Summary:

- Nvidia Corporation’s stock pulled back after a strong Q3 FY2025 earnings report, driven by high expectations amid a lofty valuation, with a narrowing 3Q EPS beat.

- Blackwell is now in full production, boosting revenue consensus for the coming quarters, as management anticipates increased supply and signals exceeding the “several billion dollars” revenue outlook.

- The company prioritizes strong Blackwell demand at the cost of gross margin contraction, guiding a “low 70s” outlook in the near term and anticipating continued margin decline until 2H FY2026.

- While geopolitical risks under Donald Trump’s administration may not directly impact NVDA’s overall growth, they could significantly affect stock sentiment, which the market has yet to discount.

- Nvidia trading at 37x EV/sales TTM, nearing its all-time high, creates higher downside risk as YoY revenue growth and margins have normalized in recent quarters.

BING-JHEN HONG

What Happened

Nvidia Corporation (NASDAQ:NVDA) has rallied over 40% from its September low, driven by continued positive earnings revisions. The stock declined by 2.5% despite the company delivering another strong quarter. While NVDA’s lofty valuation remains a major concern, it has significantly outperformed the iShares Semiconductor ETF (SOXX). Nonetheless, bullish sentiment surrounding the earnings release weakened following the “double beat” 3Q results.

Investors are closely monitoring the Blackwell production ramp, particularly after recent delays. This ramp-up is expected to contribute several billion dollars in revenue starting in 4Q FY2025, even though a recent report indicated a potential overheating issue, causing some price fluctuations. The company has reported that demand for Blackwell exceeds supply for several quarters into FY2026.

Despite this, I maintain a bearish outlook on NVDA’s stock due to growth normalization and its lofty valuation multiples. While the Blackwell ramp could drive upward revenue revisions in the coming quarters, the good news is largely priced in. I expect YoY revenue growth and gross margins to trend lower, continuing into 1H FY2026. Therefore, I stick to strong sell rating on the stock.

However, the upside risk to my rating is if NVDA’s supply shortage improves significantly, aligning with rising demand, which could drive QoQ growth reacceleration and lower its EV/sales fwd to 20x sooner. Additionally, as Blackwell ramps up, the company’s gross margin could return to the mid-70s level in 1H FY2026.

3Q FY2025 Earnings: Less Impressive

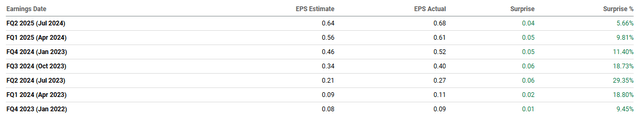

NVDA topped both revenue and non-GAAP EPS estimates, even after recent upward revisions by analysts. However, with the stock at all-time highs, I believe much of the optimism was already priced in before the 3Q earnings. This led to an initial negative price reaction, down more than 5%. Particularly, its 3Q FY2025 non-GAAP EPS was only 8% above consensus, marking another narrowed beat since 2Q FY2025.

In my 2Q FY2025 earnings review, I forecasted 83% YoY non-GAAP EPS growth in 3Q, implying $0.73 per share. NVDA delivered $0.81, an 11% upside surprise. However, the stock has rallied 24% since then, which clearly reflected higher growth expectations beyond 3Q. In addition, its 3Q non-GAAP gross margin came in 75%, in line with my consensus, showing a 70 bps sequential decline from 2Q.

Blackwell Volumes Are Key to Watch

Sell-side analysts have significantly boosted NVDA’s 2H FY2025 revenue consensus over the past three months, following the company’s comments on the initial ramp of Blackwell chips. They previously expected Blackwell production to generate several billion dollars in additional revenue and volumes increasing sequentially in the coming quarters. During the 3Q FY2025 earnings call, management announced they are in full production for Blackwell and shipped 13,000 samples last quarter. They also highlighted that 64 Blackwell chips can match the power efficiency of 256 H100 chips.

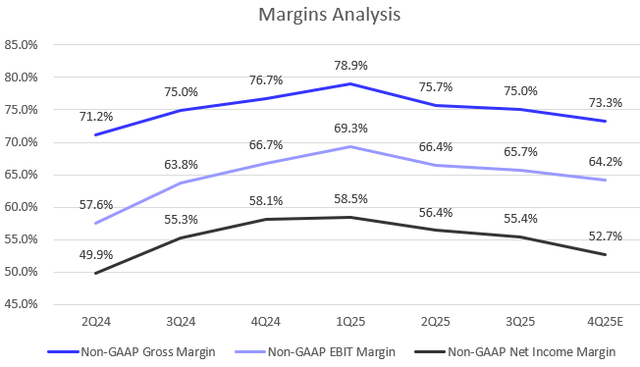

While the early volume ramp boosts near-term revenue, it could pressure gross margins. Management indicated gross margins could moderate to the “low-70s” when fully ramped. However, they also noted the potential for a gradual improvement to the mid-70s in 2H FY2026.

