Summary:

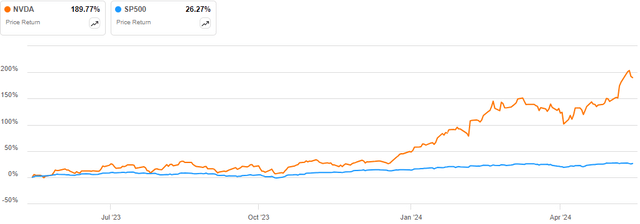

- Nvidia Corporation stock has gained about 190% over the last year, outperforming the S&P 500 by 163%.

- The company has a solid market position and dominance in the AI chip market, backed by strong financial health.

- NVDA is projected to have a price target of $1742.67 by 2027, with an upside potential of 51.53%.

BING-JHEN HONG

Investment Thesis

Nvidia Corporation (NASDAQ:NVDA) stock has gained about 190% over the last year, outperforming the S&P 500 by a margin of more than 163%.

Despite this overwhelming performance, I am bullish on this stock given its solid market position and dominance backed by firm financial footing. I believe its fast-paced innovation amid the surging demand and the strong market growth in the AI Chip market bodes well for its sustainable growth. Based on my projection, I have a price target of $1742.67 by 2027 translating to an upside potential of about 51.53%. Given this background, I rate NVDA a buy and recommend it to potential investors in the tech industry. Its near-term catalyst is the impending 10-for-1 forward stock split effective from 10th June 2024. This means that each stockholder will receive nine additional shares for every old share they possess. I expect this split to lead to increased liquidity and potentially more interest from retail investors due to the lower share price. The increased demand for the stock will likely push the share prices higher.

Brief Company Overview

Nvidia was founded in 1993 and has grown into a leader in graphics processor technologies. The company is prominently known for its pioneering work in GPU-accelerated computing. Its innovations extend beyond computer graphics, high-performance computing, and artificial intelligence. NVDA offers a broad range of products such as GPUs, CPUs, and SoCs. Its products target a vast market ranging from professional visualization to data centers and automotive applications.

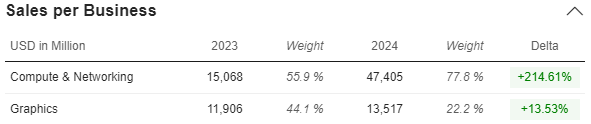

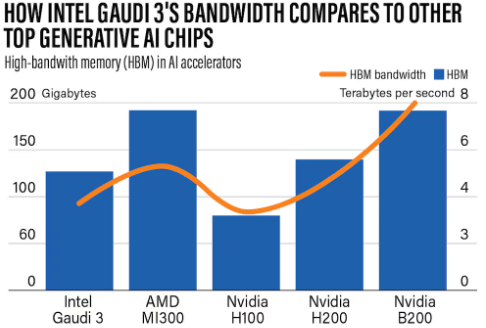

The company operates in two major segments whose revenue contribution is as shown below.

Market Screener

Given its rich history of innovation, NVDA boasts a wide global reach which has earned it a strong reputation and loyal customer base as evidenced by its large market share, which I will discuss in the sections that follow. Below is its revenue distribution from its global footprint.

Market Screener

Strong Market Position: Why NVDA Will Maintain Its Market Dominance

NVDA has a dominant and solid market presence which appears very difficult for competitors to challenge. It has been consistently at the front line of technological advancements, particularly in the GPUs and AI. With AI being the major thing in the tech industry currently, this is where Nvidia has proven its dominance. It is estimated that the company has about 90% market share in the GPU AI chip market and not less than 80% market share in the entire data center AI Chip market.

With this commanding market share, I find two major reasons that I believe make NVDA a powerful company that will maintain its market dominance in the long run. To begin with, Nvidia has stayed ahead of its competitors in terms of innovation, something that gives them a competitive advantage. To demonstrate this better, let’s compare Intel Corporation (INTC) with Nvidia in the innovation race.

