Summary:

- Nvidia has exceeded expectations with its revenue growth and margins, but there are still risks that prevent a bullish rating on the stock.

- The competition between Nvidia, Intel and AMD in the GPU market is intensifying, and Nvidia’s monopoly on high-priced chips may not be sustainable in the long run.

- The long-term outlook for AI demand is uncertain as Nvidia’s customers must generate appropriate ROI in order to justify/continue buying ever more chips.

Justin Sullivan

Investment thesis

I have to admit being wrong about Nvidia (NASDAQ:NVDA). The company has grown revenue faster and at a higher margin than anyone could ever have imagined, including the biggest bulls. Nevertheless, even though Nvidia has outperformed so much, both the stock and the financials, that does not mean the stock is free from risks. In fact, the multitude of risks prevents me from assigning a bullish rating on the stock.

Background

I have covered Nvidia plenty times before. Perhaps one of my most fundamental ones was comparing Nvidia vs. Intel (INTC) in 2020, as both companies were and are on definite collision course this decade: Nvidia Vs. Intel: The Semi Battle Of The Decade (INTC).

So far Nvidia seems to have the upper hand, but it would be premature to declare any winners yet, as Nvidia has only just launched a CPU and Intel a series of GPUs. Clearly, though, the GPU market (which is really the data center AI market in particular) is faring much better in terms of demand and growth than CPUs. However, that just means that Nvidia has potentially much more to lose as both companies attack each other’s stronghold.

More recently, in June I reiterated a 2021 call of having reached Peak Nvidia. As stated, I have to admit to being wrong with this call.

Q2 results

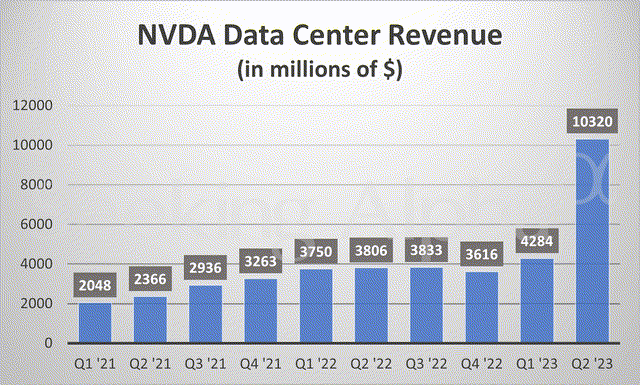

The results can be found here: Nvidia Non-GAAP EPS of $2.70 beats by $0.61, revenue of $13.51B beats by $2.43B. Nvidia doubled revenue YoY, although the QoQ trend is most meaningful given the recent explosion in data center sales. The latter was also in the triple digits.

In addition, the guidance was also a clear beat, pointing to strong continued growth.

Analysis

Competitive environment

Although I have been wrong about the stock, arguably every single investor has been wrong. While, sure, the bulls may have been right about the company and stock’s trajectory of going up, no one could possibly have foreseen that Nvidia’s data center business would outright (more than) double quite literally overnight (in one quarter), at least not prior to last quarter’s guidance.

Seeking Alpha has compiled a series of graphs, with following being the most notable one. Nvidia (and hence its investors) have simply been on the benefiting side of (what can only be described as) a black swan event.

The question that follows is where Nvidia will go from here, and therein lies the problem. Tellingly, after the initial after-hours pop, the next day the stock was basically flat, despite the large beat on both Q2 performance and Q3 guidance. One might wonder what would have happened if the results were merely in line.

So perhaps wisely, investors have decided to use the beat to let the valuation compress itself. Nevertheless, given that there have been various reports/rumors of supply of H100 potentially doubling or quadrupling from respectively 1M or 550k to 2M in 2024, and comments from management of strong demand visibility, one could make the case that the valuation in the near-term has actually been largely derisked. That’s certainly quite extraordinary for a stock that many (including) myself have called a bubble.

Still, as mentioned that does not mean the stock is free from problems, and not just because having a path to grow into one’s high valuation does not mean there is any further upside beyond that. For that, one has to look a bit deeper than just these results. In conjunction with the reports/rumors about the supply, equally speculation about the price of these GPUs has ramped. Depending on the source, one could find estimates from $20k up to $50k or even higher, due to factors such as the current supply-demand imbalance or the China market.

In any case, since it is widely acknowledged that the A100 is/was going for about $10k per piece, this implies that the price has more than doubled. Since the current ramp in revenue/demand coincides with the ramp of H100, this actually indicates that the supply in terms of units might not actually have increased all that dramatically, at least compared to the surge in revenue.

What this in turn implies is that Nvidia is simply capitalizing on its monopoly (offering double the performance for more than double the price). This should be obvious since the price of a single H100 chip is (a lot) higher than what its manufacturer TSMC (TSM) charges for a single wafer. A wafer contains many dozens of H100 chips. Hence, at the chip level Nvidia (as discussed in previous article) has quite literally a gross margin of something like 98%. In reality, it will be a bit lower due to other components such as the HBM memory, but the argument stands.

Now, as has been argued in for example the All-In podcast, such high gross margins in principle are simply unsustainable in the long run due to competition. There are plenty of companies, both start-ups and incumbents such as Intel and AMD (AMD), who will observe that (even if they have somewhat lower performance in the worst-case) they can quite easily achieve a compelling price per performance leadership if they accept somewhat lower margins than Nvidia.

