Summary:

- Nu Holdings remains a solid investment, but its 20% stock price increase has eroded its margin of safety, making it less attractive.

- Despite impressive Q2 earnings and strong customer growth, Nu Holdings’ premium valuation at nearly 30x earnings reduces its attractiveness compared to peers like Inter & Co.

- Inter & Co, while smaller and riskier, offers greater value with ambitious growth targets and a significantly lower valuation at 14x earnings.

- Considering Nu Holdings’ high valuation and macroeconomic risks, I rate it a ‘hold,’ while Inter & Co offers a more compelling alternative.

EschCollection

In my last article on Nu Holdings (NYSE:NU), which was just before the Q2 earnings, I considered the stock to be a buy. Based on growth prospects and the quality of the company, Nu Holdings is still a solid choice, but since that last article, Nu Stocks have advanced ˜20%.

Before the Q2 earnings – which were interesting but hardly surprising – I had already mentioned that Nu Holdings was trading at a premium in valuation, and with 20% gains in a few months, this premium has become even greater, and as a result, there has been a corrosion of the margin of safety.

In my opinion, this makes Nu Stocks less attractive, especially when compared to its peer Inter (INTR), which trades at half its valuation and also has very interesting growth prospects.

Nu Holdings reported impressive Q2 earnings despite slower growth

In Q2 earnings, Nu Holdings reported very interesting figures, but a few disclaimers are in order. Just by maintaining the numbers seen in Q1, such as growth in customers, a very interesting efficiency ratio and a very high ROE, Nu Holdings’ quarter would already have been great, but that’s it in a nutshell, an excellent quarter but without many surprises, and in QoQ this accelerated growth already seems to have slowed down (which may be due to the bank’s greater maturity).

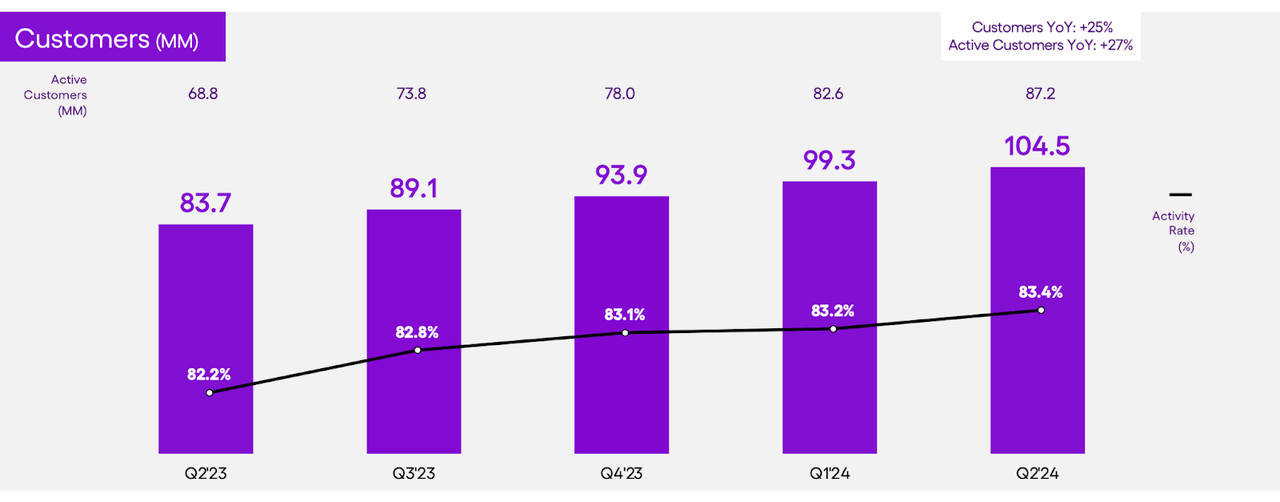

The addition of new customers continued to be very strong, in line with the average of the last 2 quarters (Q1 and Q4 2023), where the company also added around 5 million new customers. For a company that already had almost 100 million in Q2, adding another 5 million customers is quite a lot.

