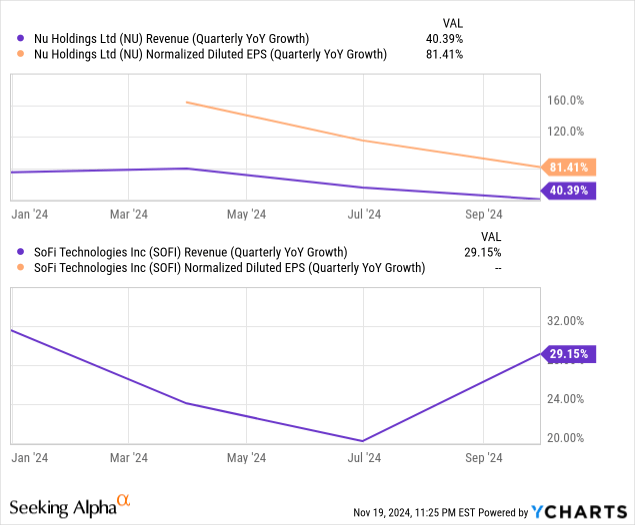

Nu’s foreign exchange neutral (“FXN”) revenue increased 56% from the previous year’s comparable quarter to $2.94 billion, missing consensus analysts’ expectations by $3.38 million.

Nu Holdings Third Quarter 2024 Earnings Release.

The company’s third quarter 2024 earnings release states (emphasis added):

Interest Income and Gains on Financial Instruments increased 62% YoY FXN, reaching $2,473.8 million in Q3’24. This growth was mainly driven by two factors: (i) sustained high interest income from the consumer finance portfolio, generated from the ongoing expansion of credit cards and lending; and (ii) the credit mix, mainly related to the increase in installments with interest [Pix and Boletos] within the credit card portfolio. Fee and Commission Income in Q3’24 increased 32% YoY FXN to $469.4 million. This growth was mainly driven by the following increases: (i) interchange fees, supported by increased purchase volumes on credit and prepaid cards, reflecting ongoing growth of Nu’s customer base and activity rates; and (ii) late fees also due to the overall growth of Nu’s credit portfolio.

You can calculate the bank lending profits by subtracting the interest paid on the funding source for the loans from Interest Income, which equals Net Interest Income (“NII”). Think of NII as a bank’s gross margin. Funding sources are either deposits or funds borrowed from other financial institutions.

Nu Holdings Third Quarter 2024 Earnings Release.

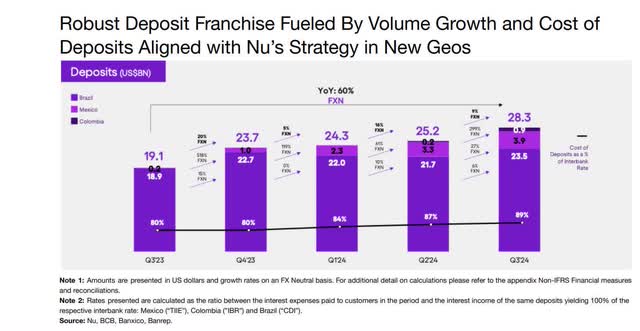

Nu’s third quarter 2024 FXN deposits increased 60% over the previous year’s comparable quarter to $28.3 billion. For the bank to maximize NII, it needs funding source costs to be low, and the lowest-cost funding source is deposits. So, we want a high percentage of its funding from deposits. “Cost of Deposits as a percentage of Interbank Rate” represents the interest expense paid to customers on their deposits as a percentage of the interest rate on interbank loans. The chart indicates that deposit funding costs rose nine points to reach 89% of the blended interbank rates of the countries in the bank’s countries of operation—the rise in funding costs results from the company’s expansion in Mexico and Colombia. Deposit funding costs may increase if the Brazilian Central Bank raises interest rates further.

Nu Holdings Third Quarter 2024 Earnings Release.

