Summary:

- Nu Holdings stock has outperformed the market by a factor of 2 since April 2024. I believe more will come in the medium term – read on to learn why.

- NU’s strong Q1 results show growth in user base, revenue, and margins, supporting my previous bullish thesis.

- MS analysts state that they expect the Q2 2024 for the entire Latin American market to be very solid in terms of top-line and earnings growth.

- Despite competition and high valuation, according to my updated calculations, NU stock is undervalued by about 19% today.

- NU’s high upside potential leads me to the conclusion that I should confirm my buy recommendation today.

Rockaa/E+ via Getty Images

Into & Thesis

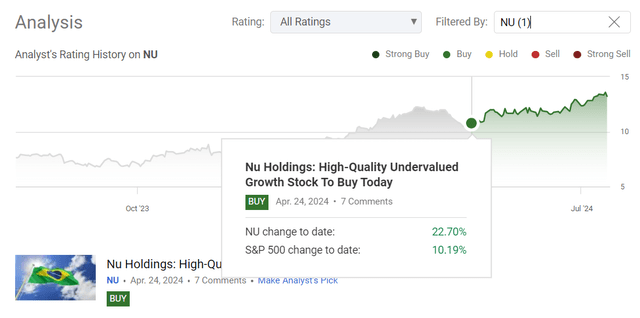

My first and so far only article on Nu Holdings Ltd. (NYSE:NU) was published at the end of April 2024, and since then the stock has experienced an upward trend and clearly outperformed the broad market by a factor of 2:

Seeking Alpha, the author’s coverage of NU

Despite this strong outperformance in the past, I think that my old thesis has only just begun to play out and that Nu Holdings stock has every chance of growing even further thanks to the expansion of its end markets, the stable margin development, and the still favorable valuation level.

Why Do I Think So?

According to Seeking Alpha, NU is set to report its second-quarter 2024 results in about a month; until then, let’s review its Q1 results, which were released back in May 2024.

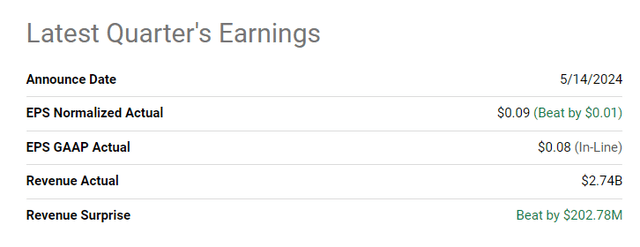

In May, we learned that Nu Holdings had reached the milestone of 100 million customers as of the end of Q1. This generally confirmed my earlier conclusions that the company’s financial offerings are quite “sticky” in terms of user engagement. Speaking of revenue, NU reported $2.74 billion, which led to a net income of $379 million – this allowed the company to beat analysts’ consensus by a comfortable margin in terms of EPS growth.

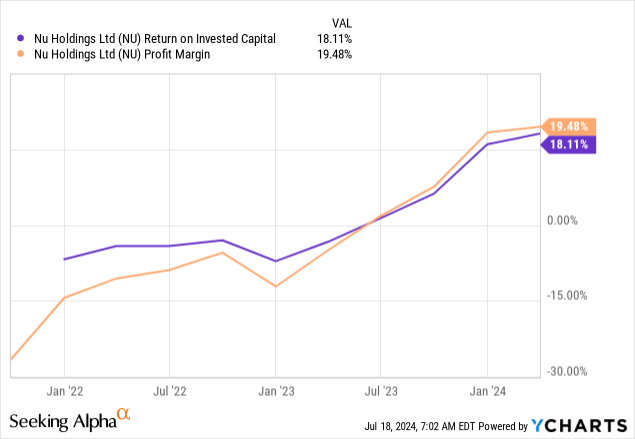

NU thus gained ~5.5 million users during Q1 FY2024, making it the 4th largest financial institution in Latin America in terms of the number of customers. The average monthly revenue per active user rose to $11.4, an increase of 30% year-on-year in constant currency. What’s more important here: the average monthly customer service costs remained below $1, allowing the company to achieve new highs in key margins, which confirms my thesis from the previous article.

