Summary:

- Nu Holdings reported strong Q2 earnings with accelerated growth momentum in KPIs, beating earnings and revenue expectations.

- The company is outperforming competitors in Mexico and Colombia, expanding its customer base and market share in these countries despite strong neobank competition with more aggressive offerings.

- Despite political risks, Nu’s strong fundamentals and upcoming tailwinds from a banking license in Mexico, and tax reform in Colombia, justify a strong buy rating on the stock.

PM Images

Nu Holdings (NYSE:NU) earnings were released this week and all they did was reiterate the accelerated growth momentum that this neobank is encountering in its core metrics. On top of that, from the side of expectations, both earnings and revenue exceeded forecasts, with normalized EPS at $0.12 and revenue at $2.85 billion for the second quarter of the year.

Nu is the largest non-Asian neobank in the world, and in this analysis, I will go through its Q2 earnings, and discuss other aspects that are affecting the business to justify my strong buy rating on the stock. If you are not familiar with Nu, you can read the first analysis I wrote about them back in March.

Q2 Earnings: Further Demonstration of Strong Growth and Unit Economics

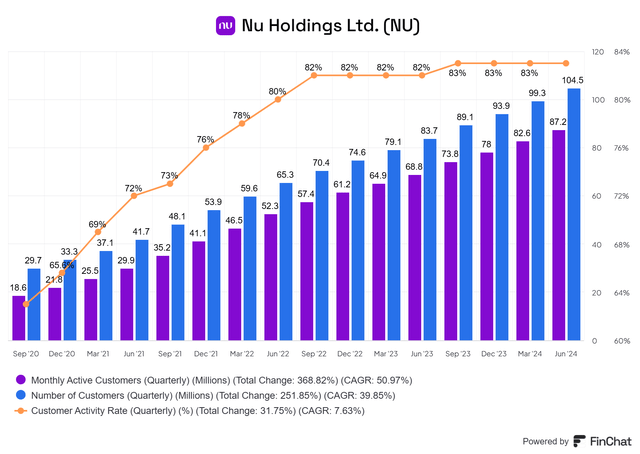

In Q2, Nu added 5.2 million new customers out of which, 1.2 million came from Mexico, 400 thousand from Colombia, and 3.6 million from Brazil. The core market reached 95.5 million customers, raising its penetration rate among the Brazilian adult population to 56%. Furthermore, 60% of the monthly active customers in Brazil use Nubank as their primary bank account, which sums up a third of the adult population. All of this growth was accomplished while maintaining its 83% activity rate, which is among the highest of Brazilian banks.

On a forex-neutral basis, the deposits of $25.2 billion grew relatively slower year-over-year than the total interest-earning portfolio of $9.8 billion (64% vs. 81%), but still ended with a sustainable loan-to-deposit ratio of 39%. Finally, the monthly average revenue per active customer climbed considerably to $11.2 compared to $8.6 from a year ago and $10.6 from the previous quarter. This demonstrated strong operating leverage as the monthly average cost to serve an active customer stood pretty low at $0.9, and management commented on the earnings call that they do not see this KPI rising above $1 in the foreseeable future.

When it comes to net interest income, it continued to expand at a stunning rate of 77% YoY to $1.718 billion on a forex neural basis. At the same time, the net interest margin was situated at 19.8% and became the highest quarterly NIM ever recorded.

Even though the loan portfolio expanded in Q2, their credit loss allowance decreased, primarily due to slower loan growth quarter-over-quarter and because early delinquencies behaved better than historical seasonality. Therefore, their risk-adjusted NIM amplified to 11% compared to 8% from a year ago.

Nu, Outperforming Competitors in Mexico and Colombia

As the customer growth in Brazil is limited due to its high penetration, the expansion to Colombia and Mexico is developing pretty well. It seems that Nu has a magic wand that other competing neobanks do not.

