Summary:

- The U.S. technology sector, led by semiconductor manufacturers, has outperformed other sectors in the market rally.

- Nvidia Corporation reached an all-time high with a $1.5 trillion market capitalization, but technical analysis suggests caution due to potential overextension.

- Anticipating six interest rate cuts, the larger market may impact stocks like Nvidia, leading to a recommendation to take partial profits and set a trailing stop loss.

- In this technical article, I discuss essential price levels and metrics investors could consider to gain an edge over Nvidia Corporation stock’s likely price action.

egal/iStock via Getty Images

Nvidia Corporation (NASDAQ:NVDA) has demonstrated robust performance in the last month, surpassing optimistic projections and propelling the stock above the trillion-dollar valuation. However, evaluating the risks and opportunities at these price levels is prudent. This article outlines a short-term trading opportunity, exploring various outcomes while maintaining a balanced risk perspective. The discussion includes setting appropriate stop-loss levels and actively managing risk exposure, considering both the broader technology market and industry performance.

A quick look at the big picture

The U.S. technology sector has taken the lead in the rally that began in January 2023, and has maintained a significantly more robust performance than other economic sectors over the past year. Semiconductor manufacturers have been at the forefront, demonstrating outstanding annual performance and strong momentum in the last month. Computer hardware, software infrastructure, and software application companies have followed suit. Conversely, other sectors, particularly energy, commodities, and real estate, have recently shown weakness.

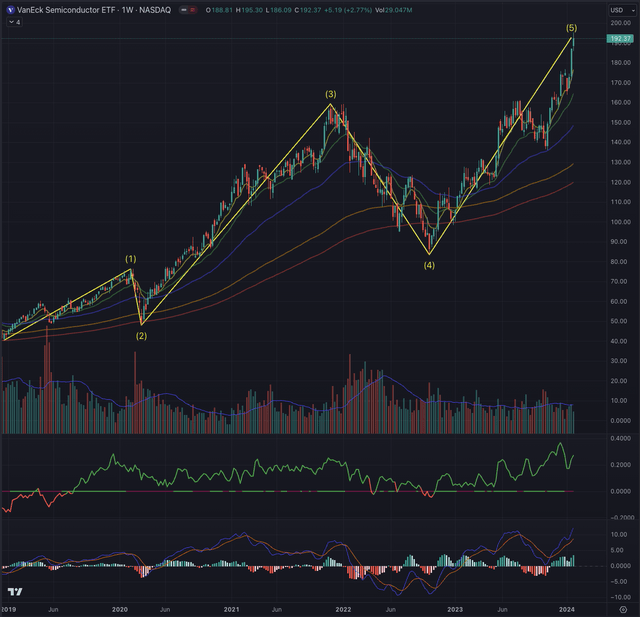

The VanEck Semiconductor ETF (SMH) has seen a protracted and significant rally, surpassing key overhead resistances and consistently finding support at both short-term EMAs and the more determinant EMA55. The industry benchmark has concluded an impulse wave sequence, where my estimate suggests a potential extension of wave 5 to reach a peak of $193. This surge is supported by robust relative strength compared to the broader technology market, represented by the Nasdaq Composite (COMP.IND), or the Nasdaq 100-Index (NDX) tracked by the Invesco QQQ Trust ETF (QQQ). However, it’s noteworthy that the momentum indicator, the MACD, appears extended and may signal a potential peak.

Where are we now?

As the global community delves into the AI exploration and development stage, NVDA is experiencing its peak performance, standing as an optimal contender to meet the surging demand for this groundbreaking technology. Unlike any other company in the industry, NVDA is currently unmatched in its ability to provide comprehensive, advanced, scalable, and high-performing solutions, leveraging its optimized software and hardware.