Nu Holdings IR

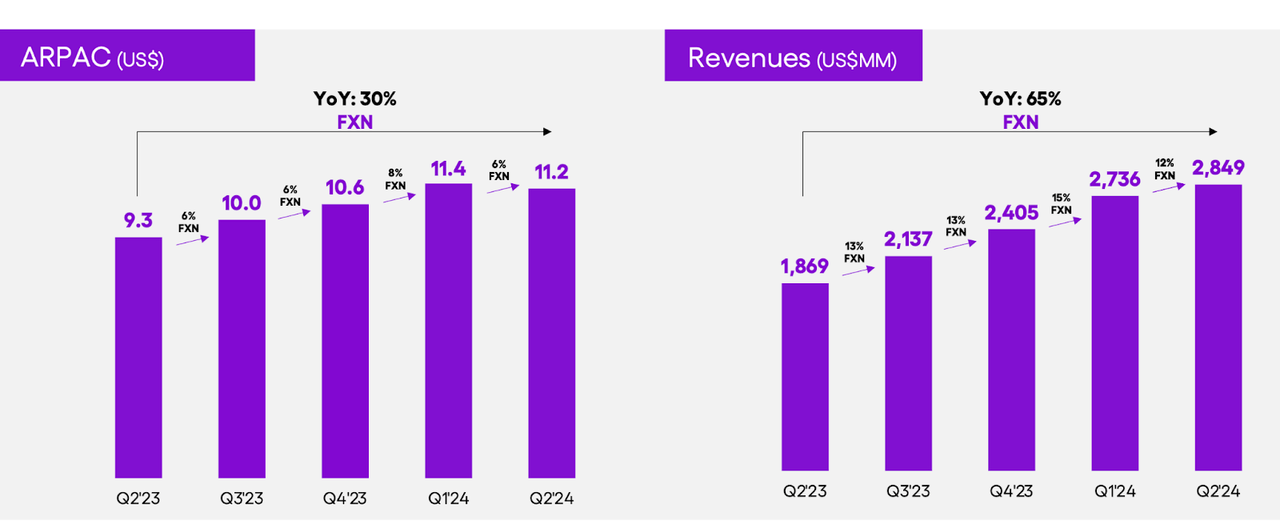

For the topline, this growth has already fallen, YoY there was still a 65% growth (FXN) in revenue, but QoQ was only 4%, while FXN was 12%. ARPAC was also similar, with a decrease to $11.2, but FX-Neutral saw a 6% increase compared to Q1. It’s worth mentioning that due to currency effects, the total portfolio also shrank to $18.9bn against $19.6bn in Q1.

Nu Holdings IR

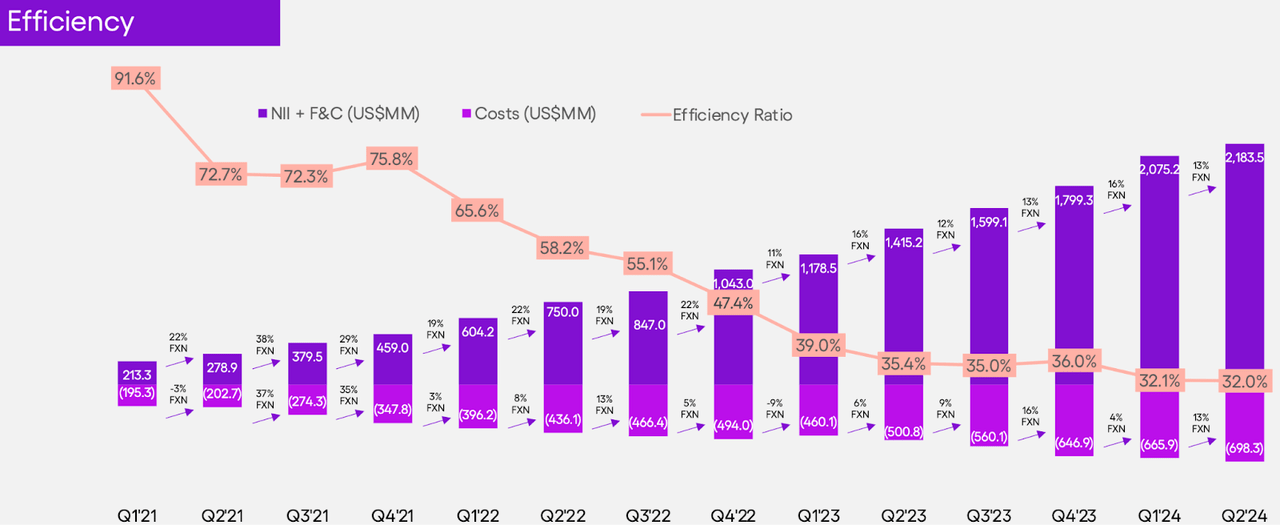

These currency effects also contaminated the analysis of the cost to serve per active customer. There is the impression of stability at $0.9, but in FXN there was an increase of 8% QoQ. When we look at the consolidated efficiency ratio, there is no negative surprise, as the bank managed to remain at 32%. As mentioned at the beginning of the analysis, just by maintaining this level Nu is already able to report excellent indicators and consequently generate value for the shareholder.

