Summary:

- Nu reported better-than-expected results in terms of revenue and profits, but some signs left me skeptical.

- The loan portfolio had its first quarterly reduction in history, caused mainly by exchange rate variations, while NPLs began to increase.

- In my view, this is not consistent with a 10x P/B valuation, which in my view already prices all of the bank’s growth and expansion initiatives.

Justin Lambert

Investment Thesis

I recommend holding Nu (NYSE:NU) shares after Q2 earnings. This report is a continuation of my earnings coverage of Nu, one of the largest digital banks in the world in terms of number of customers, and which has been experiencing rapid growth, operating in Brazil, Mexico and Colombia.

Despite the robust growth delivered in Q2, it struck me that this was the first result in history where there was a quarterly reduction in the loan portfolio. Additionally, the 90+ NPL is on an upward trajectory, while provisions are on a downward trajectory. All this, combined with a 10x P/B valuation, makes me skeptical about the thesis.

Nu Results Update in 2Q24

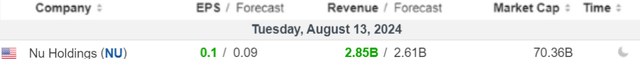

Nubank released its Q2 results on August 13, and as we can see below, the bank exceeded market expectations for revenue and net income.

Although the main numbers came in above expectations, there are some points that raised a warning sign for me. In the next chapters, I will do a detailed analysis of each segment of the result. Enjoy reading!

Total Portfolio – Growing With Consistency

The loan portfolio fell 3.2% q/q and grew 27.8% y/y to $18.9 billion. Brazil still accounts for 70% of new clients, although Mexico and Colombia are gaining share.

As I said in my report on the start of coverage, my doubts were never related to the capacity of Nu’s managers, so I believe that the bank will continue to evolve in terms of customer acquisition and profitability of its portfolio.

However, it is interesting to highlight that the quarterly reduction in the loan portfolio is the first in its history. We also need to analyze the results as a whole, which is why we will look at NPLs.

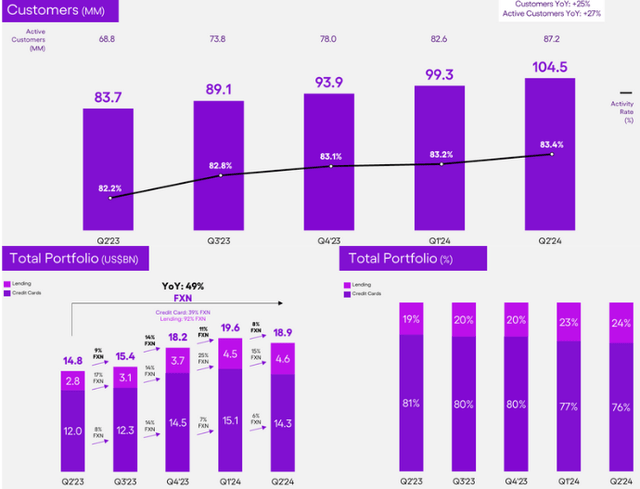

Nonperforming Loans (NPL) – One Of The Concerns

While short-term NPLs improved by 50 bps q/q, 90+ NPLs rose by 70 bps to a record 7%. However, Nu has been reducing its provisions, while credit provisions reached $760 million, down 8.5% q/q.

From an operational point of view, this is the point that makes me most skeptical, in addition to the valuation that we will see ahead. The Nu indicates that the reduction in provisions reflects a better-than-expected short-term default rate.

However, Brazilian peers such as ABC, Banrisul and Inter (INTR) saw improvements in the indicator, with reductions of 39 bps, 21 bps and 11 bps respectively, which raises a warning sign and supports my recommendation to hold the shares.

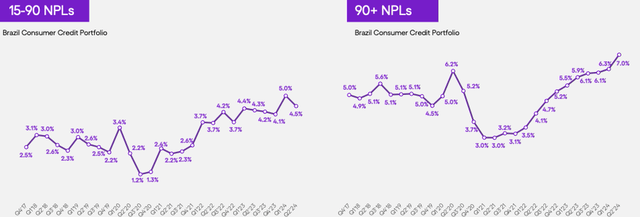

Net Interest Margin (NIM) – Growing

Net interest margin reached $1.7 billion with annual growth of 77%, as we can see below.

Returning to what I discussed in the previous chapter, in 2022, Nubank’s loan portfolio was mainly composed of credit cards, which do not pay interest and accounted for 85% of the total, that is, only 15% of the portfolio yielded interest for the bank.

Today, 32% of the portfolio pays interest, with Nubank adding products such as Pix Credit, which has a loss of around 20% but yields 60% per year in interest for the bank, and accelerating in personal credit.

