Summary:

- Nu Holdings is now the largest Brazilian bank by market value, with a market cap of $59 billion and over 100 million customers.

- The company’s growth is driven by fast customer expansion, increasing revenue per customer, and efficient operating costs, leading to strong profitability.

- Despite risks such as economic downturns and high-interest credit portfolios, Nu Holdings’ shares are attractively valued at 26.6x the next 12 months’ earnings, offering potential for significant shareholder value.

- Nu Holdings shows strong growth, robust profitability, and expansion potential in LatAm markets, making it a compelling buy despite macroeconomic risks.

Sidney de Almeida

Nu Holdings Ltd. (NYSE:NU) is now the largest Brazilian bank in terms of market value, which also has a presence in other LatAm countries. Its market cap advance has been so great that it has overtaken Itaú Unibanco Holding S.A. (ITUB), a financial institution that has been around for decades and is highly consolidated (with a net profit of over $1.5 billion per quarter).

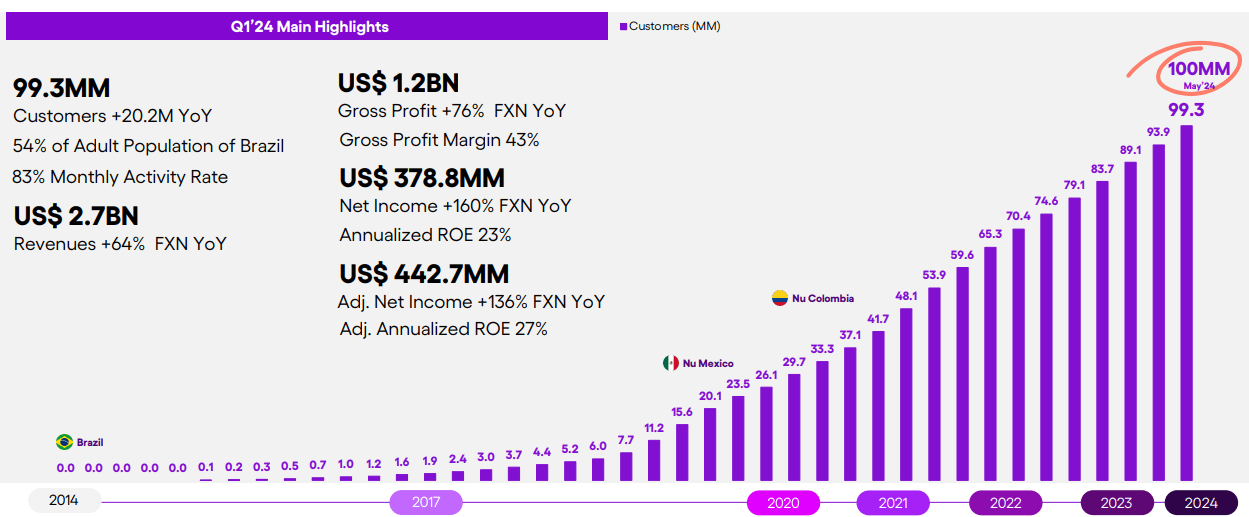

Its market cap of $59 billion is based on expectations of growth and the excellent work that has already been done. In May 2024 the 100 million customer mark has already been surpassed, along with extraordinary returns.

All this narrative of quality with growth still comes with reasonable multiples for a growth company, but it is necessary to weigh up some risks, such as the risk to the economy of the countries in which it operates.

The 3 Pillars of Nu’s Thesis

In the words of David Vélez, Nu’s CEO, the business model in Q1 was “anchored in three fundamental principles – fast customer expansion, expanding revenue per customer, and efficient operating costs”. That seems to sum up the thesis well, but let’s break down each of these aspects a little further.

It’s hard to find a history of expansion as solid as Nu’s. By disrupting the Brazilian banking market with digitalization, it was able to add millions of customers in a few years. Four years ago, its customer base was just under 30 million, which means that this number has more than tripled, even though it was already at a relevant level. Since Q1’22, this CAGR of customers is almost 30%.

