Summary:

- Nvidia Corporation reported strong earnings and provided positive guidance, but concerns about growth and competition are emerging.

- The company’s new product, the Blackwell, has been well received, but I see it as a sign of weakness.

- Nvidia Corporation’s valuation is nearing an all-time high, while growth prospects may worsen in the future.

Klaus Vedfelt/DigitalVision via Getty Images

Thesis Summary

Nvidia Corporation (NASDAQ:NVDA) reported Q1 earnings last week, beating expectations and providing strong guidance. But was anyone really not expecting this?

In the earnings call, we learned a lot about the company’s new product, the Blackwell chips. It has now been one year since Nvidia’s chips kicked off the AI revolution, so where does the company stand now?

In my last article, I highlighted the fact that while AI is no bubble, Nvidia might be. I pointed out some clear similarities between AI/Internet and Nvidia/Cisco Systems (CSCO).

My take back then was that Nvidia did not need to even do badly for investors to see a significant loss in value at these prices, and today I double down on this sentiment.

We are seeing a clear slowdown in growth while competition is accelerating and profit margins are topping out. The quick release of the Blackwell seems to be, in my opinion, a desperate move to stay ahead of competitors and investor expectations, but it may not work as intended.

I am, in fact, downgrading Nvidia to a sell, though I would not short this stock. The valuation is as high as it has ever been, while expectations are also sky-high and growth comps moving forward are going to become very challenging.

A great company, but not at these prices.

