Summary:

- The company has achieved impressive financial performance, with strong revenue growth, profitability, and improving average revenue per active customer while maintaining per-customer service cost constant.

- Nu’s strategy of growing through cross-selling to Brazilian customers and the introduction of savings accounts in Colombia and Mexico makes me believe that there is still ample room for growth.

- Despite the company’s stock surging impressively from historic lows, the decreasing multiples due to favorable accounting data are compelling signals that reinforce my strong buy rating.

Editor’s note: Seeking Alpha is proud to welcome Daniel Urbina as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Antonio_Diaz/iStock via Getty Images

The stock of Nu Holdings (NYSE:NU) has risen more than 132% in just one year, recovering from its massive drop of -71% it experienced months after its IPO. Despite this impressive recovery, in this analysis, I will explain why I believe this stock is still a strong buy. I’ll do so by examining its competitive advantage, growth opportunities in local and foreign markets, and its valuation compared to peers. All of this will be considered in light of potential risks such as increased competition, policy changes, and political polarization. As mentioned in the title, setting an alert for this stock seems like a prudent move, so I will also be discussing the price retracement range where I will find an attractive entry point.

The Nu Formula

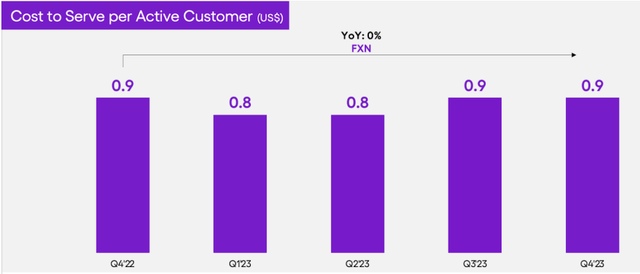

Nubank, a subsidiary of Nu Holdings, is a Brazilian neo bank that offers financial services to individuals without physical locations; everything is conducted online. Traditionally, Brazil has had a cash-centric culture, limiting access to financial services for underserved communities. Nevertheless, ten years ago, Nubank revolutionized this by establishing a model where the cost to serve a customer became extremely low (currently at $0.9 per month). Consequently, the bank commissions were reduced to basically zero, along with the convenience of opening a bank account within minutes. Today, NU has a staggering market cap of $54 billion, and $8 billion in FX neutral revenues. Even though 93% of the revenues still come from the parent market, Nu has also entered the Colombian and Mexican markets with the same intentions of following the Nu formula that gave them growth success in Brazil.

To give you a holistic view of what NU offers, here is a list of products available in Brazil:

– Credit cards with no management fees.

– High-yield savings accounts offering 100% of the interbank rate (NuConta)

– Life & Phone Insurance Payroll loans for federal civil servants (NuConsignado)

– Investment brokerage services (NuInvest)

In Colombia and Mexico, Nu only offers a credit and debit card, providing 13% and 15% interest on account deposits, respectively. The preceding rates are fixed (although subject to change), in contrast to Brazil, where the deposit rate precisely matches the interbank rate and is calculated every business day. As of the day of this writing, the Brazilian interbank rate stands at 9.66%.

Focusing exclusively on Brazil, which, again, accounts for 93% of the revenues, the previously mentioned products do not deviate from what a traditional bank offers. However, there are some components that, in my opinion, make them unique and allow them to differentiate from the traditional competition of Banco Itaú or Banco do Brasil, for example.

Credit Cards with no management fees

For instance, consider credit cards. The fact that credit cards are offered without charging any management fees is an appealing characteristic for many individuals who have never obtained a credit card before due to high management fees in Latin America. Personally, I follow the Dutch approach of paying for everything upfront with a debit card. This approach has prevented me many times from accepting a credit card and hindered me from boosting my credit score. However, with a credit card where I can consolidate every purchase into a single installment, thus paying no interest, and on top of that, incurring no monthly fees, all I see are benefits in getting one. To provide you with a sense of the cost levels, in Colombia, the MasterCard Classic offered by the largest bank, Bancolombia (CIB), currently charges around $85 US dollars annually exclusively for credit card management fees, whereas Nu charges $0. Bancolombia has recently introduced the American Express Libre, which does not impose any monthly fees. However, in my opinion, it is a subpar product since it applies interest one day after the purchase. It appears that the pricing models they run, are telling them that introducing a credit card with a one-month grace period and no monthly fees may cannibalize fee-paying customers and turn them to that hypothetical card. Who knows.

