Summary:

- Nvidia’s stock surged after an excellent earnings report and 10-1 stock split announcement.

- Despite a 35% crash, Nvidia’s stock rebounded and may see a similar melt-up into earnings.

- Nvidia remains the top AI stock, with a dominant market-leading position and potential for considerable upside.

JHVEPhoto

The last time I wrote exclusively about Nvidia (NASDAQ:NVDA) was before the recent split, when the stock was at around $950 (split-adjusted $95). I discussed buying the stock because Nvidia provided another excellent earnings report, announced a 10-1 stock split, and shared other constructive developments.

The road higher was well-defined, and Nvidia’s stock surged by approximately 50% in roughly one month before topping at about $140. Then I put out a cautious piece, indicating that Nvidia and other top momentum AI plays likely needed a reset, and a reset they got.

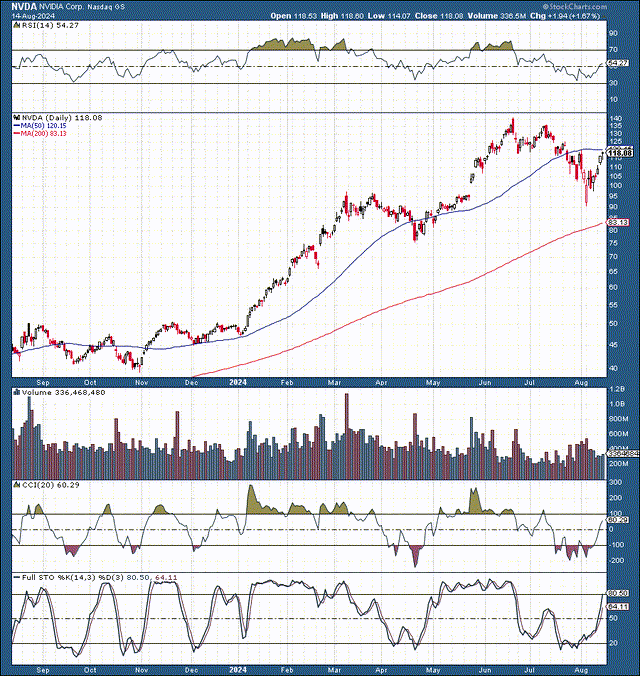

Nvidia 1-Year Stock

NVDA (stockcharts.com )

Nvidia’s stock crashed by about 35%, skidding to a low of around $90 before rebounding recently. While the pullback was substantial, it appears very similar to the pullback Nvidia had before its prior earnings announcement. The March/ April selloff brought Nvidia down by about 25% before the stock turned around and marched to new ATHs. Therefore, based on prior technical events, we may see a similar melt-up into earnings.

Nvidia should deliver one of the most highly anticipated earnings reports after the market closes on August 28th. While expectations are high, Nvidia went through a considerable technical correction process and experienced a substantial valuation reset.

Moreover, Nvidia guided to about $28B in revenues, yet the consensus estimate is for around $28.54B. While the estimate is slightly higher than the guidance, Nvidia could still beat the projections because it likely sandbagged its estimates to “easily beat” when it reported. Therefore, I expect another superb quarter, and Nvidia’s stock is a strong buy here.

The AI Market’s Epic Expansion

Market participants seem prematurely looking for a top in the AI rally. Recently, Goldman Sachs and other market strategists have raised concerns regarding the extent of the AI trade. While it is healthy to point out concerning factors in the market, we don’t want to make unfounded conclusions, especially regarding the validity of the AI rally or its time frame.

As in any bull market cycle, there have been concerning factors, but that is why the market recently went through a constructive pullback and consolidation phase. Also, I believe that AI is still in a relatively early stage of its development and monetization cycle, and the current bull market run may be around the fourth or fifth inning. In other words, roughly 40-50% done, suggesting there could be considerable upside potential before a true market top is reached.