Q1 Earnings

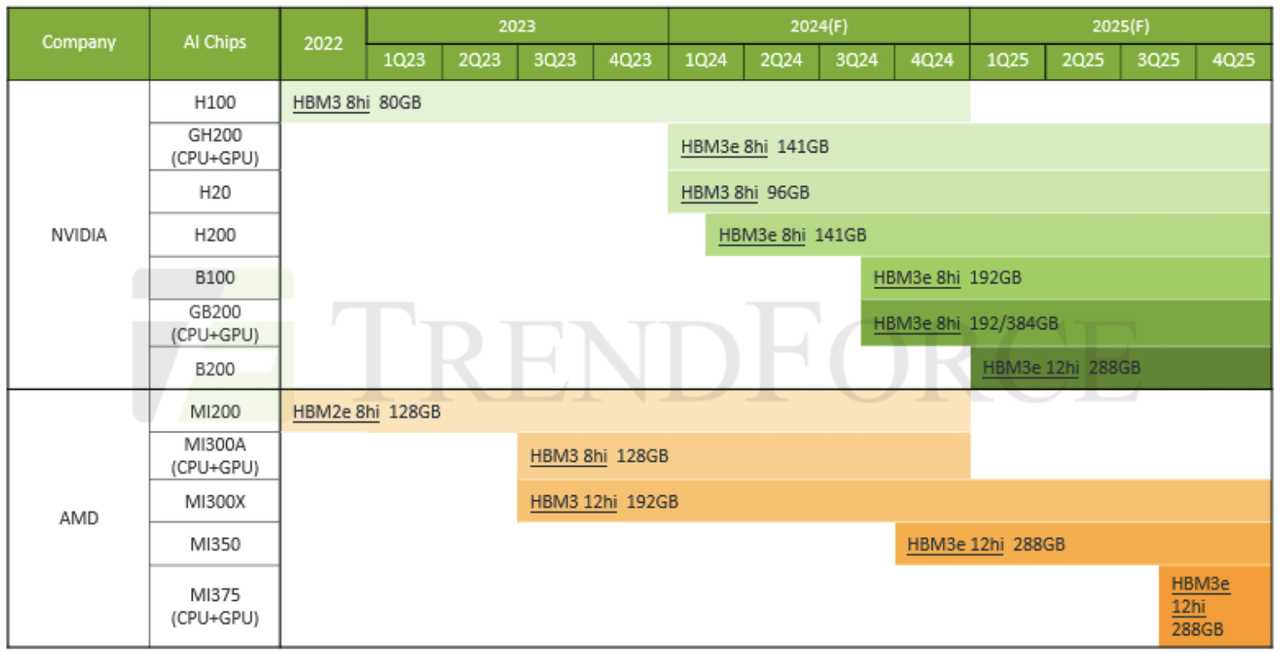

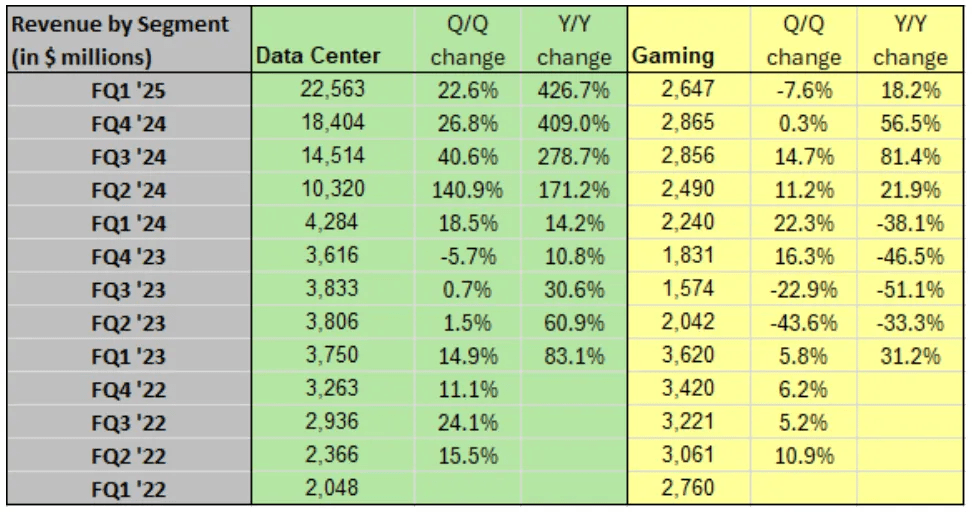

Just to quickly catch up on the latest earnings, Nvidia increased Data center revenues by 426% YoY.

NVIDIA revenues (SA)

We can see in the chart above how Nvidia’s Data center and Gaming revenues have evolved. Gaming revenues actually fell on a sequential basis, while Data Center increased 22.6%. We can also appreciate that quarterly growth has slowly been slowing down, though still a healthy +20%.

Based on the company’s guidance, next quarter should see close to $28 billion in revenues, which would imply a 25% growth in revenues.

