Summary:

- Nubank’s rapid growth and exceptional unit economics, with 110 million customers and low acquisition costs, highlight its potential to become a superapp in LATAM.

- Despite economic, geopolitical, and currency risks, I believe Nubank has significant upside over the next 10 years.

- Expansion into Mexico and potential entry into Argentina and other markets present huge opportunities for revenue growth and diversification.

- Mature customer cohorts show significantly higher revenue contributions, indicating further runway.

Editor’s note: Seeking Alpha is proud to welcome Alexander Ball as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

J Studios/DigitalVision via Getty Images

Introduction

I first started investing in Nu Holdings (NYSE:NU) back in May of this year. What caught my eye was the size of their rapidly growing user base. At the time, they had just under 100 million users and were adding approximately 5 million a quarter. Even though Nu primarily made their money through the banking segment, it was obvious to me there was a huge opportunity here outside of banking. Very few businesses have 100 million users or the kind of user growth Nu is seeing. I believed at the time, Nu had a strong chance to develop into a super app providing many services beyond just banking, leaving an opportunity for substantial upside. With the recent pullback, I thought it would be a good time to revisit my thesis and share why I am long Nu, as well as how my super app thesis has been playing out.

Nu

Nu is a digital financial technology company that was founded in Brazil in 2013 by David Vélez, Cristina Junqueira, and Edward Wible. At the time, it was founded on the novel idea of a purely digital bank in an emerging market. Traditionally, banks in the Brazilian market had only catered to higher income individuals. It was common practice to have to pay to have a checking account and a savings account. There was no such thing as “no fee” credit cards. The primary reason for these lackluster business models is quite simply a lack of competition. This is common throughout all of LATAM and has left over 100 million unbanked and without access to proper financial services. Due to the delay in development of LATAM, it’s not entirely uncommon for them to skip entire aspects of the development cycle. Meaning, many folks have never banked at a traditional bank prior to going fully digital. This leads me to believe there are many other opportunities in the market for Nu to perceive. Before I expand on this further, though, I want to start by going through their basic numbers to understand the business as it is today.

The Numbers

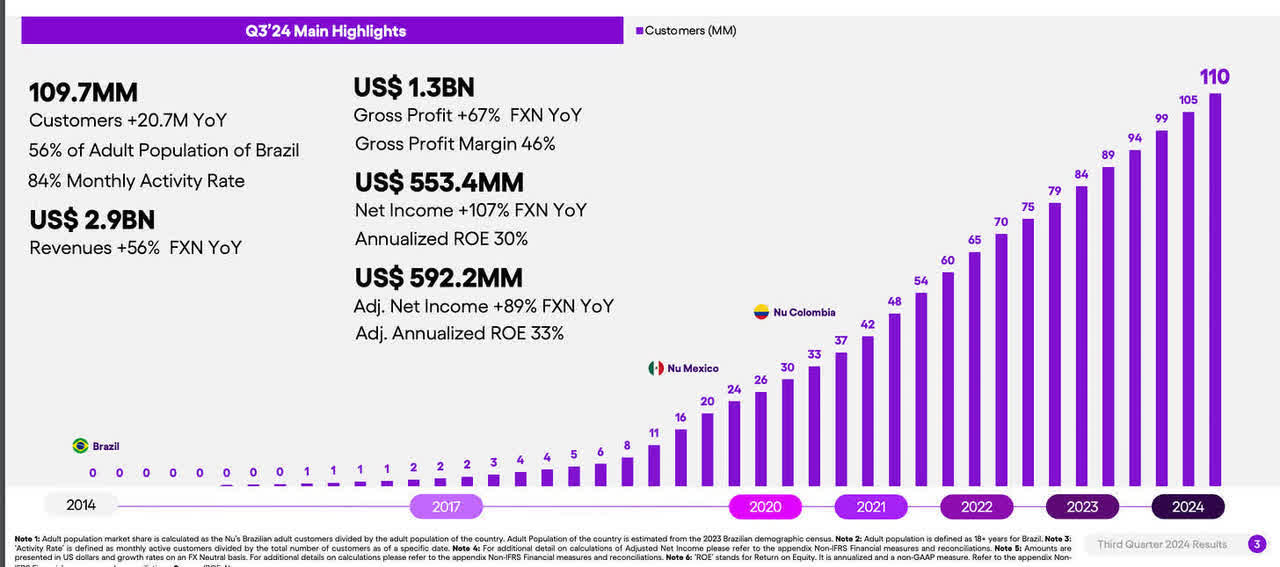

Nu user growth overtime (Nu q4 earnings presentation) (Nu Holdings q4 earnings presentation)

