Summary:

- I am bullish on Nvidia Corporation due to its data center and AI technology, which are major long-term growth catalysts.

- Despite recent stock volatility, I believe, Nvidia’s innovation, especially with the H200 and Blackwell chips, will drive significant future growth.

- Q2 2025 earnings report shows strong financial performance with record sales, substantial data center revenue growth, and a positive outlook for Q3.

- Regression analysis projects a 41.2% stock price growth by 2025, supporting a buy-and-hold strategy for long-term investors.

lcs813/iStock via Getty Images

Investment Thesis

I am bullish on NVIDIA Corporation (NASDAQ:NVDA) because I believe its data center and AI technology are major long-term growth catalysts. The company presents a trillion-dollar opportunity as it embarks on a massive effort to outfit its global data centers with new technologies. Its impending rollout of Blackwell chips will be the most recent growth catalyst in exploiting the market with industry-leading innovation, and I believe it will help produce significant revenue, as past innovations have.

In June 2024, I published a bullish thesis where I detailed my optimism about this company given its market dominance both in market share and being ahead of competition in innovation. Since then, the stock has exhibited what appears to be a consolidation, particularly due to the market response to the Q2 earnings report where the stock exhibited a pullback. This is perhaps due to some investors closing profits and reacting cautiously to recent growth figures.

In this article, I will discuss the recently released earnings report and how they align with my bullish thesis, as well as discuss why I believe that NVDA is a buy and a prudent choice for long-term investors.

Price Action: Why I AM Not Worried About The Recent Slump

Nvidia’s shares fell almost 7% in extended trading following its Q2 release last Wednesday after it surpassed earnings estimates but disappointed investors with the latest figures indicating slowing growth.

Although its shares have soared by around 114% YTD, they have experienced significant volatility recently. They fell as much as 33% between July and August before staging a stunning recovery ahead of earnings, trading only 11% below their record high through Wednesday’s 28th close. In my view, this volatility demonstrates the mixed reactions in the market, especially on the company’s growth potential. While this could be a concern to investors, I don’t think it is something to worry much about. What this means to me is that the company could have saturated its concentrated market with its existing GPUs, and therefore an upgrade is needed to unlock its growth potential. NVDA depends on a small number of clients for a significant portion of its revenue, which means that saturating its market is easy. Thus, constant innovation is needed to mitigate this risk by staying ahead of the competition as well as offering new solutions to its target market.

In light of this background, it is every investor’s concern about how sustainable Nvidia’s growth is when its figures point out at a cooling pace amid a narrow customer pool. The solution to this is innovation because the tech industry is very dynamic and one can only thrive through industry-leading innovations – and that is where NVDA thrives best. The company is lining up two major products, the H200 and Blackwell which, I think, will bring about a massive growth trajectory for this company.

According to Nvidia’s product roadmap for this year, the H200 is the first GPU to use the 8Hi (8-layer stack) HBM3e (fifth-generation high-bandwidth memory), and the Blackwell series chips that come after will also be fully upgraded to HBM3e. These are a few of the distinctive features that make them superior in the industry. My focus is not on how superior or unique they are because that is out of the question. Rather, I’m interested in their market potential.

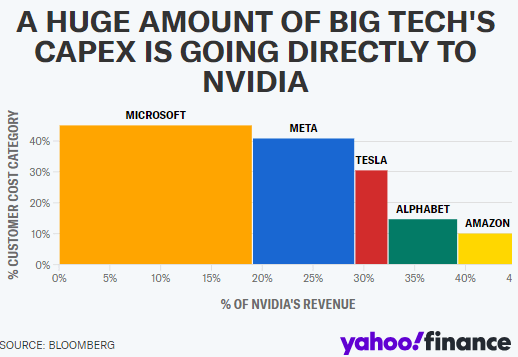

It is interesting to note that the H200 chips are already commanding prices of up to $40,000 per GPU, which speaks volumes about its high revenue generation potential. That aside, Blackwell is estimated to drive over $200 billion in data center revenue by 2025 compared to its current annual revenue of $60.92 billion, indicating a massive growth potential. While the company has innovative products that are likely to drive growth eventually, I find this stock to be a decent investment. This is because its main customers who happen to be big names in the tech industry and also in the AI race have massive CapEx coming to NVDA. This means that its output is the input of other big companies dictating the AI evolution and this positions the company strategically in the market.

