Summary:

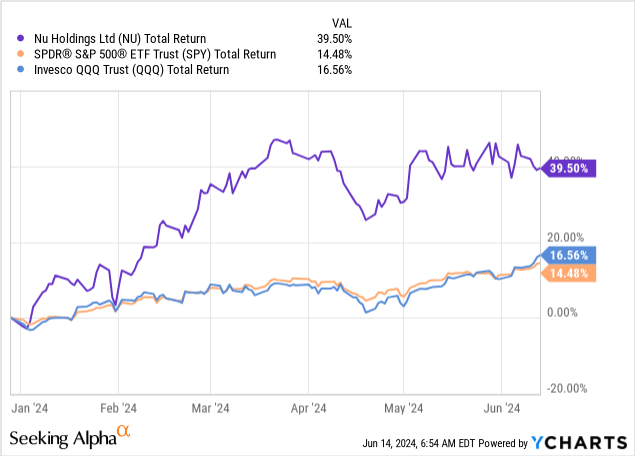

- Nu Holdings stock has risen 40% YTD, now 3x higher from the January 2023 lows.

- Despite this, the stock is undervalued and trading close to its IPO price.

- Several near-term catalysts are expected to drive the stock significantly higher.

Andrei Akushevich/iStock via Getty Images

Nu Holdings (NYSE:NU) has seen its stock rise by over 41% year-to-date, now up more than 3x from their January 2023 lows.

I argue Nu remains under-appreciated and undervalued, and the stock is still trading below its IPO price.

Let’s go over the near-to-mid-term catalysts that should send the stock much, much higher.

Revisiting The Nu Holdings Investment Thesis

I started covering Nu Holdings in December 2023, naming it my top pick for 2024. Nu offers a rare combination of a huge growth opportunity, an already extremely profitable company, and an undemanding valuation.

In terms of the opportunity, Nu surpassed 100 million customers, making it the largest digital banking platform outside of Asia. While it may seem like a testament to maturity, in reality, Nu has an abundance of runway to monetize this fast-growing customer base, and it’s still in the very early innings.

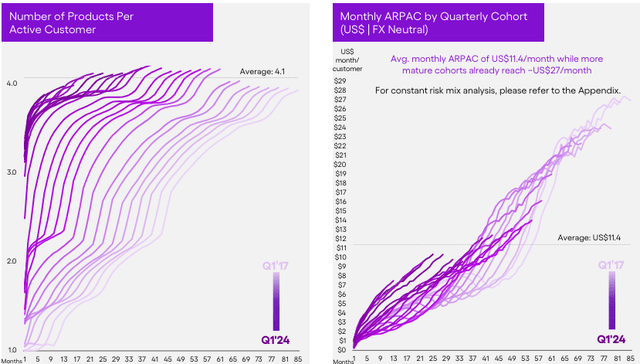

The easiest way to grasp that is the following slide:

Nu Holdings Q1’24 Presentation

Nu’s mature cohorts are at a monthly ARPAC of $27, compared to the total average of $11.40. That alone is almost a $20 billion opportunity, and that only takes into account existing offerings. In addition, Nu is constantly launching new services and products, which will lead to a higher mature ARPAC over time.

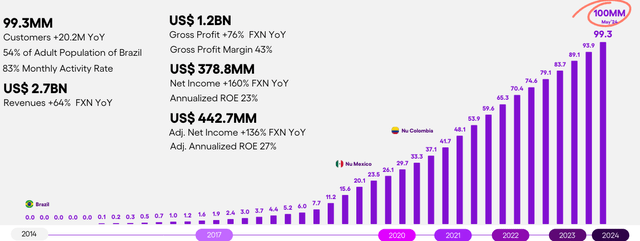

Importantly, the 100 million customer mark is also far from being a peak:

Nu Holdings Q1’24 Presentation

Nu continues to grow extremely fast, maintaining a pace of more than one million new customers each month. Furthermore, Nu currently operates only in three geographies, which are three of the most important economies in LATAM, but there are still dozens of other relevant core geographies to enter.

So, the growth story is clear and simple, but unlike many other growth companies, Nu is already an extremely efficient and profitable business.