Nu is currently at 110 million customers and is adding 5 million new customers a quarter. Of these 110 million customers, 80% are active at least once a month and 60% of their customers use Nu as their primary bank account. Currently, the cost to acquire each customer averages just $20. The average revenue per active customer (ARPAC) is $11 and the average cost to the bank is $0.90 per month per customer. I estimate the payback period per customer is about 6 months. Given the lifetime of a banking customer, these are truly exceptional unit economics. It’s also worth noting 80% of Nu users have been customers for less than 5 years. I’d fully expect as users go through their lives, the amount they earn and the numbers of products at Nu they use will both increase and thus increase a user’s revenue contribution. Additionally, I fully expect even mature cohorts to have a long runway for increasing their revenue contribution as more products are added. To understand a user’s contribution, it’s best to understand how the ARPAC of users works.

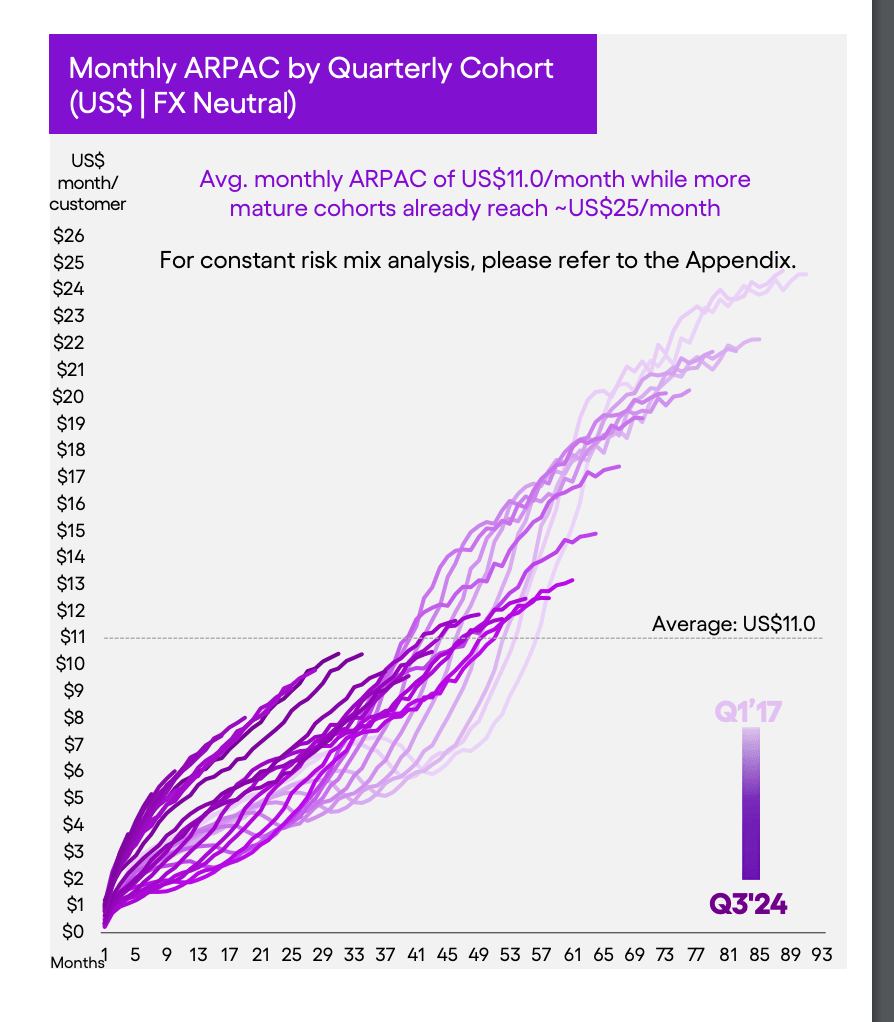

ARPAC Growth Over time (Nu q4 earnings presentation)

