Summary:

- Big tech companies are engaged in an AI arms race, potentially over-investing in Nvidia Corporation GPUs.

- Game theory helps us understand how everyone acting in their perceived self-interest leads to a suboptimal outcome.

- There were plenty of unanswered questions posed to Nvidia customers this past earnings cycle.

- Given the noises Nvidia customers are making, I think this arms race will persist into next year.

BING-JHEN HONG

Arms Races and Game Theory

The spring 2024 earnings season was one of the most interesting I can remember. During the various earnings calls and CEO interviews, a group of well-heeled tech companies all admitted to a fact we could already plainly see. They are engaged in an AI arms race, potentially over-investing in GPUs from Nvidia Corporation (NASDAQ:NVDA), which reports its earnings on August 28th.

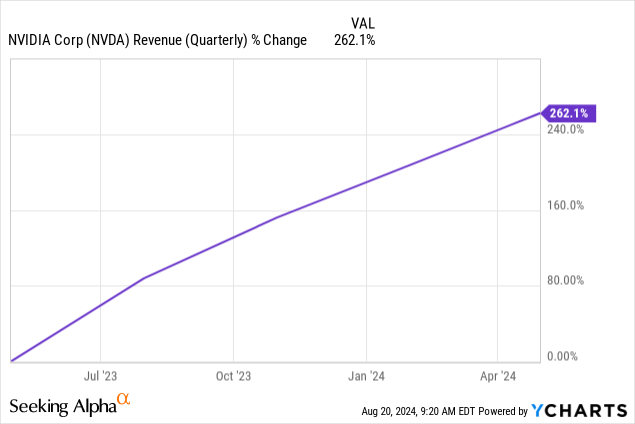

So there’s this side of the equation, Nvidia’s revenue:

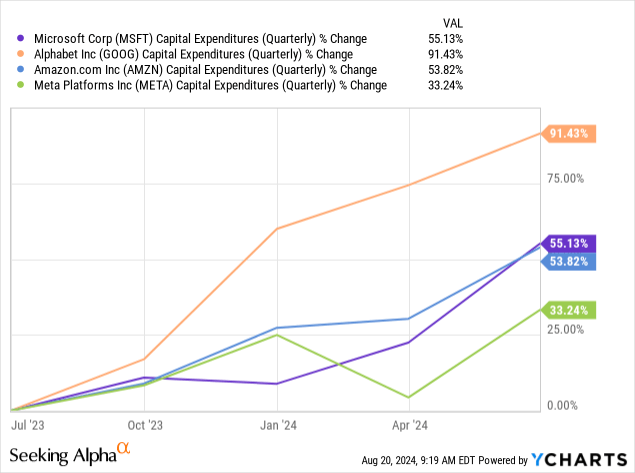

But everyone’s revenue is someone else’s expense:

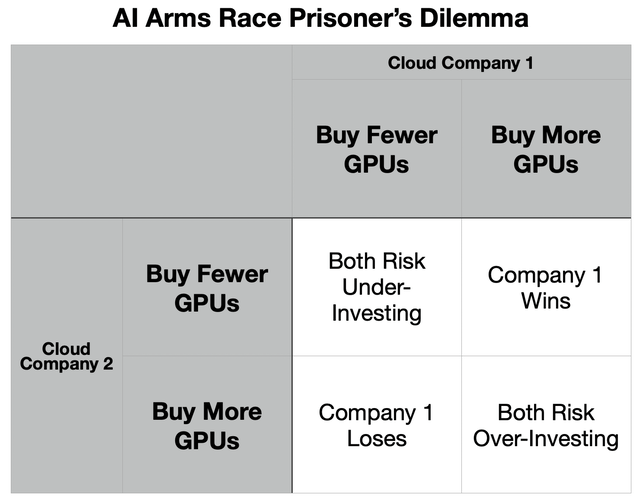

Those are the companies engaged in this figurative arms race. Like literal arms races, it is the result of what’s known as a “Prisoner’s Dilemma” in game theory.

As we will look at below, Nvidia customers have decided that the risk of under-investing in GPU cloud capacity is greater than the risk of over-investing. Looking at the table from Company 1’s perspective, this is how they are ranking their preferences.

- Top-right. Company 1 risks over-investing, and Company 2 risks under-investing. Company 1 wins the GPU race.

- Top-left. Both companies risk under-investing. GPU cloud compute becomes scarce, and cloud companies can raise prices and margins. Saves CapEx.

- Bottom-right. Both companies risk over-investing. GPU cloud compute becomes abundant, and margins get pressured.