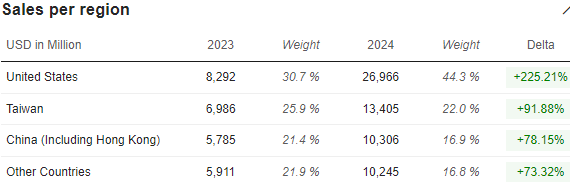

In April this year, INTC launched its most recent innovation, the Gaudi 3, which outweighed Nvidia’s H100 GPUs by approximately 50% in inference and about 40% in power efficiency. While this product seems to be a major competitor to NVDA, I don’t believe there lies a major threat here. First off, Gaudi 3 is expected to have volume production in Q3 2024, which implies that it can’t hit the market until then. On the contrary, NVDA is projecting to do an H200 chip shipment in Q2 2024; above all, INTC Gaudi 3 is being matched with H100 which is a generation older given the H200 and B200 products from NVDA. This implies that Intel’s superior product is a generation behind Nvidia’s innovation, and it will commercialize a quarter later than Nvidia’s H200 which has better features than Gaudi 3 as shown below.

IEEE

Nvidia’s unmatched capacity to be a leader of innovation has been solidified by its announcement to shift to a new AI architecture known as Rubin (R100). The innovation is unique in several ways and is designed to be very competitive in the market, majorly against competitors like INTC. The product is expected to commercialize in 2026 and here are some of its unique and powerful features.

The R100 will have a high bandwidth memory enabled by HBM4, which is a new form of high-bandwidth memory. This feature is expected to offer a significant boost to data transfer speeds and efficiency. In addition, it will operate at 3,600 Gbps offering a significant leap in interconnect bandwidth, something crucial for AI and machine learning workloads where data transfer speeds are a bottleneck. Another unique feature is its advanced networking which includes an X1600 converged InfiniBand/Ethernet switch for advanced networking capabilities which is very crucial for modern data centers. While this is a WIP, the initial features of the product show it is a superior and a unique offering in the dynamic tech industry, especially given the rising demand for data centers, which I will discuss later in this article.

Given this background, it seems apparent to me that NVDA is miles ahead of the competition in the innovation race, which gives them a major competitive advantage. With the company’s recent rhythm of annual new AI chip models, I think NVDA is hard to match in terms of competition and this will make their market dominance long-lived.

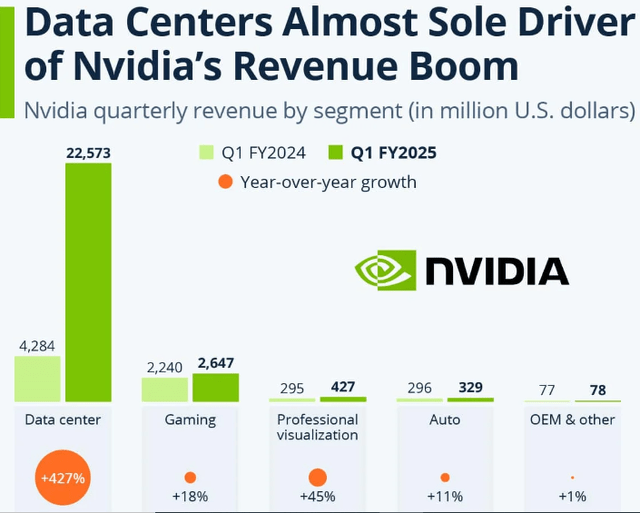

The second reason behind NVDA’s market dominance is its strong financial health. NVDA recently announced solid Q1 2025 performance with revenue of $26.04 billion, a YoY growth of 262.12%, and record data center revenue of $22.6 billion marking a YoY growth of 427%. This compares to Intel’s Q1 2024 revenue of $12.72 billion, marking a YoY growth of 8.6% and data Centre and AI group [DCAI] revenue growth of 5%. Nvidia’s overwhelming performance speaks volumes about its market dominance, particularly in the data center niche. Looking at its performance, it appears that the data center was nearly the sole growth catalyst for its groundbreaking performance.

