Summary:

- Nvidia Corporation’s software ecosystem, including NIM and NeMo, could have a more profound and longer-lasting impact on the company’s growth than its hardware.

- Its software platform could strengthen its value chain and generate more recurring revenue.

- Nvidia’s Project GR00T, focusing on generalist robot technology, shows promising results and could become a key growth driver in the long run.

- However, there are substantial downside risks.

- Today’s Nvidia Corporation shares several key similarities to Cisco Systems in the 2000s both in terms of valuation and business fundamentals.

Justin Sullivan/Getty Images News

Thesis

Nvidia Corporation’s (NASDAQ:NVDA) 2024 GTC has arguably become a market event – rightfully so. As the market leader in AI and high-performance computing, NVDA’s announcements and advancements showcased at GTC can have ripple effects across various industries that rely on these technologies. Its new GPUs (Graphics Processing Units) can have large impacts on its financials and also potentially on the entire chip market. In recent years, NVDA’s profit growth was largely driven by the Data Center business, where customers continue to favor its products for generative AI and other high-performance applications.

However, it was my impression that the commentaries and analyses on the 2024 GTC have largely focused on its hardware such as AI chips thus far. Of course, there are good reasons. AI chips are still NVDA’s core business. Investors and analysts are naturally interested in updates and advancements on this core product line. Hardware also offers better tangibility and measurability with better-defined specs. New chip specifications like performance improvements, power efficiency, and production timelines are often more concrete and easier to analyze compared to software updates.

With this background, the goal of this article is to dive into two aspects of the GTC that were less discussed: NVDA’s software and robotics. The thesis I will argue is that if NVDA were to add another trillion dollars to its market cap from here, I think their newer frontiers, not the chips, would be the main drivers. In the remainder of this article, I will detail my takeaways from the GTC on these two fronts and also analyze some of the key uncertainties I see.

NIM and NeMo

As just mentioned, NVDA’s advances in recent years have largely been driven by data centers’ need for high-performance chips. But my view is that NVDA’s reliance on hardware (i.e., chips) could create potential vulnerabilities and its ongoing efforts to build its software eco-system (like the NIM and NeMo) are key to addressing these vulnerabilities. The evolution of the chip industry (or the semiconductor industry in general) has convinced me that hardware eventually will face commoditization, no matter how advanced it appears at its prime time (I will revisit this point later when I analyze the lessons from Cisco). Specific to the chip industry, it is highly competitive now, with many other companies constantly innovating.

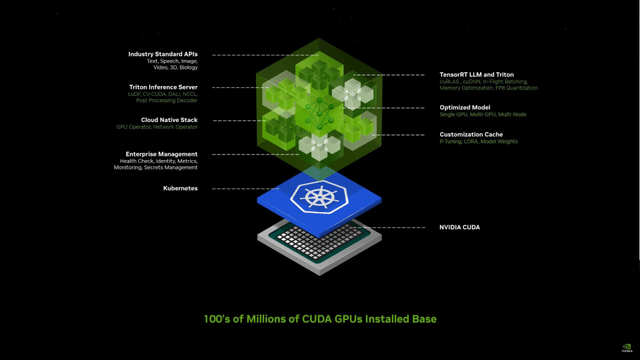

In contrast, software offers a much better value proposition. It is much more scalable, offers much better recurring revenues, and enjoys a much better margin in the long run. Recognizing these considerations, I anticipate the updates NVDA provided on its software ecosystem (see the chart below) to have more profound and longer-lasting impacts. In particular, its microservice NVIDIA NIM integrates all the software it has made in the past few years. It has the potential to cut the middlemen (e.g., software companies) out of its value chain and enable traditional enterprises to directly and simply deploy exclusive industry models run on NVDA’s hardware.

Project GR00T

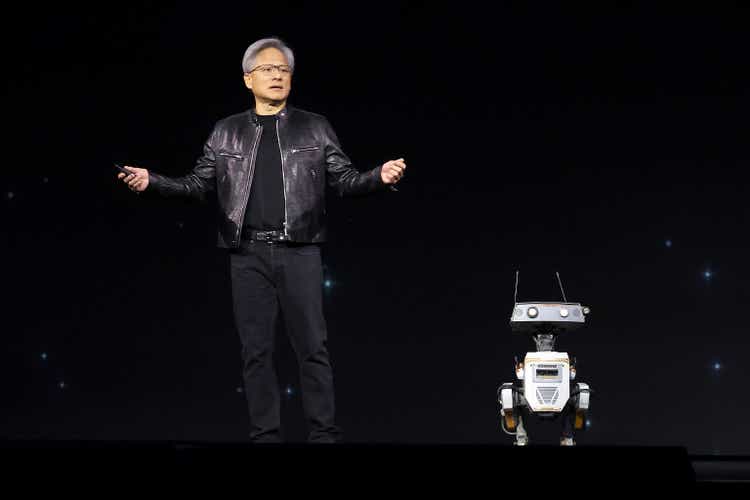

Another nonlinear growth driver from the GTC involves Nvidia’s Project GR00T, focusing on Generalist Robot Technology (see the chart below).

Admittedly, generalist robotics are still a futuristic vision currently and carry significant hype. However, from the GTC, I see a quite concrete plan at play at NVDA and some encouraging results. My understanding from CEO Jensen Huang’s keynote speech is that Nvidia is currently building three platforms on this front: IAI, Omniverse, and ISAAC. These three platforms are all highly related to the robot industry and complement each other well in my mind.

