Summary:

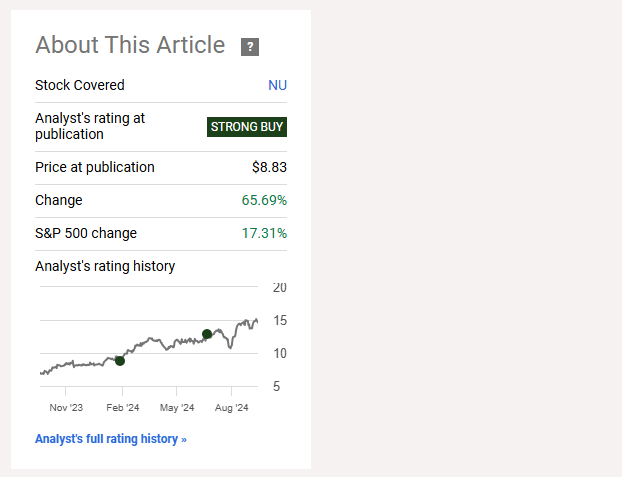

- We’ve been bullish on Nu Holdings stock since the start of the year, and shares are up significantly in that time. The company’s Q2 report has only solidified our thesis.

- NU’s digital banking model in Brazil, Colombia, and Mexico has driven efficient client growth and high margins, positioning it well for future expansion.

- Shares of NU are reasonably priced at 6x FWD sales.

- While we advocate a stock position, selling put options on NU can also generate a significant yield for income investors, offering a win-win setup no matter your investing goals.

- We reiterate our ‘Strong Buy’ rating on NU.

Alberto Coto/DigitalVision via Getty Images

Back in January, we wrote an article about Nu (NYSE:NU) titled “Nubank: Bet Big On Latin America With This Fintech Monster“.

The main thrust of the piece was that a combination of regional factors and single-stock catalysts could drive serious returns for NU investors, which has proven to be the case up to the present day.

Financial results have only accelerated since the start of the year, growth rates remain very high, and the stock is up more than 60% since our initial bullish rating:

Seeking Alpha

We’re happy with this performance, but the Q2 earnings report released last month showed us even more evidence that the company is on the right path.

Well priced, at only 6x sales, we think shares of NU appear more attractive than ever, especially given the company’s progress so far in 2024.

Today, we will be exploring NU’s recent earnings report and explaining why we’re still so bullish on this Latin American fintech, despite the recent run-up.

Sound good? Let’s dive in.

NU’s Q2

Let’s start by taking a look at NU’s recent Q2 report, which was fantastic.

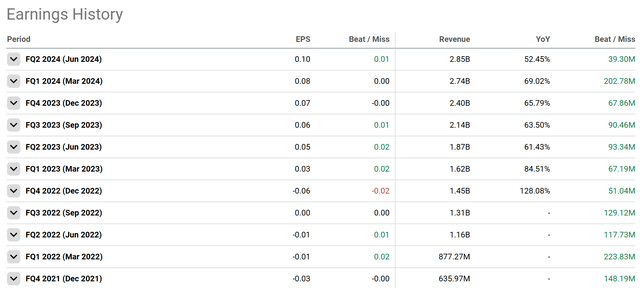

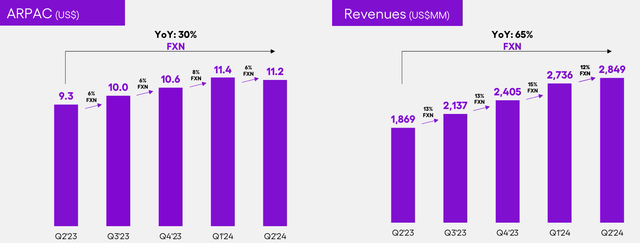

In Q2, NU reported EPS of $0.10 per share, and revenue of $2.85 billion:

This revenue beat kept the company’s tradition alive – since IPO – of beating on top line sales, and the record EPS number beat expectations by one cent.

Revenue growth of 52% YoY did come down a tad from prior quarters, but generally, as sales grow, it becomes very, very difficult to sustain revenue growth rates in the 60%+ range. Even for smaller, high growth companies, it’s hard to sustain growth rates above 25%+.

NU’s continued progress on the top line is encouraging, and while growth is decelerating somewhat, it’s totally natural, and we’re happy with the level of ‘controlled descent’, especially given NU’s already impressive size and $10 billion annual run rate.

In case you’re unfamiliar with NU, the company operates a digital banking franchise in Brazil (the main market), along with franchises in Colombia and Mexico as well.

Those regions have seen historically low levels of competition within the banking system, as legacy, ‘oligopoly’ banks have traditionally taken and kept share.

However, with NU, that is all changing.

