Summary:

- Nvidia Corporation is expected to reach $380 billion in revenue by 2032, driven by accelerated computing and AI, with a compound annual growth rate of 30%.

- The company’s future growth is anticipated to come from data center growth, AI software, and autonomous driving technology, transforming Nvidia from just a chip company to an AI software and autonomous driving technology company.

- Despite competition from Intel Corporation and Advanced Micro Devices, and geopolitical risks in China, Nvidia’s comprehensive solutions and collaborations with industry-leading players make them highly competitive in the market.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) invented the GPU in 1999 and introduced the CUDA programming model in 2006. They opened up the parallel processing capabilities of the GPU for accelerated computing, along with proprietary algorithms and libraries. I believe that accelerated computing and artificial intelligence (“AI”) will drive their future growth, and Nvidia is no longer just a chip company but also an AI software and autonomous driving technology company. I see Nvidia having a clear path to reach $380 billion in revenue by 2032, implying a compound annual growth rate of 30%.

Investment Thesis

Data Centre Growth Powered by Accelerated Computing and AI: Nvidia has consistently positioned itself at the forefront of major technology megatrends, including gaming, crypto mining, cloud computing, and now AI. These megatrends rely heavily on accelerated computing, which has increased the demand for Nvidia’s GPUs and associated software. I believe that the data center market will require more GPU hardware and software for two primary reasons.

Firstly, the computing performance improvement of CPU-only servers is currently limited, making them cost-intensive. As a result, there is a significant drive towards adopting GPUs for accelerated computing. Secondly, generative AI applications, which involve deep learning and machine learning, require more GPUs due to the size and complexity of AI modelling. The workloads associated with AI necessitate acceleration.

In Q2 FY24, Nvidia is anticipating a substantial increase in demand related to generative AI and large language models. Cloud service providers, consumer Internet companies, and enterprises are investing heavily in data centers for AI projects. Nvidia is projecting $11 billion in revenue for Q2 FY24, reflecting a 64% year-over-year growth.

According to the “Data Center Accelerators: Global Strategic Business Report” on researchandmarkets.com, the global market for data center accelerators is expected to reach $351 billion by 2030, implying a 34% compound annual growth rate from 2022. Currently, most data center infrastructures are predominantly populated by CPUs. According to Nvidia’s management team, the world currently has $1 trillion worth of data centers equipped with CPU servers. This represents a significant market for GPU penetration and growth.

In my opinion, accelerated computing and AI will drive the growth of GPUs over the next decade, transforming the existing traditional computing infrastructure into accelerated computing with smart NICs and switches.

Full Eco-system and Full End-to-End Stack Solutions Led by CUDA: I don’t view Nvidia solely as a chip company because they provide a complete ecosystem and an end-to-end stack. Since 2006, they have invented and made CUDA, a software package that enables access to the core features of their chips, available on every single GPU. I believe this is one of the most significant reasons for their current success. In my opinion, CUDA has given Nvidia a strong advantage in accelerated computing and framework optimizations, creating a formidable moat.

Interestingly, it took Nvidia 12 years to reach 2 million developers, but they have doubled that number in the last two and a half years. The community of CUDA developers is key to Nvidia’s success, as more developers use these kits, resulting in more applications being developed with Nvidia’s GPUs and algorithms. CUDA allows AI developers to tap into the core hardware features of the chips, making Nvidia chips highly favored by these developers. I believe that these 2 million developers have become valuable assets for Nvidia, making their chips irreplaceable.

Nvidia’s software ecosystem has involved collaborations with industry-leading players in cloud infrastructure, cloud applications, and platforms. Alongside the growing demand for accelerated computing and AI, Nvidia’s comprehensive solutions make them highly competitive in the market.

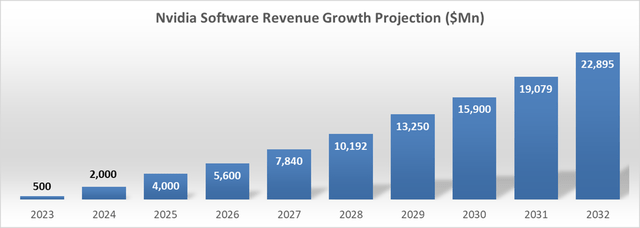

AI Software Growth: Nvidia disclosed that software is a growing part of their group revenue while software still represents a very small percentage of the total today ($300 million of revenue). Nvidia is planning to sell software separately. Currently, most of their solutions are incorporated a significant amount of software that is not sold separately but included in the whole package price.

