Summary:

- NVIDIA Corporation’s fundamentals are strong, and despite previous conservative estimates, the stock is likely significantly undervalued, leading to an upgrade from Hold to Strong Buy.

- The intrinsic value per share is recalculated, resulting in a price target of $189, representing a 37% potential upside.

- NVIDIA’s competitive edge in AI chips remains strong, as evidenced by the tepid investor response to AMD’s recent AI chip launch.

- Several compelling reasons suggest that NVIDIA will be able to protect and fortify its competitive edge.

Antonio Bordunovi

My thesis

As I wrote in my previous neutral article about NVIDIA Corporation (NASDAQ:NVDA) (NEOE:NVDA:CA), the sentiment around the stock is extremely strong and supports unstoppable momentum despite generous valuation. In my initial article, I said that the rally was driven by the FOMO effect, but it appears that I was too conservative when I calculated the intrinsic value per share.

Since I remain quite optimistic about NVDA’s fundamentals and valuation was the only reason why I decided to stay on the sidelines last time, today I made a strong emphasis on the stock’s intrinsic value. I simulate various scenarios and explain why the stock is actually highly likely undervalued. Of course, I also share my insights about the company’s fundamentals from the business perspective as well. Developments look quite bullish, and my in-depth emphasis on valuation makes me admit that I was too cautious when sharing my thesis in July. Therefore, I am upgrading NVDA from Hold to Strong Buy.

NVDA stock analysis

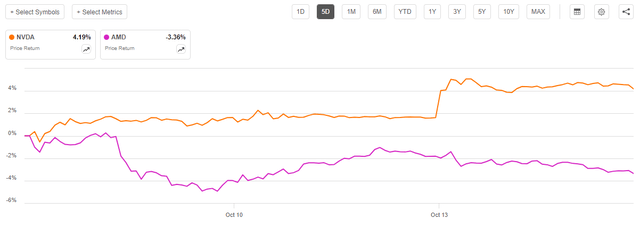

I want to start the core part of my analysis by talking about one of NVIDIA’s competitors. Advanced Micro Devices (AMD) has recently held a big event where it unveiled its new AI chip, but it appears that investors were not impressed. The event took place last week, and since then, AMD’s stock dipped by around 3.4% while NVDA appreciated by 4.2%. This appears quite illustrative, in my opinion, as AMD’s new AI chip event highly likely increased confidence that NVDA’s positioning in this niche is still intact.

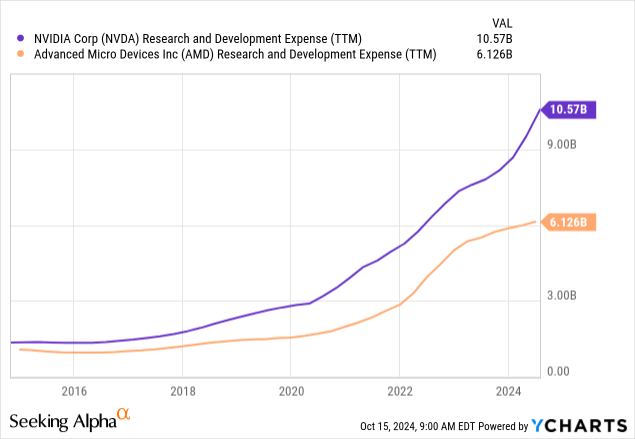

This is vital and should not be underestimated because such a picture suggests that NVIDIA’s 80% market share in AI chips is still rock-solid. Therefore, NVIDIA remains by far the best positioned company to capitalize on the projected 20.4% industry CAGR for the next five years. Retaining a competitive edge is crucial for NVDA and its R&D spending is still far beyond AMD’s and the gap is widening.

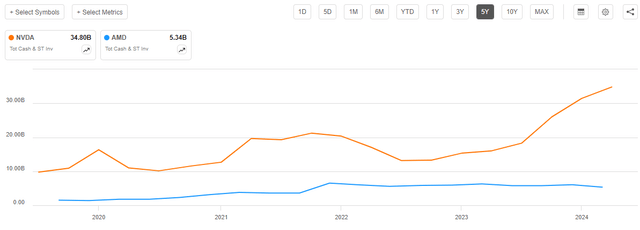

Fortunately for NVDA bulls, the gap in spending on innovation between the company and AMD is likely to expand rapidly. As the old saying goes, cash is king, and starting from 2023, the gap in outstanding cash is expanding exponentially. As a result, NVDA’s outstanding cash balance as of the latest reportable date was almost seven times higher than AMD’s. This means that NVDA has a much greater potential to invest in growth and innovation compared to its main rival in AI chips. Therefore, it is highly likely that NVIDIA will be able to protect and fortify its wide moat.