Nu’s IR

In the comparison between 2022 and 2023, Nu was the conglomerate that added the most customers, with 17 million. In second place was MercadoLibre, Inc. (MELI) with 8 million, and in third place was Inter & Co, Inc. (INTR) with 6 million. With this data, it’s already possible to infer a few things. Firstly, Nu is in the lead and with a huge gap to the others. Secondly, there is a clear trend that favors digital banks, while more traditional players such as Banco Bradesco S.A. (BBD) and Itaú showed modest growth of 3 million customers. One reason for this is that the base of these traditional banks is already quite large, but it also seems to me that there is latent competition, with digital banks gaining the upper hand in terms of market share and growth.

Although the bulk of its customer base is in Brazil, its presence in other Latin American countries seems right to me and should be a good avenue for growth in the future. In Q1, the company already reached 6.6 million customers in Mexico, which resulted in a market share of 5.1%

The second pillar of the thesis is increasing revenue per customer, and this is one with the most cloudiness.

The company’s total portfolio is $19.6 bn, of which 77% are credit cards and 23% are personal loans. This type of portfolio is highly profitable due to its higher interest rates, but it is also riskier. Its 90+ delinquency ratio was 6.3% in Q1, while the average for Brazil’s financial system was 3.2%. This type of portfolio has also made Nu appear on some social networks and news sites with reports of the high interest rates charged, with cases of unpaid credit card debt of R$2,000 turning into almost R$1 million.

In other words, it is difficult to perpetuate the profitability of today’s portfolio, since the bank can better diversify the portfolio in the future with other types of safer loans as it reaches the limit of this type of credit, in addition to the risk of the sustainability of maintaining these extremely high interest rates in weaker economies, which also ends up translating into a risk of delinquency.

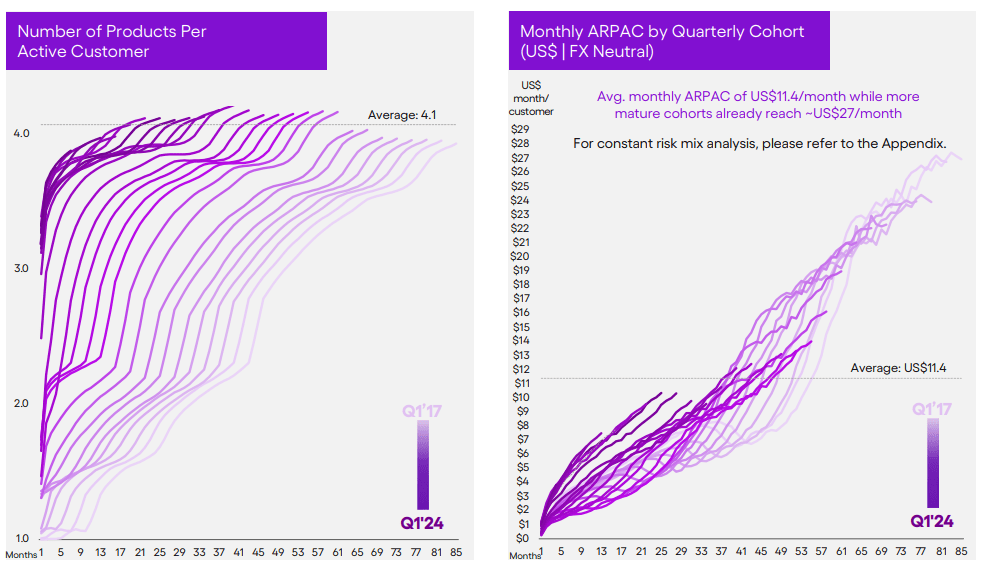

But the bank doesn’t live on portfolio interest alone. Nu is already a complete bank, offering other services such as insurance, shopping, and the like. The number of products also depends on the maturity of the clients, with the average number being 4, which results in an ARPAC of $11.4/m, while that of more mature clients is $27/m.