4Q FY2025 Outlook: Continued Normalization

The company model

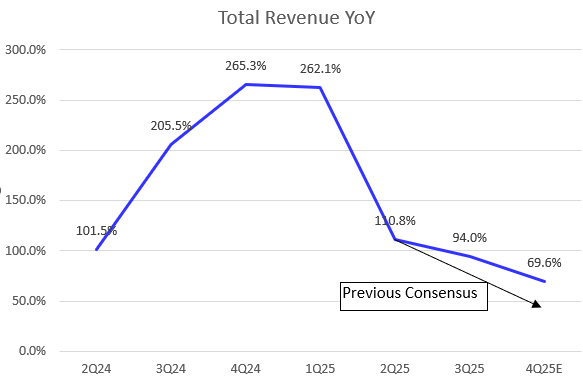

NVDA’s 4Q guidance disappointed some investors, with a guided 69.6% YoY growth in revenue at the midpoint of the guidance. This outlook has included a strong revenue tailwind from Blackwell and continued demand for Hopper architecture. Due to the increase in supply, the management indicated in the 3Q earnings call that it’s on track to surpass its earlier estimate of “several billion dollars” in revenue. Despite this, I still expect that NVDA’s revenue YoY growth will decelerate on QoQ basis going forward.

Moreover, NVDA guided for a non-GAAP gross margin of approximately 73.25% in 4Q FY2025, indicating a sequential contraction from 3Q and falling below the “mid-70% range” previously guided by the management. During the call, they indicated that the gross margin would moderate to “the low-70s when fully ramped.”

Based on its 4Q guidance for non-GAAP operating expenses, other income, and a 16.5% non-GAAP tax rate, we can estimate a non-GAAP operating margin of 64.2% and a non-GAAP net income margin of 52.7% for 4Q FY2025. These both reflect QoQ contractions, as shown in the chart. Therefore, we can calculate NVDA’s non-GAAP EPS will be around $0.8 per share in 4Q, implying 54.6% YoY growth, down significantly from 103% YoY in 3Q.

How Trump’s Policies Could Impact NVIDIA

Recently, I was asked how President-elect Donald Trump’s reelection could affect NVDA. In my view, the stock’s sentiment is more likely to be impacted by Trump’s stricter stance on tariffs and export controls against China. NVDA’s valuation reflects above-trend growth momentum from secular AI tailwinds, but higher geopolitical risks could dampen investor sentiment. NVDA’s Data Center revenue grew QoQ in China during the last quarter, but significantly below previous levels due to export control. During the call, Jensen Huang stated: “Whatever the new administration decides, we will, of course, support the administration.”

Although the escalation between the US and China may not drastically change NVDA’s long-term growth outlook, such geopolitical tensions could severely impact investor sentiment. This could potentially trigger sharp pullbacks similar to the one seen in August, when the selloff coincided with the unwinding of Japanese carry trades.

Trading At 37x EV/Sales Raises Concerns

I acknowledge that NVDA remains a “GOAT” in terms of its financial metrics, but its risk and reward profile has been deteriorating. High expectations often lead to unexpected selloffs if growth momentum slows. My strong sell rating is not based on technical indicators, as the current bullish momentum remains robust, drawing in many momentum-chasing traders.

However, NVDA’s EV/sales TTM of 37x, nearing its all-time high, is very concerning. While elevated valuations are common under the current equity market backdrop, a multiple nearly double the “lofty” level of 20x sales seems overdone. I’m convinced that the stock may face significant downside, given NVDA’s sharp YoY growth slowdown and persistent margin contractions over the past three quarters.

I also believe that the recent stock’s rally has outpaced its positive forward revisions, with a non-GAAP forward P/E of 51x, higher than the 42x in my previous analysis. Lastly, the current valuation also has barely priced in any uncertainty of higher geopolitical risk under Trump’s administration, which may impact the sentiment. While NVDA can still be traded, it’s less attractive to buy and hold at these levels.

Conclusion

In sum, NVDA’s 3Q FY2025 earnings beat all consensus estimates, but buy-side expectations were higher, driven by the recent expansion in its valuation multiples. With Blackwell chips now in full production, analysts may revise revenue expectations positively following this earnings release.

However, the percentage surprise of 3Q earnings was significantly below past trend, and the company’s 4Q outlook points to a sharp YoY growth slowdown in non-GAAP EPS due to continued revenue growth normalization and gross margin contraction. This downtrend is expected to persist in the coming quarters. Furthermore, NVDA’s current valuation raises significant concerns, with an EV/sales TTM close to 40x, nearly 2x higher than my threshold. While the stock remains attractive for short-term traders, the elevated valuation and increasing downside risks lead me to reiterate a strong sell rating on NVDA.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.