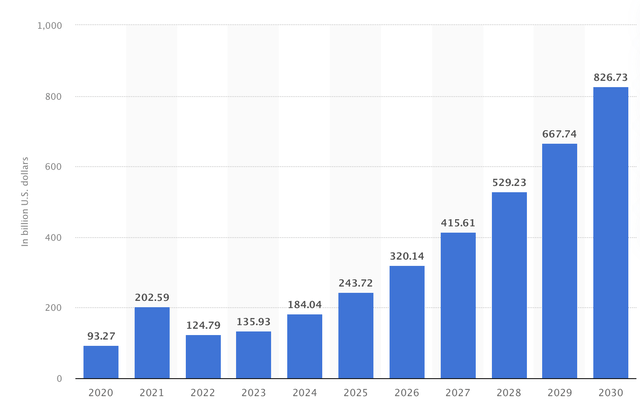

AI Market Size 2020-2030

AI market size (statista.com )

The AI market is expanding rapidly. It is expected to grow from around $184B this year to $826B by 2030, and other sources predict even more robust growth. The global AI market CAGR may be around 37% in this hyper-expansion time frame. Nvidia’s dominant market-leading position could enable it to capitalize more on the AI super growth cycle in future years. Therefore, I am skeptical about making bearish near-term AI predictions, as there could be immense growth in this lucrative space.

Nvidia Remains The Top AI Stock

Nvidia remains the king of AI primarily because its state-of-the-art GPUs, APUs, and other advanced processors are the preferred power providers of the giant enterprise AI server market. Nvidia’s products are effectively the picks and shovels in the trenches, powering the enormous AI industry from the ground floor.

One of the main factors that should enable Nvidia to continue moving higher is that it essentially has a moat. Its flagship GPUs combined with its CUDA software enabled an enormous head start for Nvidia in the AI space, and switching to an alternative may seem unthinkable to many users.

Nvidia enjoys enormous pricing power, controls an estimated 70-95% of the AI chip space used for training and deploying models like OpenAI’s GPT, and boasts a massive gross margin of around 78%. Intel (INTC) and AMD (AMD) have gross margins of 41% and 47%, respectively, but Nvidia’s dominance signals how far ahead it is in the AI/enterprise market GPU/APU space.

At Some Point, Nvidia’s Stock Could Deflate

Whereas a 78% gross margin is a significant reward for the company now, it likely is not sustainable in the long term. In time, competition could grind down Nvidia’s advantage, causing its gross margin and other profitability metrics to fall.

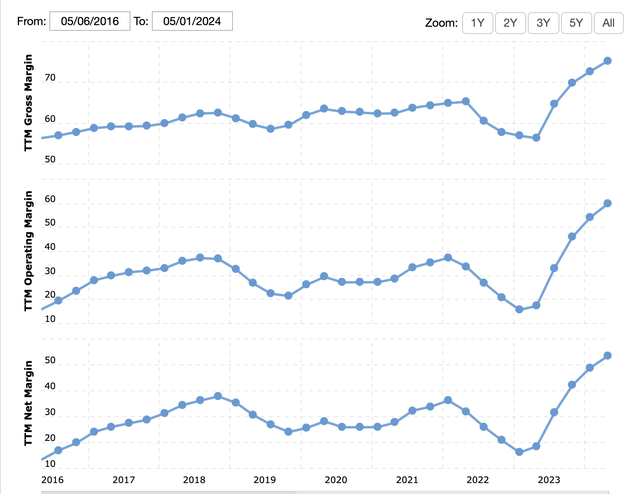

Nvidia’s Margins – Historically High

Margins (macrotrends.net )

Historically, Nvidia has enjoyed relatively high margins, with the gross margin around 60-65% in recent years. However, due to the enormous demand for the AI/enterprise segment and Nvidia’s pricing power, its gross margin has recently surged to 75-80%.

While this level of profitability may not be sustainable in the long term, it is not a reason to sell Nvidia’s stock today. Nvidia’s profitability prowess could deflate steadily instead of sharply, and the deflation period could be years away.