Of course, I am just a small sample representing the 380 million inhabitants between Brazil, Colombia, and Mexico. However, I am confident that many people in LATAM follow the Dutch approach. The removal of management fees, done properly—unlike Bancolombia—provides no excuses for not obtaining a credit card and boosting one’s credit score.

High yield savings accounts offering 100% of the interbank rate (NuConta)

Nu may not crow several decades of existence, unlike traditional banks, but with its substantial user base in Brazil (87.8 million), it is rapidly gaining brand awareness and trust every day. Nubank also enjoys an impressive

Net Promoter Score (NPS) of 85%, a remarkable figure for a financial institution, indicating a high likelihood for users to recommend the service to friends. When you couple these factors with Nu’s offering of interest rates for depositors at 100% of the interbank rate in Brazil, it presents a robust formula for significantly reducing customer acquisition costs. The company reports its Customer Acquisition Cost (CAC) at $7, a fascinating setup for a bank.

On last week’s earnings call, where I had the opportunity to join live, an analyst asked a question to CEO David Velez. While formulating the question, the analyst referenced the fact that traditional banks in Mexico remunerate depositors with 70% of market rates and questioned why Nu was paying almost twice of that with a current rate of 15%. In response, the CEO indicated to the analyst that he was being too generous with that percentage, asserting that, in many cases, banks pay absolutely no interest. Moreover, he highlighted that most banks even charge depositors to park their money. Velez responded that remunerating customers with high rates is a significant investment that is paying off fairly quickly. It is allowing Nu to attract more high-income Mexican customers, thereby improving credit quality as better data enables them to assess credit card acceptance or limit increases. He emphasized that the country only has a 12% credit card penetration rate, providing a wide-open opportunity for the bank to gain market share.

Investment brokerage services with low deposit amounts (NuInvest)

The third component of Nu that I identify as a differentiator from traditional banks, or in this case, brokerage firms, is Nu Invest. Nu began its penetration into the investment industry in Brazil after acquiring Easy Invest in 2020. With this acquisition, the company started offering investment products to its existing clients while maintaining its philosophy of low costs, specifically zero brokerage costs for stocks and bonds. If you are reading this from the US or Europe, you’re likely aware that zero trading fees were an innovative concept in your respective countries at the time. Today, almost all brokers have adopted this model. However, in Latin America, where financial markets are not as well integrated, this broker’s characteristic is still relatively new to these lands.

Nu Invest allows Brazilian clients to invest with very low amounts in various financial instruments, including stocks, bonds, ETFs, private REITs, mutual funds, and even options. Yes, options! The first time I saw this, I was shocked to find a Latin American broker offering derivatives to the general public.

Unfortunately for Nu, these zero brokerage costs have also been implemented by the competitor Itaú Unibanco Holding (ITUB). However, in my opinion, the initiation of a price war by brokerage firms could result in a net positive outcome, as low costs enable the Brazilian market to garner a more robust interest in financial market investments. In their most recent earnings presentation, I couldn’t find many key performance indicators (KPIs) about Nu Invest. Nevertheless, they disclosed that they currently boast 15 million active users with an impressive growth rate of 103% year-over-year.

Growth Opportunity

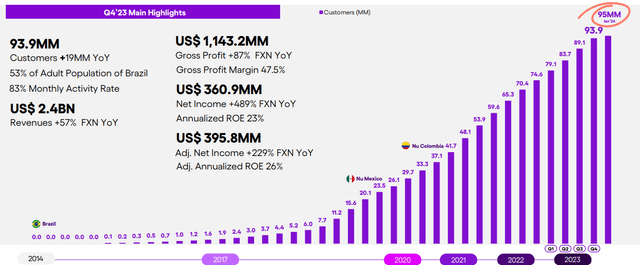

The growth story of Nu is clear, and the KPIs confirm the momentum. Over the span of 10 years, Nu has grown from 0 to 93.9 million customers, displaying a record high active rate of 83.1%. Currently, Nu in Brazil serves 53% of the adult population, indicating that the growth opportunity in terms of user growth rate has decelerated. Nevertheless, the company’s focus in Brazil is to leverage the data from their extensive user base to cross-sell other services, such as personal loans, investment brokerage, and life insurance.