Nu Holdings IR

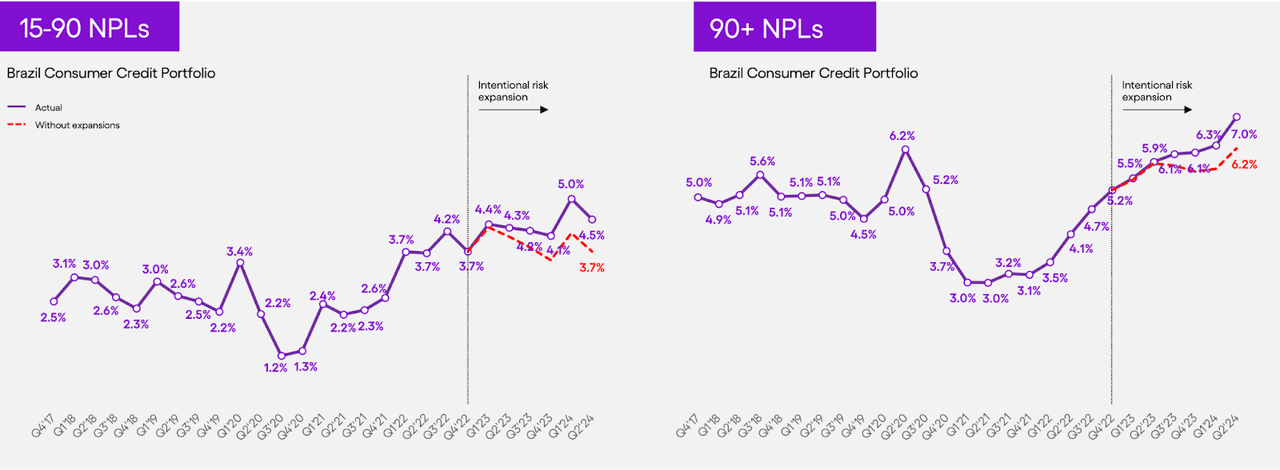

One of the factors that could be interpreted as negative was the increase in the delinquency rate over 90 days, reaching 7%, which is a high level even for a bank focused on riskier credits. The same indicator for the banking industry in Brazil was 3.20% in Q2. On the other hand, this is part of management’s strategy (as mentioned in the sentence below from the Q2 earnings call) and this exposure to riskier credits together with expansion (note, that without the expansion both delinquency between 15-90 days and 90+ days would be better) are what allow for a high ROE and strong earnings growth.

We are intentionally and strategically growing our lending book and expanding down the credit spectrum where we see relevant opportunities. In line with our credit philosophy, we prioritize decisions that optimize the long-term net present value of our credit cohorts, rather than focusing solely on short-term NPL metrics.

– Youssef Lahrech

Nu Holdings IR

In this scenario, the bank managed to beat market estimates, delivering $0.1 EPS adj. against $0.09 that was expected. The overall bottom line was an impressive highlight in my view. Net income reached $487.3 million, with a margin of 17%, while adjusted reached $562.5 million with a margin of 20%. The annualized ROE of adjusted was an incredible 33%, while accounting was 28%. The Brazilian banking industry is known for having high ROEs, with consolidated banks such as Itaú Unibanco (ITUB), Banco do Brasil (OTCPK:BDORY), and others consistently delivering ROEs above 20%, but even for this industry, 33% is impressive.

Nu stock’s premium valuation is getting harder to justify

The Q2 earnings were able to demonstrate that Nu Holdings is still an excellent company, and is certainly among the highlights of the growth theses, IMO being the main growth thesis with exposure to Latin America even considering MercadoLibre (MELI).

Nu Holdings still has a lot of growth to capture, it continues to make progress in attracting new customers (benefiting from the expansion of banking in the countries where it is present) and with the stability of the cost to serve and the maturing of ARPAC, it should continue to be a lever for generating value in the coming years. For this reason, Nu stocks should be traded at a premium valuation.

