Summary:

- Many institutional investors sold their positions in NVIDIA in Q2, while some notable investors added shares.

- Reasons for selling include profit taking, market concerns, and uncertainty around upcoming earnings.

- NVIDIA’s upcoming Q2 earnings will be closely watched, with focus on growth, margins, and guidance; investors should consider taking profits.

Jonathan Kitchen

Thesis Summary

As 13-F filings have been released, it has become apparent that a lot of institutional investors sold their positions in NVIDIA Corporation (NASDAQ:NVDA) in Q2, though some notable investors have also been adding.

NVDA did fall over 20% from its recent peak, though it has recovered with the rest of the market. We will have to wait until the next quarter to see if this dip was bought by institutions too.

With that said, there are certainly some compelling reasons for these investors to begin to sell their positions, including profit-taking, concerns over AI investment and the delay in the Blackwell GPU.

The next quarter will certainly be key in determining where NVIDIA’s stock heads next, and there are some bullish signs that make me think we could rally into and after earnings.

With that said, sentiment is clearly beginning to turn on NVIDIA. Although I did pick up some shares on the dip, I still rate NVIDIA a Sell and would ultimately urge investors to begin to think about their exit plan, just like the big boys are doing.

In my last article, I discussed the risks with NVIDIA, such as high valuation and falling growth rates. As we move into Q3, these risks remain, and we can now also add falling margins and delays in the Blackwell.

I did initiate a long position at the lows based on technicals, I am getting ready to take profits, just like the institutions have been doing.

Big Boys Sell

NVIDIA’s stock has appreciated more than 10x since its October 2022 lows. Earnings are still growing close to 100% YoY and though investors are a bit more wary of the AI narrative, companies continue to invest heavily in NVIDIA’s chips.

Nonetheless, it is very telling that a lot of large funds have begun to unwind or even completely exit their NVIDIA positions. This much has been made clear after the recent stream of 13F filings that have been released.

George Soros and Stanley Druckenmiller have completely sold out their NVIDIA positions. We can also add the Bill And Melinda Gates Foundation to recent notable exits from the stock.