- Bottom-left. Company 1 risks under-investing, and Company 2 risks over-investing. Company 2 wins the GPU race.

In this simplified game, regardless of what Company 2 decides to do, Company 1 thinks they are better off buying more GPUs. For Company 1, the right cells are always a better choice than the corresponding left cells. For company 2, the bottom cells are always preferred to the corresponding top cells.

The point is that like in literal arms races, both sides are acting in what they perceive to be their self-interest, but wind up with a suboptimal outcome, nonetheless, an arms race that mostly benefits the arms dealer. In the case of the Cold War, it was nuclear arsenals so large that they eventually had to be negotiated away.

Now imagine that there was effectively only one vendor of nuclear missiles for both the US and USSR. That is what we see now. Nvidia’s customers are engaged in a GPU arms race, and Nvidia is effectively the only vendor.

Unanswered Questions

At Long View Capital, we’ve talked a lot about the supply and demand sides of AI

- Supply side: Investment in GPU hardware, and new AI models/services.

- Demand side: Demand for AI cloud services, and AI models/services sold to customers.

We have already seen plenty of capital going into the supply side — both hardware and models/services. We have also seen plenty of demand for cloud services from those new models/services running in the cloud. A lot of that cloud spend is subsidized by the cloud companies themselves via investments in AI startups.

But what we have yet to see is high demand for AI services that translates into enough revenue to pay for all these GPUs. The unanswered questions I keep asking on that last point: What is the value proposition? From where is the revenue going to come? When will it come?

David Cahn, a partner at VC Sequoia Capital, has called this the “$600 Billion Question.” His very rough math is that for every dollar spent on Nvidia GPUs, there needs to by $4 in AI services revenue to back it up, with rough estimates of a 50% margin for the cloud, and a 50% margin for the software. That means with something like $150 billion in Nvidia GPU sales by Q4, $600 billion in AI revenue needs to flow into the ecosystem from customers.

Does that seem likely to you? For reference, AI leader, OpenAI, was recently at a revenue run rate of $3.4 billion a year.

The questions are starting to pop up during earnings calls, like this one on the Google (GOOGL) Q2 call.

Ross Sandler (Barclays)

So it looks like, from the outside at least, that the hyperscaler industry going from kind of an under-built situation this time last year to better meeting the demand with capacity right now to potentially being overbuilt next year if these CapEx growth rates keep up. So do you think that’s a fair characterization? And how are we thinking about the return on invested capital with this AI CapEx cycle?

Sundar Pichai (CEO)

Look, obviously, we are at an early stage of what I view as a very transformative area. And in technology, when you are going through these transitions, aggressively investing upfront in a defining category, particularly in an area, which in a leveraged way, cuts across all our core areas, our products, including Search, YouTube and Other Services as well as fuels growth in Cloud and supports the innovative long-term bets and Other Bets. It is definitely something that for us makes sense to lean in.

The one way I think about it is when you go through a curve like this, the risk of underinvesting is dramatically greater than the risk of overinvesting for us here. Even in scenarios where if it turns out we are overinvesting, these are infrastructure which are widely useful for us, they have long useful lives, and we can apply it across and we can work through that.

But I think not investing to be at the front here, I think, definitely has much more significant downsides.

Having said that, we obsess around every dollar we put in. Our teams work super hard, I’m proud of the efficiency work, be it optimization of hardware, software, model deployment across our fleet. All of that is something we spend a lot of time on, and that’s how we think about it.

This was an excellent question, and Pichai gave only a partial answer. He talked about:

- It’s an arms race, and we can’t fall behind.

- These assets are long-lived.

- We are trying our best to keep expenses under control.

Nothing about from where the revenue is going to come, and when it will come. “How are we thinking about the return on invested capital with this AI CapEx cycle?” goes unanswered. That’s because the answer is that the return on investment is a long way off. The GPUs purchased in 2023-2024 may be fully depreciated before that happens.

In a Bloomberg interview, Facebook (META) CEO Mark Zuckerberg echoed that first point:

Emily Chang (Bloomberg)

But when does it start paying off? Like, is it a bubble? And if not, when do you start seeing the money?

Mark Zuckerberg

I think bubbles are interesting, because a lot of the bubbles ended up being things that were very valuable over time, and it’s just more of a question of timing, like you’re asking. Even the dot-com bubble, it’s like there’s all this fiber laid, and it ended up being super valuable, but it just wasn’t as valuable as quickly as people thought.

