Summary:

- With revenue, ROE, and NIM continuing to expand at elevated levels, the growth story remains intact.

- With this earnings release the stock’s PE should decrease by approximately $7.81 based on the new diluted EPS and post-market trading price, improving the valuation.

- Although not everything in this release was all sunshine and rainbows, Q1 appeared strong, I am reiterating my high conviction in the stock and going with a strong buy rating.

Justin Lambert/DigitalVision via Getty Images

Yesterday Nu Holdings (NYSE:NU) announced its Q1 2024 earnings results, and after listening to the earnings call, I reiterate my conviction and rate this company with a strong buy. In this analysis, I will briefly guide you through the business profile of Nu, to later discuss the things I liked and didn’t like about the earnings release and how this new EPS data moves the PE multiple of the company.

Nu Business Profile

To briefly recall, Nu Holdings is a conglomerate that primarily consists of three banks under the Nu brand in Colombia, Mexico, and Brazil. By far their largest market is Brazil, the country where they started and offer a broad portfolio of services such as credit cards, savings accounts, personal loans, insurance, and brokerage services to individuals. Also, in Brazil, they offer point-of-sales solutions to SMEs via NuTap. In Colombia and Mexico, their services are currently limited to credit and debit cards, where both operations in those countries remain unprofitable due to the business stage and relatively earlier market penetration.

If you aren’t familiar with Nu, I advise you to have a look at my previous analysis, where I laid out in more detail their business profile and how they have been differentiating themselves from traditional banks in LATAM. So far, that has been my most viewed analysis here on Seeking Alpha.

Nu Earnings Q1 2024

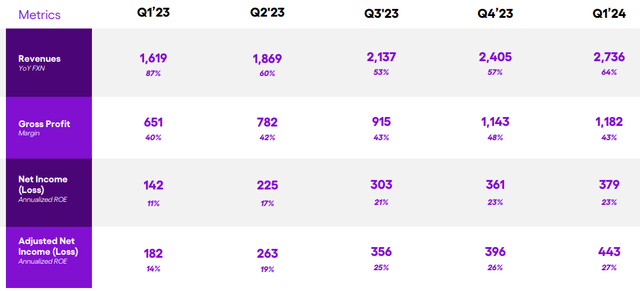

On Tuesday after hours, Nu reported its Q1 earnings, where revenue had an incredible surprise of +26.8%, increasing from an expected revenue of $2.16 billion to actually achieving $2.74 billion for the quarter. Representing a 64% FXN growth YoY and a 15% QoQ. From the EPS side, earnings came in inline with expectations at $0.08. This event made the stock price jump 3.46% to $11.95 after hours, although I remember seeing a -4% drop minutes after the release. Nu didn’t issue guidance, and hasn’t tended to do so in past earnings releases.

Nu Q1 2024

When having a closer look at both top-line and bottom-line metrics, their growth trajectory remained intact with high-growth levels still being the case, without notable signs of them fading away. Revenue growth and ROE growth both expanded and although the gross profit margin slightly decreased for the quarter, it remained high enough and close enough to recent quarters (excluding Q4).

Nu Q1 2024

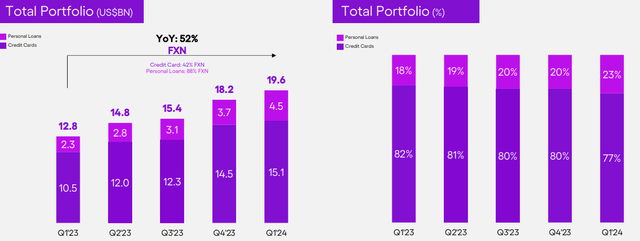

The credit portfolio also continued its growth path, and there is a clear tendency of personal loans to compile a higher allocation in the total portfolio, which has increased by 5% from a year ago.

Nu Q1 2024

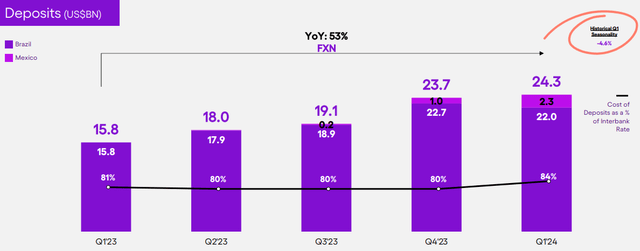

In aggregate, deposits continued to grow, but still saw the cost of funding rise and demand deposits in Brazil to fall from the previous quarter. Nonetheless, deposits remain very elevated from the year prior, and also, during the earnings call the company pointed out that there is some seasonality within this metric, and they were expecting a drop to occur. Still, the company mentioned that the deposits decline in Brazil was lower than the historical drop in Q1 demand deposits in the banking industry of Brazil, with a decline of -3.12% vs. -4.6% of the industry history.