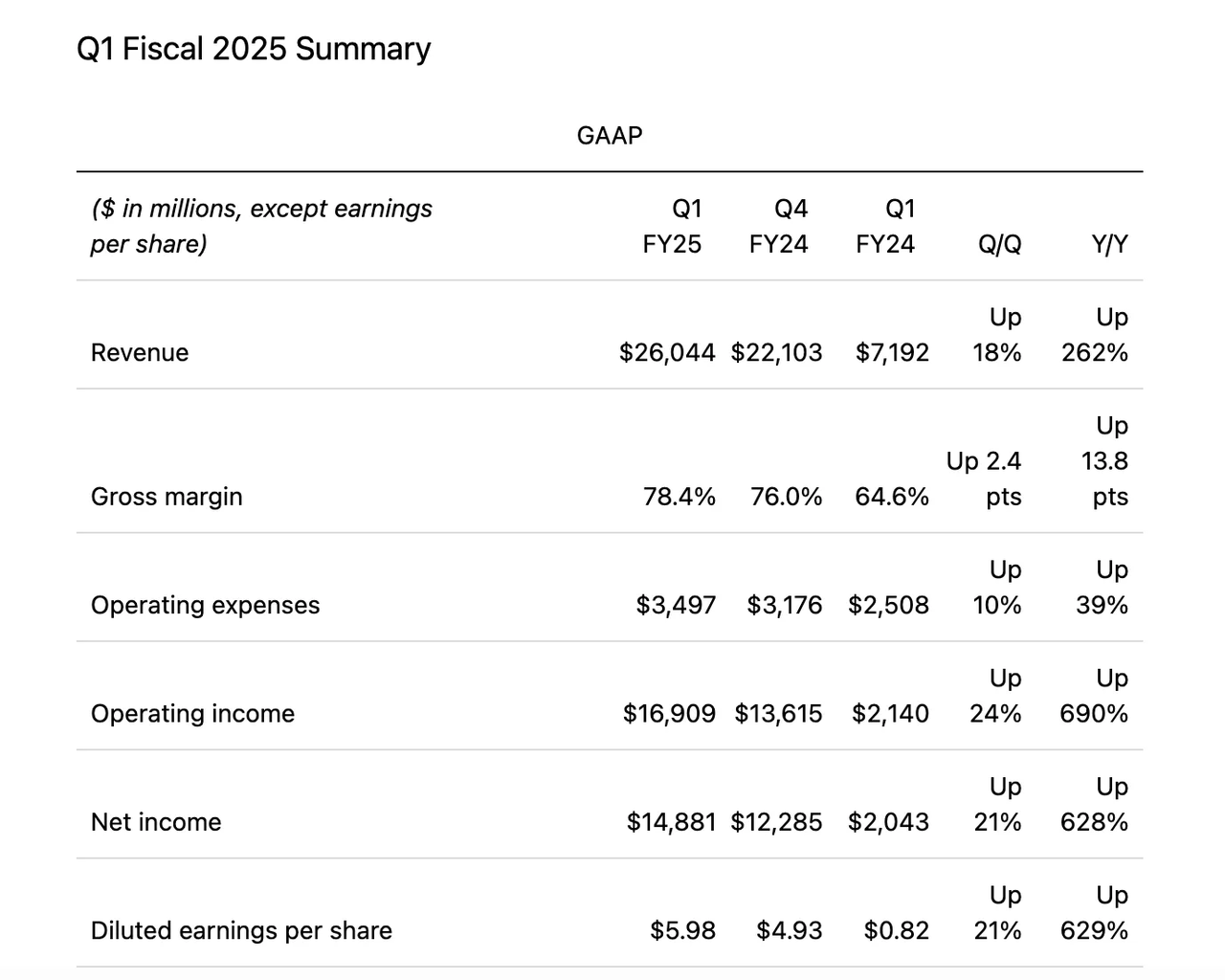

On the earnings side, Nvidia achieved just under $6 GAAP EPS.

NVIDIA Fiscal Summary (Press Release)

The gross margin increased to 78.4%, though based on guidance, this should come down to the mid-70s range in the coming quarters.

So, overall, it was another great quarter, but with some underlying concerns creeping up in my opinion.

Nvidia is going to struggle to maintain such high levels of growth, which we are already seeing trail off. Furthermore, it seems like profit margins could have also maxed out.

With all eyes on the AI giant, Nvidia knows it has to keep its pedal on the gas, and it is responding to this with its new chips and AI architecture.

The Blackwell

If AI chips are what the market wants, then that’s what Nvidia will provide. The Blackwell platform was mentioned 40 times in the earnings call.

At GTC in March, we launched our next-generation AI factory platform, Blackwell. The Blackwell GPU architecture delivers up to 4x faster training and 30x faster inference than the H100 and enables real-time generative AI on trillion-parameter large language models.

Source: Earnings Call.

The Blackwell is underpinned by the new H200s and the upcoming B100, GB200 and B200 GPUs. The platform is designed to be backwards compatible, so that clients can easily transition from the older versions.

According to the earnings call, we will indeed see substantial revenues from Blackwell. See below the projected timeline for Nvidia and Advanced Micro Devices (AMD) products over the next 8 months.

Nvidia’s fast release of the Blackwell may come as a surprise, given that it could indeed cannibalize the H200s, which are only a year old. However, if the rumors on price and performance are accurate, then there’s certainly no reason to wait.

According to rumors, the Blackwell architecture will be priced at $30,000-$40,000, about 20%-30% higher than the H100s. While this may seem like a costly upgrade, it should actually be saving money for its clients, since Nvidia reports that the B200 will provide a performance 30x superior.

Competitive pressures and peak growth

Nonetheless, the release of the Blackwell and the overall speed of the new releases could also be symptomatic of something much worse.

Nvidia’s competitors are closing in, and the company has to continue delivering higher performing chips in order to both stay ahead of competitors and continue providing more revenue and earnings growth.

We can see clear evidence of this already. Just last week, Nvidia was forced to cut the price of its highest end chips in China, due to weak demand and competition from Huawei.

However, according to Reuters’ three supply chain sources, there is an abundant supply of the chip in the market, signaling weak demand.

Source: SA Press Release.

Furthermore, AMD seems to also be gaining ground on Nvidia. In a press release last week, AMD confirmed that its MI300X Accelerators are being used to power Azure’s OpenAI workloads.

According to Reuters, Microsoft (MSFT) is now providing its Azure clients with an AMD alternative to the Nvidia AI chips.

Overall, NVIDIA has a lot against it at this point. Expectations are sky-high while competitors are catching up, and it is clear that clients are happy to change over or even wait for newer models.

Amazon (AMZN), for example, has paused its purchase of H100s to wait for the updated Blackwell models. Clearly, the company doesn’t mind waiting for better performance at a reasonable price.

Long gone seem to be the days when Nvidia’s chips were flying off the shelf before they even got there.

Valuation

All of this brings us back to the key issue at stake: Nvidia’s valuation.

When I last covered Nvidia, I actually admitted that following explosive growth in earnings and the upwardly revised projections, the stock didn’t actually look that cheap.

Indeed, following those earnings, Nvidia was actually trading at a forward P/E below that of Apple (AAPL), which is not the case now.

