Summary:

- NVDA is another bubble among the various asset bubble charts throughout history, starting with the 1600s Dutch tulip bulb bubble.

- The bulls seem to believe that NVDA will maintain its lead in AI chips and near-monopolistic pricing power in perpetuity.

- Three attributes suggest the stock is losing “energy.”.

jetcityimage

The commentary on NVDA below is from the latest issue of my short seller’s newsletter.

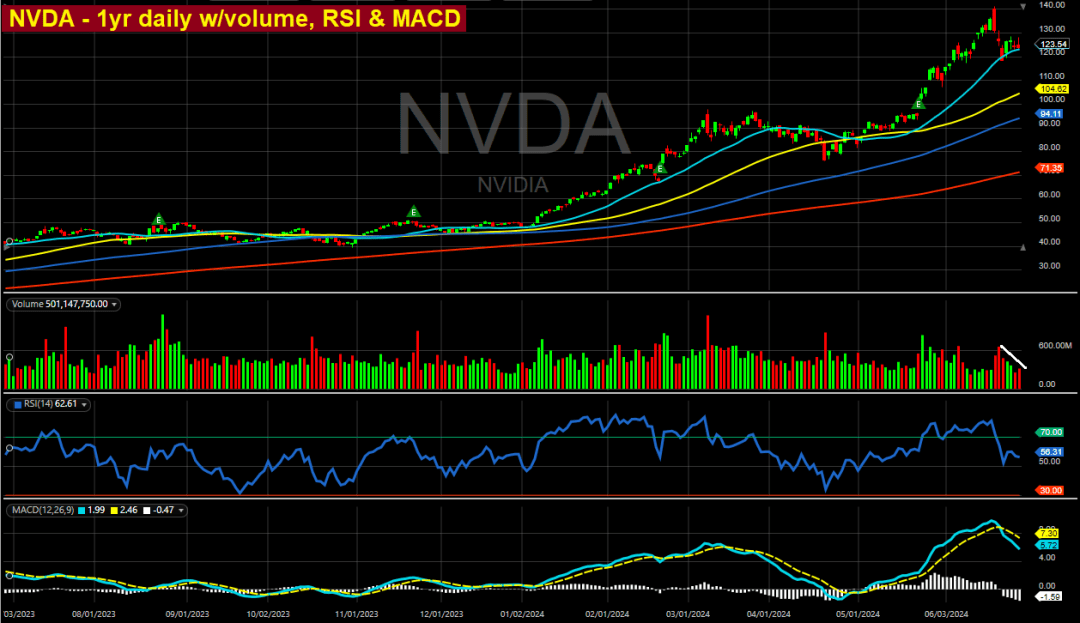

Nvidia update (NASDAQ:NVDA – $123.54) – The 2x Long NVDA ETF (NVDL – $69.55) had a record $743 million inflow of investor money during the week that ended Friday, June 21st. Perhaps that was the ultimate contrarian indicator, as the stock price fell from an intraday high of $140 on June 20th (Thursday) to a closing price of $118 on June 24th (Monday). That’s a loss of $542 billion in market cap over a three-day period.

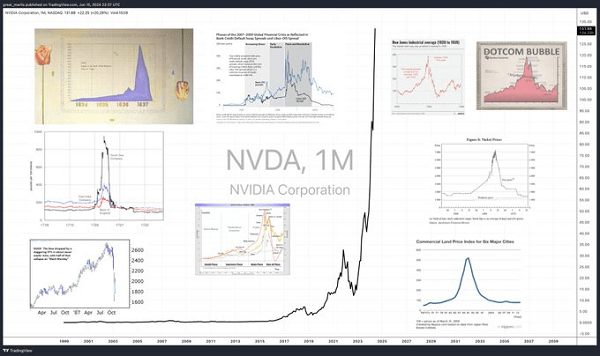

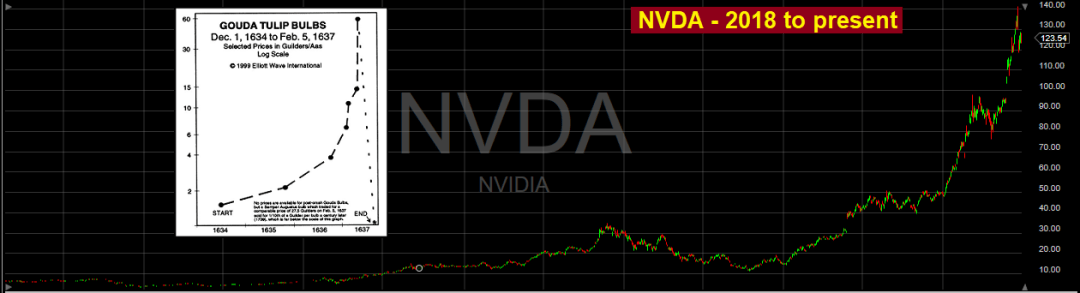

NVDA is another bubble among the various asset bubble charts throughout history, starting with the 1600s Dutch tulip bulb bubble on the upper left (source: @great_martis):

We’re being told that “it’s different this time” with respect to NVDA’s market cap. One portfolio manager was on CNBC saying he expects NVDA to hit a $6 trillion market cap this year “as investors realize how cheap the stock is…” That would be a double from the current stock price. It’s a laughable prediction. That would take the trailing P/E to 144, the forward P/E to 68x, and the price/sales to 76x. I just don’t see it happening.

The bulls seem to believe that NVDA will maintain its lead in AI chips and near-monopolistic pricing power in perpetuity. It won’t. At some point, competitors will bring competitive chips to market at lower prices. Plus, most are overlooking the fact that semiconductors are a highly cyclical industry. The proliferation of AI will not change that. At some point, the market will become saturated with NVDA’s chips and its business will be subjected to the law of supply and demand.

NVDA’s share price has a history of boom/bust cycles. On a split-adjusted basis after the recent 10:1 stock split, NVDA went from 5 cents in October 1999 to as high as 61 cents in January 2002. By September 2002 it had dropped back to 7 cents. Between September 2004 and October 2007, another stock bubble era, NVDA ran from 12 cents to as high as 99 cents. By November 2008 it had dropped to as low as 14 cents. The cliff-dive in “Dutch tulip bulb” charts happens much more quickly than the ascent to the top of the cliff. It won’t be different this time.

After that three-day plunge, NVDA stabilized at its 21 DMA (light blue MA line, $123.21 on Friday). Volume has tailed off considerably and the RSI/MACD momentum indicators are heading south. Those three attributes suggest the stock is losing “energy.” Also, the last three days of the week, the stock closed well off of its highs of the day.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.