Bloomberg

Above all, the company still commands an unshakable market share, which anchors its sustainable growth in the long term. Commanding a market share of more than 80% in the AI chip market, with its industry-leading products and the high CapEx big tech coming to them, I think Nvidia’s long-term growth is unquestionable.

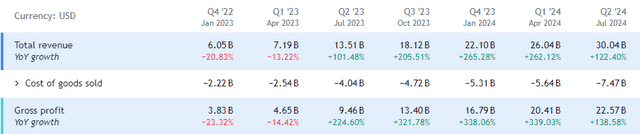

Q2 2025 Highlights

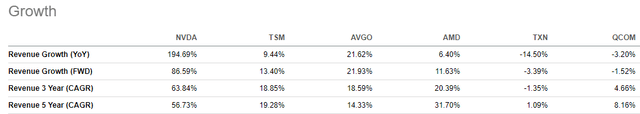

The Q2 2025 earnings release from Nvidia has yielded several noteworthy insights that underscore the company’s continued strength as an investment prospect. It announced record quarterly sales of $30 billion, up 15% QoQ and 122% YoY. Over the last year, its revenue growth is 194% YoY, which is a massive growth as well. Although it showed a slowdown in what has been an exponential growth, this growth is far from being matched by its peers, speaking volumes of its market dominance and competitiveness.

Secondly, the Data Center business experienced considerable growth, with revenue of $26.3 billion, up 16% from the prior quarter and 154% YoY. This expansion is fueled by high demand for Nvidia’s accelerated computing and AI technologies. The data center industry is a major growth driver. Nvidia’s GPUs are critical for AI and machine learning workloads, and the growing use of AI across industries is driving demand for its data center solutions.

GAAP earnings per diluted share increased to $0.67, up 168% YoY and 12% QoQ. Non-GAAP earnings per diluted share increased to $0.68, up 152% YoY and 11% from the prior quarter. Further, in the first half of fiscal 2025, it paid out $15.4 billion in share repurchases and cash dividends to shareholders. The Board of Directors has also approved an extra $50 billion in share repurchase authority, which is capable of reducing approximately 471 million (approximately 2%) of outstanding shares assuming the current price of $106.21. This demonstrates the management’s commitment to creating value for its shareholders.

The company kept growing both its product line and its market penetration. Samples of its new Blackwell GPUs are being shipped to partners and customers. Finally, it provided a positive outlook for Q3, estimating revenue of around $32.5 billion and non-GAAP gross margins of 74.4% to 75%. This bright outlook is a symbol of the management’s confidence in the company’s future performance.

Nvidia’s second-quarter earnings report highlights its solid financial performance, strategic posture, and growth prospects. Its strength in AI and machine learning, large addressable markets, and strong product pipeline make it an appealing investment prospect. With a healthy balance sheet and a focus on innovation, it is well-positioned to capitalize on future growth trends and deliver value to shareholders. Its balance sheet has a total debt of $10 billion and a total equity of $58.2 billion, translating to a debt-equity ratio of 0.17 indicating that the company is very much deleveraged and hence low debt risk. Further, with total assets of $85.2 billion and net cash of about $24 billion, NVDA exhibits a lot of flexibility and financial resilience. This offers an ample environment for sustainable future investments and acquisitions.