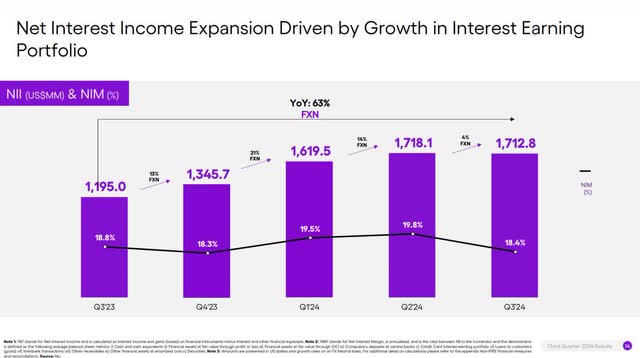

FXN NII increased 63% year over year to $1.712 billion. However, it declined from the $1.718 produced in the second quarter.

The company’s earnings release stated (emphasis added):

Growth was driven by sustained expansion of Nu’s credit card and lending portfolios, collectively boosting NII and net interest margin (“NIM”) on an annual basis. The slowdown in growth QoQ was mainly driven by the combination of three factors: (i) yields on the credit card portfolio declined reflecting an improved customer and product risk profile; (ii) lending yields declined as secured loans continue to grow; and (III) funding costs in Mexico and Colombia continue pressured, in line with Nu’s yield strategy to quickly ramp-up deposit growth in new geos.

Although the market understands that growing in Mexico and Colombia will benefit the company long-term, some investors may not be pleased with slowing NII growth and a dip in NIM, the percentage difference between interest received from loans and interest paid out to depositors or other funding sources.

Next, let’s look at the bank’s gross profits for its overall business.

Nu Holdings Third Quarter 2024 Investor Presentation.

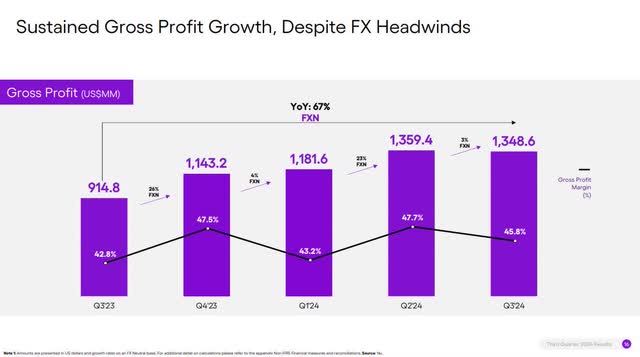

Despite the higher funding costs in Colombia and Mexico (where Nu is heavily expanding), the company maintained a solid gross margin of 45.8% in the third quarter.

Nu Holdings Third Quarter 2024 Investor Presentation.

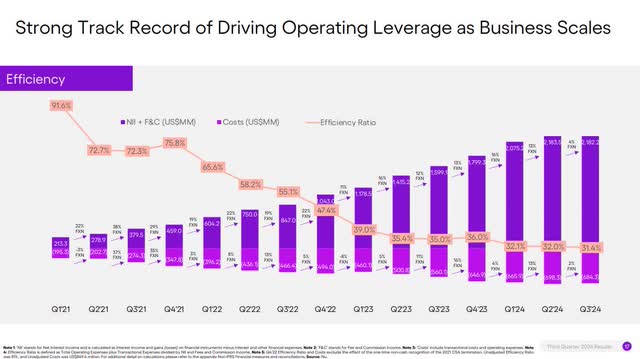

The above chart shows revenues increasing much more rapidly than costs. It also indicates that Nu Holdings has successfully driven operating leverage as its business scales. Operating leverage means Nu’s fixed costs, such as technology infrastructure and customer service, remain relatively constant. At the same time, the company grows variable costs like employee salaries and marketing expenses at a slower rate than revenue, leading to operating income growing much faster than revenue. Growth investors often seek out companies with high operating leverage, like Nu. The company’s profit potential may warrant purchasing the stock. CFO Lago said the following about operating leverage on the earnings call:

Achieving operational leverage is a fundamental aspect of our strategy. During this quarter, our efficiency ratio improved by 60 basis points quarter-over-quarter, reaching 31.4% and more than 360 basis points better than a year ago. This was achieved even with costs for the third quarter increasing 2% sequentially on an FX-neutral basis, mainly reflecting a one-off in marketing expenses related to the repositioning of the NuCoin [cryptocurrency] program and the impairment of capitalizing tangible assets associated with it. We are poised to capitalize on our platform’s operating leverage as we continue to expand our customer base, up-sell and cross-sell products, introduce new features and achieve profitability in the new markets of Mexico and Colombia, which are currently in their investment phases.