The software components are included in three main parts. Firstly, Nvidia AI Enterprise is the software layer of Nvidia’s AI platform. It is a full package of the essentials of an operating system to do overall AI. As the operating system, AI Enterprise can be running under existing cloud infrastructure players.

Secondly, Omniverse is a platform solution software, which powers metaverses in many ways. It has the ability to create digital twins, and 3D environment on the Internet. Currently, most AI works are trying to solve the productivity of digital worlds, however, in the future, I think AI will be brought to the physical worlds, for example in transportation, robotic surgeries, or warehouse management, etc. Omniverse’s solution could be a phenomenal success in the future, in my opinion.

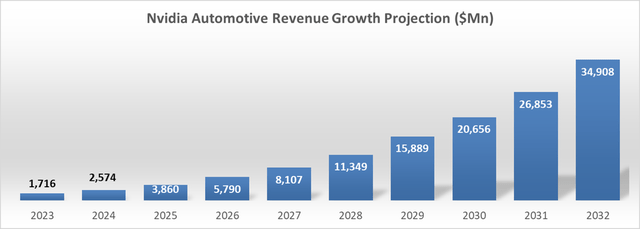

Lastly, automotive software is a very important piece for Nvidia. GPU-based hardware is playing a critical role in supporting the AI and required for autonomous driving. Historically, Nvidia’s automotive revenue was largely driven by infotainment. Going forward, I think their automotive business growth will be fueled by their AV and AI cockpit platform with a full software stack.

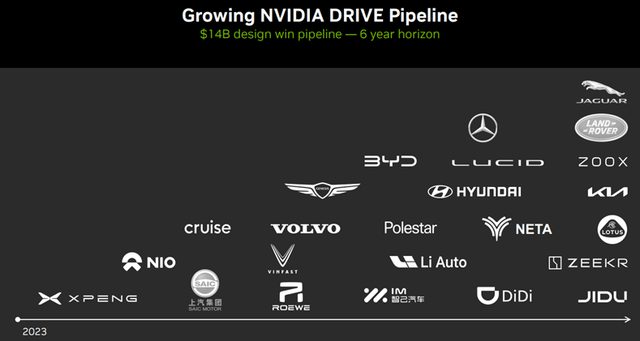

I guess the majority of automotive OEMs, of course including Tesla (TSLA), are going to adopt third-party GPU platform and associated software to develop the autonomy technology. Automotive currently only represents 3.3% of group sales for Nvidia, however, I anticipate this business will grow tremendously in the future. Their automotive design win pipeline over the next six years now stands at $14 billion, up from $11 billion a year ago, giving them visibility into continued growth over the coming years.

Nvidia Q1 FY24 Earning Presentation

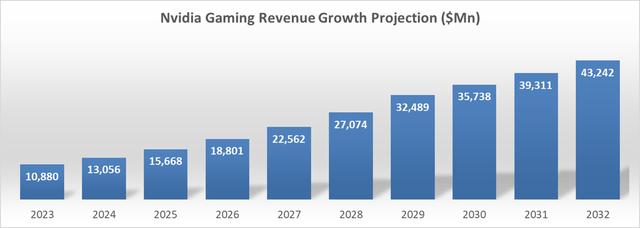

Gaming Growth: Gaming represents approximately 33% of Nvidia’s group sales, making it the second-largest end-market after data centers. According to Newzoo Gaming Report 2023, despite the pandemic and remote work tailwinds, the total number of gamers worldwide stands at only 1.1 billion, a relatively small figure compared to the global population of 8 billion. Nvidia’s GeForce gaming revenue experienced a compound annual growth rate of 20% from 2019 to 2022, while the consumer PC market remained largely stagnant. This growth can be attributed to new gamers and creators entering the PC market, as well as an increase in average selling prices. Currently, only 44% of the GeForce installed base has upgraded to RTX.

I believe that more gamers will opt to purchase higher-class GPUs, driving both unit sales and ASP and contributing to Nvidia’s revenue growth in the future. In my model, I anticipate a normalized 10% growth in unit sales and a 10% growth in ASP, making the gaming business a significant driver of growth for Nvidia.

Key Risks

Competition From Intel and Advanced Micro Devices: There is no doubt that Intel Corporation (INTC) and Advanced Micro Devices (AMD) are striving to catch up with Nvidia’s GPU technology.

Intel re-entered the GPU market in late 2020 with solutions that were arguably mediocre. They then launched the Arc Alchemist GPU, which began shipping in early 2022. For AI models with up to 10 billion parameters, Intel believes their Xeon CPU can handle all the data preparation work. For larger models, Intel offers GPU Max and Gaudi accelerators. Initially, Intel planned to combine GPUs with CPUs but later abandoned this plan.

