Summary:

- NVIDIA Corp. faced a triple-hit to its stock price this week, including a correction, proposed acquisition delay, and shipment delays to top customers.

- Patient investors have an opportunity to buy NVDA stock with three catalysts still in play: R&D profile, operational efficiency, and human capital structure.

- Despite concerns about valuation, an AI bubble, and a potential antitrust probe, NVDA is now a strong buy with potential for growth in revenue and earnings.

David Tran

Trouble comes in threes, they say, and if we believe that aphorism, there’s no denying that this tech giant has its hands full. This week alone, NVIDIA Corporation (NASDAQ:NVDA) (NEOE:NVDA:CA) took a triple-hit to its stock price. The stock price correction on the back of the “bubble land” comment from Elliot Management was the first, the second being news of a possible antitrust probe from the Run:ai proposed acquisition and Nvidia’s dominance in the top tier of the chip market, and the third being an ‘insider’ report of delays to the shipment of its Blackwell product line to its largest customers – Microsoft (MSFT), Alphabet (GOOG)(GOOGL), and Meta Platforms (META) – due to a possible design flaw that the report says:

…have forced the company to run new test production runs with the chipmaker Taiwan Semiconductor Manufacturing Company (TSM).

I believe this represents an excellent opportunity for patient investors who have been waiting for the right time to buy this stock. In my last article on NVDA titled: Why I Think Nvidia Will Continue Returning Value In The Long Run, I identified three lesser-known catalysts that I believed (and still believe) will allow the company to keep growing at a faster pace than its peers: one, its R&D profile, which I outlined in some detail; two, its operational efficiency and pricing power; and three, its unique human capital structure.

These three catalysts are still very much in play, and that thesis extends today to an upgrade to Strong Buy for yet another three reasons: one, the sell-off is overdone, in my opinion; two, I believe Street analysts’ concerns are based purely on what appear to be excessive valuations; and three, I think the bad news on a possible antitrust probe and the delayed shipments aren’t going to impact the long-term growth trajectory of this company.

Let’s begin with the obvious elephant in the room; not the largest, perhaps, but definitely something that investors have been worried about – the excessive valuation leading to an overdone correction. I’ll follow that up with arguments supporting the other two extensions to my thesis, as outlined above.

#1: The Correction is Understandable and Expected; Take Advantage of It

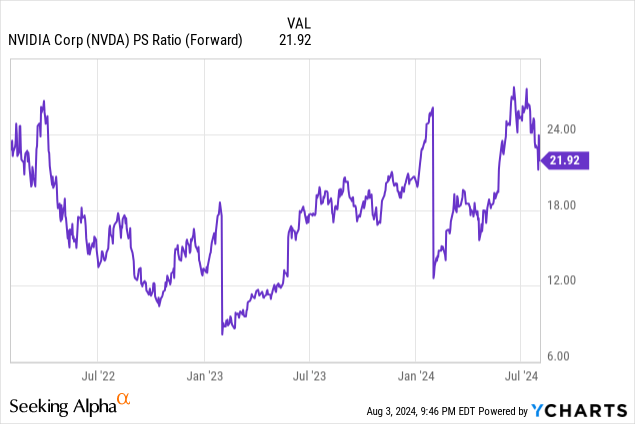

Any investor who thought NVDA’s stock price is going to have a straight-line, upward-sloping trajectory is only kidding themselves. When a stock is priced at such nosebleed levels, corrections are only normal. The key point here is that NVDA might have been priced for perfection, but that’s the market’s own fault. It’s only natural that corrections happen to bring prices back down to earth.

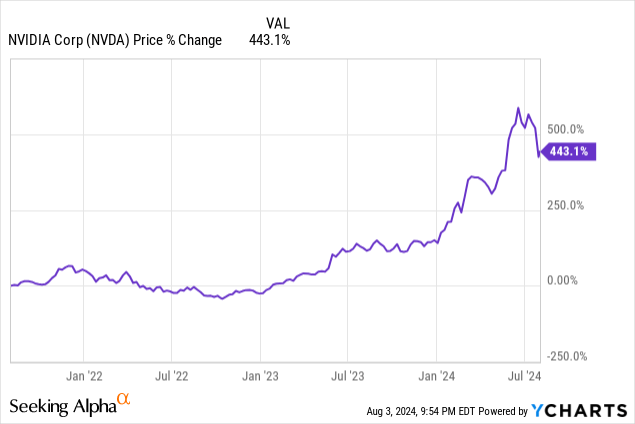

Realistically and historically, if you look at NVDA’s valuation on a revenue basis, you’ll see that the forward P/S ratio has actually been moving sideways, albeit in a wide range. On a split-adjusted basis, the stock is trading at the level it was in early 2022, before the AI craze took over. Moreover, looking at the kind of revenue generation that the company exhibited, its revenue multiple actually formed a trough between then and now. As for the price return, is 440% (including the recent drop over the past month) not good enough to warrant that kind of valuation? I think it is.