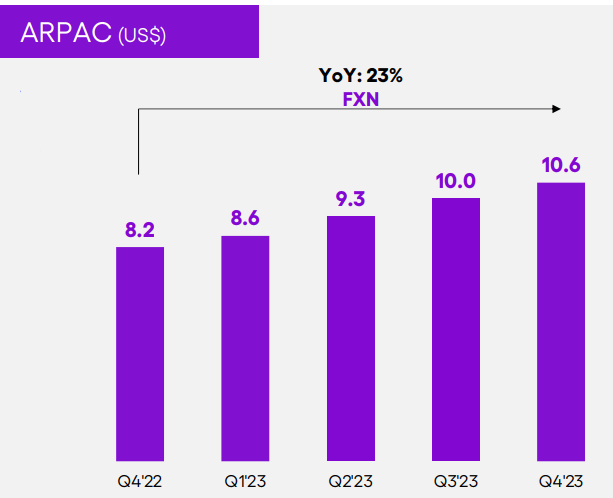

Nu Earnings Presentation

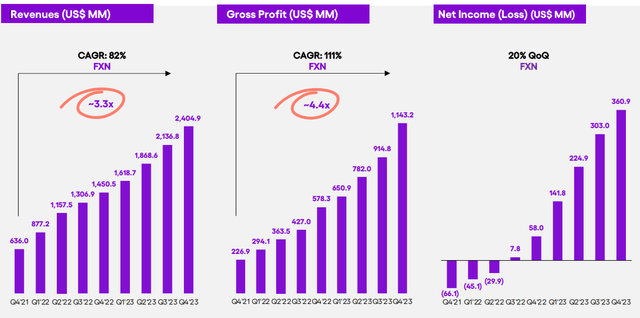

The key metric to monitor for this strategy is the average revenue per active customer (ARPAC). As illustrated in the left graph, Nu has successfully increased ARPAC. In 2023, it grew at a rate of 23% YoY, increasing every single quarter. What is even more interesting is that Nu achieved this while maintaining the costs to serve an active customer stable (see graph below). Growing revenues without significantly impacting the costs of serving an additional customer is one of the advantages that Nu has over traditional banks, thanks to the full digitalization of 100% of their processes.

Nu Earnings Presentation Nu Earnings Presentation

Nu is currently endeavoring to replicate its success story in Brazil, this time expanding its reach to Colombia and Mexico. Following its success in Brazil, these two nations possess the highest populations in Latin America, totaling approximately 180 million inhabitants. As articulated in the latest earnings call, the strategy is well-defined. The initial focus is on targeting the upper class, providing them with credit cards devoid of management fees. Subsequently, the plan is to extend offerings to the general public, presenting them with savings accounts featuring high-interest rates. From there, the aim is to achieve rapid growth by delivering a product that is not only affordable, user-friendly, but also convenient – enabling users to open an account in just a few minutes. Win in Mexico, ramp up secured lending in Brazil, make progress in high income and super core customers in Brazil, and a money platform becoming a reality are the next pivotal objectives for Nu in 2024.

Now, examining the reported financials, we can assess Nu’s performance in both the top and bottom lines. On the top line, revenues have consistently increased at a robust pace. Although the revenue growth rate decreased from 106% to 62% in 2023, the current growth rate remains impressive. In 2023, revenue reached $8 billion FX neutral. Additionally, the growth margins expanded by 800 basis points to 43%, delivering business confidence to investors. Turning to the bottom line, Nu experienced its first annual IFRS profitability in 2023, recording 1 billion in FX neutral net income. This translates to an 18% return on equity and a 13% net income margin. Profitability not only brings evident advantages to the company but also provides opportunities for fund portfolio managers with restricted mandates to invest in Nu.

Nu Argentina

In 2019, Nu attempted to establish operations in Argentina. However, due to unfavorable macroeconomic conditions, the mission was aborted, despite the opening of an office and the hiring of twelve employees. Nevertheless, earlier in the year, Nu’s co-founder, Cristina Junqueira, mentioned that the company does not rule out reconsidering entry into the Argentine market.

Interestingly, President Javier Milei retweeted the news about the potential re-entry of Nu into the Argentine market on his X account. If conditions change favorably, there could be an opportunity to target an adult population of thirty million Argentinians with Nu’s products in the future.