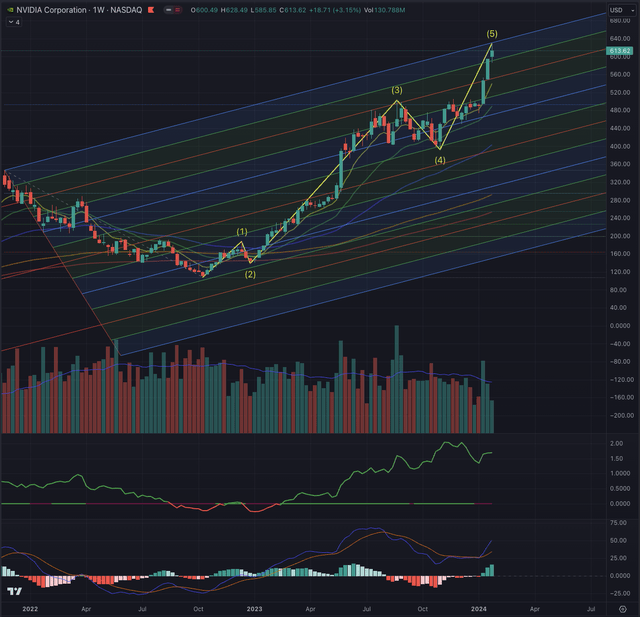

Since the peak in November 2021, the stock has ascended to the upper limit of the trend channel I’ve outlined, driven by a breakout from a retracement lasting approximately 1.5 years. This retracement brought the stock close to the $100 mark. Subsequently, NVDA has undergone a steep wave sequence characterized by brief retracements and robust impulse waves, propelling the stock to its All-Time High [ATH] at $628.49 and an impressive market capitalization exceeding $1.5T.

The current assessment of NVDA suggests a potential overextension in the short term, as indicated by the elongation of its EMAs and a deceleration in momentum, according to the stock’s MACD and the decline in buy-side volume. While these observations were drawn from NVDA’s weekly chart, it is imperative to zoom in and verify these findings on the daily chart. This finer timeframe will play a pivotal role in refining and determining the subsequent actions for my investment strategy.

What is coming next?

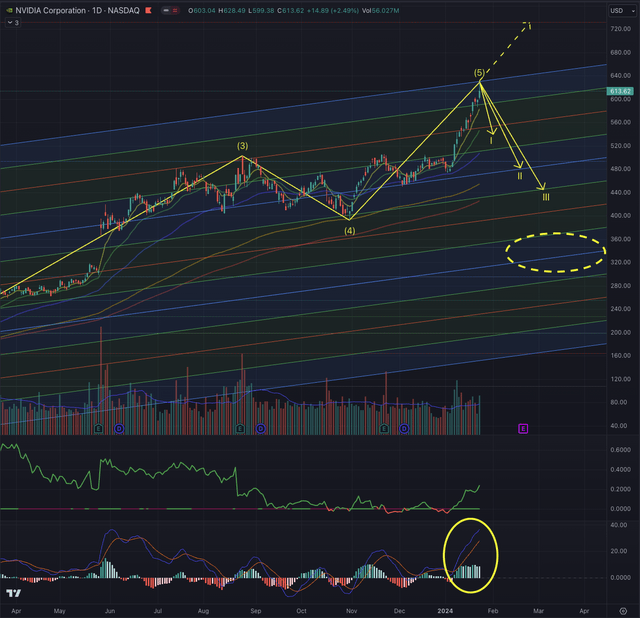

On NVDA’s daily chart, the MACD affirms the extended condition noted on the weekly timeframe, a observation also suggested by the industry benchmark. This hints at a higher probability of the strong positive momentum nearing exhaustion. While the stock’s relative strength compared to the broader technology market remains notably robust, it’s essential to consider the deceleration in buy-side volume. Despite the absence of significant distribution days in recent trading sessions, there are indications that investors are holding onto their positions with the anticipation of further upside potential.

While NVDA could surpass the upper limit of the trend channel and reach the projected target of $733, I find it more plausible that the stock undergoes a retracement, cooling off from its recent rapid ascent. I identify three potential retracement targets, estimated sequentially at $538, $482, and a third range between $$450 and $424, where NVDA could intersect with its EMA200.