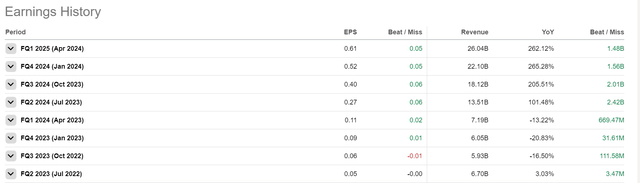

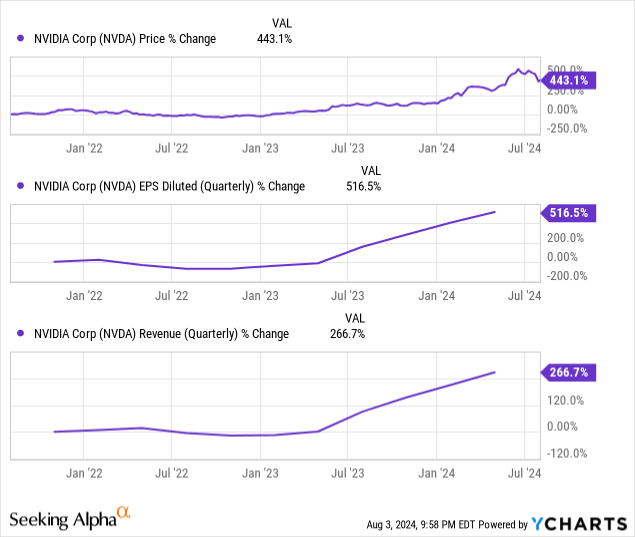

It’s only reasonable to call a stock overvalued if the business can’t deliver superior performance that’s in line with its valuation, and NVDA has been spot on with that metric. Not only have revenues growth by astounding leaps and bounds, but the bottom line has been growing almost twice as fast.

As an investor, these are the metrics you should be worried about because that’s what you’re paying for. Remember, you’re not paying for valuation; you’re paying for value, and NVDA has clearly shown that it’s a value creator.

The stock has corrected by more than 12% in the last month alone, and you’re not likely to get another opportunity like this for a long time. That’s the first element of my extended thesis for NVDA – it might look like a falling knife, and I say let it fall, and fall right into your portfolio! If you want to be cautious and think it’ll go down even further, dollar-cost average into a cheaper cost basis over time if you have to, but don’t lose this opportunity.

#2: AI is NOT in “Bubble Land”

As for the downgrade by Elliot Management, I see that as nothing more than a gross misunderstanding of how the AI story will play out over the next several decades. We’re only beginning to scratch the surface of AI capabilities. Yes, I agree that not every AI product is going to lead to an immediate surge in revenues for hyperscalers, but that view is extremely shortsighted, in my opinion.

One argument I can get behind is that the larger players aren’t going to keep ordering AI chips in such volumes. One of the reasons for that could be the cost of NVDA’s chips, but then again, if they’re willing to spend on such an expensive product line up, they must have a very good reason. I think the company has a very astute pricing strategy to address this demand pull; since their line-up is currently and unarguably the best-in-class available at the moment, it does deserve premium pricing.

What the detractors to this assumption are missing is that once these hyperscalers show tangible topline growth from AI initiatives, other, smaller companies are going to follow suit. They may look for cheaper alternatives that companies like Advanced Micro Devices (AMD) may offer in the future, but if they need to be at the top of their segments and well ahead of the competition, they’ll need to invest in such capex premiums.

Therefore, while I do agree that Nvidia’s AI revenues are currently concentrated among the top cloud providers and hyperscalers, we’re eventually going to see it spread out to other cohorts that are waiting on the sidelines for cheaper alternatives that perform just as well. In truth, that might be a long wait, and as it becomes increasingly urgent to cater to end-users’ demand for AI products, the pressure will be on these CEOs and CFOs to release funds to companies like NVDA and AMD. That’s why I’m also bullish on the latter, as I made known in my article on Advanced Micro Devices last month.