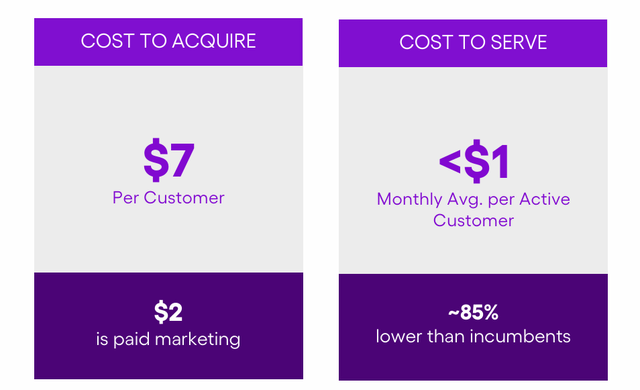

Operating as a digital-only franchise, NU’s offering is very low-cost from a Capex standpoint, and digitization trends in the region mean that the offering is available to almost all citizens across the country.

This fact, combined with a strong brand and customer satisfaction, is what has primarily driven efficient client growth for NU:

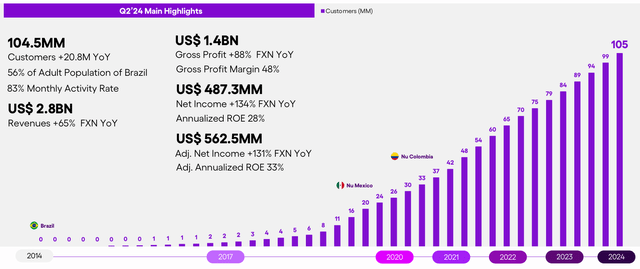

NU has a strong position within the markets it serves, when, combined with strong margins, means that the company is in a great position to grow net income over time:

At the same time, while CX, demographics, and cost advantages have powered ‘CAC’, on the revenue side of things, the company’s ‘land and expand’ strategy has been powering ‘LTV’, or ‘Long-Term Value’.

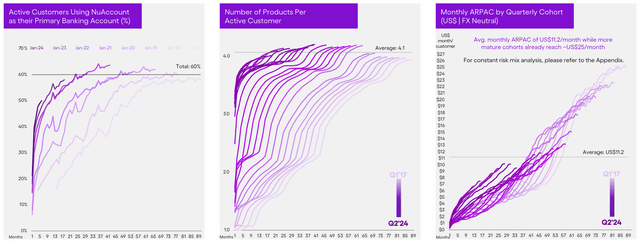

In the Q2 report, NU continued to show progress with this strategy, as customers were increasingly choosing NU to be their primary account:

Not only that, but as newer customers are signing up, they’re signing up for more and more NU products, more quickly, like bank accounts, cards, investing accounts, and insurance.

This growth has sent average revenue per user higher now than in previous cohorts, which means that the speed-to-adoption is increasing.

This is encouraging because it means that NU isn’t only reliant on new customers to power growth. In Q2, ARPAC grew 30%, which was responsible for half of NU’s revenue growth overall:

As NU continues to grow and launch new products, we expect long, LONG tails of revenue growth to follow.

Added up, NU’s unit economics per customer are simply unbelievable, and only improving as evidenced by Q2 earnings. Chalk it up to a first-mover advantage, which is why so many new companies in Brazil have sprung up to copy the digital banking strategy NU has pioneered.

Finally, from a liquidity perspective, NU is in a strong position to keep this growth coming.

Low funding costs mean that the bank is well positioned from a solvency perspective, and the $8 billion in cash on the bank’s balance sheet should be more than enough to invest in efficient marketing, especially in new markets, that could power the next leg of adoption.

All in all, NU’s Q2 report gives us confidence that the best is still ahead for both Nubank customers and shareholders.

NU’s Valuation

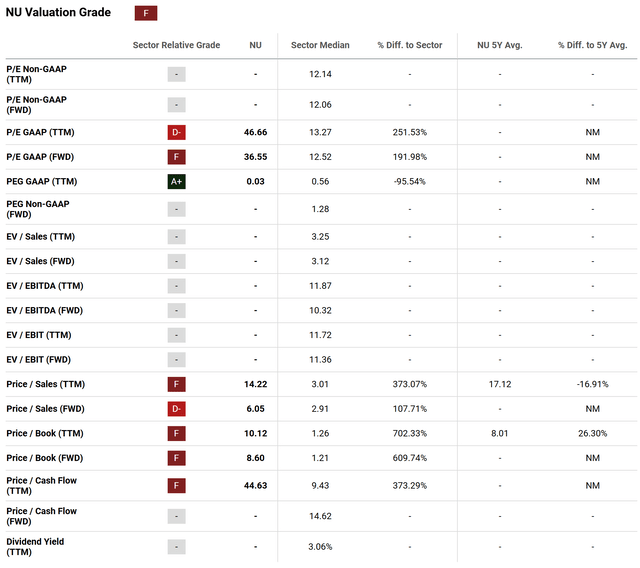

But how expensive are shares in NU?

In our view, they’re very reasonably priced.