Continued Profitable Excellence In Q1-24

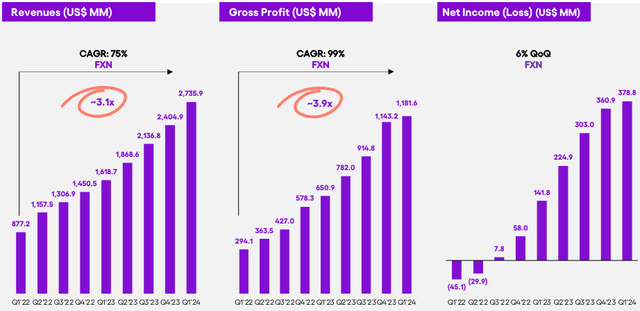

In Q1’24, Nu’s revenues reached $2.7 billion, that’s up 13.8% Q/Q and 69% Y/Y. Growth was led by interest income, which rose 16.9% sequentially and 82.0% from the prior year period.

Gross profit, which primarily reflects financial expenses, credit loss allowances, and loan facilitation costs, reached $1.2 billion, growing in line with interest income.

Operating income grew 2.4x to reach $578 million, as Nu’s operational leverage was demonstrated in full force. The company maintains one of the leanest organizations in the world, with near-zero marketing expenses. As a result, operating margins grew to 21.1%, up 600 bps from Q1’23.

Net income grew 2.7x to reach $379 million, as the improved profitability and revenue growth flowed through to the bottom line.

Nu Holdings Q1’24 Presentation

Nu’s credit underwriting, which is based on its proprietary models and differentiated datasets, continues to lead the company to industry-leading results.

The company’s net interest margin reached a record 19.5% in the quarter, up 450 bps from Q1’23 and 120 bps from Q4’23. Meanwhile, the risk-adjusted net interest margin was 9.5%, up 320 bps Y/Y and a 70 bps decline from Q4, as the company takes on riskier, yet very lucrative loans.

It’s important to understand that Nu is no different than any other credit business in the sense that its number one goal is to reach the optimal balance between absolute profits and risk. It’s not one or the other.

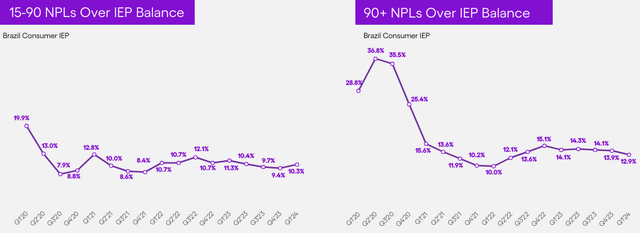

A good way to understand the risk-return profile is to look at NPLs over the interest-earning-portfolio balance:

Nu Holdings Q1’24 Presentation

Despite Nu’s NPLs growing, we can see that the NPLs over IEP are improving. This embodies Nu’s strategy, as every “loosening” of the underwriting boundaries is done intentionally.

Nu’s exceptional execution has led to a 27% adjusted return on equity, and this should only go higher as Nu’s capital is put into use, NIMs are growing, and operational leverage continues.

Nu’s Valuation Remains Undemanding

I usually dedicate the last section of my article to valuation, but this time I want to focus on catalysts as the main theme. So, let’s briefly discuss valuation, as it hasn’t changed materially from my March article.

Traditionally, banks are evaluated based on their book value, but for an emerging digital bank like Nu, there are several flaws with this approach.

First, it doesn’t own physical branches, which are a significant asset for traditional banks.

Second, deposits (a liability) are underutilized compared to loans (an asset), resulting in less equity at the current stage.

Third, the company is still at a stage of accelerated credit allowances and doesn’t have decades of profits behind it, meaning it has yet to accumulate meaningful retained earnings.

Lastly, and most importantly, Nu is increasingly expanding outside of core banking operations into areas like investment platforms and mobile.

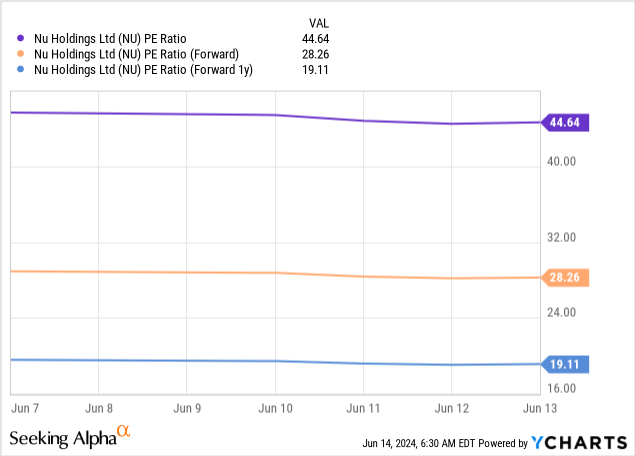

All in all, I think the right approach is to evaluate Nu like a fintech at its current stage, which means we’ll look at P/E, rather than P/B.