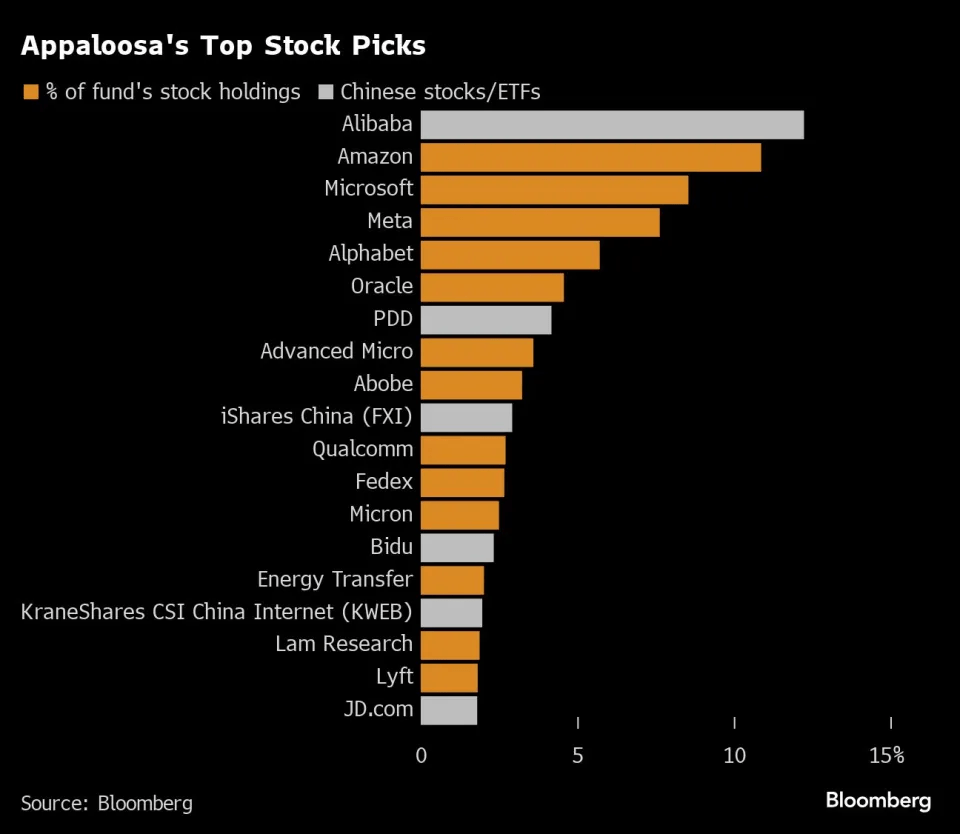

Appaloosa Management, a $14 billion fund, heavily trimmed its NVIDIA position in Q2, while keeping significant exposure to Advanced Micro Devices, Inc. (AMD).

Appaloosa Stocks (Bloomberg)

Perhaps the most notable of all the big sellers has been NVIDIA’s own CEO, Jensen Huang, who sold $322.7 worth of Nvidia in July, bringing his total selling spree to $500 million.

While these kinds of names selling make for good headlines, we must also look at the broader context of the situation here.

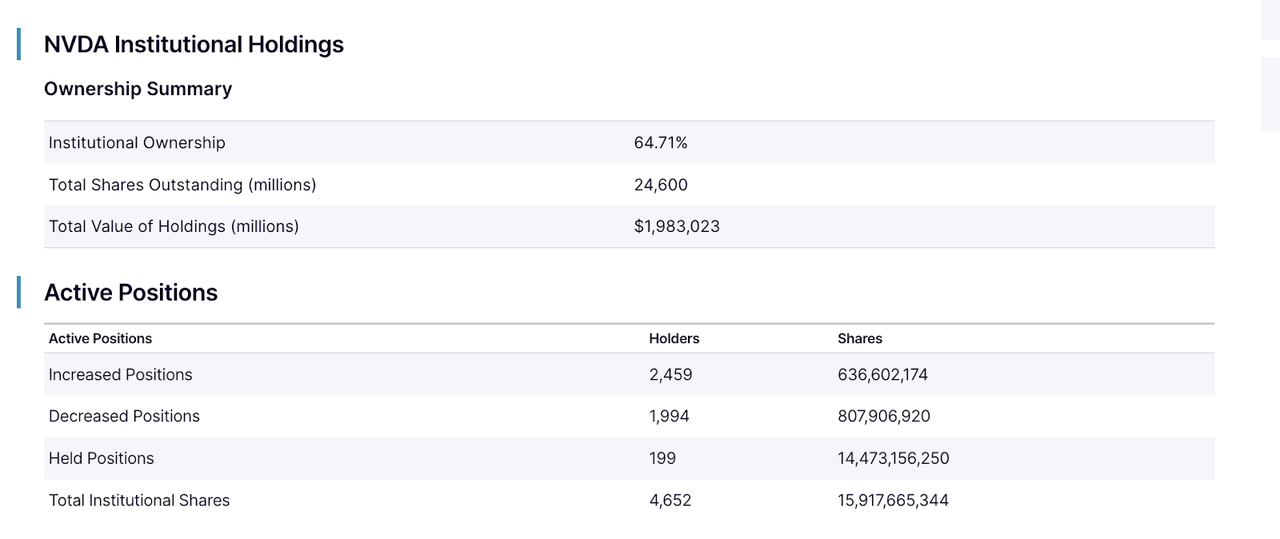

NVDA institutional ownership (Nasdaq)

While some notable names have exited, institutional ownership is still high. Also, the data above shows that more institutions have recently increased positions than decreased them.

Meanwhile, other notable investors such as Pelosi have been adding shares in the last month, so it’s not like everyone who’s anyone is selling.

But it does beg the question.

Why Are They Selling?