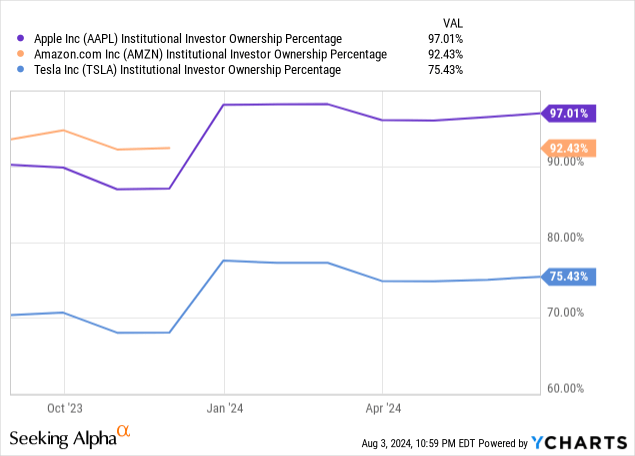

The narrative about companies like Nvidia being “overhyped” and in “bubble land” is not new. Sell-side analysts are extremely cautious about being wrong, especially when institutional investors have high visibility into the securities in question – and what’s more visible than the Magnificent 7 at the moment, which NVDA arguably rules over?

In an interesting research paper published 17 years ago in the Journal of Financial Economics, this was mentioned (emphasis mine):

Analysts who build reputations for providing reliable, accurate, unbiased, and timely forecasts and recommendations generate additional trading business for their brokerage firms (Irvine, 2004; Cowen, Groysberg, and Healy, 2006; Jackson, 2005), receive higher compensation, ceteris paribus (Kothari, 2001), and are more likely to be hired by the most prestigious investment banks (Hong and Kubik, 2003; Hong, Kubik, and Solomon, 2000). Poorly performing analysts generate less brokerage business and are ultimately associated with higher job turnover (Mikhail, Walther, and Willis, 1999). Most analysts’ reputational capital and hence career prospects ultimately depend on institutional investors’ views of the quality of their research. Institutional investors periodically evaluate an analyst’s performance relative to other analysts, both directly (e.g., in the annual Institutional Investor poll) and through their choice of which brokerage firms to use. Thus we view institutional investors as the ultimate arbiters of an analyst’s reputation.

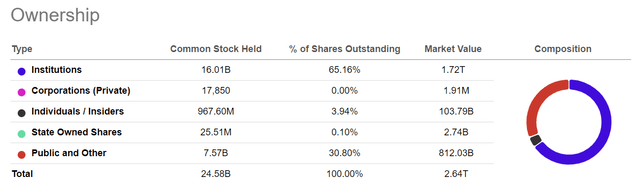

Using that context, it is my opinion that many sell-side analysts’ ‘bubble’ views are based on these companies having high institutional ownership, and we can easily validate that.

Unfortunately, YCharts doesn’t seem to have this data for all the Mag 7, but Seeking Alpha’s data shows that Nvidia’s institutional ownership is at 65%, or about two thirds of all outstanding shares.

As such, I believe that firms like Elliot Management owe it to institutional investors to write unbiased recommendations, as the study itself showed. So, why am I disagreeing with their call?

The answer is simple. Investment firms often tend to look at short-term stock price movements and medium-term scenarios, and my assumption is that the general market downturn that began the day before the CPI report came out on July 11 triggered a decline that’s continued until now, and this perceived triple-threat to NVDA is part of that larger narrative that Elliot Management has interpreted as a bubble situation. Logically, however, it also implies that the narrative itself is not directly related to NVDA but the broader Magnificent 7, which is why the stock has been impacted to such a degree over the past month.

This second part of my thesis, therefore, is that the company is NOT in bubble land because revenues aren’t suddenly going to drop off the cliff. These investments are made well in advance of deliveries, but they’re expensed over the entire life of the asset, per GAAP rules. The flip side of this is that NVDA records these revenues in a number of ways:

We recognize revenue from product sales when persuasive evidence of an arrangement exists, the product has been delivered, the price is fixed or determinable and collection of the related receivable is reasonably assured. For most sales, we use a binding purchase order and in certain cases we use a contractual agreement as evidence of an arrangement. We consider delivery to occur upon shipment provided title and risk of loss have passed to the customer. At the point of sale, we assess whether the arrangement fee is fixed or determinable and whether collection is reasonably assured. If we determine that collection of a fee is not reasonably assured, we defer the fee and recognize revenue at the time collection becomes reasonably assured, which is generally upon receipt of payment.

This gives management the flexibility to record revenues from larger clients at any time between when the “binding purchase order” is received and the time when “the product has been delivered.” Reading into that, It’s not a stretch to assume that the company can use any of these criteria to record revenues from its hyperscaler clients, which gives it a superior level of control over how much revenue growth it can show in any given quarter and still stay within the GAAP framework.

And that brings me to my third thesis point about chip shipment delays and the possible antitrust probe.

#3: Shipment Delays and Antitrust Concerns are Overblown

To be clear, I’m not trying to downplay the impact of these negative catalysts, but I do seem them as having elicited or, dare I say ‘provoked’, a much stronger reaction than is warranted. I’ll explain why I think so.