Valuation & Stock Movements

|

Neo Bank |

Size |

Business Stage |

|

|

NU |

Yes |

Large Cap |

Growth |

|

ITUB |

No |

Large Cap |

Maturity |

|

BBD |

No |

Large Cap |

Maturity |

|

BSBR |

No |

Large Cap |

Maturity |

|

INTR |

Yes |

Mid Cap |

Growth |

(Source: Author’s compilations)

Identifying comparable companies that are neo banks, publicly listed, of comparable size and business stage, and operating primarily in Brazil was quite challenging, if not impossible. After an exhaustive search, I managed to find only one publicly listed neo bank in Brazil: Inter & Co (INTR) Although Inter significantly differs in size from Nu ($2.38B vs $53.7B), it can still provide valuable insights for this analysis, especially since it is a direct competitor of Nu. Next, I turned to traditional banks. Despite not being neo banks and most likely being in their mature stage, which would typically justify a lower P/E, they can serve as a useful comparison. After all, they are essentially engaged in the same activities—gaining spreads from lending at higher rates and borrowing at lower rates. The table below illustrates the trade-offs.

Again, finding comparable companies in all three aspects was impossible, but I believe value could still be extracted from this peer company comparison.

Some might argue why Mercado Libre is not on the list, and although Mercado Libre has a strong fintech arm with Mercado Pago, the majority of its business comes from e-commerce and not all the components of the fintech division competes with Nu. Actually, most of their fintech revenues come from electronic payment processing, business where Nu is not competing. The same could be the case with Pag Seguro and StoneCo.

|

NU |

ITUB |

BBD |

BSBR |

INTR |

|

|

P/E (FWD) |

31.21 |

8.41 |

8.22 |

$7.87 |

$15.09 |

|

Price to Book (TTM) |

8.38 |

1.72 |

0.86 |

0.96 |

1.55 |

|

Return on Equity |

18.24% |

18.01% |

8.87% |

8.42% |

4.80% |

|

Return on Assets |

7.12% |

2.97% |

-2.41% |

1.99% |

– |

|

Revenue Growth (TTM) |

43.86% |

8.59% |

7.69% |

7.04% |

33.90% |

|

Forward EPS Growth (FY1) |

63.64% |

20.00% |

39.29% |

20.21% |

56.48% |

|

Net Income Margin (MRQ) |

27.80% |

26.58% |

20.85% |

24.29% |

9.42% |

(Source: Seeking Alpha)

When evaluating Nu alongside its peers, it becomes evident that the multiples associated with Nu are significantly higher. Specifically, Nu’s currency is trading at 31x forward earnings and 8.38x book value, both of which represent substantial premiums. However, these elevated multiples are well-justified.

Price-to-Earnings (P/E) Ratio: The high P/E multiple can be attributed to Nu’s expected EPS growth rate. Currently, analyst on average, expect an EPS of $0.75 in 2026 which translates to a CAGR of 52.86% based on the current EPS of $021. Despite the higher multiple, this growth trajectory supports the premium.

Price-to-Book (P/B) Ratio: Nu’s P/B multiple is strengthened by its robust Return on Equity (ROE). In fact, Nu’s ROE surpasses that of conventional bank competitors, underscoring the solidity of its business fundamentals.

Overall, NU’s financial metrics are fascinating. Other metrics below, not necessarily used as valuation tools, show how Nu is growing faster in both the top line and bottom line against peers. Also, exhibiting the highest net income margin among all five banks.

|

EPS 2023 |

(E)EPS 2026 |

3Y (E)Growth |

Current P/E |

3Y PEG |

|

|

NU |

0.21 |

0.75 |

52.86 |

53.14 |

1.01 |

|

INTR |

0.17 |

0.80 |

67.58 |

38.17 |

0.56 |

(Source: Author’s calculations based on companies’ data)

One of my favorite multiples to analyze companies that are in growth stage is the PEG ratio. Unfortunately, many data vendors do not currently provide PEG ratios for Nu and Inter. Perhaps, they use a particular equation, and those inputs aren’t fully available. Nonetheless, I decided to calculate it myself. The PEG ratio combines the P/E ratio with the expected growth rate. In this case, I used the current trailing P/E and divided it by the expected three-year earnings. The results indicate that Nu’s multiple to expected growth is fairly priced at 1.01. The other company in its growth stage, Inter & Co, appears undervalued. Of course, there is probably an implied size discount in the multiple, but again, a 0.56 PEG looks very appealing. With this attractive PEG ratio, I plan to delve deeper into Inter & Co’s analysis in my upcoming writings, so hit the follow button and stay tuned.