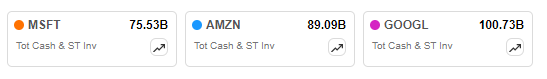

These are strong indications that NVIDIA is poised to remain the primary beneficiary of the aggressive global spending on data centers. The momentum for semiconductors is still strong, as the Semiconductor Industry Association reported that semiconductor sales in August rose nearly 21%. I expect the strong growth trajectory to remain strong here as cloud leaders all continue investing aggressively in new data centers across the world. Some recent releases suggest new multi-billion investments from Microsoft (MSFT), Amazon (AMZN), and Google (GOOGL).

Seeking Alpha

It is highly likely that none of the cloud leaders are willing to lag in this AI race. Since these three giants have a cumulative outstanding cash balance of more than $260 billion, I think we will see announcements about new data centers quite often. Since we have figured out that NVIDIA wide moat in AI chips is quite strong, it is highly likely that NVDA will benefit from the AI battle between MSFT, AMZN, and GOOGL. The confidence is high, as NVDA’s data center offerings appear to be the best practice because Microsoft recently was very proud to announce that Azure is the first one to deploy NVIDIA’s Blackwell GPUs.

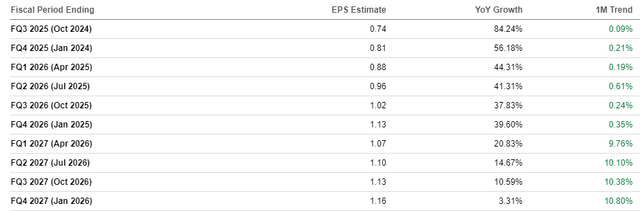

Therefore, it is unsurprising that recent trends in earnings revisions are quite positive as well. We can see that there were positive EPS revisions for the next several quarters. Revisions for revenue are also positive, which can be seen here.

Intrinsic value calculation

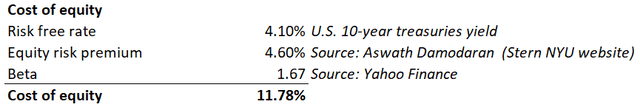

Since the stock continues rallying even despite my previous analysis indicating overvaluation, I think that I need to revise my discount rate assumption. The discount rate for my DCF model is the cost of equity, calculated using the CAPM approach. There are two solid reasons why I am using cost of equity instead of WACC: NVDA’s extremely low leverage, and the fact that I am using levered FCF as the key metric for the DCF.

In my previous calculations, I used a 6% equity risk premium. This might be too conservative, since Aswath Damodaran from NYU Stern suggests that the current U.S. equity risk premium is 4.6%. Other assumptions for the CAPM did not change significantly compared to my previous NVDA article.

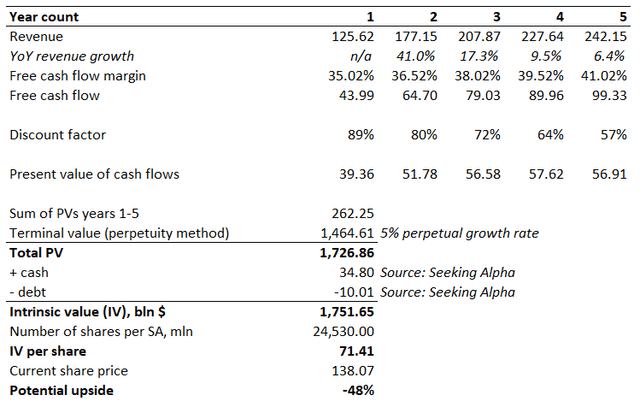

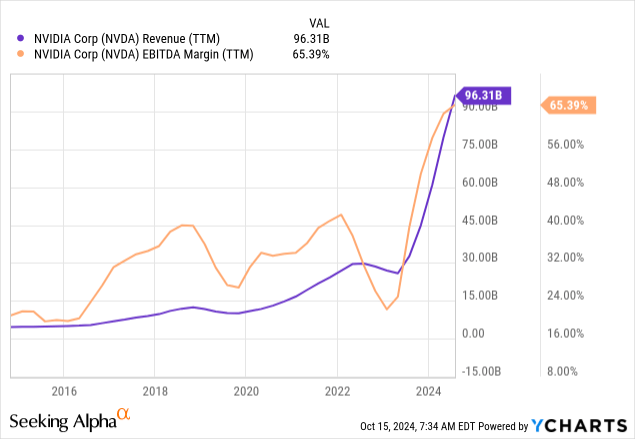

NVDA’s exposure to AI is strong, and there are several bullish fundamental factors. Therefore, I reiterate the same 5% constant growth rate for my first DCF scenario. Revenue projections for years 1-5 were obtained from Wall Street consensus. The TTM levered FCF is 35.02%, which I expect to increase by 150 bps per annum. Confidence in NVIDIA’s ability to drive profitability growth is backed by historically strong operating leverage, which can be seen below.