Intel has announced their forthcoming “Falcon Shores” chip, which is planned to be introduced in 2025. By that time, Nvidia is likely to have another chip with better performance than the H100. Additionally, in my opinion, Intel is a poorly managed company with bureaucracy present at every level of the organization. I believe they will continue to lag in the AI race.

AMD’s MI250 is currently being used in supercomputing and is involved in extensive large language model training.

MosaicML conducted real workload-based tests comparing AMD’s MI250 GPU with Nvidia’s A100 for large language model training, without any additional configuration. Their conclusion was that the AMD MI250 GPUs achieved 80% of the per-GPU data throughput of Nvidia’s A100 40 GB model and performed within 73% compared to the A100 800 GB model.

AMD is currently developing the MI300. They recently announced a new GPU-only model called MI300X, which combines eight accelerators on a single platform and boasts an impressive 1.5TB of HBM3 memory. AMD claims that the MI300 delivers eight times the AI performance and five times the performance per watt compared to the Instinct MI250. The MI300X is set to start shipping to select customers later this year. Although AMD has not disclosed the price, the introduction of the new MI300 could potentially create price pressure on Nvidia’s H100, which costs $30,000 or more.

China Exposure: China represents approximately 21% of Nvidia’s group sales. To comply with the chip ban, Nvidia has taken steps to provide modified versions of its flagship A100 and H100 GPUs. Nvidia has reported that Chinese Internet giants like Alibaba (BABA), Baidu (BIDU), and Tencent (OTCPK:TCEHY) are utilizing the modified chip, known as the H800. I believe that geopolitical risks will persist in the near future. Consequently, Nvidia has no choice but to continue supplying modified versions or older generations of chips to China, which could increase Nvidia’s costs over time.

TSMC Manufacturing: Nvidia primarily relies on Taiwan Semiconductor Manufacturing Company Limited (TSM) (“TSMC”) for their chip manufacturing. Considering TSMC’s manufacturing locations, there is indeed a geopolitical risk. However, Nvidia is exploring the possibility of chip manufacturing with Intel. Furthermore, TSMC is in the process of constructing a plant in Arizona, and Nvidia’s CEO has indicated their intention to utilize TSMC’s Arizona plant for their future chip manufacturing. As a result, I believe the risk is quite manageable.

Growth Outlook

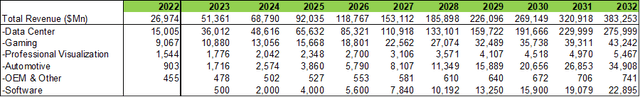

How big can Nvidia grow? To estimate Nvidia’s revenue growth, I will break down Nvidia’s sales into several components: data center GPU, gaming GPU, automotive autonomous driving, and AI software.

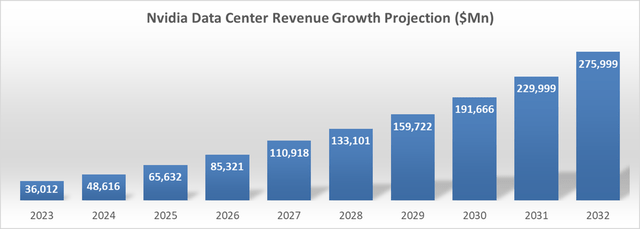

Data Center GPU: I believe that the data center segment will become the primary growth driver for Nvidia over the next decade. The growth of the data center accelerator market will be fueled by new infrastructure opportunities and the replacement of existing CPU-powered infrastructure.

During the Q1 earnings call, Nvidia stated that over the past four years, $1 trillion worth of data centers have been built solely based on CPUs and non-accelerated network interface cards. These unaccelerated infrastructures will be replaced or upgraded over the next decade. This indicates a $100 billion market opportunity just for the replacement of the infrastructures built in the past four years. Additionally, for new data center growth, based on historical trends, I estimate annual investments of around $250 billion.

Taking these factors into account, the potential market size for Nvidia in the data center segment could be approximately $350 billion per year, according to my estimates. I expect Nvidia to maintain its GPU advantages in the data center market, and I assume they can capture more than 75% of the market share by 2030. This projection suggests that Nvidia’s revenue in the data center segment could reach $190 billion in 2030. In my projection model, I anticipate a compound annual growth rate of 33% for the data center business from 2022 to 2032.

Author’s Calculation, DCF Model

Gaming GPU: Nvidia generated 33% of its revenue from the gaming segment in FY22. As mentioned earlier, I anticipate a 10% growth in units sold and a 10% growth in pricing for the gaming business. According to my model, I expect an annual growth rate of 20% for this segment.