Although the strategy has been successful so far, it seems to me that, with some macroeconomic setbacks, the bank will have to be less bold.

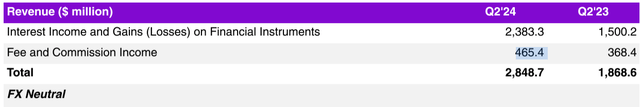

Service Revenue and Efficiency – Ok

Nu’s revenues from services reached $465 million (+2% q/q and 236% y/y). Due to lower-than-expected interchange rates, it is worth noting that this number has been below market expectations on a recurring basis.

As for expenses, the bank presented an efficiency ratio of 32% (-10% q/q) with an improvement in operating leverage. I believe this number should continue to improve as the client base grows and the number of cross-sells and upsells increases.

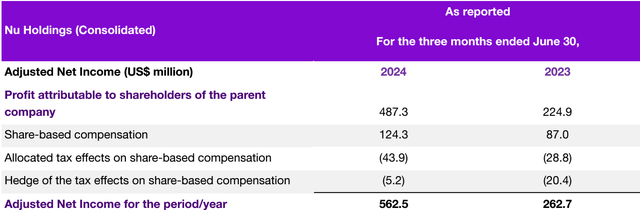

Net Income – Above Expectations

With solid revenue growth combined with controlled operating expenses, Nu achieved net income of $487 million (+29% q/q and +117% y/y), implying a ROAE of 28% for the quarter.

Although I believe that Nu has the capacity to enter new businesses and operate in new geographies, I point out that exchange rate variations can significantly affect profit growth in the coming periods.

Valuation – Remains Stretched

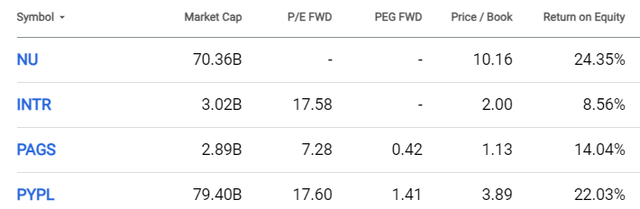

In the following, I will use SA to compare it with peers in Brazil and USA, such as PayPal (PYPL), Inter (INTR) and PagSeguro (PAGS). We will analyze the P/E TTM, Price / Book with the Return on Equity.

It doesn’t seem reasonable to me that Nu is trading at a P/B above 10x, while its peer PayPal with a 22% ROE trades at 3.9x P/B. You can say it’s growth, but peers PagSeguro and Inter also have strong embedded growth and trade at less than 2x P/B.

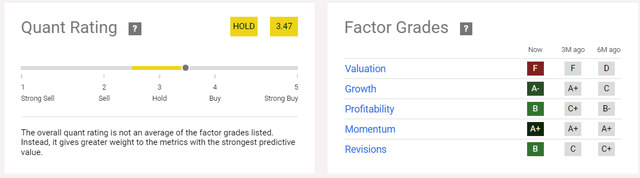

With a market cap of $70 billion, all the bank’s current initiatives to launch new products or expand into other geographies seem to be priced in, which supports my recommendation to hold the shares. I also think it’s interesting to note that Seeking Alpha’s Quant tools also point to holding stocks.

Quant Rating & Factor Grades (Seeking Alpha)

As we can see in Factor Grades, all Nu evaluations are very positive (as I described), with a question mark only in valuation. And to further elucidate the ideas, I will describe the risks to the thesis.

Potential Threats To The Thesis

One of the reasons for the quarterly reduction in the credit portfolio was the exchange rate variation, since the dollar appreciated against the currencies of Brazil, Mexico and Colombia (around 12% on average) due to the exchange rate effect. Without the exchange rate effect, the loan portfolio would have increased by around 8%.

Another risk to my thesis is between NPLs and NIM. As Nu expands its credit portfolio to more aggressive lines and increases NIM, it is expected that there will be a deterioration in NPLs.

However, given Nu’s customer profile and the history of bumps in the Brazilian economy, I recommend that investors exercise caution and be diligent in analyzing Nubank shares.

The Bottom Line

Nu reported results above expectations in terms of revenue and profits; however, several points raised doubts in the minds of investors, and that is what I have tried to clarify here.

It does not seem to make sense to have a 10x P/B valuation for a company that has seen its NPLs rise, and whose loan portfolio has seen its first quarterly reduction in history, even if the exchange rate variation was responsible.

Based on this analysis, I recommend holding Nu shares. In my view, investors should be very cautious before investing in the company’s shares, given Nubank’s customer profile, the history of the Brazilian economy’s ups and downs, and the increase in defaults.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.