On the point of shipment delays, this is solely based on an alleged report from “two people who help produce the chip and server hardware for it.” The original report was published in a premium article on The Information, and it also alleged that “a Microsoft employee and another person with direct knowledge” claimed that Nvidia has informed Microsoft of this, and “Nvidia’s upcoming artificial intelligence ships will be delayed by three months or more due to design flaws.”

That’s the extent of it, and if we’re going to sell off NVDA on that rumor, we’re essentially going against a tried and tested philosophy that tells us to do just the opposite – buy the rumor and sell the news. Of course, this strategy isn’t foolproof, but what’s happening with NVDA seems to be the exact opposite. There hasn’t been any formal news of delayed shipments from any of these companies. Indeed, just four days ago, per Tom’s Hardware, Jensen Huang said at SIGGRAPH that:

This week we are sampling we are sending out engineering samples of Blackwell all over the world they are under people’s chairs right now

On balance, I’d rather listen to the CEO of the company making these chips over a few sources that may or may not have an accurate view of the situation. Even in the worst-case scenario, these alleged shipment delays aren’t likely to affect Nvidia’s top line growth. We might see some softness going forward, but it’s definitely not going to affect these larger orders. Besides, Blackwell chips were expected to start shipping in Q2 and ramp up in Q3, with Mr. Huang confirming on the Q1 2025 earnings call that “Blackwell is in full production” and that “We will see a lot of Blackwell revenue this year.”

As such, I would discount the rumor and wait, instead, for some concrete news. As a side note, I’m surprised by the sheer number of news outlets that have re-reported that initial one from The Information.

As for the potential antitrust issue, the specific item that grabbed the world’s attention was the announcement of a definitive agreement between Nvidia and Run:ai for the former to acquire the latter for a then-undisclosed sum that was later pegged at $700 million. Chump change for a company with more than 10x that amount in C&CE alone on its balance sheet, but it has reportedly triggered an investigation by the Department of Justice. On its own, it’s an insignificant development, but on the back of a July 23 joint statement from the FTC, the DOJ, and their UK and European counterparts, it has gained a lot of momentum.

At the time of writing this, the FTC’s webpage with the actual statement was down, but the press release I’ve linked to above the image clearly states:

The joint statement notes that while AI has the potential to become one of the most significant technological developments of the past couple of decades, it also raises competition risks that may prevent the full benefits of AI from being realized. All four antitrust enforcers pledged in the joint statement to remain vigilant for potential competition issues and expressed their determination to use available powers to safeguard against tactics that would undermine fair competition or lead to unfair or deceptive practices in the AI ecosystem.

From the wording, I would assume that this is still in very early stages and, as such, poses only a distant threat. I’m not discounting it by any means, but it’s not a reason for the market to immediately panic and embark on a sell-off spree.

Should You Buy NVDA Now? Heck, Yes!

I’m upgrading my earlier Hold rating to a Strong Buy, and I hope I’ve presented you with some compelling arguments to support that view. I do realize that the correction phase might not be over. Risk-averse investors who wanted to ride the NVDA train are now shaken up, and that might lead to a prolonged sell-off. I posit that this presents an excellent opportunity to add to your position and then keep dollar-cost averaging down until it finds a bottom and then resumes its upward trajectory.

Are there risks that this won’t happen the way I’m projecting? Yes, absolutely. When the market is in panic mode, any minor event could trigger a sell-off. We just saw that with the triple news hit NVDA went through this week. Nevertheless, the more you focus on the fundamentals and the reality of competition being far behind in the AI hardware space, the more you start to realize that Nvidia’s growth story is by no means over.

We haven’t even discussed the strong revenue growth expected from H200 sales, which we already know is in low supply compared to the demand. Again, from the Q1 2025 call:

While supply for H100 [im]prove, we are still constrained on H200. At the same time, Blackwell is in full production. We are working to bring up our system and cloud partners for global availability later this year. Demand for H200 and Blackwell is well ahead of supply and we expect demand may exceed supply well into next year.

I believe any delays to the larger shipments of Blackwell should be mitigated by Hopper orders. As I noted before, revenue can be recognized “when persuasive evidence of an arrangement exists”, which gives the company a lot of revenue reporting flexibility.

As for the upcoming Q2 2025 report coming out on August 28, it’s amply clear to me that Street analysts are getting increasingly less accurate at predicting either revenue or earnings, so I wouldn’t be surprised by a double beat that offers the stock stronger downside support.

In summary, as NVDA approaches the $100 mark, I’m upgrading my rating from Hold directly to a Strong Buy, and I hope I’ve justified that call with this article. Please feel free to let me know what your take is, in the comments. Thank you for reading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.