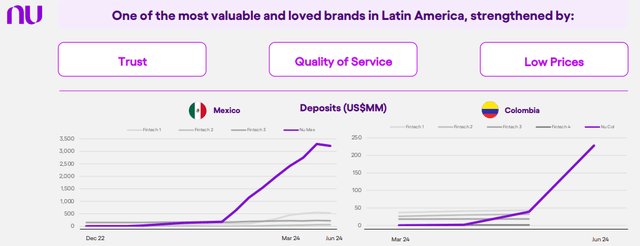

For example, in Mexico, Nu got to offer high-yield savings accounts of up to 15% APY and short-term CD to attract customers’ deposits. Nonetheless, other neobanks such as Uala, Mercado Pago (MELI), and Klar, have been far more aggressive, and as exhibited in the image above, Nu has been considerably more successful in bringing in new customers. At the same time, as of August 22nd, Nu in Mexico will decrease its APYs once again following the central bank’s rate dynamics.

| Nu’s APYs in Mexico | Available Balance (Cajitas) | 7 Days CD | 28 Days CD | 90 Days CD |

|---|---|---|---|---|

| November 2023 | 15.00% | N/A | N/A | N/A |

| March 2024 | 14.75% | N/A | N/A | N/A |

| May 2024 | 14.50% | 14.60% | 15.00% | N/A |

| July 11 – August 22, 2024 | 14.25% | 14.30% | 14.50% | 15.00% |

| August 22 – October 9, 2024 | 13.50% | 13.60% | 13.90% | 14.75% |

Source: Data Gathering from Omar – Educación Financiera

Another thing to keep in mind is that Nu in Mexico is not yet a bank per se. They are what’s called a “SOFIPO”, which have deposit insurance which is approximately fourteen times lower than the coverage of a bank. When you seek online reviews about neobanks in Mexico, the insurance aspect is broadly discussed as there are other neobanks, such as Uala that do have a banking license. Nonetheless, during the earnings call, CEO David Velez mentioned that they expected to obtain a banking license in Mexico in the following months. This banking license will be an obvious tailwind for Nu, especially on the perceived trust that they can add to their brand in Mexico.

From the side of Colombia, a similar situation is happening. Although the savings account was recently made accessible to the general public, it is now the 9th bank in Colombia with the largest amount of deposits. Even though Nu Colombia was reported as the institution with the most expensive cost of deposits, the fact that in two quarters they surpassed other neobanks such as Lulo Bank, and RappiPay, with far more time since launching is impressive.

All of this money collection is being achieved while the other neobanks are more aggressive and offer more cash-related solutions, which are still crucial for a significant part of the Colombian population. For example, at Lulo Bank, customers get free ATM withdrawals, 8% interest on their checking balance, 0.5% cash back, and the possibility to deposit money in cash. At Nu, none of that is available, and the only benefit that they have is that their interest in “cajitas” is being paid daily rather than monthly.

To add to the momentum, two pending tailwinds would most likely boost Nu’s ability to attract more customers and overall bring higher satisfaction to existing clients. These are the consolidation of accounts for the calculation of the 4 x 1000 tax eligibility, and the introduction of Bre-B from the Colombian Central Bank, which is the Colombian version of Pix in Brazil. The former will allow the population to open several bank accounts without worrying about paying extra taxes, and the latter will facilitate instant transfers in the financial system. Currently, neobanks with high yields do not have a system for instant money transfers such as TransfiYa, for example, so this would potentially change the game for new players.