There must be at least some reason why so many notable names, including the CEO, chose Q2 to begin to sell NVIDIA. I see at least three possible reasons.

Profit Taking

Perhaps the most simple reason here is simply that with the stock up over 1000%, a lot of investors want to lock in some profits. It’s never a bad idea to take profits, and that’s especially true after a run-up like this.

It also makes a lot of sense if you are the CEO, and most of your personal wealth is concentrated in NVIDIA shares. Though $500 million sounds like a lot, Jensen still has around 90 million shares.

Market concerns

With that said, it only makes sense to take profit if you think the upside is limited, and that may be the case here.

It’s not only NVIDIA that has been sold by institutions. A lot of the big tech names have fallen out of favour. Zuckerberg and Bezos have also been selling shares, and Buffett sold a significant stake of his Apple Inc. (AAPL) holdings.

Interestingly, this all happened ahead of the huge sell-off that took place a couple of weeks ago. This Black Monday-like event unfolded as the BoJ came out and said it would be tightening, which led to a big rally in the Yen and what many have called an unwind of the Yen carry trade.

Most of those losses have been recovered since then, with the market staging quite a rally in the last 10 days. But does that mean the worst is over?

While there are plenty of reasons to be bullish, it’s also clear that markets, and perhaps high-flying AI tech stocks in particular, could be getting ready to turn.

Upcoming Earnings

Alternatively, it’s very much possible that there’s something about the upcoming earnings that investors aren’t sure about. This is the next natural catalyst for NVIDIA and will no doubt be a catalyst for NVIDIA’s price and the broader market. All eyes will be on the chipmaker.

-

Will growth surpass expectations?

-

Can margins keep expanding?

-

Will Blackwell delays hurt the bottom line?

-

Is competition making a dent in NVIDIA’s market share?

-

Is the AI market still growing?

These are all great questions, which I will try to answer in the next section.

What to expect from NVIDIA’s Q2 Earnings

NVIDIA reports earnings on the 28th of August. First off, let’s look at the analyst expectations.