When I first recommended Nu Holdings in December 2021, its efficiency ratio was above 70%, which is terrible for a bank. The lower the efficiency ratio, the more profitable the bank. The company’s world-class efficiency ratio of 31.4% indicates a banking business operating very efficiently. In comparison, one of the best banks in the U.S., JPMorgan Chase (JPM), had an efficiency ratio of 53.00% at the end of its September quarter.

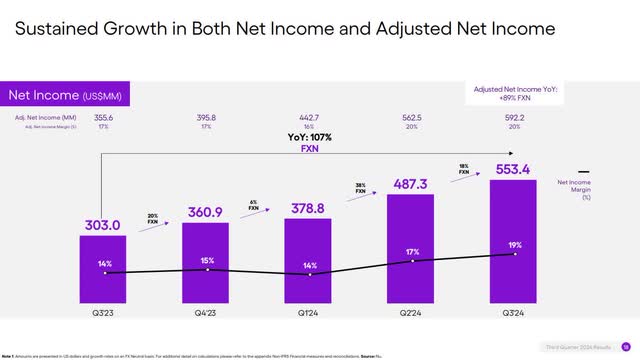

Nu Holdings Third Quarter 2024 Investor Presentation.

Nu’s net income increased by 107% year-on-year to $553 million, and its profitability margin was record-breaking at 19%. Adjusted net income was $592 million for the quarter, up 89% compared to the third quarter of last year. Nu’s third quarter 2024 earnings release stated, “Adjusted Net Income is defined as profit (loss) attributable to shareholders of the parent company for the period, adjusted for the expenses and allocated tax effects on share-based compensation.” In other words, adjusted numbers eliminate the effects of stock-based compensation, which was 3.14% of quarterly revenue and 3.77% of annual revenue.

The company’s IFRS (International Financial Reporting Standards) earnings-per-share (“EPS”) is $0.11, beating analysts’ expectations by $0.01. Adjusted EPS is $0.12, beating analysts’ expectations by $0.01.

Nu Holdings Third Quarter 2024 Investor Presentation.

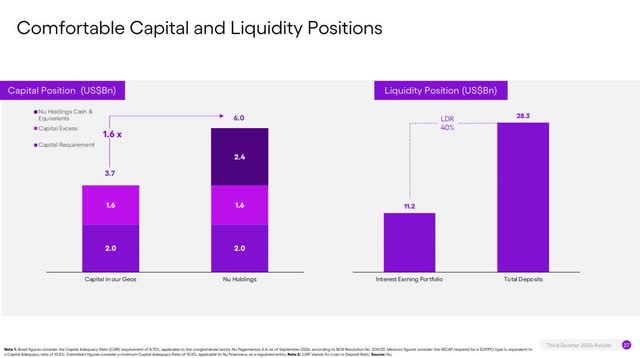

Nubank’s Capital Adequacy Ratios are $3.7 billion, $1.6 billion above the regulatory minimums in all its operating countries. The holding company’s balance sheet has an additional $2.4 billion in excess liquidity. It is one of the best-capitalized banks in Latin America.

The bank’s Loan-to-Deposit Ratio (“LDR”) is around 40%, which means it has $0.40 of loans for every $1.00 of deposits. The higher a bank’s LDR ratio, the higher the potential NII. However, it raises the possibility of loan defaults and liquidity issues. The lower the LDR, the less likely a bank will face financial problems. Still, it leaves more NII-generating potential on the table.

According to the Philadelphia Federal Reserve, an average large U.S. bank has an LDR of around 60%. An LDR of 40% would be considered highly conservative in the U.S. market. However, considering the instability of Latin American economies, management is correct to be cautious. A favorable long-term consideration is that if the worries surrounding the Brazilian economy dissipate, Nu has significant room to push the pedal to medal on growth by raising its LDR.