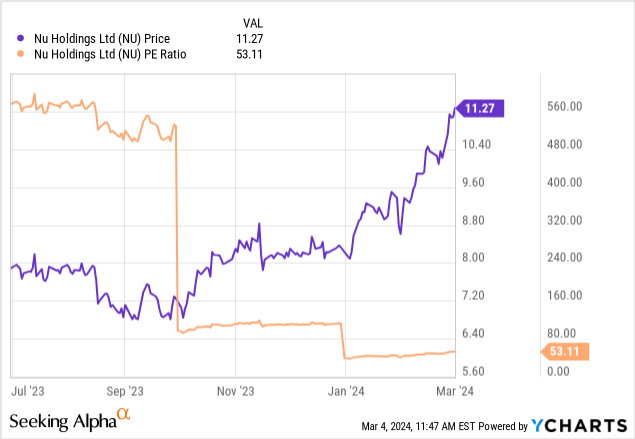

The image above portrays the ideal scenario for any investor: growing stock price and growing earnings, coupled with a decreasing P/E ratio. Within this context, even though Nu’s stock has steadily risen for more than a year now, some may argue that it is now too high. However, it’s crucial to note that earnings are also on the rise, resulting in a net decrease in the P/E ratio. This means that earnings growth is affecting the ratio more than the stock price growth. Conversely, a concerning scenario would be the opposite—where stock price enthusiasm outpaces improvements in fundamentals.

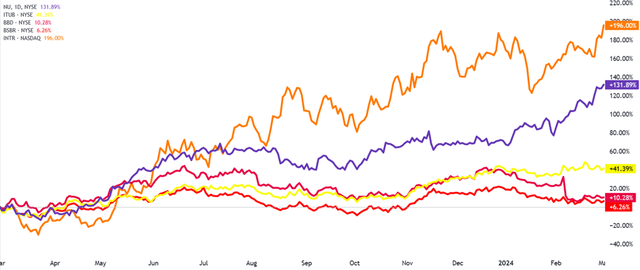

When comparing the performances of the five companies, we observe a divergence between the neo banks and the traditional banks. Nu and Inter have experienced extraordinary gains in the last year, growing at 132% and 196%, respectively. In contrast, Banco Santander Brasil (BSBR) and Banco Bradesco (BBD) fall into the category of laggards, achieving modest returns of 10% and 6% on their respective ADRs. Notably, these returns fall below Brazil’s primary index, which grew by 20.77% over the past year.

|

NU |

ITUB |

BBD |

BSBR |

INTR |

|

|

1M Return |

25.08% |

7.45% |

-10.75% |

-1.87% |

15.85% |

|

3M Return |

35.78% |

11.79% |

-13.26% |

-6.56% |

18.88% |

|

1Y Return |

131.89% |

52.89% |

17.97% |

12.64% |

196.00% |

(Source: Seeking Alpha)

Something important to mention is that even though Inter & Co, has been the performance 1-year winner, Nu has been taking the lead in the last three months and is outpacing them by encompassing a 36% return.

Risks

One of the major risks that Nu faces is the emerging competition from fintech companies that offer precisely what Nu does. An exemplar of this competition is Uala, an Argentine startup founded by Pierpaolo Barbieri and supported by the controversial investor and activist, George Soros. For instance, in Colombia and Mexico, both savings accounts provide exactly 13% and 15% interest rates on deposits. Both banks operate entirely digitally and are free to use. In my view, Nu’s superior branding will make me opt for them; otherwise, they both offer essentially the same product. Unfortunately, Uala remains a private company, so I was unable to ascertain the number of users they have in Mexico. In Colombia, Uala experiences 400k users compared to Nu’s 800k. Other competitors in Mexico include Stori and FINSUS, while in Colombia, Lulo and Pibank pose competition, all private.

Competition not only arises in markets where Nu is relatively new and aims to gain market share (e.g., Mexico and Colombia), but it also faces considerable competition in Brazil. If you are from Europe, you are likely familiar with Wise or Revolut. Well, both have recently entered the Brazilian market. To be fair, the landing pages of Wise and Revolut seem to focus more on wire transfers and remedies abroad by offering multi-currency accounts. Nevertheless, they are both FinTech’s serving customers with Mastercard and Visa debit cards. Additionally, N26 started operating in Brazil but was not successful enough, leading to the cessation of operations at the end of last year. Other local competitors to Nu include Inter, PicPay, and C6 bank.

