Summary:

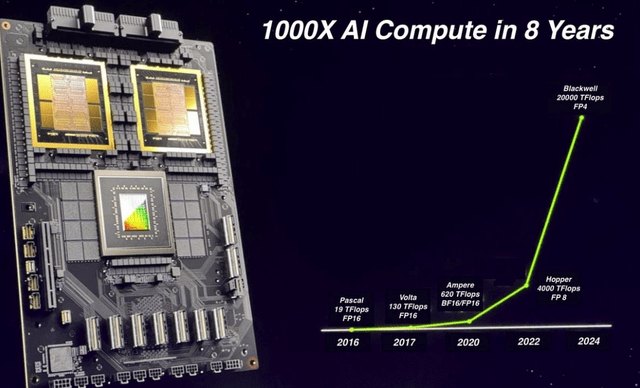

- Nvidia Corporation is pulling out all the stops with the Blackwell release, which has received unprecedented demand and is sold out for the next 12 months.

- In the long term, stakeholders should recognize that Nvidia’s capitalization on the AI arms race in training power represents a one-off opportunity.

- I expect that in the next three to five years, Nvidia will report a revenue contraction. That is, unless it significantly capitalizes on robotics and inference trends with strategic timing.

- Nvidia is not Cisco yet, but amid current market dynamics, it is showing early signs that a crash could be a few years away.

timandtim/DigitalVision via Getty Images

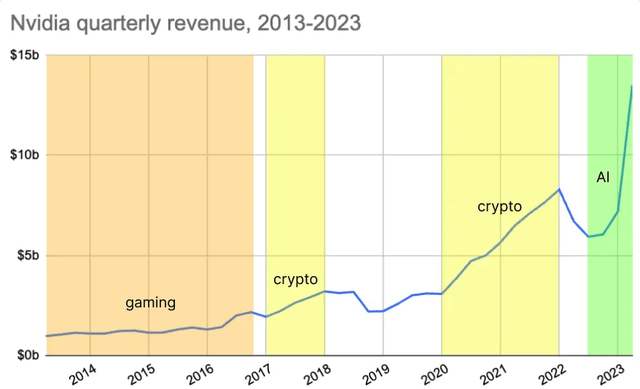

Nvidia Corporation (NASDAQ:NVDA) might be the stock of the moment—growing almost 17% since my last Hold rating—but momentum can’t defy gravity. I think the stock is due for a big crash in the medium term when the demand for training GPUs significantly tapers. This could lead to a big revenue contraction for Nvidia. Even though in the next two to three years revenue growth looks set to continue (at a slowing pace), in the distant horizon, the dynamics of the AI compute market show signs of trouble for Nvidia shareholders.

My Nvidia rating is currently still a Hold, but someday soon, in the next year or so, I’m sure it will be a Sell. Here are the main reasons why.

Blackwell Is Showing Unprecedented Demand, but It Can’t Defy Gravity

Nvidia’s Blackwell GPUs have sparked unprecedented demand, with supplies for the next 12 months completely sold out. This doesn’t change my Hold thesis, but it does set the stage for what could be a period of sustained growth (albeit more moderate than what we saw in 2024) through 2025. Major tech companies like AWS (AMZN), Google (GOOGL, GOOG), Meta (META), Microsoft (MSFT), and Oracle (ORCL) have pre-purchased all available Blackwell GPUs for the next year.

Nvidia is competing with Advanced Micro Devices (AMD), which has released its Instinct MI325X AI chip (which management claims outranks Nvidia’s H200 processor in specific AI workloads). It has plans to release the MI350 series (to compete with Nvidia’s Blackwell) in 2025. However, the demand for Nvidia’s products and its dominant position in the market puts it far ahead of AMD, which has carved a market position related to cost competition rather than world-leading performance.

The high demand for AI training chips currently is due to the AI arms race. It is a major consideration that the group demand for AI GPUs is likely to remain unabated until all Big Tech companies begin to slow down in tandem. The Magnificent Seven need to collaborate as well as compete in this regard. Too heavy an emphasis on “being the best, the fastest” could spur herd buying behavior among the cohort, leading to Western financial inefficiencies and poor returns on investment in our flagship tech industry.

That being said, in the interim, Nvidia seems set to continue growing quite robustly. The company expects to generate several billion dollars in revenue from Blackwell in the fourth quarter of 2024, with continued demand into 2025. Nvidia currently controls approximately 90% of the market for advanced AI chips, and this development further positions it as a growing monopoly despite the competition from AMD.