The ramp up ARPAC is highlighted by this graphic. We can see the most mature cohorts from 2017 are already at $24 a month, double that of the current active customer. It’s important to note that user growth is a headwind for this metric, as new users generate less revenue and thus actually decrease ARPAC. So, essentially, user expansion into both Mexico and Colombia are headwinds to ARPAC because the size of their product offering is less, and the users are newer so they have adopted less products. We can see here many of the newer cohorts are generating half the revenue of the more mature cohorts. Revenue per user grows overtime, and it takes years for a customer to reach their full potential in terms of revenue contribution. As we saw above, the aggressive user growth means many users are early in their life cycle in their revenue contribution. Let’s take a look a current contribution by cohort

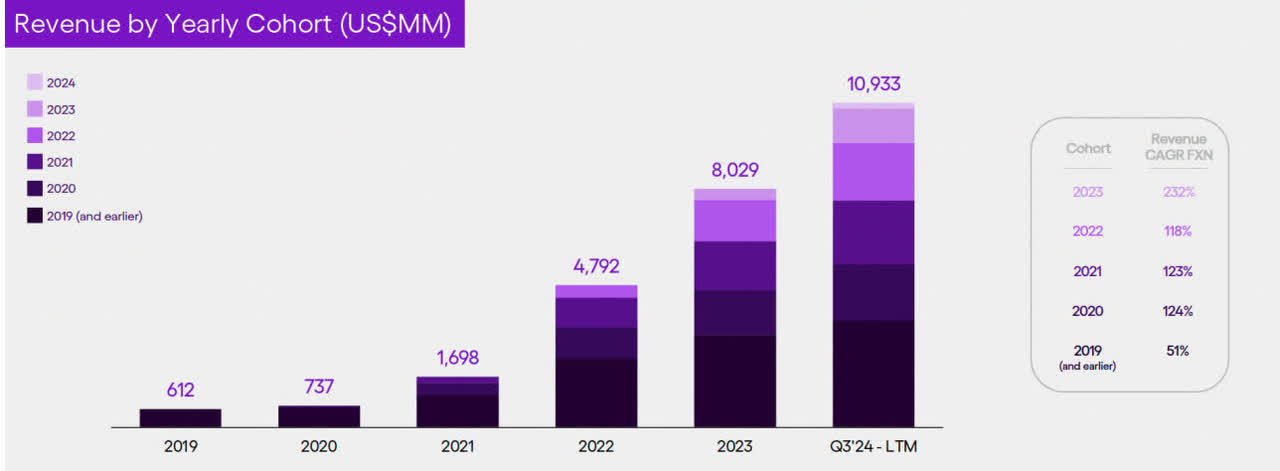

Revenue contribution by cohort ( Nu q4 earnings)

From this graph, we can see that the 2019 cohorts represent approximately 20% of all users but about 30-35% all of revenue. While conversely, the 2023 and 2024 cohorts represent 40% of all users but just 15% of all revenues. As of now, a smaller percentage of the user base is driving much of the revenue and profits. As the newer user base matures overtime, we will continue to see tailwinds for revenue growth as their earnings power increases and product usage increases. I also believe newer cohorts have a higher ceiling in terms of revenue generation, as the newer cohorts are likely younger and therefore more likely to use Nu for as many of their needs as possible. Someone who already has insurance, for instance, is less incentivized to use the Nu offering. But a younger user is more likely to have a wide array of needs that are yet met, and therefore more likely to just use Nu for these services. Additionally, as the product base Nu offers increases, we will also see these products integrate with each other. If a user is using banking, credit, insurance and cellphone, Nu can offer better pricing and recommend products that make sense for each user. Already this strategy is holding traction as seen by strong financial metrics.