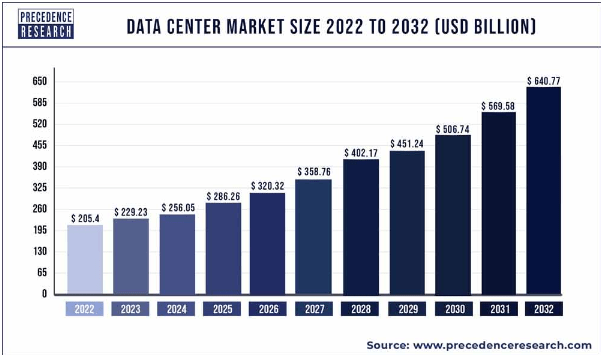

This leads me to assess the projected market growth of the data center market because it is a major growth catalyst for the company. According to precedence research, the global data center market size is projected to grow to about $640.77 billion in 2032 from $229.23 billion in 2023, representing a CAGR of 12.10%.

Precedence Research

Given this solid market growth projection, I am confident in Nvidia’s future financial performance considering its vast market share and its edge-cutting innovations such as Blackwell and Rubin, whose competitive features are highlighted in this article.

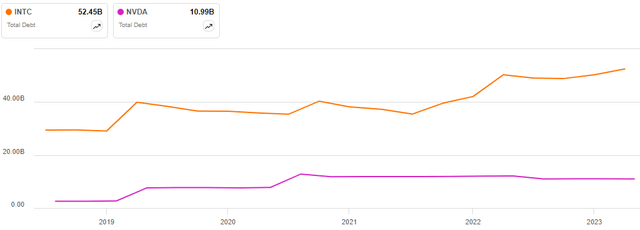

The most interesting aspect of Nvidia’s financial health is not even its financial performance, but its strong balance sheet and healthy cash flows. One distinctive feature between NVDA and INTC is its capital structure. While INTC has embarked on an innovative journey characterized by growing debt and negative cash flow, NVDA is much deleveraged with positive net cash and solid cash flow generation.

With a total debt of $10.99 billion and cash of $31.44 billion, it implies that Nvidia has net cash of $20.45 billion. In addition, its trailing operating cash flow stands at $40.52 billion. This implies that its net cash can fund its trailing CapEx of $1.2 billion more than 17x, and its operating cash flow can fund its trailing CapEx more than 33x. This means that this company is on a very strong financial footing where it can fund its growth opportunities easily without depleting its cash reserves, unlike INTC which relies on debt. This is contrary to INTC where its debt has risen substantially over the last 5 years from $29 billion in 2019 to its current level of $52 billion, almost doubling its debt burden in five years. To make it worse, it has a negative unlevered cash flow of $14.25 billion, which tells us that the growing debt is a burden. Consequently, the company is unlikely to match NVDA because its debt level is growing, and its cash flows are very weak to cover it. Adding more debt to invest in growth projects to catch up with competition could be detrimental. It is even alarming to see its investment initiatives are yet to pay off, as shown by the $7 billion operating loss in its foundry division in the 2023 FY.

In summary, NVDA seems powerful and dominant in this industry, with a vast market share. The company’s leading and unmatched pace in innovation and its strong financial position make it hard for competitors to match them. For these reasons, I believe Nvidia will keep dominating in the long run exhibiting consistent and sustainable growth.

Growth Potential: What Are The Tailwinds?

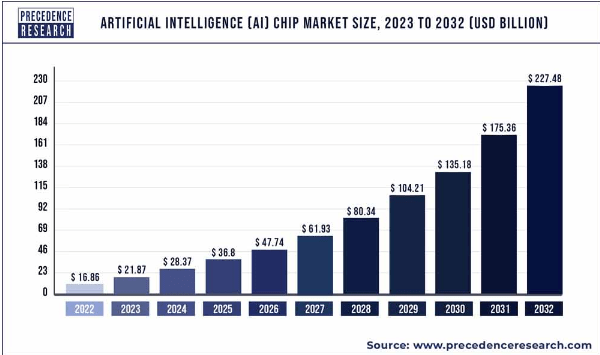

Although NVDA’s market position is a major growth catalyst, the company has a strong upside potential based on several factors. The first one is favorable market trends. Given the company’s heavy investment in AI chips, which has earned it a top spot in the market share, it can only be worth the investment if the market is growing substantially. It is projected that the global AI market will grow to $227.48 billion in 2032 from $16.86 billion in 2022, marking a CAGR of 29.72%.