So, um, is that gonna happen here? I don’t know. I mean, it’s hard to predict what’s gonna happen in the next few years. I think AI is gonna be very fundamental.

I think that there’s a meaningful chance that a lot of the companies are overbuilding now, and that you look back and you’re like, “Oh, we maybe all spent some number of billions of dollars more than we had to.”

But on the flip side, I actually think all the companies that are investing are making a rational decision, because the downside of being behind is that you’re out of position for, like, the most important technology for the next ten to 15 years.

Like Pichai, Zuckerberg did not answer the important question Emily Chang asked: “But when does it start paying off?” What did we get?

- Bubbles are interesting because they leave behind valuable investment.

- The risk of under-investing in AI is greater than the risk of over-investing.

That is an arms race mentality.

Then it was Microsoft’s (MSFT) turn to not answer the question:

Keith Weiss (Morgan Stanley)

Can you give us a little bit more help in understanding the timing between the CapEx investments and the yield on those investments?

Satya Nadella (CEO)

I would say we primarily start right now from the demand side. What I mean by that is what’s the shape of the product portfolio, what we learned even from the cloud transition, which, as you know, Keith, was similar in the sense it was both a knowledge-intensive and a capital-intensive transition. We needed to have the product portfolio where there was the right mix of, I’ll call it, infrastructure meters as well as SaaS applications. So that’s the first thing that we are looking at.

And how is that value landing with customers and what’s the growth rate. So when I think about what’s happening with M365 Copilot as perhaps the best Office 365 or M365 suite we have had, the fact that we’re getting recurring customers, so our customers coming back buying more seats. So GitHub Copilot now being bigger than even GitHub when we bought it. What’s happening in the contact center with Dynamics. So I would say – and obviously, the Azure AI growth, that’s the first place we look at.

That then drives bulk of the CapEx spend, basically, that’s the demand signal because you got to remember, even in the capital spend, there is land and there is data center build, but 60-plus percent is the kit, that only will be bought for inferencing and everything else if there is demand signal, right? So that’s, I think, the key way to think about capital cycle even.

The asset, as Amy [Hood, CFO] said, is a long-term asset, which is land and the data center, which, by the way, we don’t even construct things fully, we can even have things which are semi- constructive, we call coal shelves and so on. So we know how to manage our CapEx spend to build out a long-term asset and a lot of the hydration of the kit happens when we have the demand signal.

There is definitely spend for training. Even there, of course, we will only be scaling training as we see the demand accrue in any given period in time. So I would say it’s more important to manage to capture the opportunity with the right product portfolio that’s driving value. And on that front, I feel good about the breadth of Microsoft offering, whether it’s in consumer side, whether it’s on commercial per seat side or on the consumption meters, that’s, I think, the fundamental driver.

That is a lot of words to not answer the question directly: “Can you give us a little bit more help in understanding the timing between the CapEx investments and the yield on those investments?” What did we hear?

- Though they will not break out any hard numbers, they are seeing demand for AI services like their Copilots.

- It’s not all GPUs. Land and buildings are long-lived assets.

We still do not have a sense of when this will all pay off in revenue, besides cloud demand. The answer is likely that it is a long ramp, but the capital and R&D costs are here, today.

The Upshot

It’s still a faint whiff, but in the last month or two I’m sensing more skepticism over all this investment. It’s the beginning of popping this bubble. Bubbles can last a long time before they pop. The Dutch tulip craze went on for almost 3 years, and then one day it was over.

But make no mistake. These Nvidia Corporation customers are not slowing down. They are signaling to us, and to each other, that they are going to stockpile GPUs because it is the scarce resource, and because they can. They don’t care what analysts, or you, or I think. Not only that, but they are not going to stop buying GPUs, sitting as they are at the intersection of FOMO and YOLO.

Driving all this is the idea that AI will keep advancing at the rate it did in 2022-2023. The history of AI is one of technological leaps followed by years of crawl, and eventually disillusionment. Since the release of GPT-4 in March 2023, just 4 months after ChatGPT was released, progress has slowed.

But what hasn’t slowed is this arms race. Given the noises everyone is making, I think it will continue into next year, in the near term, mostly to the benefit of Nvidia.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

At Long View Capital we follow the trends that are forging the future of business and society, and how investors can take advantage of those trends. Long View Capital provides deep dives written in plain English, looking into the most important issues in tech, regulation, and macroeconomics, with targeted portfolios to inform investor decision-making.

Risk is a fact of life, but not here. You can try Long View Capital free for two weeks. It’s like Costco free samples, except with deep dives and targeted portfolios instead of frozen pizza.