Nu Q1 2024

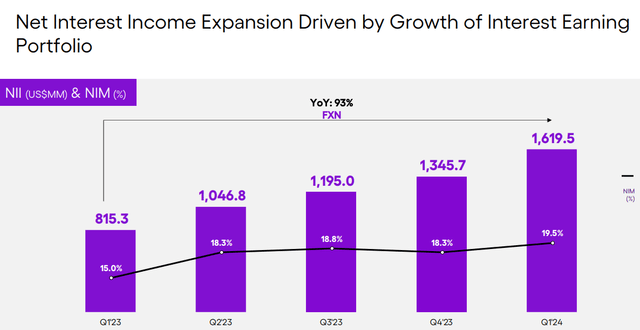

Importantly, net interest income saw a QoQ increase of 20%, with net interest margin also expanding to 19.5%, besides the seasonality factor of Q1. Yet, risk-adjusted NIM contracted 70 bps, and the company attributes this effect to rising deposits in Mexico at higher funding costs. Also, their recovery rate halved from the previous quarter. Excluding all of that, Nu has been able to maintain its average cost to serve an active customer at $0.90 and the efficiency ratio continued to improve, hitting all-time lows of 32.1% vs. 36% from the previous quarter.

Nu Q1 2024

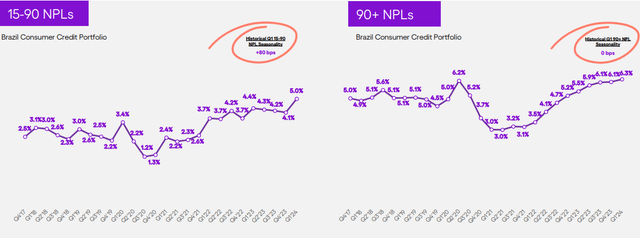

Of course, not everything is all sunshine and rainbows, and there was an important increase in shorter-term delinquency rates. The 15-90 day non-performing loans jumped 90 bps to 5.0% from the previous quarter, which is its highest on record based on the information that Nu published. Again, the company reiterated that there is a seasonality factor within this respect and that on average the historical effect in Brazil is for an increase of 80 bps which falls roughly in line with the rise in Nu’s shorter-term NPLs. In addition, 90+ day non-performing loans hit a record at 6.3%, although they didn’t have a significant increase from the previous quarter.

Customer KPIs in Q1

Nu Q1 2024

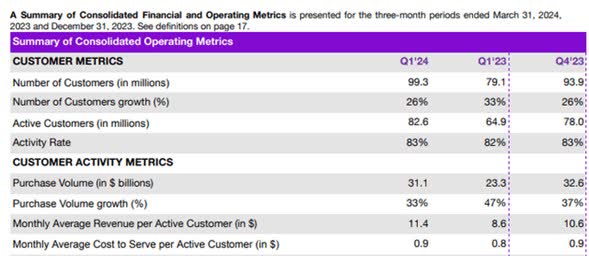

From the side of clients, KPIs continued their growth momentum, with Nu reaching the handsome amount of 100 million clients in May 2024 and becoming the first digital bank outside of Asia to be able to do so. It’s also insane that their activity rate is 83%, which many other banks would envy. For example, fellow Seeking Alpha analyst, Sergio Cachoeira, mentioned in his Banco Santander (Brazil) analysis that they have an active rate of 47% which is almost half the one of Nu.

Purchase volume slightly decreased, even with all the heavy seasonality factors that tend to occur in Q1. Interestingly, monthly average revenue per active customer continued to climb to $11.40. Again, to put it in perspective, this is a company that has a cost of less than a dollar to serve each active customer.

Nu 2024 Priorities

During the earnings call, CEO David Velez reiterated Nu’s priorities for 2024.