Financials

Quarterly Revenue (Seeking Alpha)

Quarterly Net Income (Seeking Alpha)

Revenue growth has been aggressive, with a 4x increase in the last 2 years alone. However, we can see that revenue growth has slowed this year and there are a couple of reasons for that. First Nu reports in USD, but their business is in LATAM currencies. LATAM currencies have weakened approximately 15-20% against the dollar this year, which has dampened Nu’s growth in USD. Additionally, Nu’s growth is also simply just slowing down relative to their size. 20 million new users in 2021/2022 would have been 100% user growth YoY so it wasn’t as difficult to attain 100% revenue growth YoY. Now with 20% user growth (which is still substantial) it makes it harder to achieve the same scale of revenue growth simply by adding users. With that being said, Nu still has a couple of tailwinds in this department. First, it takes roughly 5 years to achieve max ARPAC, but 80% of Nu’s user base has been added in the last 5 years. So we will naturally see this ARPAC continue to expand, simply by their user base growing into their max revenue capacity. Mature cohorts are in the mid $20s while ARPAC is $11, so we will see this number eventually double when new user growth starts to slow. 2. Nu is now targeting higher earning demographics. Mexicans have a higher GDP per capita and thus higher potential for ARPAC. Mexico also doesn’t have as mature of a financial ecosystem, leaving even more opportunity to offer new and innovative products in Mexico 3. And finally, Nu is still in the early stages of their new product offerings. As they develop new business models beyond banking, the ceiling for ARPAC could go from mid-20s to potentially much higher. This means revenue growth still has a long runway, which leads me to touch on profitability. And finally, like most growing businesses, Nu isn’t maximizing their profitability as they are still focused on growth. As businesses reach maturity, they then tend to switch to focus on expanding margins. It could be another decade before we see this with Nu. Besides growth though, there is one other important financial factor to consider, which is Nu’s financial health.

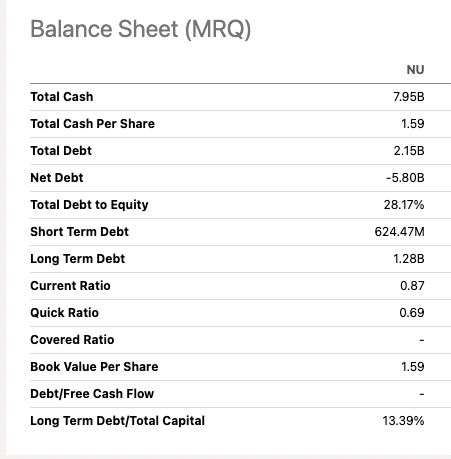

Nubank Balance Sheet (Seeking Alpha)

I want to quickly touch on the balance sheet of Nu here. As we can see, they currently hold $7.95B in cash on their balance sheet with -$5B in net debt and a total debt to equity ratio of 28%. One of the main risks with a bank is if they could go out of business in a downturn due to the risk of large losses from their various credit and loan businesses. Nu has a fortress balance sheet, with 1/7 of their market cap in just cash on the balance sheet. If they needed to, they could clear and settle all net debt while still having cash to run the company. This positions Nu well for any economic cycle, even in the worst instances. As things stand now, Nu could settle all of their debt and still have billions on the balance sheet. It’s important for banks to be conservative in this regard and always be prepared for another financial crisis like the great recession. Since Nu does a lot of credit cards and personal loans, I think it’s also useful to take a look at their coverage ratios.

Nubank Coverage Ratio (Nubank q3 earnings sheet)

Each stage represents the level of delinquency, typically at level the loan is not going to be paid back at all and typically at stage 1 most loans will be repaid. Here we can see Nu has a 90% coverage ratio on their worse performing loans, which indicates their credit algorithms are working as expected. Because their loans are short term, it also means their loans will typically go delinquent faster. This is actually a good thing because they are able to adapt faster in a downturn. Longer-term loans like real estate tend to respond slower, and it can leave banks much more exposed. So in terms of credit so far, we can see Nu has done a good job of calculating expected losses in their credit loss for each stage. If these ratios were lower, especially at stage 3, it would likely mean they don’t understand the credit they are giving out well enough. In summary, Nu’s balance sheet is robust and their future for revenue and earnings growth is encouraging. Which leads me to my most basic and high-level argument.