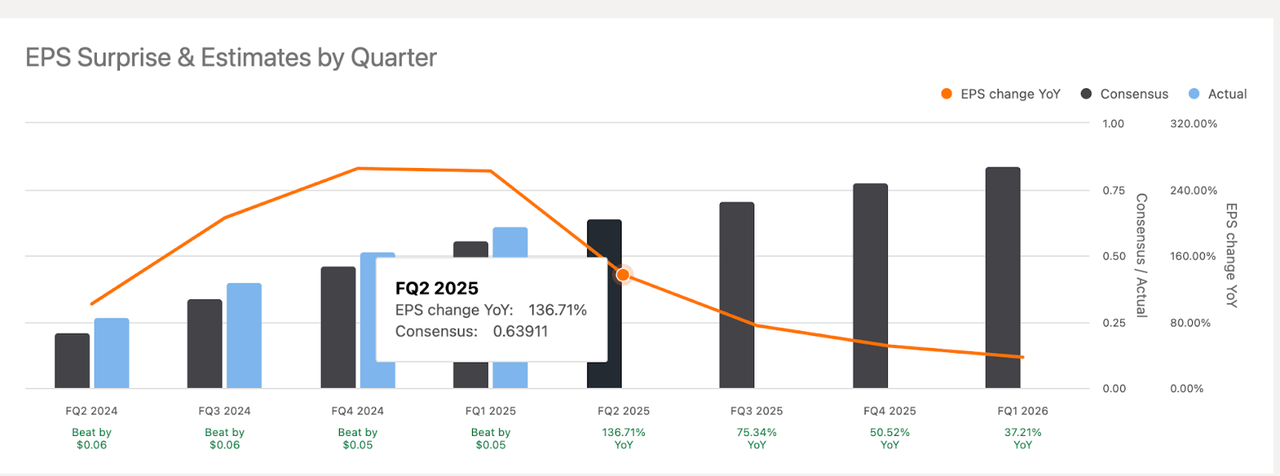

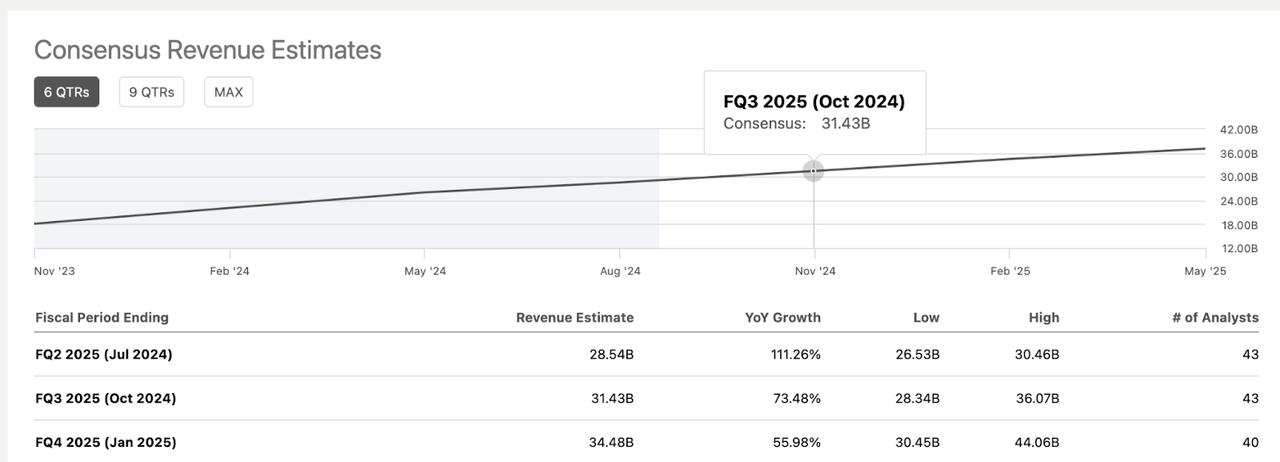

NVIDIA’s earnings are expected to come in at around $0.63, representing a 136.7% YoY increase, though only a 4% increase when compared to last quarter.

In terms of revenue, analysts expect $28.54 billion for the quarter.

This would still be over 100% YoY growth and around 9.6% on a sequential basis.