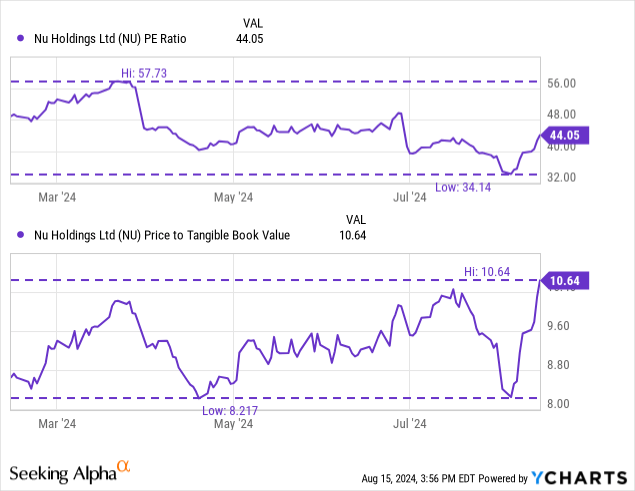

NU Valuation: Multiples Have Expanded

As of the day of this writing, over the past five trading days, the stock of NU has appreciated more than 9.89% due to outstanding earnings results, and also the macro backdrop. Being at approximately $14 per share, Nu has hit its all-time high with a strong uptrend that has followed steadily since January of 2023. Nonetheless, the PE ratio still looks decent compared to where it has been over the past six months.

On the side of the price to tangible book value, it has expanded considerably over the past month. Yet, since Nu is a bank with only six quarters of profitability, the retained earnings portion of the equity section is low compared to a traditional bank such as Itau (ITUB), and therefore I don’t think this is yet a critical metric to currently analyze the stock, but there it is for the nerds.

Also, their elevated expected EPS growth is in theory going to serve as an input to justify their PE ratio, not their PB ratio. Based on that, I do not think that the PE multiple has changed materially, and therefore, I still maintain a strong buy rating.

Political Environment and Bottom-line in Mexico are Risks to Consider

Nu’s main focus right now is what they call “winning in Mexico”. As a result, their primary emphasis is on attracting new customers there. Nonetheless, they are extremely unprofitable in that country, and they expect that situation to revert in less than three years. In H1, their credit loss provisions coming from credit cards and personal loans accounted for more than twice their net interest income, which is a pretty significant loss. The same goes for administrative and promotional expenses, which were approximately $92 million based on an average exchange rate of 17.0906. For your context, based on the latest search, Nu Mexico has approximately 200 ads running on Google’s platforms.

Although Nu increases its total addressable market by operating in the three economies with the highest population in Latin America, the political risk is huge. For example, the three presidents of these countries are considered socialists and recently, these countries collectively abstained from voting in the OEA to request the electoral rolls for the questioned election in Venezuela. A fraudulent election that the whole Western world condemns.

Also, in Colombia, the president plans to propose a bill in which the government can use balances from bank accounts and later transfer them into public banks to generate forced loans in tourism, and infrastructure. The proposal is both dangerous and alarming, as this would deteriorate the trust in the banking system based on Moody’s. Nonetheless, the likelihood of a bill like this ever being approved is minimal, but it’s there to raise concerns.

Last, the recent price movement has been a boom, and perhaps buying at all-time highs is technically (not fundamentally) not a good idea. Yet, DCA’ing is also a prudent approach to averaging the entry price, especially for companies with rich fundamentals that trade at ATH.

Conclusion: Nu’s Tailwinds and Stock Rating

The last earnings result of Nu reiterates that their growth keeps on shining and that their NII rise in Brazil through expanding their loan book hasn’t been materially affected by charge-offs. Although in Mexico, and Colombia the fintech competition is being more aggressive in attracting deposits, Nu has other non-financial characteristics such as strong branding and user experience, and perhaps a higher marketing budget, which allows them to grow considerably faster than their competition. Tailwinds from upcoming banking licenses in Mexico, Bre-B, and reform to the 4 x 1000 tax in Colombia, allow them to attract more customers going forward, partially offset by lower central bank rates that would ultimately be translated to some degree to their customers.

Although some political risks have to be considered, as of now, I do not see this aspect altering Nu’s ability to implement its strategy going forward, and its fundamentals strongly counter that risk. Therefore, for the third time now, I rate the stock of Nu as a strong buy, with the precaution of DCA’ing an entry into the stock or combining a position with out-of-the-money puts due to the recent ramp-up in the stock price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.