Super-App Thesis

I, personally, believe the strongest argument for Nu’s future success lies in the size of their customer base. 110 million users are a lot of users to monetize. When I look at LATAM as it is currently, it’s obvious to me there are many more opportunities for Nu to pursue. Nu was actually originally founded trying to solve one of the largest pain points, which is the business of banking. An old and outdated legacy system designed to only benefit the wealthy, and this has been their focus for the last 10 years. When a business is in its early days, they have limited capital and therefore often can only focus on solving one problem at a time. As Nu has hit profitability in the last year, it positions them well to start exploring more business opportunities. I find this comment from David Velez in their Q3 2024 earnings call indicative of the future of Nu.

There is a huge amount of synergies around the consumer base that we have. We are getting close to 60% of the Brazilian adult population, over 100 million Brazilian customers. So they have to spend very little money on customer acquisition and marketing. There is a huge amount of synergies on serving customers efficiently. We know how to do that for different sub-segments. For us specifically, there is a lot of value in creating a digital ecosystem. This is something we’ve been speaking about for several quarters now where we think that there is a big opportunity to go beyond financial services in new verticals.

Despite the company being 10 years old, it is early days for the potential of this company. When you go back and look at many of the most successful businesses, many go through a very similar path. Early on, they focused on one path to profitability and as they hit profitability in that line of business, they started to expand into new lines of business. Amazon started with books, then general retail, then web services, pharmacy, streaming, etc. you get the point. Nu has found success in banking, so as of today they are still “just a bank.” But I believe they will find lines of profitability across many businesses. Just in November, Nu announced their move into telecom offerings in Brazil, another pain point in terms of products in the Brazilian market. It won’t surprise me at all to see them continue to offer more and more products through their app. In terms of competition, the reason other companies don’t pursue these businesses is because many of them don’t have either the capital or technical know-how. While both of these are commonplace in the United States, it’s much rarer outside of the US and especially in LATAM. There isn’t the same VC and funding structure, there isn’t the same drive towards easy to use and simple experiences, and there are not many large and successful tech companies (yet) in this demographic. As a result, the ceiling of what NU can pursue and achieve is much higher than people realize due to lower competition and large user pain points. Because of this, in emerging economies, I believe there is more opportunity for a company like Nu to monopolize multiple industries instead of just one. We rarely see this in the United States because it is very competitive. This puts Nu in a very unique position to build a product for their users across multiple lines of business and across multiple countries. Nu has already started to pursue this, and they now have their eyes set on Mexico.

Mexico

While Nu is also in Colombia, Mexico is their largest opportunity outside of Brazil currently. The GDP per capita is larger in Mexico (Mexico’s $11,477 to Brazil’s $8,917) and the size of the unbanked market is approximately 50% of the country (60 million people). This is a huge opportunity for Nu to essentially double their potential revenue. As someone who has lived in Mexico a fair amount, I can tell you that you always need cash in Mexico, as many vendors do not take credit cards. While there, I asked my fiancé’s friends (all are Mexican) if they had Nu cards, and they all did. It’s obviously anecdotal, but it’s clear to me there is demand and desire for Nu’s products in Mexico. Nu is starting to see an acceleration of new users in the country, with 1 million added last quarter. With increased profitability, Nu can spend more on advertising and focus on growing their customer base before they eventually move to focus on profitability. Nu tends to ramp up slowly and verify business economics. The first 5 years of Nu in Brazil, they didn’t offer a savings account, for instance. With Mexico, I believe it will follow a similar path as Brazil, and we will see the ramp continue to tick up overtime. It’s still early days for this international expansion but presents a similar opportunity for success as they have found in Brazil.

Argentina

I want to touch on Argentina briefly here. Under Javier Milei, it’s quite possible Argentina will finally move on from decades of bad economic policy towards a more prosperous and financially stable country long term. David Velez has mentioned they are watching and keeping an eye on Argentina to see how it develops. In a few years’ time, we could see Nu moving into Argentina, and if so, that would provide another sizable opportunity.