Nu’s IR

There is also a question market in the issue of maturity. It’s clear from the graphs above that it exists and should bring returns for the bank’s financials, but what level this maturity would stabilize at still seems very difficult to say, especially considering the competition and factors such as the number of clients using Nu as their Primary Banking Account. In any case, the second pillar is also solid, with this revenue per client having advanced by 30% YoY, which together with the increase in clients, caused revenue to jump to $2.7 billion.

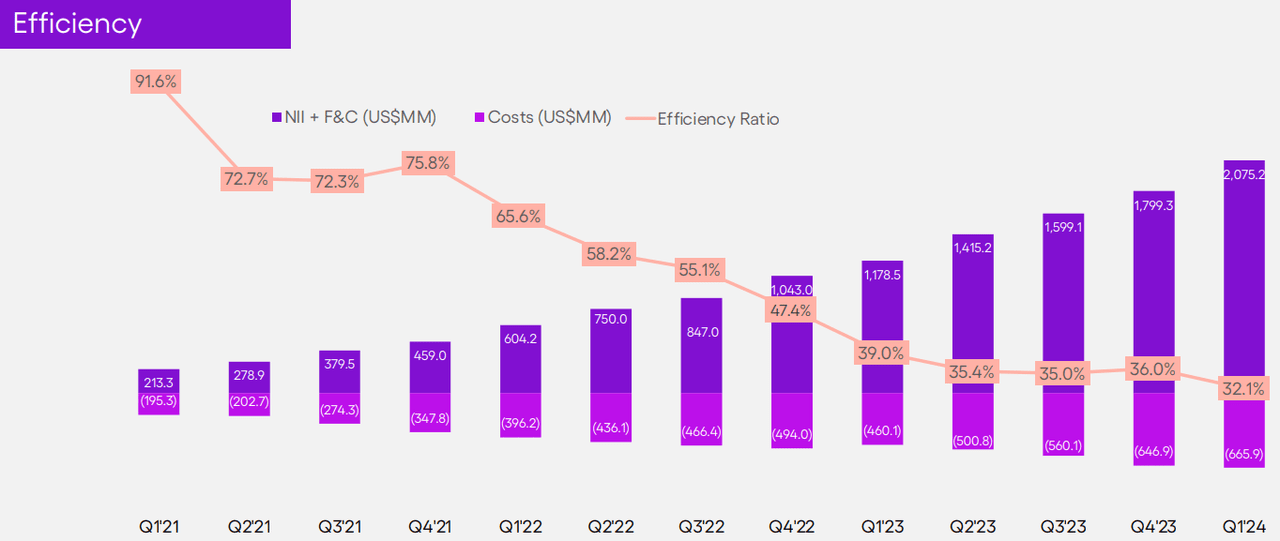

Finally, the third pillar is “efficient operating costs”, made possible by enormous growth and the achievement of gains in scale. From the beginning of 2023 to Q1 2024, Nu added another 20 million customers to its base and advanced in revenue per user, while the cost to serve per customer remained stable at just $0.9. This results in tremendous operating leverage, evidenced by its Efficiency Ratio of 32.1%.

This low cost is made possible mainly by its lean structure, since its technological and agency-free model, developed over the years, allows for such leverage.

Nu Holdings Is Not That Expensive

Until a few quarters ago, Nu’s net profit was low, but this is already changing significantly. In the annual comparison, the amount advanced by 160%, reaching R$378.8 million and R$442.7 million in the adjusted amount, giving us an annualized ROE of 23% and 27%, respectively. This level of profitability is not only higher than many Brazilian banks, known for their high profitability but also substantially better than well-established American banks such as JPMorgan Chase & Co. (JPM), Wells Fargo & Company (WFC), and Bank of America Corporation (BAC).