As we can see, Nu is trading below a 30x P/E over 2024 earnings, and below 20x for 2025. This is for a company that’s expected to grow revenues by more than 30% for several years, and to more than double its EPS by 2026.

The only way to justify this is the market placing a very deep discount on Nu’s place of doing business, i.e., Latin America. While I agree that Nu shouldn’t be treated like a North American company, I believe this discount is way too extreme. Especially when considering companies like MercadoLibre (MELI), which operates in similar geographies, is trading at elevated multiples.

I think that a 1x PEG would be reasonable for Nu, which currently trades somewhere in the 0.75x range, taking a 30x P/E and the expected 40% growth rate.

This equals a 30% upside, and a price target of $15.60 per share, by early 2025.

Catalysts

So, we have upon ourselves a huge growth opportunity, a proven track record of execution and profitability, and a low valuation.

While the stock is up over 40% since my December article, outperforming the market by a significant margin, I have to say I expected more, especially considering Nu has beaten expectations handily in Q1.

I think that the most burning question on investors’ minds right now is not whether or not Nu is a good investment, but rather, what are the near-term catalysts for shares to continue to work. Let’s discuss that.

Estimates Remain Too Low

Let’s start with a fairly obvious catalyst. I find that consensus estimates for the second quarter are just too low. Current estimates are for $2.77 billion in revenues and a $0.09 EPS. Consensus estimates essentially reflect flat revenues Q/Q, coming out of a quarter with 13.8% sequential growth.

The only explanation for this estimate is the decline in the Brazilian Real, which was an average of $0.202 for the first three months of the year, and is currently averaging $0.194 in the second quarter.

This reflects a 4.2% headwind for results in US Dollar terms. Not enough for me to expect flat growth in Q2. If Nu beats estimates, and I think it will, this should naturally bode well for the stock.

Improved Macro Backdrop, Specifically In Brazil

The Brazilian Real didn’t decline for no reason. Inflation is rising in Brazil, and there are growing concerns over President Lula’s plans to reduce the public deficit. His comments about reducing interest rates are a big red flag for financial observers, who don’t respond well to the government’s involvement in central bank policies.

In these kinds of situations, it’s important to take a step back and understand that Brazil’s economy, under the current regime, has been a success story. The IMF continues to praise the country’s resilience and has a strong GDP growth outlook.

That said, every time a bad headline regarding those riskier geographies goes public, it’s reasonable that investors will rethink their positions. I find this to be a temporary issue.

Success In Mexico

Nu has had extraordinary success in Brazil. It’s still early for that geography, but I believe the market has high confidence in that part of the business.

Mexico is not there yet. Nu still doesn’t break out too many Mexico-specific numbers, and what we do know is that it offers a very high yield on deposits to attract customers.

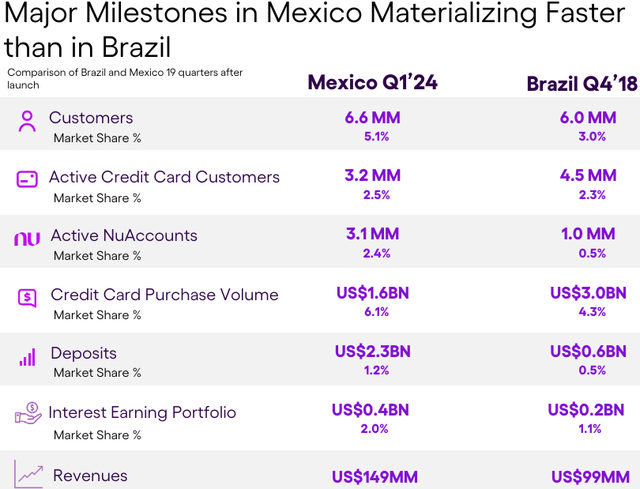

With that said, Mexico is tracking ahead of Brazil in many aspects:

Nu Holdings Q1’24 Presentation

As the company is able to leverage its learnings from Brazil, as well as its already developed technologies, I believe that Mexico will quickly become a success story for the company. For context, Mexico’s GDP is 80% that of Brazil, reflecting the size of the opportunity.

Conclusion

Nu Holdings has outperformed the market by a significant margin since the beginning of the year, rising by nearly 40%.

The company is still in the very early innings, but it has already demonstrated unparalleled execution capabilities and achieved very high profitability.

Despite that, I find that shares are approximately 30% undervalued.

I expect the company to continue to beat estimates while delivering better-than-expected results in Mexico. In addition, I believe the current geopolitical worries are temporary.

All these should be catalysts for the next leg higher.

I reiterate a Strong Buy rating with a price target of $15.60 a share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.