Other Countries

Lastly, I’ve seen multiple interviews with David Velez where he mentions going beyond LATAM. It’s not something I am betting the bank on, but I do believe there are many other economies outside of LATAM where customers do not have access to quality financial services. Building a bank in LATAM is extremely challenging, which puts Nu in an interesting position as one of the few companies who know how to succeed in developing economies. It will be interesting to see how Nu opts to grow in the coming years.

Risks

At a high level, all companies face these risks, but companies outside of the United States are especially more prone to these risks. I want to touch on them briefly as they are important to understand, the primary reason foreign businesses almost always trade at a discount relative to the US market.

Economic Risks – Brazil is heavily commodity-dependent and is thus much more susceptible to swings in the economic cycle. Brazil actually was in a recession for a good part of the 2010s, even when the rest of the world had mostly moved past the great recession of the late 2000s. A diversified economy like the US is, of course, still prone to recessions, but one sector weakness can be easily offset by another sector. With Brazil, their focus on commodities exposes them to a more cyclical economy and thus potentially more cyclical earnings.

Government and Geopolitical – A bad leader can have significant adverse effects on investments. For example, a leader who controls the central bank can easily cause runaway inflation by not managing interest rates properly, this is currently happening in Turkey. Or imagine you owned an investment in Ukraine prior to the start of the war with Russia. These are real risks when investing outside of the United States. Politics are complicated and messy. Brazil and the risks their politics play is no different and something to be aware of.

Currency risk – If you are a US-based investor investing with the US dollar, then any weakening of a foreign currency (in the case the BRL) relative to the US dollar is a headwind to your investment. If Nu were to pay out a dividend in BRL but the BRL weakens to the USD, then you would receive less despite no changes in the underlying business. Additionally, if a country like Brazil were to have runaway inflation, it could easily destroy the value of your investment overnight. One of these reasons Brazilian businesses listed on the US Stock exchanges have muted price action is due to the weakening of the BRL to USD this year. I, personally, believe of all risks; this one is the most significant. A 10% growth in the business and a 10% weakening in the BRL yields FXN growth of 0%. This is a key metric to watch over time and if it were to continue accelerating it would potentially be a good reason to exit any positions in LATAM.

Valuation

Price to book

There is a tendency to value banks on price to book, and this, in my opinion, is a mistake. Ultimately, the point of a business is to deliver earnings so that you as an investor can share in those profits. Whether a bank has a p/b of 1 or 100, it doesn’t actually indicate anything in regard to the bank’s earnings. The main value of price to book is to understand your downside in an event of a liquidation or sometimes, for a bank running at a loss, it can indicate if the bank is trading below intrinsic value. Given that Nu has been consistently profitable for several quarters, their price to book gives no indication of current or future earnings. Additionally, Nu is expanding beyond the banking business, which may cause the p/b to further expand. As a result, I want to focus on a metric I feel is more meaningful today and will be meaningful in the future, which in this case, is their price to earnings relative to their growth.

P/E and PEG

To get an idea of how Nu should trade, I believe it’s best to look at Nu relative to the largest company in the region: MercadoLibre (MELI). MELI typically trades at approximately 60-70x earnings while growing 40% annually, but it’s also important to note most of their business is online retail which is exposed to less risk, and therefore they should trade at a premium compared to Nu. Because Nu is currently making most of their revenue from financial services, I do believe they should trade at a discount relative to a business like MercadoLibre because they are exposed to risks with their loans. Since both businesses are growing rapidly, I think their PEG ratios give better context to their price. Nu had massive earnings growth this year, which distorts their PEG for 2024, so I want to calculate the year-end 2025 PEG ratio for a more realistic number. Consensus EPS growth for Nu is 40% next year. This means we’d expect a forward p/e of about 20 from today’s stock price ($12 approximately) which means Nu’s forward PEG is 0.5 (20 P/E / 40% growth) compared to Meli’s PEG of roughly 1.87. Now let’s break down NU’s price at various PEGS for year-end 2025 to understand what that means for the stock.

| PEG ratio | Price |

| 0.5 | $12.00 |

| 0.75 | $18 |

| 1 | $24 |

I believe Nu should trade around that 0.75 mark or $18 a share. It discounts appropriately for being in LATAM and being in financial services, but also takes into account that with Nu’s user base and future product offerings, there is a high ceiling here. If Nu were to diversify their business, I believe a higher PEG could be appropriate. As seen above, at a PEG of just 1, the price has 100% upside from today at approximately $24. If Nu does manage to become a super app and maintain similar growth to Meli I do believe a PEG of 1 or better is possible. So, in my view, the upside is quite high here. I do want to take a look at the valuation in one more view, which is Nu trading as a bank.