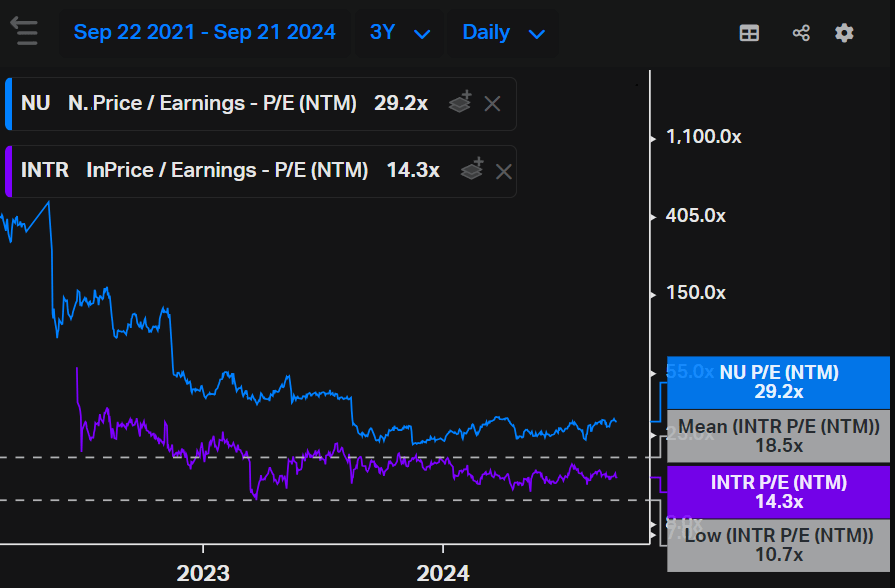

The question, then, is at what level this premium should be, up to just over 29x current earnings is a very reasonable level for a company of this quality and with these prospects, but it is undeniable that this already reduces its attractiveness. To be able to generate an attractive return for shareholders trading at almost 30x earnings, this growth has to be maintained, leaving less room for error.

The problem is that many of these mistakes may not be within the company’s reach. As a bank with operations in Latin America, such as Brazil and Mexico, economic uncertainties are a recurring theme. In Brazil, for example, contrary to expectations a few months ago, the interest rate was raised (going the other way compared to the Fed). This isn’t a problem now, but depending on what happens in the Brazilian economy over the next few years, it could directly affect Nu’s operations, especially with regard to the already high delinquency rate, which is directly affected by factors such as the population’s disposable income, unemployment and the like. Other factors such as the “bets pandemic” could also end up putting pressure on the population’s income.

Maturity (100 million customers already reached, 30% ROE, etc.) may also be a relevant obstacle to maintaining this pace. Overall, it remains likely that Nu Holdings will maintain an interesting growth rate, but the point is that pricing for (almost) perfection reduces the margin of safety.

One catalyst that reduces the attractiveness of Nu stocks is when we compare them to their main Brazilian peer, Inter & Co. Even though it has delivered very important developments in recent quarters, Inter is still trading for less than half of Nu Holdings’ NTM price-to-earnings.

Koyfin

Inter lags Nu in size but offers greater value

Like Nu Holdings, Inter is a digital bank that was born in Brazil and has similar characteristics, such as offering various services through a “super app” and therefore benefiting greatly from operating leverage, achieving stability in costs and expenses while revenue grows at a much faster pace.

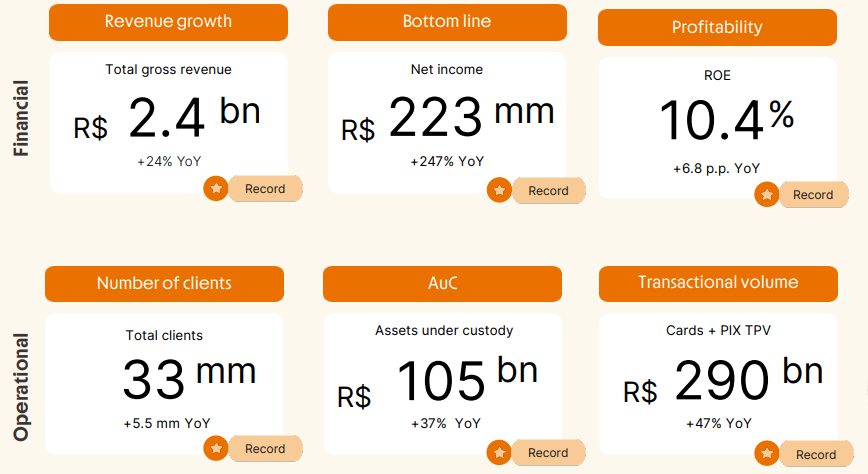

In the last few quarters, Inter has shown extraordinary, consistent results and many records have been broken. As the image below shows, Inter is at a different moment from Nu Holdings, Inter still has about a third of Nu’s customers, while its net income, although it has evolved, is still “only” $41 million.