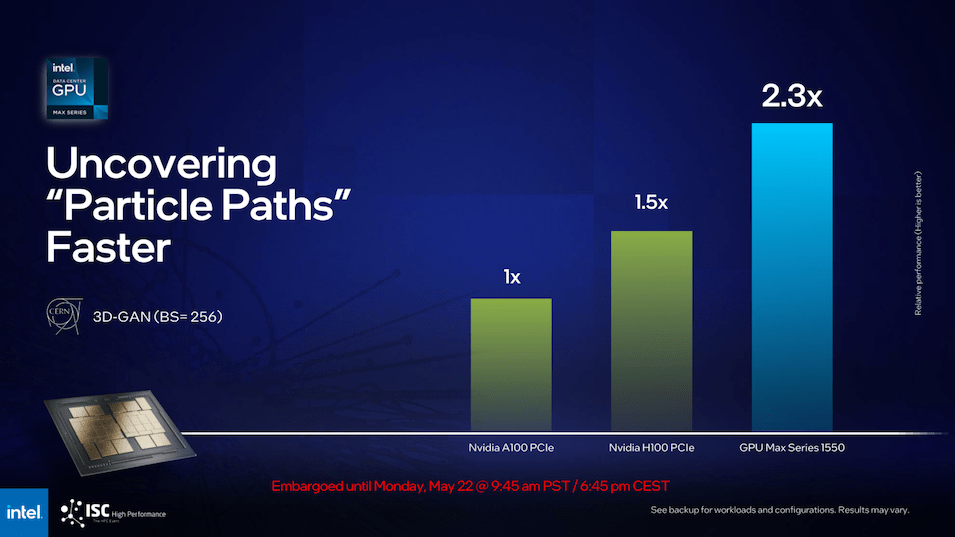

In fact, Intel has already launched two compelling alternatives (Gaudi2 and Ponte Vecchio), while AMD is launching soon. In that regard, investors should note that AMD and Intel’s margins are both so much lower than Nvidia’s that they have an astronomical amount of leeway to lower prices (compared to Nvidia) and still deliver compelling margins for their own business. Also note that Nvidia really does not have all that much of a performance advantage as both Ponte Vecchio and MI300 have a higher transistor count and insofar disclosed similar theoretical performance. In fact, Intel has shown benchmarks where it far outperformed the H100, although how this translates into LLM performance is unknown.

Intel

Still, although both AMD and Intel have cited incredible QoQ growth in their pipeline, this is from a small base (a $1B pipeline compared to >$10B Nvidia data center quarterly revenue), so admittedly the lack of substantial ramp in market share shift yet makes this risk still largely theoretical. Although logic would certainly imply that customers would look for cheaper alternatives to improve the fundamentals of their own business.

Long-term outlook

The other major risk factor is simply the lack of clarity about the long-term outlook, hence the title that all bets are off. Bulls are touting AI as a new generational trend (in its early innings), while bears have warned for demand potentially falling off a cliff once the hype cools down. Given the current state of turbulence, it simply inherently risky to invest in Nvidia.

In particular, the main argument or consideration I would point out is the monetization of the applications that run on these GPUs. It is just not obvious that one single application (a chatbot) should warrant data center chip spending for this use case to dwarf literally all other applications in existence… combined.

So while there may currently be a huge build-out (which as argued isn’t actually all that huge in terms of units given the significant price hike Nvidia has carried out for its latest chip, as for example Intel is likely already selling more units of its latest Sapphire Rapids, which launched in January, than Nvidia sells H100s, despite that the largest version of Sapphire Rapids actually has twice the amount of logic silicon, and the mainstream version is roughly on par in terms of logic area), once it turns out that monetizing this technology for end-user applications does not yield sufficient ROI, then perhaps the current build-out will slow down significantly, bringing down sales.

This is not a far-fetched or unrealistic concept. Once people realize that the picks and shovels do not yield the promised returns for their users, then demand for those tools will subside just as well, or people will simply continue to use their existing tools.

Investor takeaway

While AI itself is not new and has been a core investment for Nvidia since Volta in 2017, the recent trend in LLMs (large language models) specifically has caused a surge in AI hardware demand. Since there is no competition (as Intel set itself 4 years back by shelving its 2016 Nervana acquisition), Nvidia has had a free reign to set prices, allowing it to capitalize fully on this trend.

While I am not denying that AI is big trend, the next leg of automating civilization and increasing productivity and capabilities, what remains to be seen is if Nvidia’s growth and margins still continue to hold up as the competition that has started this year ramps up, from both Intel and AMD.

From both companies’ disclosures, they are certainly seeing a surge in demand just like Nvidia, but that is still from a tiny base, hence so far this is not impacting Nvidia. Still, there is an example from the recent past where Intel saw a significant market share and margin decline due to rising data center CPU competition from AMD, although this was exacerbated by Intel’s weak product portfolio. Besides ramping competition, one could just as much wonder if the end-users of GPUs will see enough ROI to justify buying ever more GPUs.

So while admittedly my thesis of Peak Nvidia has not held up due to the unforeseen black swan event of the chatbot craze driving a more than doubling in QoQ data center revenue, given that Nvidia’s data center chips have basically software-like gross margins, combined with that there are currently credible alternatives to Nvidia on the market, that just makes it too risky to assign a bullish rating on the stock. I’ve moved my previous Sell rating to a Hold. While bulls may continue to bet on rising demand and stable margins and market share, even the most strongly executing companies eventually have to face peak market demand. For comparison, even at peak Intel monopoly, Intel was still selling less than $30B annually in CPUs in the data center.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.