Summary:

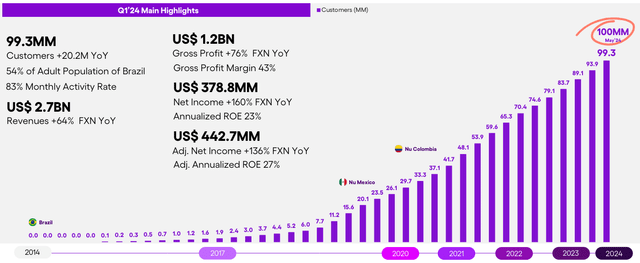

- Nu is a neobank with a strong presence in Latin American countries, showing 105% annual growth between 2020-2023.

- The company operates in Brazil, Mexico, and Colombia, with potential for expansion in other countries due to low banking penetration.

- In each country it arrives, the company ends up becoming a leader, which demonstrates a great product behind.

- Despite the 45% YTD return, I think the valuation is still attractive.

Phira Phonruewiangphing/iStock via Getty Images

Investment Thesis

Nu (NYSE:NU) is a neobank that has gained a strong presence in countries such as Brazil, Mexico and Colombia. Although its products are nothing out of the ordinary for a bank, the context of the countries where it operates allows it to find growth opportunities that have been reflected in the average growth of 105% annually between 2020 and 2023. But most importantly, looking to the future, I think that growth could continue, and the fundamentals are solid to become an important player in these regions; therefore, I think it’s currently a buy.

The Giant of Latin America

At the end of Q1 2024, Nu Holdings operates only in Brazil (93.5% of revenue), Mexico (4.5%), Colombia (1%) and another 1% of revenue comes from the United States, although this doesn’t appear to be the company’s main target market. The presence in Brazil, Mexico and Colombia is no coincidence, since these are the three Latin American countries with the largest population, Argentina being the fourth and Peru the fifth. In these five countries alone there are more than 460 million inhabitants, while Nu recently reached 100 million customers, evidencing the opportunity for expansion that remains in these countries plus others such as Chile, Uruguay or Ecuador.

The products offered vary in the three countries where it operates, for example, in Brazil the company offers a savings account, debit and credit cards, personal loans, investment funds and even a kind of marketplace. On the other hand, in Mexico and Colombia we can only find savings accounts and cards, so the opportunity to increase revenue in these two countries through upselling is interesting and would not depend only on acquiring new customers.

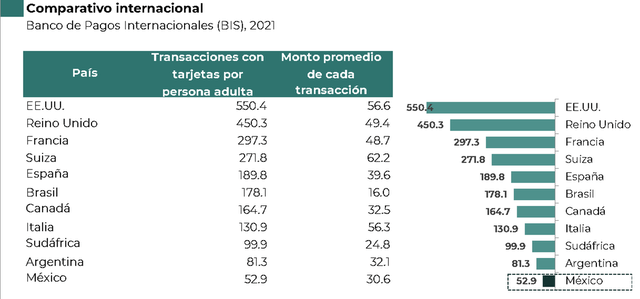

The Credit Card Opportunity

Although Nu’s products are not revolutionary at all, they are in a highly favorable context due to the low level of banking in Latin America and the high use of cash in these countries. In the following image, extracted from a report by the National Banking and Securities Commission of Mexico (page 74), we can see that in 2021 the average American citizen made 550 transactions a year with cards, while in Brazil only 178 were made and in Mexico 53. This scandalous difference in transactions translates into a revenue opportunity, since behind each purchase made with a card, there are commissions that are taken by the card-issuing bank and the payment processing network.

And Nu is not being left behind in this mission. In fact, its product is working so well that in Mexico it is already the fourth largest credit card issuer, ahead of banks with years of history in Mexico, such as Banorte (OTCQX:GBOOY) or HSBC (HSBC).

Although in the first quarter of 2024 the company’s delinquency rate was higher than that of traditional banks, this is understandable because Nu has among its target people who have never had a card before, which is a great opportunity, as we saw previously, but it also carries more risk of non-payment.

| Bank |

Credit Cards |

Credit Card Delinquency | ROE |

| BBVA | 8.9 M | 2.9% | 26% |

| Citi Banamex | 8.4 M | 3.1% | 12% |

| Santander | 3.9 M | 4.8% | 16% |

| NU Mexico | 3.6 M | 6.3% | 27% |

| HSBC | 2.2 M | 3.1% | 10% |

| Banorte | 2.1 M | 2.8% | 28% |

Source: Author’s Compilation

Valuation

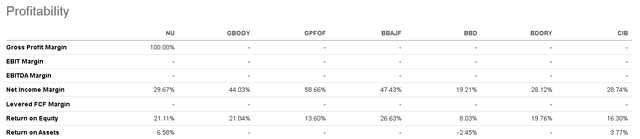

So far, we have seen that Nu is facing an interesting growth opportunity, but I’d like to show if the numbers support this thesis, to later make a projection and be able to assess if the shares are currently a buying opportunity.