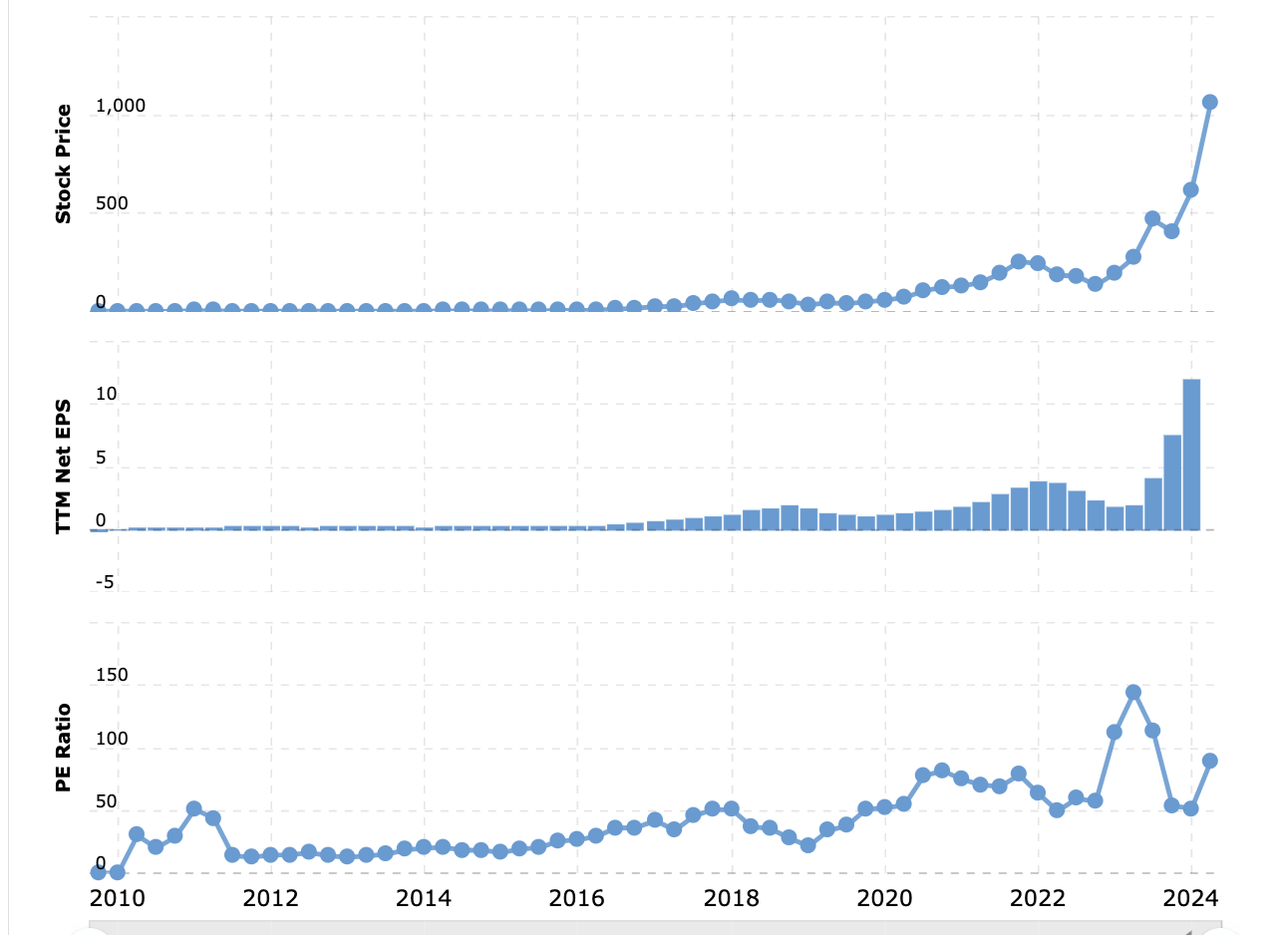

NVDA Price EPS and PE (Macrotrends)

Nvidia’s current P/E stands at just under 90 according to Macrotrends, and this just keeps expanding as the stock appreciates.

Nvidia has always commanded a high P/E, but it has only been higher than this during 2023, when huge earnings growth was expected, and therefore warranted this valuation, as the P/E actually adjusted dramatically with every new quarter.

Ultimately, Nvidia is now more expensive than ever before, while its growth prospects from here on out could worsen every quarter.

Takeaway

While I am rating Nvidia a sell at these levels, I would not advise shorting the stock either. There’s probably some room left for the upside as the AI hype continues, but I still think that today’s irrational exuberance will eventually give way to a large sell-off.

Much like I pointed out in my last article, Nvidia doesn’t even need to stop performing well for the stock to lose 40%-50% of its value. It merely has to start performing worse, as was the case with CSCO in the early 2000s.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Macro moves markets, and this is what I do at The Pragmatic Investor

Join today and enjoy:

– Weekly Macro Newsletter

– Access to our Portfolio

– Deep dive reports on stocks.

– Regular news updates

Start your free trial right now!