Therefore, if we combine the continued growth in the number of clients (and revenue per client) with this level of profitability, we should see a very significant generation of shareholder value. What would be missing to close this account would be an attractive valuation, since many growth and quality companies are traded at exaggeratedly high levels, but this is not the case.

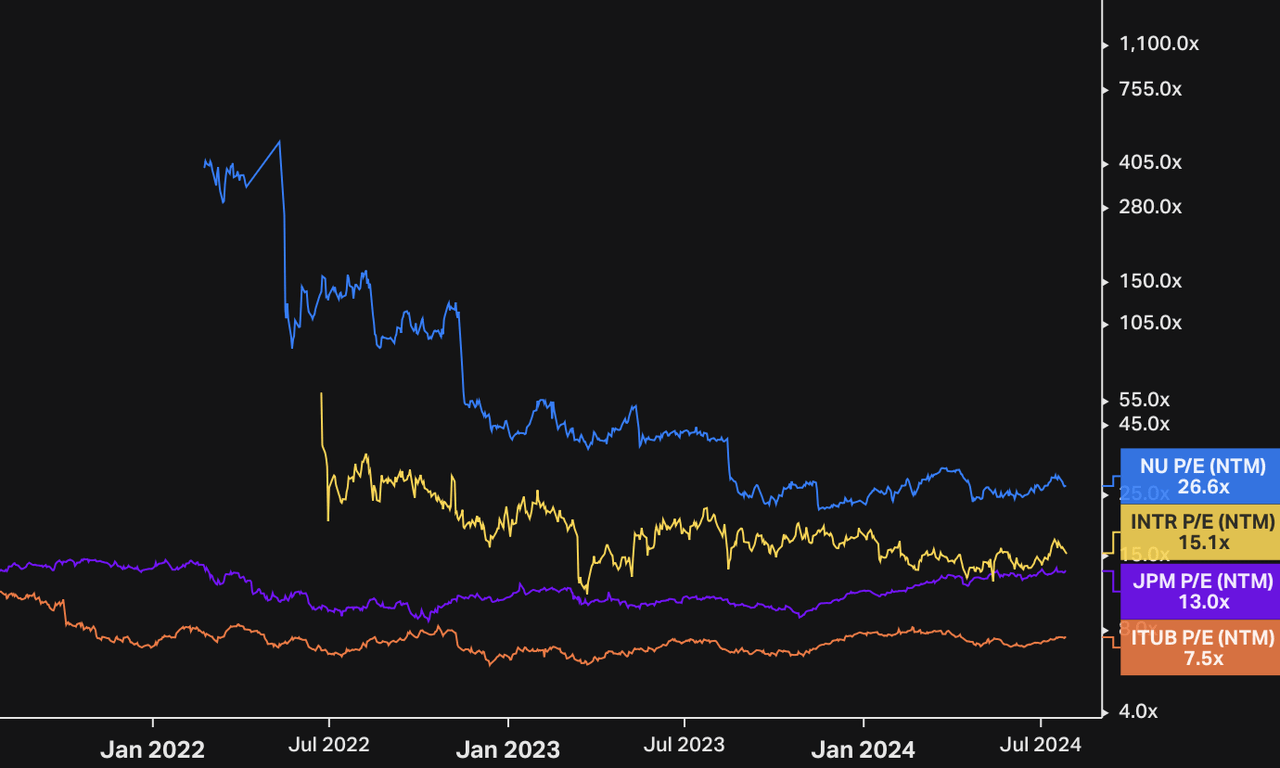

Nu Holdings’ shares are trading at 26.6x the next 12 months’ earnings, an attractive level considering all the projected growth and the quality of its operations. This level of valuation is “only” twice as high as that of JP Morgan, for example, and more than 3 times higher than that of Itau, both well-established banks with lower growth prospects. While this multiple is attractive for a company that has the capacity to grow its profits by double digits a year, I confess that the asymmetry between Nu and Itaú also seems very high, since although plausible, pricing that Nu will grow 3x more than Itaú doesn’t guarantee a huge margin of safety.