Author’s Calculation, DCF Model

Automotive Autonomous Driving: Currently, the automotive sector represents a small portion of Nvidia’s business. However, I anticipate significant exponential growth in this industry over the next decade, driven by advancements in full self-driving (“FSD”) technology reaching levels 4 and 5. In my recent article titled “A Deep Dive of Full Self-Driving – And a Reality Check” focused on Tesla, I provided a summary of the current state of autonomous driving technology. I expect level 4 autonomy, albeit with certain limitations, to become a reality in the coming years.

According to McKinsey’s “Future of Autonomous Vehicles” report, the hardware and software licensing costs per vehicle for level 3 and level 4 autonomous systems could reach $5,000 or more during the early rollout phase. Assuming there will be approximately 70 million new vehicle productions in 2032, my estimate suggests that the total market size for autonomy hardware and associated software would be around $129 billion. It is worth noting that, while Tesla is designing its own chips for autonomous driving, I don’t believe other automakers possess the capability to become chip design companies. In my model, I project an annual compound growth rate of 44% for Nvidia’s automotive business. By 2032, based on my projected market size, I estimate that Nvidia will capture a 27% share of the global market.

Author’s Calculation, DCF Model

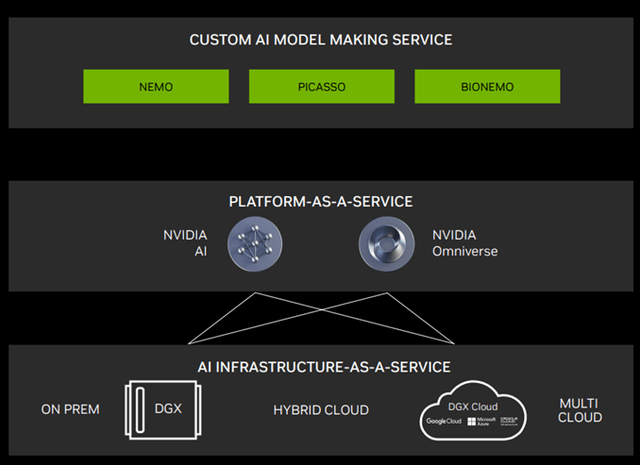

AI Software: Nvidia has planned to separate its software offerings from its package and aims to develop a comprehensive suite of software solutions. This strategic move acknowledges the importance of software in accelerated platforms, and Nvidia envisions becoming a full-stack company that covers both hardware and platform levels.

The hardware layer already constitutes a significant portion of Nvidia’s business, and the advancement of generative AI is fueling the growth of this sector. At the platform level, Nvidia provides offerings such as Nvidia AI and Omniverse. Additionally, Nvidia recently announced their AI Foundation services, which include three key cloud services: NVIDIA NeMo, Picasso, and BioNeMo. These services enable organizations to leverage and customize enterprise-level generative AI across text, visual content, and biology.

Nvidia Q4 FY23 Earning Presentation

Nvidia has been strategically laying the foundations and paving the path for its future, recognizing that software may be the most significant business model expansion initiative in the company’s history. With their extensive installed base of hardware, I believe Nvidia has the capability to capitalize on the growth of AI-related software over the next decade.

According to Grand View Research, the global artificial intelligence market was valued at $136 billion in 2022 and is projected to grow at a compound annual growth rate of 37.3% from 2023 to 2030. Nvidia’s current software offerings encompass AI cloud infrastructure, AI toolbox, and Omniverse. While it is subject to debate how large their presence in the AI software space can become, Nvidia’s core expertise lies in hardware and chips. Nonetheless, given their chips’ widespread deployment throughout data centers, they have the advantage of leveraging their hardware to deliver exceptional performance for their AI software. I anticipate that Nvidia’s software revenue could reach $22 billion by 2032.

Author’s Calculation, DCF Model

Putting all the pieces together, Nvidia is expected to reach $380 billion in 2032 in my model, implying 30% of the compound annual growth rate from 2022 to 2032.

Author’s Calculation, DCF Model

Valuation

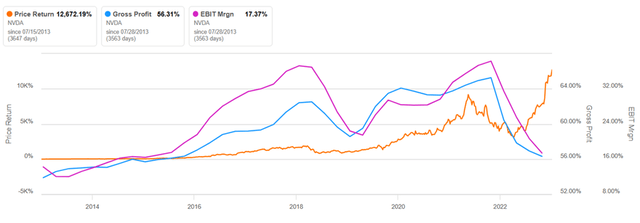

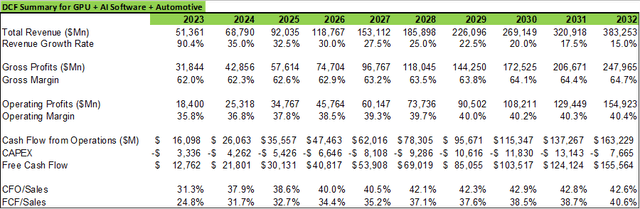

Given all the analysis above, I have used a 2-stage discounted cash flow (“DCF”) model to estimate the intrinsic value of Nvidia. In my model, I anticipate both the gross margin and operating margin to expand over the next decade, reaching 64.7% and 40.4% in FY32, respectively. I believe these margin projections are achievable, considering the significant operating leverage and Nvidia’s historical financial performance, as illustrated in the YCharts below.