More evident risks include the fact that at the end of the day, you are investing in emerging economies that often exhibit high political instability. For instance, Brazil recently witnessed a massive protest in Sao Paulo against the left-wing government of Lula Da Silva. Hundreds of thousands of citizens protested the judicial persecution against the opposition. Additionally, the Brazilian president’s attacks on Israel, comparing the War in Gaza to the Holocaust, has also been a point of contention. Additionally, like many emerging economies, Brazil faces a concentration risk in the commodities sector. The country’s main exports and production commodities include soybeans, coffee, beef, sugarcane, and iron ore.

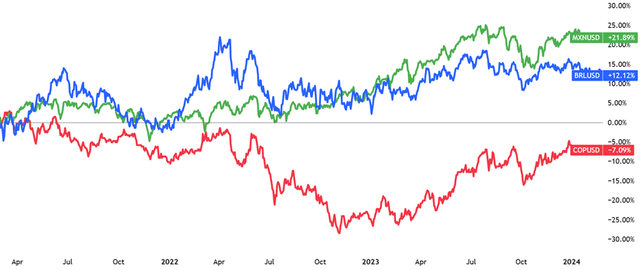

Unless your local currency is the Brazilian real, from where the majority of Nu’s revenues originate, currency risk is a factor that could affect Nu’s stock price. Predicting currency movements is a losing game, as theories like international risk parity and other foreign exchange theories have proven not to hold. Therefore, I would simply like to present the movements of the currencies in the countries where Nu operates over the last three years, without forming any expectations about currency movements. Overall, it’s not bad. Both the Mexican peso and Brazilian real have appreciated by double digits. Although the Colombian peso has depreciated over a three-year span, it has been recovering from losses since October 2022, as seen in the graph above. Please note that I have inverted the currency conversion for a more user-friendly visualization, where all performances use the dollar as the base currency.

Conclusion

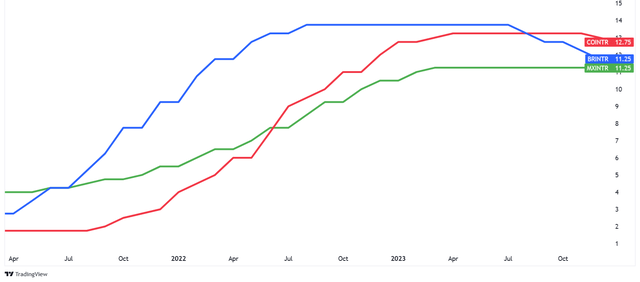

Nu’s growth trajectory is well-supported by its year-over-year and quarter-over-quarter financial performance. Despite emerging competition, the opportunity to further digitize Latin America’s largest markets remains. However, their innovation from five years ago is no longer groundbreaking. As user growth opportunity decays in Brazil, the company’s success in cross-selling new products will be pivotal for sustaining revenue growth in the Brazilian market. By leveraging high interbank interest rates, Nu can reduce customer acquisition costs through targeted marketing campaigns emphasizing the benefits of keeping money in the bank. Unfortunately, these great interest rates won’t last forever, and as an indication, the Brazilian and Colombian central banks have started to cut rates, as seen in the graph above. On the other hand, high interest rates reduce the demand for personal loans and credit card usage.

Personally, I will give this company a STRONG BUY rating. Note that this rating is based on their solid state of financials, but more importantly, its long-term projections, and the growth opportunity they have, particularly in Mexico. The cons of emerging competition and fading high interest rates, which increase deposits, do not significantly affect my rating. I firmly believe that the growth potential more than compensates for these risks. In this activity, I am not trying to predict or make an analysis about the short-term movement of the stock price. Nonetheless, if I were to select an entry point, I would probably wait for a pull-back of around 15% to 20% because the stock has indeed risen substantially, and those scenarios are highly likely to occur. Based on that, the buy range I would be looking to set an alert is between $9 to $9.60. Again, when scenarios like this occur, I typically set an alert on my broker and wait to enter because being patient in the markets will almost always pay off.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have an alert on my broker to notify me if the stock price hit the level of $9.60 (currently at around $11). I have the intention to buy the stock at $9.60 (or lower) if fundamentals remain constant or improve.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.