Precedence Research

With the company’s strong financial position which grants them a lot of financial freedom and capacity to invest in innovation and growth projects, I believe the company is well positioned to leverage this market growth better than its competitors.

Besides the favorable market trends, the company has a very reliable revenue stream, with major megacaps being its top customers. For instance, Bloomberg estimates that Microsoft accounts for about 15% of NVDA’s revenue, with Meta Platforms accounting for 13%. Amazon and Alphabet account for about 6% each. Nvidia’s partnership with mega caps ensures a consistent revenue stream, especially given that they are at the front line of keeping pace with the AI wave, which is one area where NVDA is flourishing with innovations. I believe these mega caps will give Nvidia’s growth trajectory a major boost given the recent announcement that most of them are increasing their CapEx something which implies they will likely stock H200 when it starts being commercialized in Q2 2024. For instance, Meta announced its CapEx for the 2024 FY year will increase to $35-$40 billion from the previous figure of $30-$37 billion. The increment is aimed at accelerating its AI roadmap, which is why I believe NVDA stands a chance to benefit from this, given that Meta is one of its main customers.

Another factor that I believe serves as a major tailwind is the company’s diversity and tailoring of products to different market segments and industries. In its diverse portfolio, NVDA has tailored specific products to fit specific industries. For example, its AI platforms such as Nvidia DGX systems and Nvidia Clara are designed to meet the unique needs of sectors such as healthcare, finance, and automotive industries, through these specialized solutions, the company attracts and retains customers across multiple fields, something which diversifies its revenue streams and buffers against an economic downturn in one market segment.

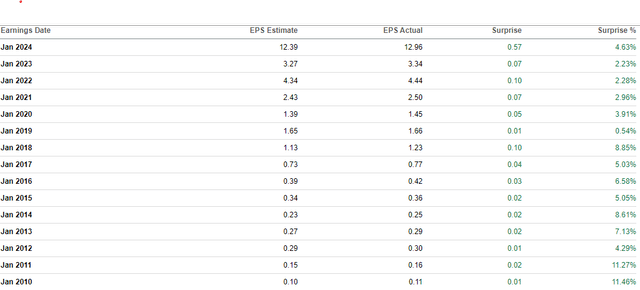

Valuation

Considering this company’s high-growth potential, I will use the PEG ratio to evaluate its valuation. I believe PEG is appropriate because it provides a more comprehensive view than traditional PE in that it combines PE with the expected earnings growth rate. With a trailing PEG of 0.08 which is 93.41% lower than the sector median, it signifies that this stock is undervalued, which makes it a buy for potential investors who are seeking a growth stock in this sector. To estimate a target price, I will use the forward PE of 42.87 and the estimated EPS of $40.65 by 2027. My rationale for using these inputs is the company’s respectable history of beating its projected EPS, which implies that it is likely to exceed this projected EPS. Since 2010, the company has beaten its EPS estimates and therefore this justifies my decision to use its estimated EPS to project my target price in the next three years.

With this justification, multiplying the forward PE with the projected EPS yields a target price of $1742.67 which translates to an upside potential of 51.53%. In my view, this presents this stock as a good investment opportunity and as a result, I rate it a buy.

Risks

Although I am bullish on this stock, investing in this stock has its share of risk. One of the major risks of investing in this company is the China equation. Amidst the rising geopolitical complexities between the US and China, Chinese officials ordered telecom to do away with foreign chips by 2027. This will be potentially a major blow, considering China accounted for more than 16% of NVDA’s total revenue in the 2024 FY. Losing this Chinese market will translate to a lost diversity and revenue stream, which could impact the company’s financial performance.

Conclusion

In conclusion, NVDA is a robust investment opportunity characterized by strong growth potential and unmatched innovative ability. The company has what it takes to maintain its market dominance in the long run. I recommend this stock to potential investors seeking to diversify in the tech industry in the wake of the AI wave.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.