Summary:

- Nvidia is a leader in AI and high-performance computing, offering innovative products and solutions for various industries.

- The Hopper architecture, consisting of the H-100 Tensor Core GPU and the Grasshopper General Purpose GPU, will provide unprecedented performance and scalability for data centers.

- There is a severe shortage of H-100 GPUs, which are required for training large language models and image recognition AI models.

- The stock is undervalued using the forward PEG ratio, popularized by the legendary investor Peter Lynch.

Janos Varga

Nvidia (NASDAQ:NVDA) is a leader in AI and high-performance computing, and offers innovative products and solutions for various industries and applications, including both hardware like GPUs and software. Nvidia’s vision is to power the era of AI and the metaverse, where virtual collaboration, simulation, and creativity are seamless and immersive. The company is a leader in GPU manufacturing which is used to rapidly train and access large language and image AI models, create and use metaverse and VR technologies, mine cryptos, and gaming consoles.

Nvidia’s Hopper architecture is the next generation of GPU technology that will enable unprecedented performance, scalability, and security for every data center. The Hopper architecture consists of two types of GPUs: the H-100 Tensor Core GPU and the Grasshopper General Purpose GPU.

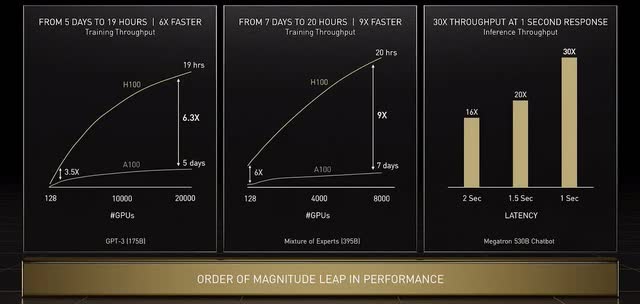

The H-100 GPU is the most powerful AI-focused GPU the company has ever made, surpassing its previous high-end chip, the A100. The H-100 GPU includes 80 billion transistors and a special Transformer Engine to accelerate machine learning tasks. It also supports Nvidia NVLink, which links GPUs together to multiply performance. The H-100 GPU is designed to handle the large number of applications and deep neural networks (DNNs) that run simultaneously in autonomous vehicles, robotics, healthcare, and life sciences. I have done my research with KOLs and came to know that there is a severe shortage of H-100 chips even on cloud computing platforms like AWS, Azure and Lambda.

H-100 GPU performance leap vs. previous generation A-100 chip (Hardware Zone)

The Grasshopper GPU is the most versatile general-purpose GPU the company has ever made, surpassing its previous flagship chip, the RTX 3090. The Grasshopper GPU includes 60 billion transistors and a new ray tracing engine to enhance graphics quality and realism. It also supports Nvidia Multi-Instance GPU, MIG, which partitions a single GPU into multiple instances for different workloads. The Grasshopper GPU is designed to power the most demanding games, simulations, and creative applications in the metaverse.

Nvidia is collaborating with leading research institutions and companies to leverage transformer neural networks for drug discovery and clinical data analysis. Transformer-based neural network architectures like GPT-4 “allow researchers to leverage massive datasets using self-supervised training methods, avoiding the need for manually labeled examples during pre-training.” These models are finding applications across research domains and modalities.

Nvidia and big pharma company AstraZeneca (AZN) have partnered to develop “a transformer-based generative AI model for chemical structures used in drug discovery that will be among the very first projects to run on Cambridge-1, which is soon to go online as the UK’s largest supercomputer. The model will be open-sourced, available to researchers and developers in the NVIDIA NGC software catalog, and deployable in the NVIDIA Clara Discovery platform for computational drug discovery.”

University of Florida, “UF Health is harnessing Nvidia’s state-of-the-art Megatron framework and BioMegatron pre-trained model to develop GatorTron, the largest clinical language model to date.” GatorTron aims to extract insights from massive volumes of clinical data with unprecedented speed and clarity, enabling faster research and medical decision-making.

The management team consists of experienced leaders who have driven the company’s growth and innovation for over two decades. Jensen Huang, the founder and CEO, has been named one of the world’s best CEOs by Barron’s for four consecutive years. He holds a master’s degree in electrical engineering from Stanford University. Colette Kress, the executive vice president and chief financial officer, has over 25 years of experience in finance roles at leading technology companies such as Cisco Systems (CSCO) and Microsoft (MSFT). She holds a bachelor’s degree in finance from Arizona State University.

The company’s financial performance has been strong and consistent over the years. According to its latest quarterly report filed with the SEC EDGAR website, Nvidia had $16 billion in cash and cash equivalents on its balance sheet as of July 31, 2023. Its quarterly revenue was $13.5 billion, up more than 100% year-over-year and beat analyst estimates. Its diluted earnings per share, EPS was $2.48, up approx. 10x year-over-year, also beating analyst estimates.

The company also guided forward revenue higher. It expects Q3 sales at $16B, +/- 2%, well above the $12.5B analyst estimate. For the valuation of the stock, we can use the forward PEG ratio, which uses a ratio of forward 1-year EPS / forward 1-year EPS growth. The forward P/E is 70 and its expected forward EPS growth rate is 120%. The company’s forward PEG ratio is 0.5, which is <1. The legendary investor Peter Lynch popularized this metric and considered a stock undervalued if this ratio was below 1. Using this metric, I consider this stock as undervalued.

This company is a buy-and-forget investment for me as a leader in the AI revolution. H-100 chip is the iPhone moment for the company and I expect its earnings to grow at the same trajectory over the next 10 years. Rivals like AMD (AMD) have tried hard but are unable to beat the technological prowess of Nvidia in AI GPU chips. Google (GOOG) (GOOGL) has made tensor processing units, TPUs but cannot make enough for even its own use, forget selling it to other companies.

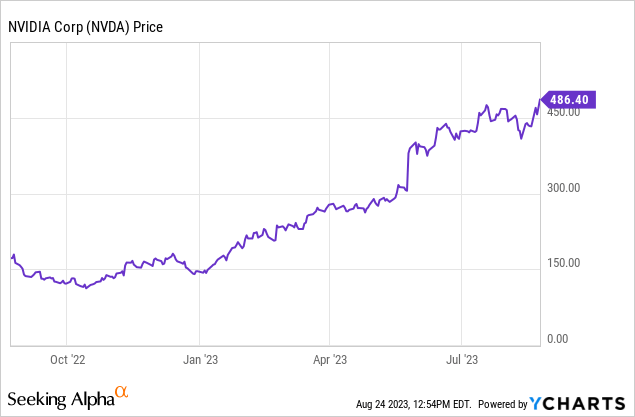

NVDA price chart (Y-Charts)

This stock is my largest portfolio position and up >20% in 2 weeks. The recent $25 billion share buyback will help to continue the recent upside momentum. Dividend investors also get a dividend from this investment.

The mean sell-side analyst 1-year price target (Seeking Alpha) is $617 or 31% upside potential. The Wall Street high analyst price target is $1100 from a top-ranked analyst with 80% success rate on ratings on the company’s stock.

Risks in the investment include the inability to maintain recent earnings growth in the future, the origin of new rivals, etc. This note is my own opinion and not investment advice. Please do your own research before any investment decisions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.