1. Start with strong momentum in Mexico.

2. Ramp up their secured lending initiatives in Brazil.

3. Enhance their strategies to advance in the high-income segment in Brazil.

4. Launch products to leverage real-time payments with AI.

Nu Q1 2024

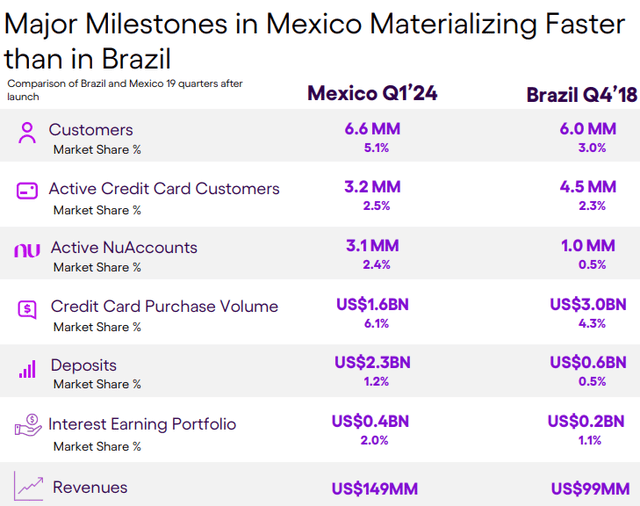

Within the earnings presentation, there aren’t slides that directly discuss the last three priorities. Nonetheless, they did emphasize in a slide that focuses on the first priority which is winning in Mexico. For that, they compared the performances of Mexico and Brazil 19 quarters after launch, and they demonstrated how their current growth in Mexico, at least in the initial entry phase, is comparable to the success experienced in Brazil. Also, keep in mind when examining the table above, that Brazil has a population of around 90 million more people than Mexico.

Furthermore, it’s worth mentioning that Nu already started to decrease their interest rates to depositors in Mexico, passing from an APY of 15% to one of 14.75%, following the exact 25 bps drop from the Bank of Mexico. Still, Nu’s rate remains above the central bank rate at 11%, but slightly down from fintech competitors such as Stori and Uala who decided to keep their rates intact at 15%.

Cons of the Q1 Earnings

Nu Q1 2024

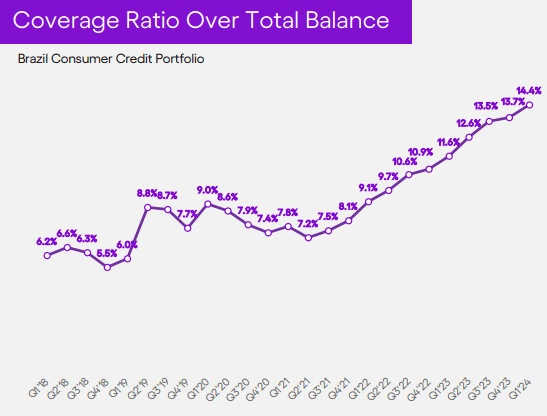

The rise in shorter-term delinquency rates and the decline of the gross profit margin are of course the cons of this earnings release. Nonetheless, the delinquency rates increase is justified by seasonality factors and the new gross profit margin level is comparable to recent quarters as well. Regarding the former con, even though delinquency rates rise, the same is occurring with the coverage ratio over the total balance, which is a positive sign to the company’s risk profile.

NU Trading Multiples

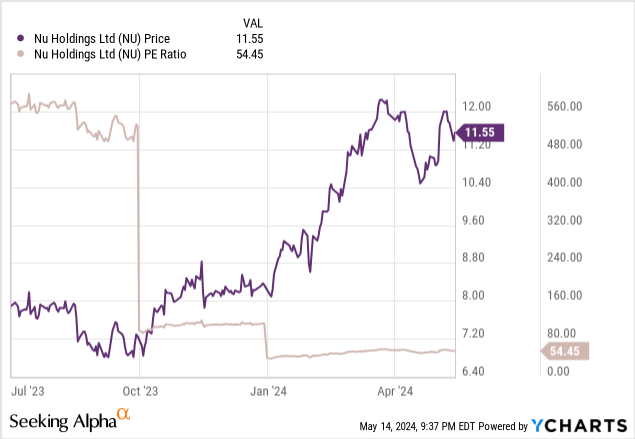

In my previous analysis, I mentioned that even though the stock price of Nu saw triple-digit returns in 2023, the PE multiple was falling, representing a positive sign. Let me illustrate this again with the graph above, but keep in mind that this graph does not take into account post-market prices nor denominator changes in EPS, so it won’t reflect this earnings release.

Even though data vendors don’t have this information ready yet, based on my calculations, it is likely for the PE to follow the decreasing trajectory after this Q1 release.

To illustrate this, the TTM Diluted EPS of Q1 was $0.2605 and after dividing it by the post-market price of $11.95, gives a PE of 45.87x vs. the one on Monday at 53.68x based on a closing price of $11.38 and a Q4 TTM Diluted EPS of $0.2120.

At the same time, it is worth remembering, that even though the PE will likely remain elevated today, their forecasted 12 Month Forward PEG ratio appears cheap on an absolute basis at 0.56.

Takeaway

To conclude, in this earnings release, I didn’t see anything material that would make me change my high conviction in the stock. On the other hand, I saw a great quarter with the growth story continuing its ongoing path and representing a lot of further opportunities to penetrate the LATAM markets with digital banking growing at these high rates. I am bullish and will remain so until things unwind or the multiples expand to unjustifiable levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.