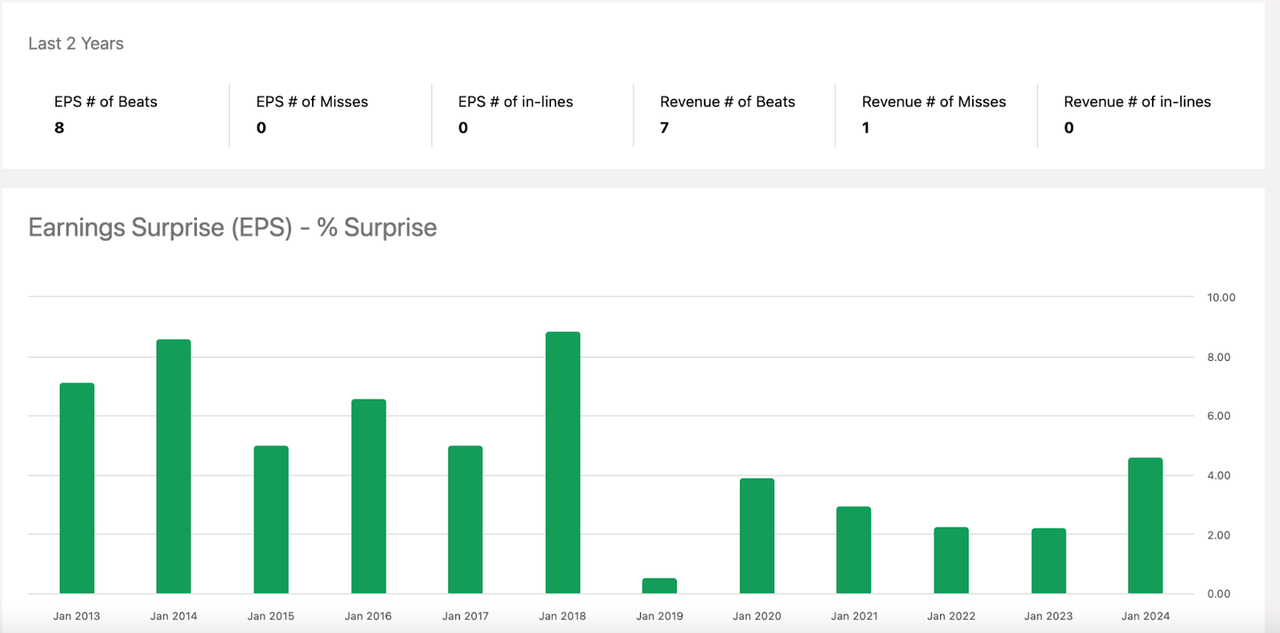

Of course, at this point, it’s almost as if everyone is expecting NVIDIA to beat expectations. The company has managed to do so consistently the last two years.

But this time the bar is higher, and though NVIDIA will no doubt have a great quarter; will it be enough to keep investors happy?

What exactly could go wrong for NVIDIA? Both growth and margins will be heavily scrutinized by investors.

In terms of margins, we actually know that they should be lower:

GAAP and non-GAAP gross margins are expected to be 74.8% and 75.5%, respectively, plus or minus 50 basis points, consistent with our discussion last quarter.

Source: Earnings Call

The last quarter and the one prior were aided by favourable costs of inputs and margins reached 78%, but this is not likely to be repeated, and the company has guided for lower margins for this quarter.

As noted last quarter, both Q4 and Q1 benefited from favorable component costs.

Source: Earnings Call

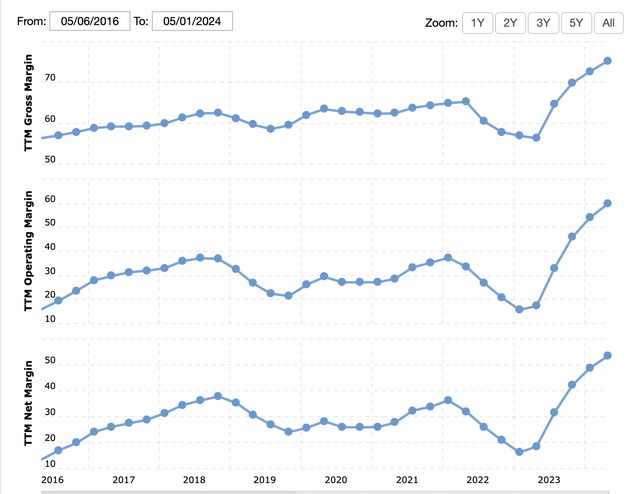

NVIDIA margins (Macrotrends)

As we can see, NVIDIA’s profitability has skyrocketed in the last year, but profit margins could have actually peaked.

This is something that investors will be very wary about, and if margins fall by more than expected, watch out below.

In terms of revenue, demand continues to be strong as expected:

We see increasing demand of Hopper through this quarter. And we expect to be — we expect demand to outstrip supply for some time as we now transition to H200, as we transition to Blackwell.

Source: Earnings Call

The real issue here will be guidance, and specifically, if that guidance will be modified at all in the light of the alleged delays in NVIDIA’s Blackwell.

While Nvidia has not directly confirmed the delay in public statements, they’ve mentioned being “on track” for production in the second half of the year, which could be interpreted as an acknowledgment of some delay or adjustment in their original timeline.

Source: Nextbigfuture

We will definitely be getting a much clearer picture of this in the upcoming earnings, both in terms of Blackwell’s timeline and its effect on the bottom line.

My 2 cents

NVIDIA’s earnings will take centre stage next week, should investors be looking to buy or sell?