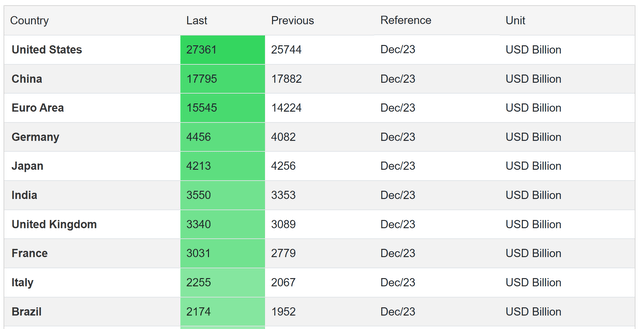

Remember, NU is a company with a rock-solid balance sheet, 50% operating margins, top line sales growth of 52% YoY and a market-leading position in a top-ten global economy:

What multiple would you pay for those stats?

Looking around, for those stats you’re looking at comps like Nvidia (NVDA), Eli Lilly (LLY), and Broadcom (AVGO):

Each of these companies trade for mid-teens multiples or higher, and other smaller companies, like Grindr (GRND) and First Solar (FSLR) are trading at roughly 6-8x sales.

Right now, NU is trading at around 6x FWD sales, which appears highly reasonable, despite the SA quant rating of ‘F’:

We’d agree that NU looked expensive vs. the financial sector if the company had comparable stats to other large banks, but NU’s financial performance is more akin to a high-growth tech stock, which makes the premium multiple easier to stomach.

All in all, the company continues to execute well, and shares appear reasonably priced. What’s not to love?

High Yield Options Overlay

While we’re rating Nubank a ‘Strong Buy‘ and advocating a ‘long stock’ approach, there are other ways to play shares of NU if you’re willing to have long exposure.

For example, if you’re more of an income investor but like the idea of being exposed to NU, then selling put options on the stock can generate a significant yield while also reducing risk significantly. Making a trade like this does hamper capital appreciation, but by trading upside, you can earn a significant cash payout from the put buyer.

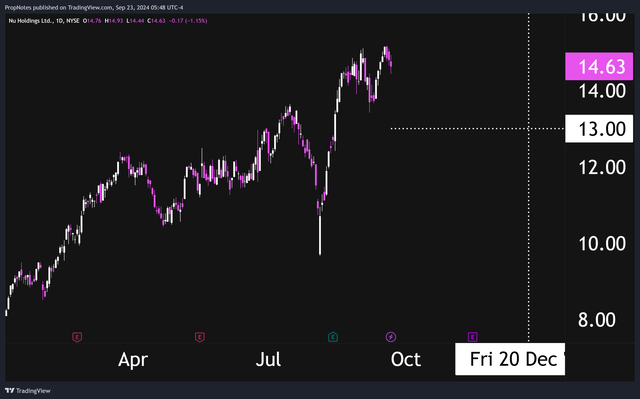

For example, right now, if you sell the December 20th, $13 strike put options, you’d earn a cash payout of $0.44 per share, or $44 per contract:

This works out to a yield on capital invested of roughly 3.5% ($44/$1,266) over the next 88 days.

Annualized, that’s a yield of about 14.5%, which is significantly better than you can find elsewhere – especially as rates are headed back down. Additionally, the option has a roughly 75% probability of ending OTM, which would be ‘max profit’ on the trade, and even if you were assigned on shares, you’d get them at a combined cost basis of $12.66, which represents a 14% discount to the current price.

Just to be clear, in a trade like this, if NU shares finished on December 20th above $13, then you’d get to keep the $44 per contract free and clear. If they finished below $13, then you’d still get to keep the cash, but you’d need to buy the shares at $13 a pop. If assigned, selling calls at the $13 level to generate further yield would likely be the best course of action.

Given that $13 is beneath where the market is currently trading, we find this setup to be an attractive win-win for those seeking yield as opposed to appreciation in their investing.

Risks

That said, whether you’re going long or selling put options in NU, there are still some risks to be aware of here before making a move.

First off, NU faces considerable FX headwinds in its financials. Between Brazil, Mexico, and Colombia, and the stock listing in USD, the company has consistent exposure to FX.

While some of these may work out to be tailwinds from time to time – depending on the fluctuations on a quarter-to-quarter basis – we expect that over the long term, earning profits in BRL and COP, and then returning capital to investors in USD will cause some slippage.

This is due to our view that the USD should remain stronger than emerging market currencies over the interim due to stronger global adoption, interest rate discipline, and balance of trade.

Additionally, recent moves against Elon Musk by the supreme court in Brazil make us less trustworthy of the country’s rule of law, which has a demonstrable impact on returns globally. If Brazil becomes known as an inconsistently regulated jurisdiction, then we’d likely see equity multiples drop, which could hurt NU investors.

Summary

That said, despite the risks and competition, we see NU as a top-tier investment opportunity for growth-minded investors, and we rate shares a ‘Strong Buy’.

For those seeking income, you can also play the stock with an easy-to-execute option trade designed to boost portfolio yield and achieve a better cost basis on the stock if assigned.

Stay safe out there!

Analyst???s Disclosure: I/we have a beneficial long position in the shares of NU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.