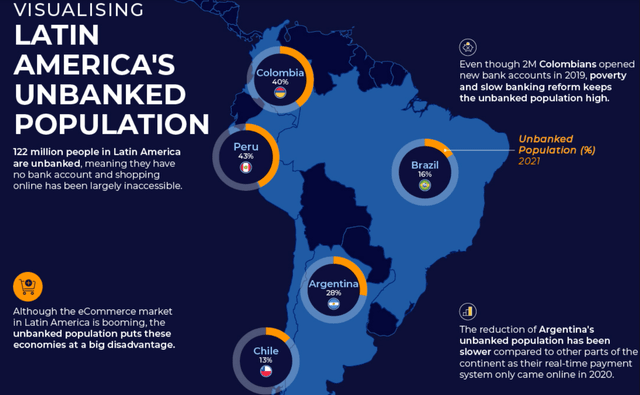

Moreover, the fact that costs per customer remain stable from quarter to quarter, while sales continue to grow, shows that the company’s customer acquisition costs are relatively low. This suggests strong operating leverage, which is likely to further increase profitability as sales grow. I expect this sales growth to come from expansion into underbanked regions of Latin America. According to Visual Capitalist open source data, in 2021 Brazil had ~16% of its population underbaked, while across the entire Latin America, the total number of underbanked users was reaching 122 million people. Of course, three years have passed since 2021 (even if it may seem like yesterday). In my opinion, this “old” data can still be relevant today, because it takes many years for the population to become fully “banked”. Even if we assume that the 2021 numbers can be halved, it is still a very large population (read – “addition to the TAM”) that needs to adapt to new technologies. This adaptation will be an incentive for the growth of companies like NU and its competitors.

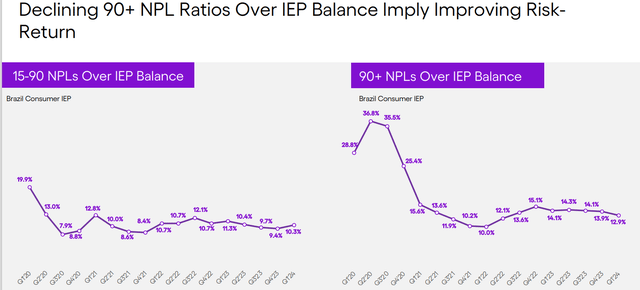

At the same time, the company’s profitability and growth prospects thanks to great operating leverage are not the only things that should excite investors. The positive news doesn’t end there, because if we look at the company’s balance sheet, we see that Nubank’s capital adequacy ratios remain well above the minimum regulatory requirements, supported by $2.4 billion of excess cash. The interest-earning portfolio grew to $9.7 billion in the first quarter, while total deposits rose to $24.3 billion, representing a loan-to-deposit ratio of ~40%. Although NU’s NPL ratio increased to 5%, which was a result of a typical seasonal rise seen in early-stage delinquencies, Nu Holdings’ NPLs have trended lower relative to interest-earning balances, suggesting that the company is growing its loan portfolio faster than NPLs, which should increase earnings and resilience going forward.

Management does not provide specific guidance or forecasts for the second quarter and beyond, but expects that NU should continue to have opportunities to expand its loan portfolio based on trends observed in recent quarters where “portfolio expansion has been associated with improved margins”, so again: further margin expansion seems likely to me, at least in the medium term.

Unfortunately, we can predict or discuss the upcoming quarter only based on some indirect signs and metrics. Therefore, I’d like to draw your attention to a recent study by Morgan Stanley, published on July 10, 2024 (proprietary source). MS analysts state that they expect the Q2 2024 for the entire Latin American market to be very solid in terms of top-line and earnings growth.

Morgan Stanley [proprietary source], notes added![Morgan Stanley [proprietary source]](https://static.seekingalpha.com/uploads/2024/7/18/49513514-1721302741966078.png)

Based on these key figures and the development of the markets in various regions of Latin America in the last few quarters, we can therefore conclude that Nu Holdings is likely to present good Q2 results. In Q1, the company’s customer base in Brazil grew to almost 92 million customers and growth in Mexico also accelerated, exceeding 7 million. This shows that the company has not focused on a single market in Latin America, but has developed simultaneously in several areas, which I believe should have a positive impact on the results in the second quarter.