In this matter, it stands out that Nu has not only grown much more than other large banks, but it has done so much more profitably. The net profit margin is around 30% and the ROE is above 21%. I think these figures are sustainable (and even improvable) and partly have to do with the country context, since other banks in Mexico, Brazil and Colombia also have similar ratios.

LATAM Banks Ratios (Seeking Alpha)

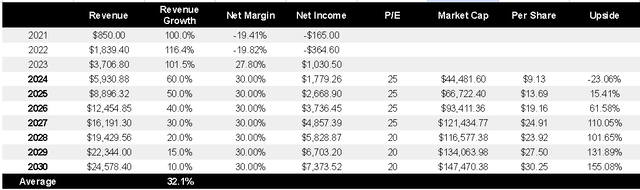

So, projecting into the future, I think the net profit margin of 30% is reasonable and could even fall short. The difficult part to project is revenue growth, since during Q1 2024 NU grew almost 70%, but it’s clear that these growth rates won’t last forever.

So, I’m going to assume that this year they grow 60% and each year the growth slows down in such a way that by 2030 the average annual growth would be 32% and in the years of lower growth the P/E multiple that I will be willing to pay It would be around 20 times. Still, his would represent a 100% upside between now and 2027.

Among the catalysts for this growth are:

- Geographic expansion to Argentina, Peru, Chile and Uruguay.

- Increase the catalogue of services in Mexico and Colombia until there’re at least the products offered in Brazil.

- Continue growing in Mexico and Colombia, since so far, penetration is still moderate compared to Brazil.

Valuation Model (Author’s Compilation)

I typically aim for a 100% return within the next five years, so achieving it in the next 3 and a half years would be a pretty appealing return for me. So, after the 45% YTD rally, the company’s shares still seem attractive to me and in my case I would be willing to continue buying in a range of $11-12 USD (if it is less, even better).

Risks

While the geography where Nu operates gives it a favorable context for growth, it also seems to me to be one of the most considerable risks. For example, reporting in dollars, but receiving revenue in Latin American currencies usually has negative effects when exchanging currencies.

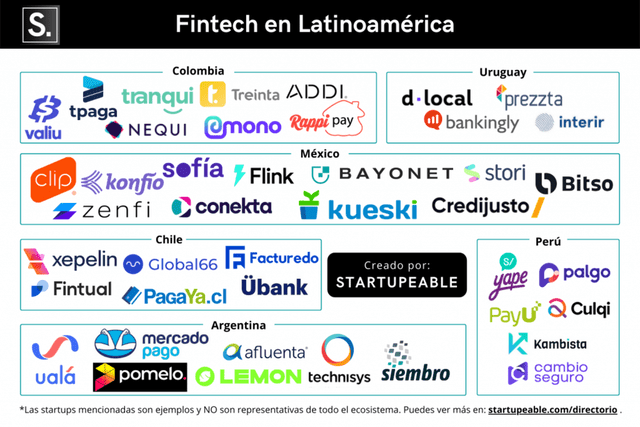

Furthermore, the Fintech competition is highly fierce. Mercado Pago (MELI) was born in Argentina, Mexico has Stori, Colombia has Rappi Pay and on top of that, they all have to compete with traditional banks too. While Nu has done well so far, if loses customers to the competition, its revenue and profitability would be affected.

Fintech in LATAM (Startupeable)

Lastly, a risk of having a presence in Latin America is that you must adjust to the different regulations of each country, unlike operating only in the US or Europe. But this can also end up becoming a competitive advantage in the form of know-how once you master it, and I think Nu will be able to benefit from this.

The Bottom Line

The company has considerable risks, but also a huge opportunity. So far, they have been able to capitalize it correctly, and in the countries where they operate they are a reference thanks to their high-yield savings accounts and accessible credit cards.

The P/E seems expensive at first sight, but it isn’t so when you take into account the growth opportunities and how profitable the company is, so I think it’s currently a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.