Inter IR

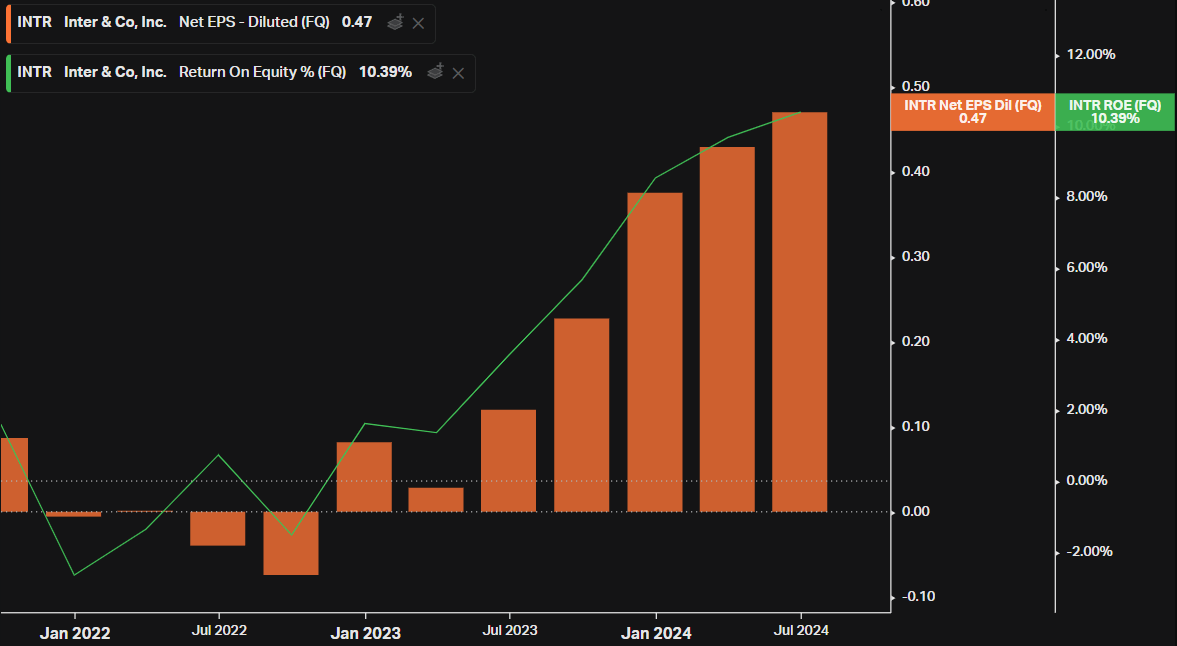

One of the most striking factors about Inter, along with the evolution of its results over the last few quarters, is its ambitious 60/30/30. By 2027, the bank plans to reach 60 million customers, a 30% efficiency ratio, and 30% ROE. It’s something that seemed quite intangible just over a year ago, but now, in addition to Nu Holdings showing that even better numbers than these are possible for a digital bank, Inter has also kept evolving (note the constant evolution of EPS in BRL and ROE quarter by quarter) and is on track to deliver this target or something similar to it.

Koyfin

Because it hasn’t yet delivered everything it promised (unlike Nu Holdings), Inter’s thesis is riskier and, consequently, more undervalued. Even so, it seems to me that the valuation gap has become too high, 14x earnings for a bank that is also digital and is delivering good developments, is cheap. While 30x earnings for a digital bank that has already delivered everything is only reasonable.

The bottom line

Nu Holdings is still an excellent company and a strong candidate for compounding, as growth still seems far from over, although it may now be that the level of maturity is starting to get in the way and reduce (even slightly) the pace of growth.

This, together with the multiple expansion and some other macroeconomic risks, translates into a worsening margin of safety. As it’s a company that should continue to deliver and is traded at high multiples, I don’t think a sell rating would fit, but I would also avoid increasing exposure at the current price and momentum.

On the other hand, Inter, even after its recent gains, looks attractive and a solid alternative.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.