Nvidia has a history of capitalizing on emerging trends, and it always shows a slight dip in revenue following this. I expect it to be no different with the AI infrastructure build-out. The question is whether sentiment in the market will remain strong as the company transitions from its high-revenue generating AI training era toward a slower growth period of AI inference and robotics.

Despite all the Strong Buy ratings on Wall Street, I still question the long-term (five-to-10-year) validity of investing in the AI arms race through Nvidia. One may be able to get one to two more years of strong returns from this investment, but the stock price is likely to become volatile as its revenues really begin to slow.

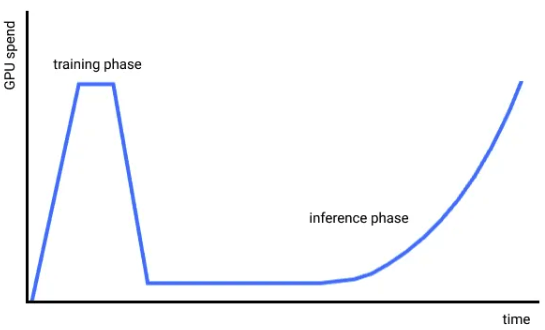

As the training phase plateaus because models are largely fully trained, the demand for GPUs is likely to decrease as fewer resources are needed for ongoing model development. The inference phase then uses trained models to make predictions or decisions—the need for efficiency in these computations then becomes desirable; therefore, the market for GPUs optimized for inference will take precedence over training GPUs.

Nvidia has positioned itself well already for inference tasks, including through its TensorRT platform. It has built an ecosystem including software tools and libraries that support both training and inference, and I expect this (along with robotics) will be management’s core focus in 2027 and beyond.

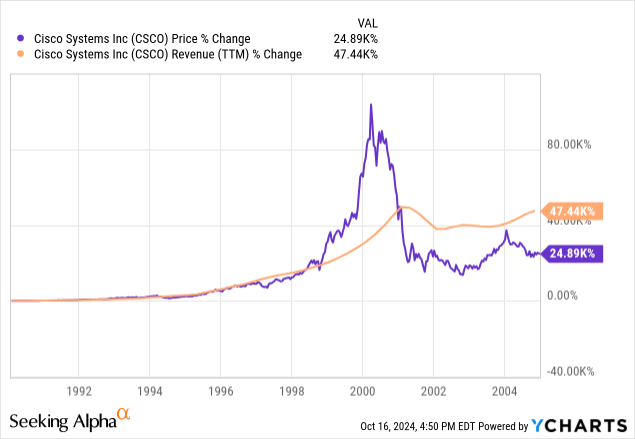

The main reason this could be problematic for Nvidia shareholders in the medium term is that the training phase requires a high initial spend, whereas spending on inference GPUs is more spread out over time. As AI applications become more widely integrated into industries, the demand for inference will grow steadily. Therefore, we can expect a significant reduction in the revenue growth rates of Nvidia once the AI infrastructure build-out has ended. In fact, I think we could even see a major revenue decline. This is when the stock could show signs of a “Cisco (CSCO) moment.”

My rating is still a Hold because the AI arms race has not culminated. However, Nvidia shareholders are in very risky territory, given my analysis here. In my opinion, Nvidia should now be no more than 5% of portfolios. I can see a valid reason to sell at the present valuation and price. However, we likely have two or three more years of steady training-based growth before this calamity could occur. I think the question is when the market picks up on this at large, not if. When it does, we could see an Nvidia “crash.” That could be in three, four, or five years.

Valuation Update: The Stock Will Continue To Climb (For Now)

Currently, Nvidia has a forward P/E non-GAAP ratio of 46.3. That’s fine to my mind, and likely somewhat sustainable over the next couple of years. I’m quite certain that demand for Nvidia’s training GPUs will remain robust in 2025 (especially as macroeconomic conditions become more favorable with a lower interest rate environment). However, I have mentioned in my publications that I believe we could enter a more troubling period of macroeconomic weakness (including potential stagflation) if interest rates are not kept moderate in 2025 and inflation issues become worse. 2026 and 2027 could be vulnerable years for Big Tech stocks, especially as geopolitical tensions could intensify at this time. I estimate Nvidia will achieve 50% normalized EPS growth in 2025. I also estimate that it will achieve approximately 49% revenue growth. Already, this is a significant contraction from the year-over-year earnings growth of 125% and year-over-year revenue growth of 109%, which I expect it to deliver for 2024—hence my Hold rating.