Other variables to finalize the DCF model included total cash and debt as of the latest reportable date, as well as the outstanding shares number. Thanks to Seeking Alpha, all these variables can be easily found at the platform.

The below working suggests that with a 5% perpetual growth rate, the intrinsic value per share is around $71. This indicates that the stock is almost two times overvalued. The stock market is rarely that wrong, and the effect of FOMO is unlikely to be the explanation of such a generous premium.

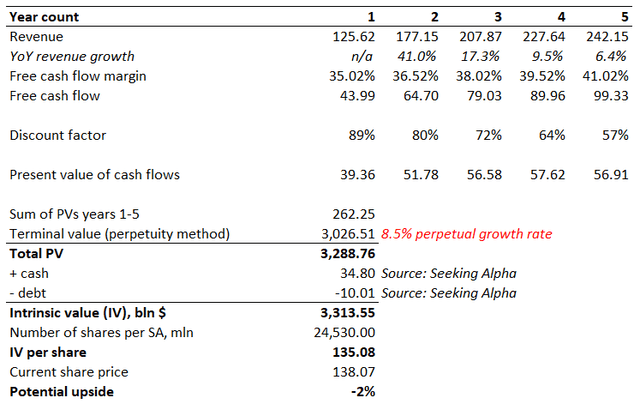

Therefore, I have to simulate another scenario to understand which perpetual growth rate the market prices for NVDA. I will leave revenue projections for years 1-5 unchanged, as well as the FCF margin. I consider these as reasonable since they rely on consensus for revenue and historical patterns for profitability.

As the above working suggests, the market currently prices in an 8.5% perpetual growth rate. Conservative investors will definitely say that this level is unrealistic because the long-term inflation benchmark is 2%, and the aforementioned perpetual growth rate is more than four times higher.

Now, let us refer to the U.S. economy’s growth rate over the last 50 years. According to macrotrends.net, the U.S. GDP was $1.5 trillion in 1974. The U.S. GDP was around $27.4 trillion, which is 19.5 times higher. This equals a 5.7% CAGR for the U.S. economy over the last half-a-century. Therefore, my 5% perpetual growth rate is indeed too conservative.

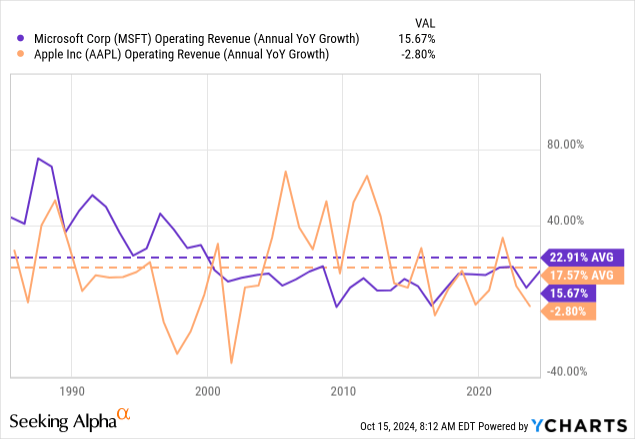

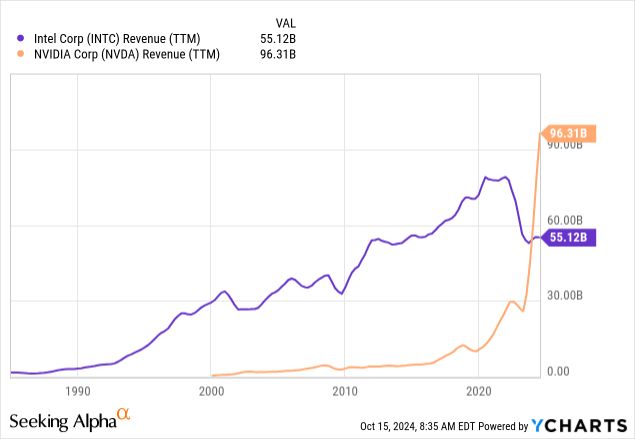

To understand what a reasonable perpetual growth rate for NVDA will be, I want to go further and look at the corporate level now. NVDA’s closest peers in terms of the market cap now are Microsoft and Apple (AAPL) now. As the above chart suggests, these two companies are maintaining double-digit revenue CAGR since the mid-1980s. Of course, this timeframe is not a perpetuity, but it is long enough to consider it representative.