Valuation

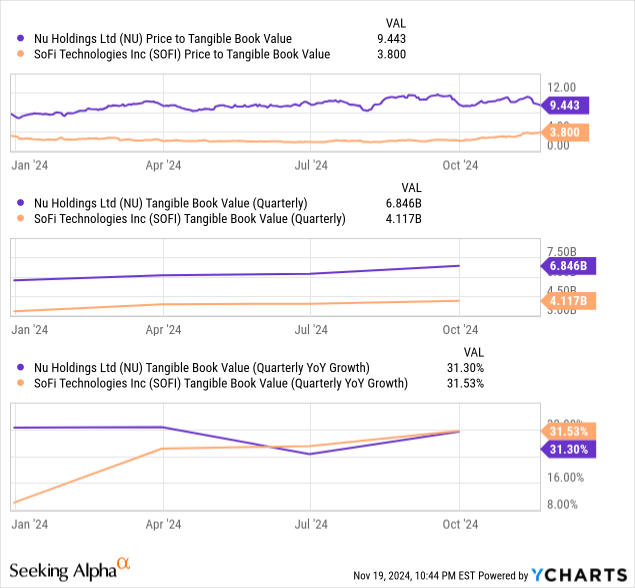

Investors favor using Tangible Book Value (“TBV”) to value a bank because the metric is a solid measure of a bank’s chance of withstanding an economic downturn and a more reliable indicator of a bank’s health than EPS. Nu’s price-to-TBV, one of the most conservative ways to value a bank, is 9.443, down from 10.85 when I last wrote about the stock on August 21, 2024.

Nu’s price-to-TBV is much higher than that of a comparable U.S. neobank SoFi Technologies. The market may justify Nu’s premium valuation because it has a larger TBV, growing at approximately the same rate. Investors may also believe Nu is less speculative than SoFi because it is a much larger company, generating more revenue and EPS growth.

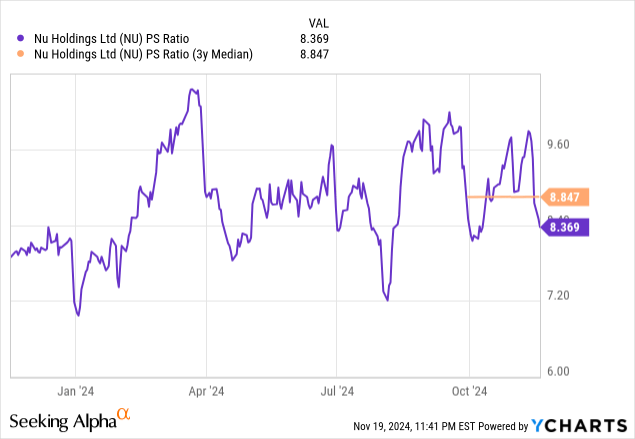

Nu’s price-to-sales ratio is 8.369, below its three-year median of 8.847. Based on this comparison, some may consider the stock slightly undervalued.

Nu Holdings has a forward price/earnings-to-growth (“PEG”) ratio of 0.50 (One-year Forward P/E of 23.35 divided by analysts estimated 2025 EPS growth rate of 46.28%). The market generally considers a PEG ratio below 1.0 as a sign of an undervalued stock.

If Nu had a PEG ratio of 1.0 today, its current stock price would be $26.84, a 99% rise above the November 19 closing stock price of $13.46. However, although the stock has significant upside potential, the market likely discounts Nu because of the risk of operating in Latin America. Additionally, the market is unlikely to value the stock at a PEG ratio of 1.0 as long as the Brazilian economy is uncertain.

Nu Holdings is a cautious buy

One reason Nu Holdings’ stock has been lackluster several days after releasing earnings is that Berkshire Hathaway (BRK.A)(BRK.B) reported that it sold 20.7 million shares of Nu’s stock. However, it still retains 86.4 million shares. Investors should take Berkshire’s moves with a grain of salt, as large investors like Berkshire can buy and sell stocks for motivations other than believing a stock will go up or down.

Risk-averse investors may want to avoid Nu Holdings for now, as the risk of the Brazilian economy deteriorating is real. However, the company has an upside over the medium term if Nu achieves profitability in its Mexico and Colombia expansion markets. If you are a risk-tolerant long-term investor, consider buying one of the top digital banks in the world. I rate the stock a cautious buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.