Nvidia operates on a fabless business model, which means it doesn’t have its own manufacturing facilities and relies on external foundries. This allows Nvidia to maintain a capital-light operation. Additionally, in my projections, the free cash flow conversion is expected to reach 40.6% in FY32.

Author’s Calculation, DCF Model

The model uses 10% of WACC, 4% of terminal growth, and 14% of tax rate. The present values of free cash flow from the firm over the next 10 years and terminal are calculated to be $269 billion and $953 billion in the model. Adjusting the cash and debt, the fair value is $500 per share, as per my estimates.

Author’s Calculation, DCF Model

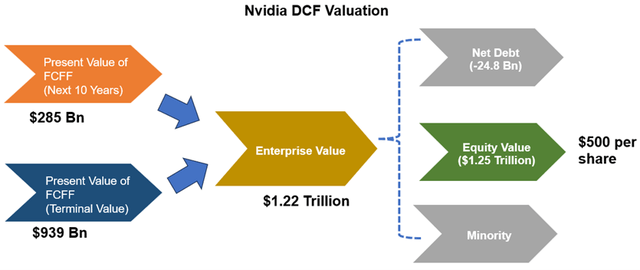

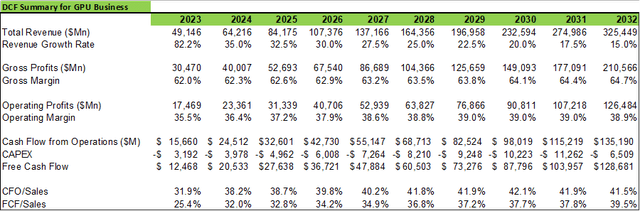

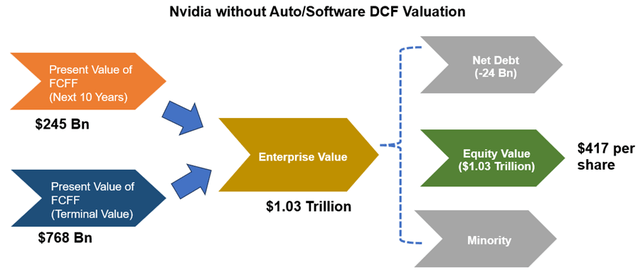

As the automotive and software businesses carry more uncertainties compared to their GPU business, it is crucial to estimate their fair value separately. Therefore, the table below presents a model summary that exclusively focuses on the GPU business. In the model, the total revenue is estimated to reach $325 billion in FY32, and the operating margin is 38.9% in the model. With the same assumptions for WACC, terminal growth rate, and tax rate, the free cash flow conversion is estimated to be 39.5% in FY32 in my model.

Author’s Calculation, DCF Model

My DCF model shows Nvidia without automotive and software worth $1.03 trillion in equity value, or $417 per share.

Author’s Calculation, DCF Model

Why I Think Nvidia is One of My Best AI Ideas?

NVIDIA has leveraged its GPU architecture to create platforms for scientific computing, AI, data science, AV, robotics, metaverse, and 3D internet applications. I believe Nvidia’s GPU technology is at least 3 or 4 years ahead of Intel and AMD. Furthermore, Nvidia provides accelerated computing technology to support all these tech giants. Consequently, regardless of who wins the AI race, Nvidia will eventually emerge victorious.

Currently, AI capital spending is primarily driven by large cloud service providers and consumer Internet companies. In my opinion, enterprises have yet to initiate significant capital expenditures for AI workloads. AI-related infrastructure and platforms have not yet taken off in the enterprise space. Therefore, I believe Nvidia has a long way to go in terms of GPU adoption in data centers. Additionally, I anticipate that autonomous driving and software could offer Nvidia additional growth opportunities in the next decade.

In summary, I view Nvidia not only as a chip company but also as a software and infrastructure player in the new AI era. I consider Nvidia to be one of my best AI ideas and assign it a “Buy” rating.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s Best AI Ideas investment competition, which runs through August 15. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.