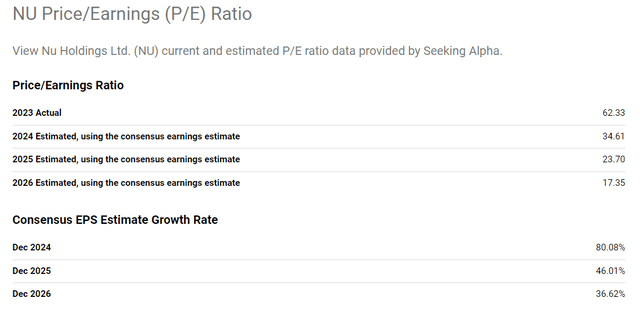

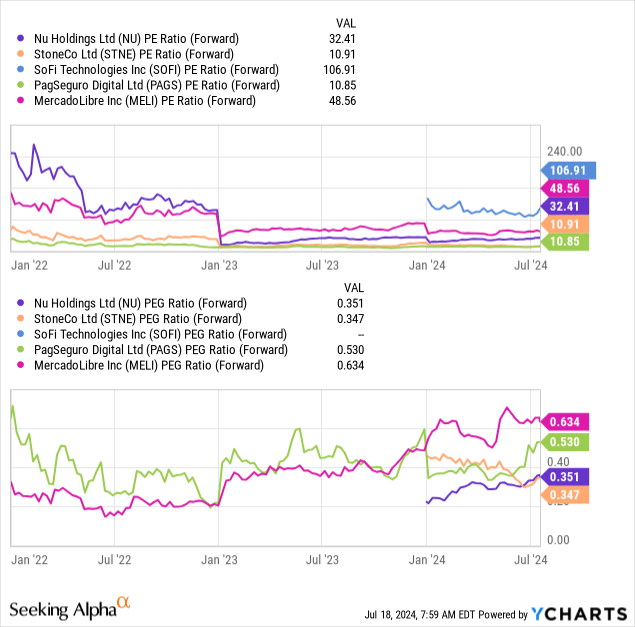

I can’t ignore the fact that the company is currently trading at over 60 times its net earnings. However, if we look at the consensus forecast for the next few years, this multiple is expected to fall by almost half by the end of 2024 and by a further 31.5% by the end of 2025. At the same time, NU’s EPS is projected to grow at a CAGR of ~25% over the next 3 years, according to the same consensus expectations. Therefore, I believe that NU’s current valuation multiples, even if they seem too high to some, are well in line with the standards of a high-quality growth company.

Based on the company’s recent financial results and the maintenance of operating leverage as well as growth prospects over the next few quarters, I’ve decided to raise my expectation for the FY2025 multiple at which the company could trade (from 20x to 28x). If the current EPS consensus forecast of $0.56 per share by the end of FY2025 is correct, this translates into a price target of $14 per share. This is almost 19% higher than the current share price. Thus, compared to my conclusion from three months ago, I can say that Nu Holdings is still an attractive investment in the medium term despite its 23% since my last update.

Where Can I Be Wrong?

First, a major risk factor for my thesis today is the very high competition among fintech companies in Latin America. In addition to Nu Holdings, there are many other high-quality services fighting for market share both locally and internationally. This competition could cause NU to lose a significant portion of its current customers if the company does not maintain its current quality standards.

The second risk is, of course, the high valuation of the company. If we look at the multiples calculated for next year, the company looks fairly valued compared to its closest peers, as the P/E and EV/EBITDA ratios show. However, there are cheaper alternatives. For example, StoneCo Ltd. (STNE) seems to be a cheaper option compared to Nu Holdings (you can read my article about this company here).

Thanks to its superior growth rates, which were above the industry average, the company has been able to justify its premium valuation. However, should the growth rate fall below the industry average in the second quarter or in the following quarters, the NU’s valuation may shrink significantly – this could have serious consequences for investors.

The Bottom Line

Despite the many risks surrounding the company, including stark competition and potentially high valuation multiples, I believe Nu Holdings still has very good growth prospects. The company finished its Q1 FY2024 remarkably well, and indirect data from MS analysts’ suggests that economic growth in Latin America during Q2 was at least as strong, if not stronger, than in the first quarter. With this in mind, I expect the company to report well for its Q2 FY2024 results in a month’s time, possibly beating current forecasts, which seem very conservative to me.

As I mentioned earlier, the company’s EPS is expected to increase by 25% over the next 3 years. In my opinion, this growth rate justifies the current high multiples – more than that, if my expectations of even higher growth rates come true, the valuation multiples in 2-3 years will become too low to ignore. According to my updated calculations, NU stock is undervalued by about 19% today, (price objective for the next 12 months). This high upside potential leads me to the conclusion that I should confirm my buy recommendation today.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!