Also, it’s not just Nvidia’s gross margin. Its net income margin has surged above 50% from its recent 30-40% trend. A 50%+ net income margin may not be sustainable, and we should anticipate seeing its net margin decline to 45-40% or lower in future years. Therefore, we should also expect a considerable stock price decline if Nvidia’s decreasing profitability stage materializes.

There Is Room To Run Higher

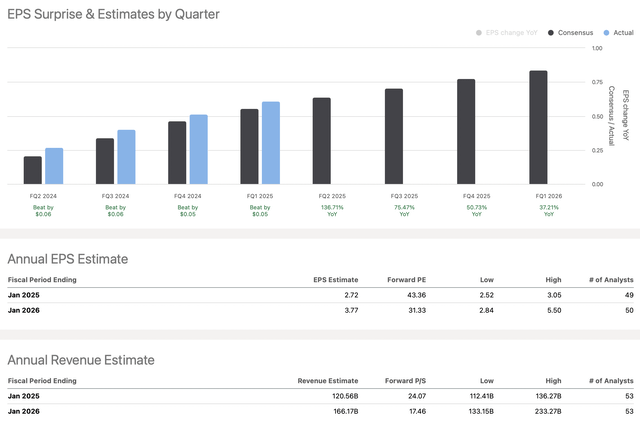

EPS vs. estimates (seekingalpha.com )

Nvidia is still in a solid earnings growth phase, and the momentum could continue driving its stock higher. Nvidia reported a TTM EPS of $1.80 when the consensus estimate was $1.57. Therefore, despite the excellent growth, Nvidia has outperformed the consensus EPS estimates by roughly 15%. This constructive trend could continue, and if Nvidia outperforms by a modest 10%, it could deliver around $3 in EPS for fiscal 2025 and about $4-4.50 in EPS in fiscal 2026.

This dynamic puts Nvidia’s fiscal 2025 P/E ratio at about 40 and its forward fiscal 2026 P/E ratio in the 30-27 range, which is relatively inexpensive for a company in Nvidia’s advantageous market-leading position. Moreover, if Nvidia can earn toward the higher end of the estimate range next year, it could achieve an EPS of $5-5.50, suggesting its forward P/E ratio may be around 25-22 in a more bullish case scenario. Due to the bullish fundamental backdrop, Nvidia’s stock price could increase considerably in future years.

Where Nvidia’s stock could be in the future:

| Year (fiscal) | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $127 | $175 | $210 | $250 | $295 | $345 |

| Revenue growth | 108% | 38% | 20% | 19% | 18% | 17% |

| EPS | $3 | $4.25 | $5.20 | $6.20 | $7.40 | $8.76 |

| EPS growth | 130% | 42% | 22% | 20% | 19% | 18% |

| Forward P/E | 31 | 32 | 33 | 33 | 32 | 31 |

| Stock price | $132 | $165 | $205 | $244 | $280 | $307 |

Source: The Financial Prophet

If Nvidia continues expanding sales and earnings, its P/E multiple could remain elevated around the 30-35 level. Therefore, we could continue seeing Nvidia’s stock price increase as its sales and EPS grow in future years. This dynamic suggests that Nvidia remains a solid long-term buy and likely has considerable upside potential.

Risks to Nvidia

Nvidia’s primary risk is disappointing the market. Nvidia’s stock has gone through a considerable expansion phase, and there are whispers that Nvidia may be in a bubble. There are also concerns that Nvidia is following in the footsteps of Cisco (CSCO), and its stock may deflate considerably, similar to Cisco’s post-internet model meltdown.

Furthermore, the market wants to see continued improvements from Nvidia to justify its ever-expanding valuation. The potential decrease in margins and profitability is a concern, and growing competition is an instrumental factor. Also, risks involving a slower-than-expected economy and relatively high-interest rates should be evaluated. Investors should consider these and other risks before investing in Nvidia.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!