It’s difficult to estimate where Nu’s net profit might be in a few years since its customer base is high and its net profit per customer is high, but at the same time, there is still a lot of potential to increase the base in new countries and expand cross-selling, while operating leverage continues to take effect. Even though it’s difficult to measure in standard accounts (profit/customer), Nu seems to be on the right track to becoming a compounder.

As already mentioned, the presence in Latin American countries could also boost this growth. According to Virtue Market Research, the fintech market in the LatAm region is expected to show a CAGR of just over 6%, unlocking value due to factors such as better demographic trends, and improved internet access, as well as other characteristics such as the greater possibility of citizens becoming banked. Leading a market with positive trends and with profitable (and good quality) operations, Nu deserves a certain premium on its shares compared to peers with lower growth (Itau) and lower market share (Inter).

My only big discomfort with the current multiple levels is that it’s a bank that’s very exposed to the Brazilian economy, meaning that it’s common for there to be a greater discount for the greater risk. The overwhelming majority of Brazilian banks trade at low price-to-earnings, such as Itau at 7.5x, Banco do Brasil S.A. (OTCPK:BDORY) at 4x, and even Inter, which is a digital growth bank, which trades at 14x. That’s why it’s worth highlighting these macroeconomic issues, such as the very latent exchange rate risk in the thesis and the risk of economic slowdown in the countries present.

Q2 Earnings Expectations

For the release of Q2 results on August 13, expectations are also positive, but also plausible to the point of allowing for positive surprises. The consensus expects revenue of $2.78bn, equivalent to a YoY of 49%, but a QoQ of only 1.9%. As for net income adjusted, the estimates are a little more aggressive, with a YoY of 73.3% and a QoQ of 6%, making it $470 million and a margin of 16.85%, compared to 16.18% in Q1. In short, very realistic expectations.

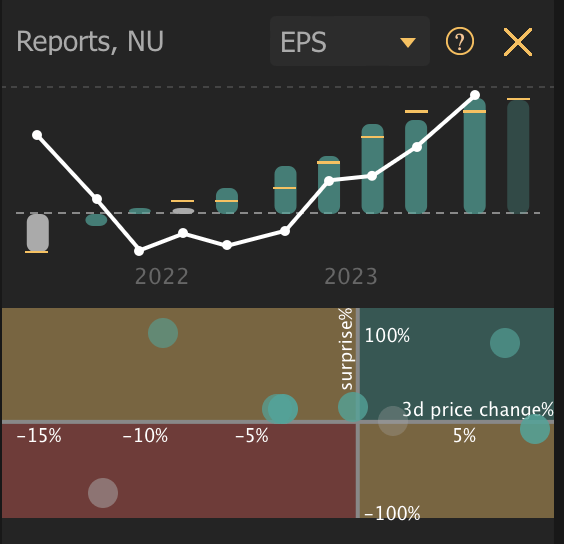

One factor that should be mentioned is that the short history of earnings shows that Nu Holdings shares don’t usually perform so well in the first 3 days after earnings. In some quarters, such as 1Q24, 3Q23, 2Q23, and 4Q22, Nu Stocks fell even though their EPS was a good surprise. In Q4 2022, the shares fell by as much as 9%, and without many specific reasons, other than a rich valuation and profits that were not yet materializing.

TrendSpider

Final Thoughts

In short, Nu Holdings seems to me to stand out by combining several aspects that investors look for in an investment, such as growth, quality, and a fair share price. Its almost impeccable track record highlights this, showing how its strategy has been successful and capable of generating shareholder value.

Potential risks should not be overlooked, such as a reliance on high-interest credit portfolios and other macroeconomic factors. Despite these risks, Nu Holdings presents a compelling investment thesis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.