Regression Analysis: Double-Digit Upside In 1 Year

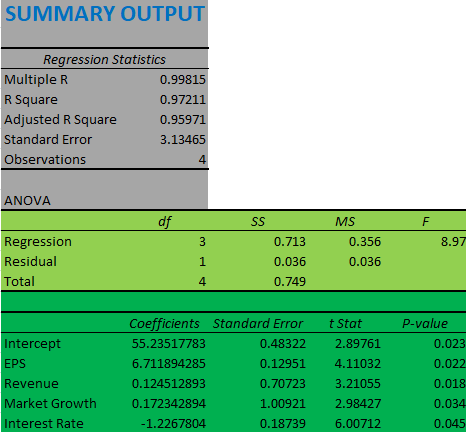

I will use a multiple linear regression model to estimate the price target for this stock by the end of 2025. My methodology is based on fundamental data to account for both industry and company-specific stock catalysts, and this explains its comprehensive scope. I have estimated the overall model using data from the last five years, and I have projected the future stock price by using the estimated values of the specific inputs by 2025. Specifically, the independent variables are a combination of macroeconomic factors (interest rates and market growth) and company-specific factors (revenue and EPS).

My model is based on several assumptions. I start by assuming that the stock (Y variable) and the independent variables (X variables) have a linear relationship. Secondly, I assume that the effect of the X variable changes on the Y variable is always independent, and my final assumption is that the X variables’ projected future values will be met. If the anticipated future values fall short of expectations, this will be the primary flaw in my model, resulting in a revised price target.

To represent the company’s financial stability, which is critical to long-term stock performance, I included EPS and revenue in my model. The external factors influencing stock performance are reflected in my model’s macroeconomic factors. For EPS and revenue, I adopted data from seeking alpha while for market data I used precedence research values. I used the Fed’s rate as my interest rate.

Given the above rationale, I ran the model at a 95% confidence interval, and below are the results.

Author

With an adjusted R square of 0.959, the output is a satisfactory fit for this analysis because it explains approximately 95.9% of the variability in the dependent variable. A higher R square suggests that a greater proportion of the variation is explained by the model, which validates the model. Furthermore, every t-stat value exceeds 2, and every p-value is less than the confidence range of 0.05. These results indicate that every variable possesses statistical significance, hence making them reliable predictors of the Y variable.

Market growth, EPS, and revenue have positive beta coefficients, which means that an increase of one unit in any of these variables would have a positive effect on the stock price equal to the beta value of that variable. Conversely, the interest rate has a negative beta coefficient, which means that the stock price is negatively impacted by every unit increase in this variable. The above output has led to the overall model;

Y=Bo+B1X1+B2X2+B3X3-B4X4+e, defined as follows;

B0-Y Intercept

B1-EPS coefficient

X1-EPS

B2- Revenue coefficient

X2-Revenue

B3- Market growth coefficient

X3-Market growth

B4- interest rate coefficient

X4-Interest rate

e-the standard error.

I projected the stock price by 2025 using this overall model. I employed the estimated revenue, EPS, interest rates, and market size by 2025 to do the forecasting according to the respective sources mentioned above. To be specific, the estimated EPS and revenue according to Seeking Alpha are $3.98 and $175.2 billion respectively, while the projected market size by 2025 according to precedence research is $286.26 billion and the forecasted fed rate by 2025 is 3.5%.

Plugging these values into the overall model equation provides an estimated stock price of about $150 or a 41.2% growth by 2025. Given the strong growth potential, I advocate a buy-and-hold approach here.

Risks

Before investing in Nvidia, one should take its revenue concentration into account. As this article highlights, a few massive corporations account for about half of its revenue. This implies that Nvidia’s financial performance would be severely harmed if any of these companies decided to switch to their rivals or if their orders decreased.

Conclusion

In conclusion, I believe NVDA has significant growth potential due to its market dominance and innovative technologies. The current slowing growth rate is nothing to be concerned about, given the potential of future product launches with a large market potential. The significant CapEx going to Nvidia from big tech businesses speaks clearly for its long-term growth as well. Given this context and the double-digit upside potential, I believe this is a buy-and-hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.