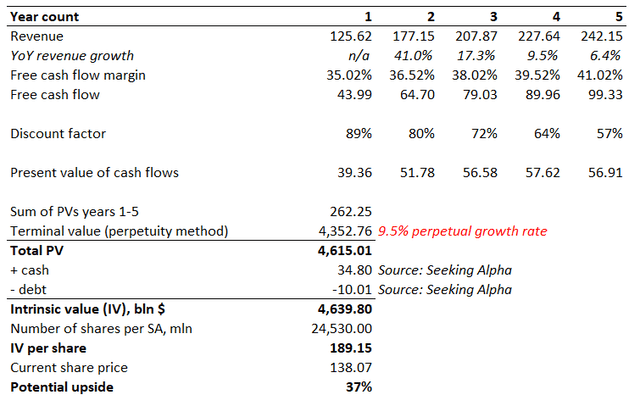

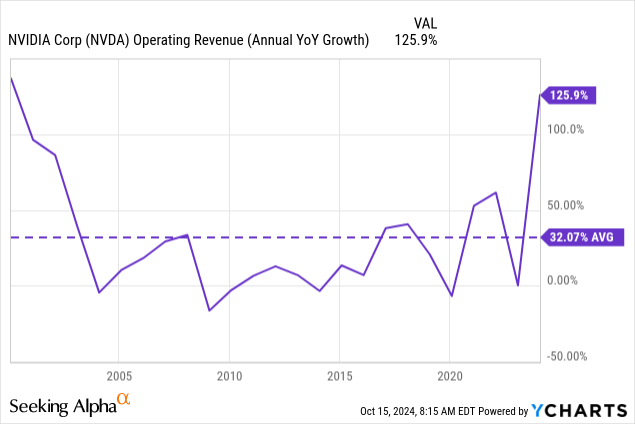

Finally, NVIDIA itself also boasts a staggering 32% revenue CAGR, which the company has maintained since the late 1990s. Therefore, it appears that even an 8.5% perpetual growth rate is too conservative. With a 9.5% perpetual growth rate, NVDA’s intrinsic value jumps to $4.6 trillion.

To summarize this part, I have to admit that I was unfairly conservative in my previous analysis when I calculated NVDA’s intrinsic value. I take a 9.5% perpetual growth rate as my base case scenario, meaning that my price target for NVDA is $189.

What can go wrong with my thesis?

Betting on a 9.5% perpetual growth rate is inherently risky, even when we speak about such an exceptional company as NVIDIA. The environment is evolving rapidly, and there are various potential risks that might undermine NVIDIA’s ability to maintain a 9.5% CAGR over the coming decades.

The company faces significant geopolitical risks. According to the 10-K, 14% of NVIDIA’s FY2024 Data Center revenues were generated in China. This is a considerable portion, which is under risk due to the ongoing trade and geopolitical tensions between the U.S. and China. The situation looks complex, and any escalation in trade restrictions could adversely affect NVIDIA’s Data Center revenue growth prospects.

Another geopolitical risk is also related to China and its disputes regarding the political status of Taiwan. Since NVIDIA outsources production of its chips to Taiwan Semiconductor Manufacturing Company (TSM), there is a real risk of supply chain disruptions if the conflict escalates between China and Taiwan. The issue is discussed at the highest political level in the developed world, which means that the scenario of a direct military conflict is not impossible.

Last but not least, let us keep in mind that there is always a risk of being disrupted. While NVIDIA’s current strategic positioning seems intact, it does not guarantee infinite success. While NVIDIA only started its path as a public company in the late 1990s with modest revenues, Intel (INTC) had already generated more than $30 billion in annual sales and its revenue grew exponentially between 1990 and 2000. This means that just three decades ago, it was impossible to imagine that NVIDIA would ever close the gap with Intel. Therefore, even if NVDA currently looks unbeatable by Intel or AMD, there might be new disruptors which are preparing themselves to become the new king and make NVDA the new INTC.

Summary

NVIDIA Corporation remains fundamentally strong, and the stock’s intrinsic value is actually much higher compared to the last close.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.