What if Nu trades like a Brazilian bank?

Itaú Unibanco Holding S.A. trades at a P/E of sub 10 with almost no growth (most Brazilian banks trade around here), so what happens if Nu trades similarly? In this instance, I want to take a step back and think about the business 10 years from now instead. If Nu does double their users to 200 million and if they manage to increase ARPAC to the mature cohort level of $25 for all users, we would then see their revenues 4x from today (2x users * 2x ARPAC = 4x). That means they would be trading at 7x earnings at today’s price. If they returned all earnings as a dividend at this time, we would see a 10%+ dividend. So our bear case here is that 1. Nu does not have any more successful products for 10 years and 2. The market does not price in any growth as the stock goes flat and 3. We assume Nu plateaus completely at the end of a decade, but we still would get a 10% dividend 10 years from now. That’s not great, but I honestly think anyone who holds long enough would break even on Nu in this case.

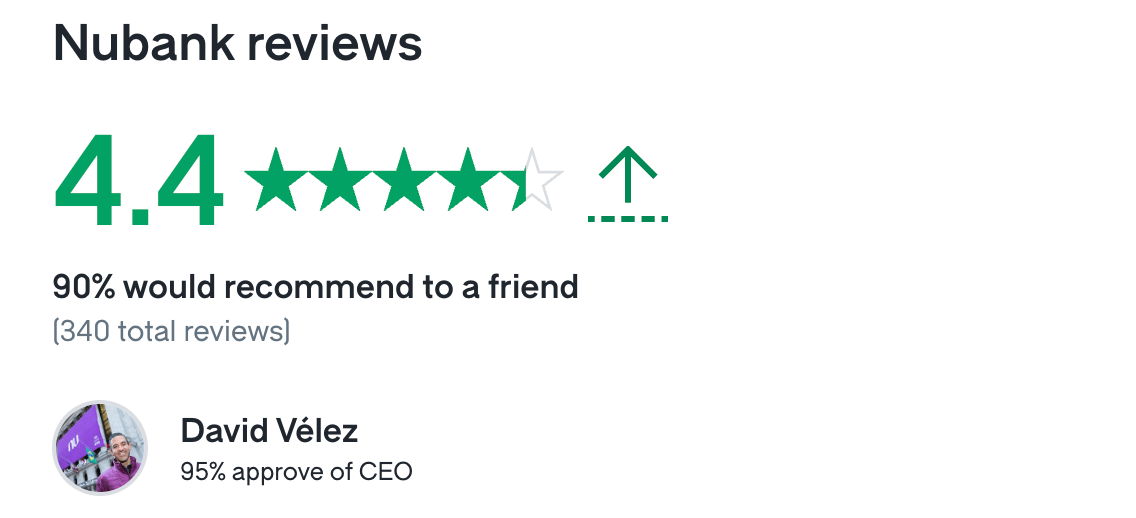

Glassdoor rating of Nubank (Glassdoor)

Conclusion

I always find high Glassdoor ratings as an additional bonus when investing in a company. I genuinely believe people who like working at a company will do better work, and I think that shows in Nu’s product. This high-quality product has resulted in rapid growth in first Brazil and now Mexico and Colombia. I believe they can hit 250 million users over the next decade because of this. Additionally, they are always adding new products to their app and still are in the planting seeds phase for many of their new products. Imagine an app that does financial services, cell phone products, insurance or even a marketplace. This leaves an incredibly high ceiling for the future of a business. Because of this, I rate Nu a buy for anyone who believes in the super app thesis.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.