Summary:

- Nvidia Corporation’s established computing power makes it a natural leader in the relatively new field of AI, and some degree of exuberance is warranted.

- As with many new exciting technologies, the market is becoming irrational and bidding up the price of AI related stocks to levels not justified by underlying fundamentals.

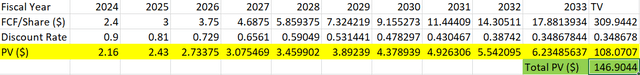

- Using optimistic assumptions, I estimate Nvidia’s fair value to be around $147/share.

- To grow into its valuation, I estimate Nvidia would have to grow FCF/share at a 30% CAGR for 10 years, which does not seem feasible.

Sundry Photography

Executive Thesis

Artificial intelligence requires massive amounts of computing power, and that is something that Nvidia Corporation (NASDAQ:NVDA) is a natural leader in since its creation of the graphics processing unit “GPU” in 1999. The company continues to be a leader in the gaming and visual arts spaces but is also pivoting into powering more complex AI solutions for business. This began with the company’s powering of Alexnet in 2012, which is an AI algorithm able to classify images into different categories.

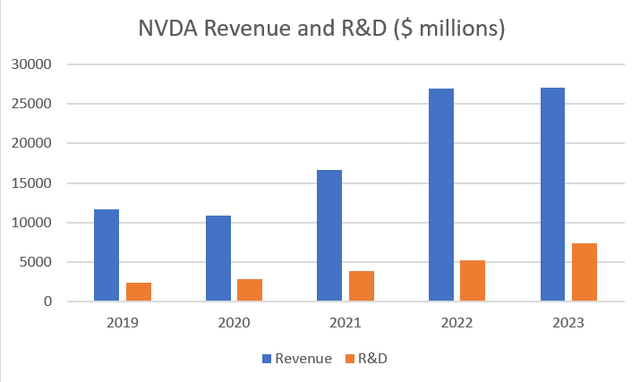

If it is a leading company in a growing industry, why I am giving it a sell rating? Ultimately, that comes down to valuation. According to our models, the company would need to grow free cash flow (“FCF”) per share at an over 30% CAGR for a $270/share valuation to make sense. This will be difficult, given the growth rate since 2013 has been lower around 23%, and the ever-increasing amount of stock-based compensation. Indeed, in FY 2023, the company had $3.8 billion in free cash flow, but $2.7 billion in stock-based compensation (“SBC”), which is pretty unacceptable in my view. The market’s new obsession with AI has pushed the stock price above what I believe any rational investor should be paying for Nvidia Corporation stock.

The Bull Case

Nvidia Corporation is a trailblazer in accelerated computing, beginning with the invention of the GPU in 1999. I first heard about the company a few years ago from friends interested in gaming, who were building their own computers. According to them, NVDA graphics cards were top of the line, and you could just forget about buying anything from Intel Corporation (INTC). Although this may have been the case in the past, Intel appears to be making strides in the space, with its graphics cards offering almost as many frames per second (“FPS”) or video smoothness as NVDA. For something like gaming, which is very competitive, having top of the line FPS is important, and NVDA already has a good reputation.

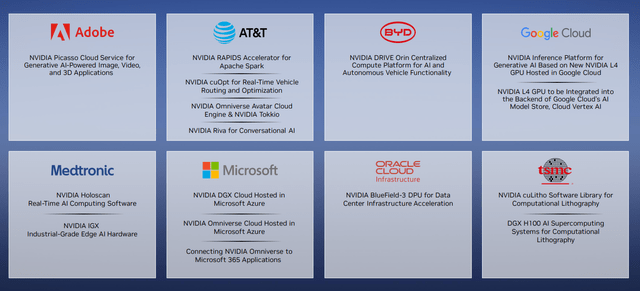

With their powerful processing capabilities, NVIDA has also been well positioned for an AI revolution, and the picks and shovels argument is a valid one. In order to stay competitive, companies are going to increasingly want to incorporate AI into their operations, and that often means turning to NVDA for help. AI utilization requires massive processing power, and NVDA offers this with its GPU-powered computing platform. The company reports it helps thousands of companies incorporate AI into their operations, and below are just a few popular companies NVDA works with.

NVDA GTC 2023 Financial Analyst Presentation

NVDA is also working with 100s of car manufacturers in order to assist with using AI for self-driving and assisted driving technologies. This tech seems bound to only increase in popularity over time, and companies like Waymo LLC of Alphabet Inc. (GOOGL) are already demonstrating safe self-driving capabilities in cities like San Francisco.

Additionally, for the bull case it’s important to note that the company is a “fabless” chip maker. This means that NVDA outsources the fabrication of its products to foundries, frequently using Taiwan Semiconductor Manufacturing Company Limited (TSM) for manufacturing. This allows for some geographical arbitrage, as it would likely be more expensive to manufacture in the USA from a labor perspective. Not having to construct and maintain manufacturing plants also reduces capital intensity, and allows the company to shovel more cash into R&D to maintain their competitive advantage.

This Writer, Data from Morningstar

Valuation

I assumed the company would be able to maintain their high margins and competitive advantages and grow FCF/share at a 25% CAGR, above their 23% CAGR since 2023. I extrapolated from FCF/share data, as this takes into account the heavy stock-based compensation. I used a 10% discount rate, as this is likely the minimum return equity investors would demand, and assumed the company could grow at a 4% rate into perpetuity along with global GDP after the 10-year growth period. These calculations are demonstrated below.

Even with these optimistic assumptions, the estimated fair value of the company would be $147/share, indicating 45% downside from market quotations at time of writing. In order for this model to indicate the stock is trading at fair value, the company would need to grow FCF/share at a 33% CAGR for the next 10 years. This growth rate would likely require perfect execution, minimal margin erosion from competitors, and reduction in stock-based compensation.

Risks

Geopolitical Risk

Being a fabless chip maker has many aforementioned benefits, but relying on foreign manufacturing is not without risk. If there is any escalation in the China and U.S. conflict, access to manufacturers such as TSM could be limited. This may also benefit NVDA’s competitors with established foundries.

Cyclicality of the Industry

Historically, semiconductors have been a cyclical industry, as many products they were traditionally incorporated in were related to consumer electronics. Purchasing shares now may put the investor at risk of buying into a cyclical downturn near all-time highs. It’s worth noting though, with the transition to AI and more companies requiring use of datacenters, there will likely be more persistence of demand.

Commodity-Like Aspects of Semiconductors

NVDA has a great reputation for its GPUs and, according to PC World, has the best high-end graphics cards on the market. This means they cost more, but if you want the best of the best, you should likely be going with an NVDA option. Maintaining this advantage may be difficult, though, and if competitors such as INTC are able to create comparable products at lower price points, margins will be compressed.

Conclusion

Nvidia Corporation is clearly a leader in its fields, with its powerful GPUs on the frontlines of powering the AI revolution, and its graphic cards having the reputation of being top of the line. Despite this, I believe the rampant speculation around AI indicates danger for the marginal investor, initially from the elevated stock prices and also subsequently from the massive amount of capital that will continue to be thrown at the industry. NVDA has the advantage of appearing to be the industry standard in multiple aspects of its business, though this edge may not last forever.

With an estimated value of $147/share using optimistic assumptions, I have to give Nvidia Corporation stock a sell rating, as 45% downside is indicated at time of writing. The elevated price likely has more to do with irrational exuberance over the growth of AI, rather than fundamentals. That being said, this is a strong company, and I wouldn’t mind owning Nvidia Corporation at the right price. I would like management to get a handle on stock-based compensation, though, and prudent investors need to take this into account.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.