| Nvidia | Tesla | Amazon | |

| 2025 Normalized EPS Growth Estimate | 50% | 40% | 25% |

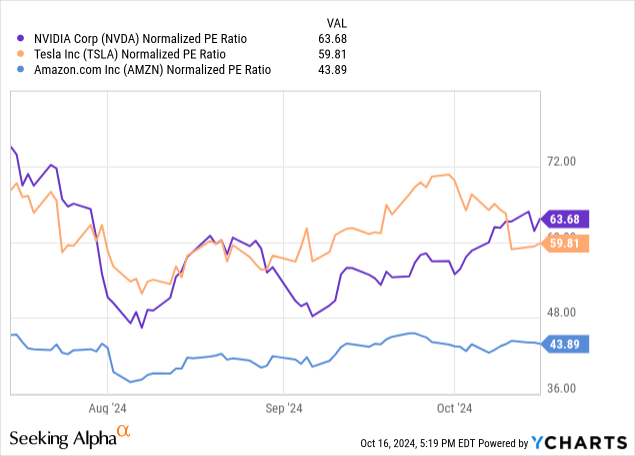

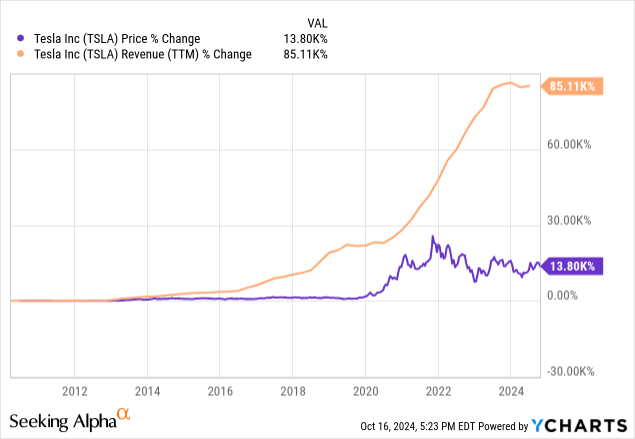

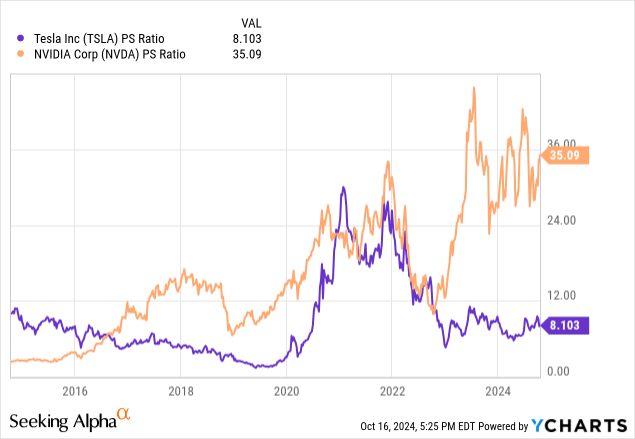

Based on the above peer analysis with other high-growth Big Tech peers, Tesla (TSLA) and Amazon, Nvidia looks approximately fairly valued to me—for now. However, just remember what happened to Tesla when it experienced a revenue contraction—hint: Nvidia’s ‘Cisco moment’. Tesla’s revenue decline was only moderate, but look at how significant the effect was on its stock price.

The good news is that Tesla is likely to have another long growth runway related to humanoid robots and autonomous taxis. My prediction is that in the upcoming years, Nvidia’s stock will crash, but it will also regain ground related to inference, robotics, and other advanced technology opportunities. That being said, Nvidia’s big golden win as the dominant player in training GPUs is not a multi-decade opportunity. Nvidia got lucky and has done remarkably well to consolidate its position in a disciplined fashion, but its luck (or should I say the opportunity) won’t last forever.

Currently, my base-case 12-month price target for Nvidia is a P/E non-GAAP ratio of 35 and a full-year 2025 normalized EPS of $4.39. That would lead to a stock price of $153.65. This is a 13% increase from the present price of $135.70. If the market continues to look favorably on Nvidia and signs of revenue contraction don’t start to manifest in the mainstream more clearly, we could see it trade at a P/E non-GAAP ratio of 40+; this would lead to a stock price of over $175, a price return of 29% or more from the present $135.70.

Conclusion

The points in this thesis should be crystal clear to long-term-oriented investors. I am currently not an Nvidia stakeholder, but if I were, I wouldn’t be holding the stock at more than 5% of my portfolio right now. I want to hold any investments I make for five, 10, or 15 years. Nvidia’s best growth days are largely behind it. Now, we’re going to see slowing growth rates, and then, in a few years, I predict a revenue contraction. That’s all going to be because the one-off big revenue opportunity related to high AI training GPU demand for the AI arms race will taper.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.