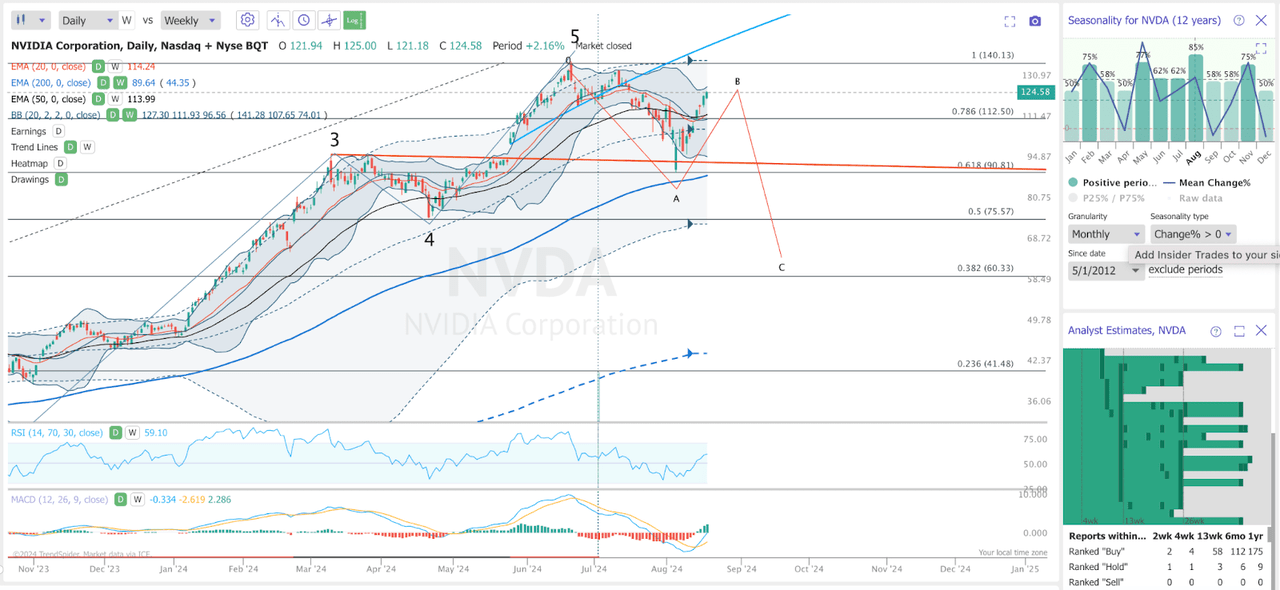

One thing is clear now, the recent sell-off was a good buying point, at least for a trade. NVDA found support at its 200 EMA and has since reversed strongly, back into the upper bounds of the Bollinger band. I did pick up a small position near the lows but may take profits soon.

While I remain bullish on markets, and this means likely NVIDIA can go higher, I still think that on the larger time frame, investors, like so many institutions, should be thinking about cutting their NVIDIA exposure, not adding more.

I discussed this in-depth in my last NVIDIA report. The stock’s growth is slowing, while its valuation is still very stretched. I just see more downside here than upside.

More immediately, if we look at the chart, there’s certainly a possibility that we could get a retest of the recent lows into earnings, and even a break below.

The current decline and reversal could all be part of a larger ABC structure that takes us to new lows. The 50% retracement from the highs projects us to $75. Below that, we have the 200-week EMA giving support at around $45.

At the very least, I think we should see some form of retracement as the technicals in the shorter time frames look overstretched.

Final Thoughts

All in all, while NVIDIA continues to perform well, and will continue to do so, the valuation is stretched, and the upside is becoming limited while the risks are growing. Investors should be looking at taking some profit, just like the big boys are doing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Macro moves markets, and this is what I do at The Pragmatic Investor

Join today and enjoy:

– Weekly Macro Newsletter

– Access to our Portfolio

– Deep dive reports on stocks.

– Regular news updates

Start your free trial right now!