Investors must take note of the considerable gap formed by NVDA between $367 and $306, which I identify as the lowest target in the foreseeable future if the stock were to dip below its EMA200. While there is a technical likelihood for the gap to act as a magnet, this scenario would necessitate a significant shift in the fundamental market conditions or factors influencing the company’s growth prospects.

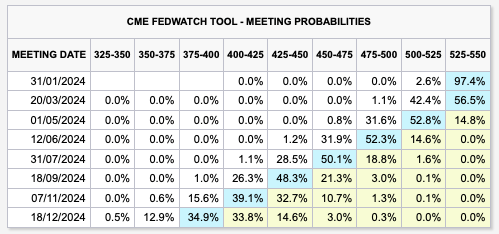

CME Group

The market is currently factoring in six interest rate cuts for the year, with expectations shifting from a dovish swing starting in March to the FED initiating cuts from its May meeting onward. This optimistic assumption, while only partially shared, exposes highly extended stocks like NVDA to potential significant drops if these expectations are not met. Prolonged higher interest rates could notably impact valuation models.

Given my observations and the recognition that both NVDA and the industry benchmark have reached important targets and are extended, suggesting a retracement is likely, I find it prudent to consider taking at least partial profits at this juncture. Despite acknowledging NVDA’s strong positioning in secular growth trends, the current stock price reflects a very optimistic environment. From a technical and short-term perspective, the risks outweigh the opportunities, leading me downgrading NVDA to a sell position.

As NVDA approaches its upcoming Q4 and FY2024 financial results event on February 21, where high expectations must be met, and with the FED providing more hints on its policy during the scheduled FOMC meeting ending on January 31, there’s a possibility that the market may realize six rate cuts could be overly optimistic. At this point, I would refrain from adding new positions as the risk/reward profile seems unfavorable.

Setting a trailing stop loss under the EMA21 or EMA55 while considering the discussed retracement targets could be a prudent strategy for investors choosing to maintain their positions.

The bottom line

Technical analysis is a valuable tool that enhances the likelihood of investors’ success by providing guidance rather than absolute certainty. It serves as a navigational instrument in the complexities of the stock market, comparable to consulting a map or using GPS for an unfamiliar journey. Employing technical analysis is like having a strategic guide when making investment decisions. I incorporate techniques rooted in the Elliott Wave Theory and leverage Fibonacci’s principles to assess likely outcomes based on probabilities. These methods assist in confirming or refuting potential entry points, considering factors such as sector, industry, and, most significantly, price action. My technical analysis aims to scrutinize an asset’s situation and calculate probable outcomes based on the aforementioned theories.

The U.S. technology sector, led by semiconductor manufacturers, has performed well in the market rally. Nvidia Corporation stock reached an all-time high with a $1.5 trillion market capitalization, but technical analysis suggests caution due to potential overextension. Anticipating six interest rate cuts, the market may impact stocks like NVDA. A partial profit-taking strategy is recommended, and NVDA stock is here downgraded to a sell position due to an overly optimistic environment. As NVDA will soon disclose financial results and the FED policy meeting is approaching, caution is advised, and investors maintaining positions should set a trailing stop loss for their Nvidia Corporation shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All of my articles are a matter of opinion and must be treated as such. All opinions and estimates reflect my best judgment on selected aspects of a potential investment in securities of the mentioned company or underlying, as of the date of publication. Any opinions or estimates are subject to change without notice, and I am under no circumstance obliged to update or correct any information presented in my analyses. I am not acting in an investment adviser capacity, and this article is not financial advice. This article contains independent commentary to be used for informational and educational purposes only. I invite every investor to do their research and due diligence before making an independent investment decision based on their particular investment objectives, financial situation, and risk tolerance. I take no responsibility for your investment decisions but wish you great success.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.