Summary:

- Nvidia Corporation investors have recently endured a challenging consolidation phase spurred by AI investment worries.

- The market is likely concerned about the ramp profile of its delayed Blackwell AI chips.

- Nvidia’s revenue growth is expected to normalize. However, the market might not have fully captured the growth opportunity from Sovereign AI and enterprise adoption.

- Nvidia’s PEG ratio has declined to attractive levels, suggesting significant pessimism is likely priced in.

BING-JHEN HONG

Nvidia: Challenging Consolidation Tests Patience

Nvidia Corporation (NASDAQ:NVDA) investors have endured an extended consolidation zone as the market reassesses the ability of the “Godfather of AI” to keep generating stellar performances. Nvidia’s guidance at its recent earnings release didn’t inspire enough confidence to keep repeating those breathtaking results. Coupled with the unanticipated delay in the shipment of its Blackwell architecture, the market will likely ask for further proof points before buying into its potential upside through FY2025.

In Nvidia’s FQ2 earnings commentary, management underpinned its confidence by asserting that Nvidia’s customers have started to sample its Blackwell chips. However, the inherent complexity of its design suggests execution risks leading to solid yields in its production process with its foundry partner TSMC (TSM) will likely be higher. While Nvidia telegraphed its confidence that its current Hopper generation can continue to underpin robust demand dynamics as Nvidia transitions to Blackwell, investors are justifiably cautious.

Nvidia’s Blackwell Production Ramp Is Critical

The company reported data center revenue of $26.3B in FQ2. Although it indicates a more than 150% YoY increase spurred by aggressive AI infrastructure investments, it also represented a slowdown from FQ1’s performance (427% YoY surge). As a result, while the optimism by the leading hyperscalers and cloud service providers should underpin a continued Hopper growth cadence, the law of large numbers is catching up rapidly.

In other words, Nvidia investors might need Blackwell to ramp up quickly in the transition. Notwithstanding the near-term caution, management emphasized that its “customers continue to accelerate their Hopper architecture purchases while gearing up to adopt Blackwell.” Therefore, Nvidia investors should be assured of the company’s optimism that “Hopper shipments are expected to increase in the second half of fiscal 2025.”

Notwithstanding the underlying strength of Nvidia’s Hopper architecture, Nvidia must demonstrate that it can effectively improve its Blackwell production yields. Accordingly, the company highlighted that it anticipates Blackwell will start ramping from FQ4, indicating we should expect a more robust growth infection from FY2026.

I concur with management’s optimism that the “demand for Blackwell platforms is well above supply.” It aligns with recent commentary, indicating that Nvidia’s full-stack infrastructure provides a solid competitive edge not just for AI training but also for inference. Nvidia AI clusters are now considered “table stakes” for the leading AI companies and big tech. Therefore, Nvidia’s Blackwell confidence seems apt, suggesting that a solid ramp cadence isn’t overstated, underpinning the potentially aggressive AI infrastructure investments.

In addition, I assess that the anticipated uptick in Sovereign AI demand is likely still nascent. Management upgraded its revenue outlook on Sovereign AI to reach “low-double-digit billions this year.” The AI arms race is expected to increase among nations as they seek to capitalize on their exclusive data domain to gain an edge.

In addition, the market might not have considered the potentially increased adoption among enterprise users as AI factories become mainstream over time. Management updated that it’s “working with most of the Fortune 100 companies on AI initiatives across industries and geographies.” Therefore, it should bolster the market’s confidence in AI monetization, even though there could be questions about how effective the AI go-to-market strategies have been.

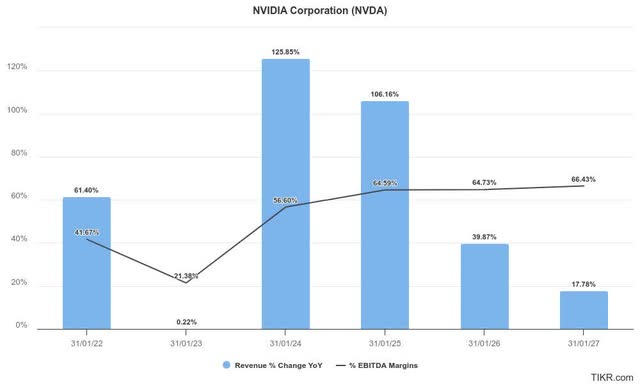

Nvidia’s Growth Profile Expected To Normalize

Nvidia’s revenue growth profile is expected to normalize after the initial spike over the past year. However, its adjusted EBITDA profitability isn’t likely to be markedly impacted, notwithstanding the recent low yield issues affecting its gross margins.

Hence, analysts expect Nvidia to maintain its pricing power even as it navigates potentially more intense competition from Advanced Micro Devices (AMD). AMD’s AI revenue will not likely present a significant threat to CEO Jensen Huang and his team in the near term. Despite that, AMD is progressing to narrow Nvidia’s full stack advantage, although it’s still too early to assess the impact on NVDA’s market leadership.

Is NVDA Stock A Buy, Sell, Or Hold?

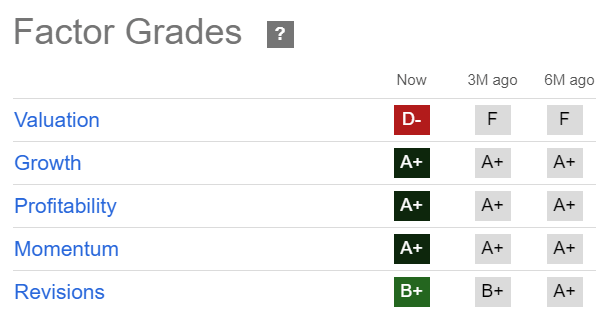

NVDA Quant Grades (Seeking Alpha)

NVDA’s fundamentally strong thesis is undoubtedly robust, boasting an “A”+ profitability grade. Therefore, it provides a solid foundation for the market to remain confident despite concerns about the production yields impacting its Blackwell chips.

In addition, its “A+” growth grade suggests investors should apply the appropriate growth-adjusted valuation metrics when assessing a further valuation re-rating opportunity.

Accordingly, NVDA’s forward adjusted PEG ratio of 1.02 is more than 40% below its sector median. Therefore, I assess that the market has likely baked in pessimism over the sustainability of its bullish AI thesis. The caution is justified, given the anticipated normalization of its revenue growth momentum. However, that also suggests that a much more robust forward outlook attributed to underlying strength in Sovereign AI and enterprise demand could move the needle on its valuation profile.

Consequently, I assess the ongoing consolidation zone as appropriate for long-term investors to consider adding exposure while awaiting more constructive Blackwell commentary from management.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!