To be more specific, NVIDIA IAI is equipped with DGX series products to simulate the physical world, Omniverse is equipped with RTX and OVX series products to drive the computing system of digital twins, and ISAAC is equipped with AGX series to drive artificial intelligence robots. These efforts have also generated some encouraging results in my eyes. For example, Nvidia has had good cooperation with BYD Company (BYDDF, BYDDY) in the past to deploy its Omniverse technologies in BYD’s cars, factories, and in the field of automotive autonomous driving. Based on Nvidia’s three platforms, I can envision the expansion of these deployments to warehouse robots, virtual training ground, and higher levels of AI driving.

Risks

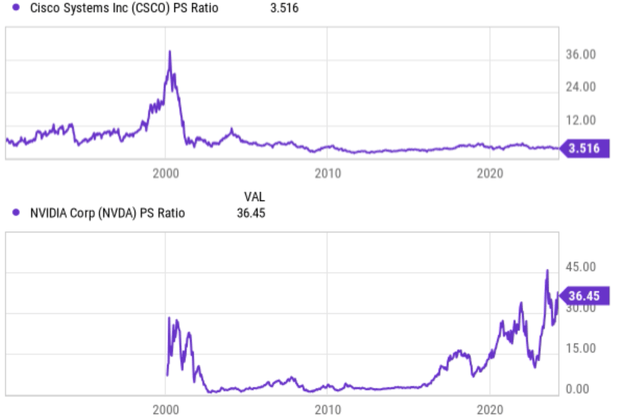

After the positives, now let me switch gears and focus on the downside risks. As nonlinear and futuristic catalysts, both its software ecosystem and robots face uncertainties and might not fit the risk profile of many investors. The story of Cisco Systems (CSCO) provides a good example here. Cisco in the 2000s shares many similarities with today’s NVDA. As you can see from the first chart below, Cisco’s P/S ratio was around 36x during the peak of the dot-com bubble, very close to Nvidia’s P/S ratio today (which sits around 36). To contextualize this, the S&P 500 (SP500) trades blow 3x P/S most of the time.

Beyond the similar valuation multiples, the similarities between today’s NVDA and Cisco in the 2000s go deeper. Both were riding a major technological wave. Both NVDA and Cisco were at the forefront of major technological shifts and were viewed as the shovel provider amid a gold rush. Cisco’s dominance came during the dot-com boom when the internet was rapidly expanding, and their routers and switches were essential infrastructure. Today, Nvidia is a leader in the AI revolution, with its GPUs powering advancements in various fields. This association with a hot trend fueled investor excitement and drove up their valuations to bubble regimes.

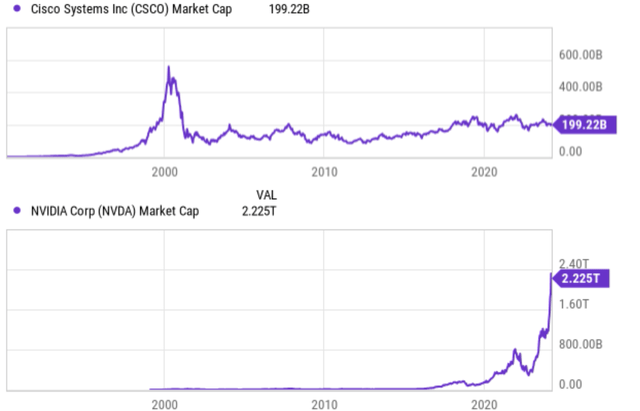

And as the sayings go, the rest is history. Today, CSCO’s market cap is still only about 1/3 of its peak during the dot-com bubble (see the next chart below).

Other risks and final thoughts

Of course, there are differences between today’s NVDA and 2000’s CSCO. And their differences add some key upside risks to the NVDA investment. One top key difference in my mind involves their different degree of business model maturity. Cisco in the 2000s relied heavily on hardware sales, a more mature business model that became a commodity quickly. Today, Nvidia has a stronger software component with its CUDA platform and development tools as discussed. This can create recurring revenue streams and potentially offer more stability than just hardware sales.

In terms of downside risks, besides the uncertainty of NVDA’s software platforms, the GR00T project, and the inflated valuation, there are a few other risks worth mentioning. Some of these risks are common to the chip sector such as competition, cyclicality, and sensitivity to macroscopic economics. In particular, the chip industry is heavily influenced by geopolitics and my feeling is that NVDA’s chips are more sensitive to these risks than the sector average. Trade tensions between the United States and China, a major market for NVDA’s products, manifest more strongly in key technological fronts such as AI, especially high-end AI chips like those from NVDA. Such tension has disrupted NVDA’s operation before. For example, new export restrictions imposed by the United States in October last year can significantly hurt its sales to China and a number of other countries for the incoming quarters.

All told, my overall conclusion is that NVDA is not suitable for all accounts, certainly not for more conservative investors. There are large uncertainties on both sides. On the upside side, the exciting advancements in AI, its software platforms like NIM and NeMo, and project GR00T all create nonlinear growth opportunities.

However, there are substantial downsides too. All these futuristic opportunities are at their incipient stage only.

The current Nvidia Corporation valuation ratios suggest too much optimism has already been baked into the stock prices. Finally, geopolitical tensions, particularly in China, could intensify and cause large stock price corrections, at least in the short term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.