Summary:

- Nvidia Corporation’s stock is positioned for mid-teens returns due to strong AI chip demand, reasonable valuation, and robust earnings growth.

- Recent price drop offers a buying opportunity; Nvidia’s P/E ratio is now in line with Big Tech peers but with higher growth prospects.

- Blackwell chips, launching Q4, promise significant performance gains, driving strong demand from Big Tech aiming for AI advancements.

- Risks include competition, potential custom chip development by cloud players, and regulatory scrutiny, but Nvidia’s product superiority supports its market position.

JHVEPhoto

Introduction

Nvidia Corporation (NASDAQ:NVDA) is a stock that needs no introduction, as it has seemed to singularly capture the world’s attention as the darling of AI. Since November 2022 and the release of ChatGPT, Nvidia’s stock price has appreciated a whopping c700%. Unlike some other hyped AI names, Nvidia’s earnings have actually roared ahead of its stock price as demand for the firm’s GPUs has proved insatiable.

Following a shift in sentiment in markets and a negative response to the firm’s recent earnings, shares are now trading at the most attractive level relative to growth in a decade. Investors need to be realistic about what time of return they might achieve, given the stock has grown into a $2.5 trillion behemoth. Expecting a repeat of the 700% since over the last two years is not realistic, but based on my own DCF analysis, I believe the stock is set up to deliver mid-teens returns for investors.

I believe it can deliver solid returns at least over the medium term given its market-leading position in AI chips, the continued pace of capex at its biggest customers and a valuation that isn’t as punchy as before. Given these factors, I am happy to initiate Nvidia with a buy rating.

Recent Price Action

Following a truly parabolic price appreciation, Nvidia stock has gone into reverse over the past two and a half months. The stock achieved an all-time high on June 18th and has fallen 20% since then as of the close Friday. Shares were down as much as 26% in early August as a mix of factors spooked investors. These included the risk of a US recession, concerns about the return on capex investment for Nvidia’s biggest customers, and a generation rotation within markets away from Tech and Communications in favor of more defensive sectors.

The negative price performance was punctuated with a drop of nearly 6.5% following the release of fiscal Q2 earnings on August 28th. Expectations for the stock clearly got ahead of realism, as markets were disappointed despite a solid earnings beat on both the top and bottom lines. Revenue grew a staggering 122% year-on-year, with data center specific revenue up 154%.

What earnings clearly showed in my view was the lack of potential air pockets in demand, as was reported by some media outlets. There had been some fear that as customers, in particular large-scale cloud operators, took time to integrate their existing GPU purchases, that there would be gaps in their demand patterns. This concern has been shown to be demonstrably false, given data center revenue grew over 150%. Additionally, less than 50% of data center sales went to Big Tech cloud players. This indicates that the insatiable demand for high-end GPUs is extending meaningfully to broader players such as Sovereign cloud operators, like in the Middle East, and enterprise customers seeking to keep up.

Blackwell and Beyond

Investors were concerned going into earnings on reports that Nvidia’s next-generation of chips, known as Blackwell, was delayed due to a design defect which impacted on production yields. CEO Jensen Huang confirmed that all issues had been resolved, and the new platform was set to begin shipment to customers in Q4 of this year. Blackwell promises to be a truly generational step forward in full-stack data center GPU computing. Nvidia claims the performance uplift over the hopper family of GPUs will be as much as 25x.

Demand for the platform is likely to be voracious as Big Tech players in particular seem fixated on achieving the holy grail of Artificial General Intelligence or AGI. Mark Zuckerberg of Meta Platforms (META) was recently quoted as saying the next generation of AI models will consume 10x the compute to train. It would seem that all roads lead to Blackwell, with the new platform becoming table stakes for the Tech giants in their competition to build out cutting-edge infrastructure. On the issue of spending cadence, Zuckerberg stated:

“It’s hard to predict how this will trend multiple generations out into the future. But at this point, I’d rather risk building capacity before it is needed rather than too late, given the long lead times for spinning up new inference projects.” (Mark Zuckerberg, Meta Press Release.)

A simple examination of capex forecasts at Big Tech players is a good proxy for future demand for Nvidia chips, given a large portion of incremental capex has been allocated in that manner. Microsoft (MSFT) increased 2024 capex by 58% and is expected to raise further in 2025 by nearly another 30%. Google (GOOG) is expected to raise their capex level by 55% in 2024 and Meta is expected to increase its number by 40%. It is clear to me that demand for Nvidia’s Blackwell platform will be as robust as it was for Hopper. The risk of missing a trick in AI development is a cost Nvidia’s largest customers are not willing to bear.

Valuation

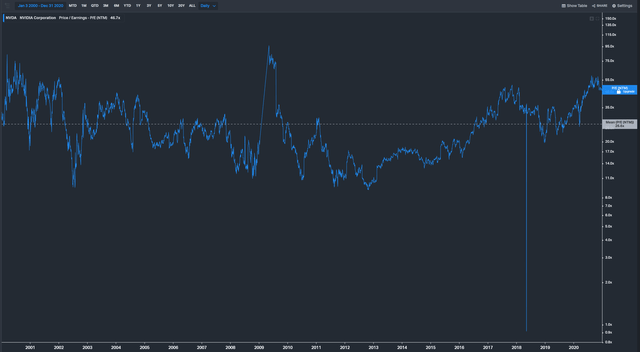

For me, valuation has consistently been a hurdle to finding a good entry point for Nvidia stock. Recently, the stock has consistently traded at or above a 40-50x forward P/E, this contrasts to a twenty-year average P/E from 2000 to 2020 of closer to 26x.

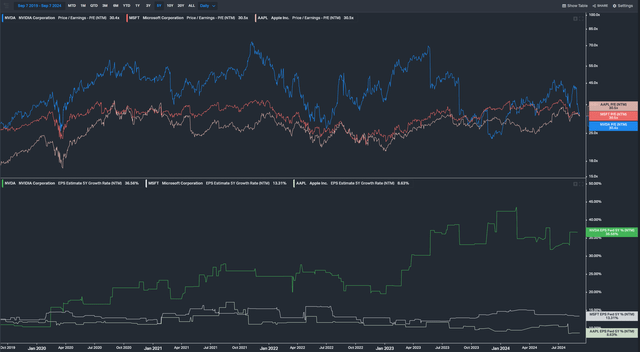

However, as earnings have continued to grow substantially as noted above and the stock price has come back down to earth, the valuation multiple once again looks reasonable. Nvidia is trading on a 30x P/E which is in-line with Big Tech peers Microsoft and Apple (AAPL). However, despite an equivalent P/E multiple, Nvidia is forecast to grow substantially more in the medium term, with an EPS forecast nearly 3x Microsoft’s and over 4x Apple’s.

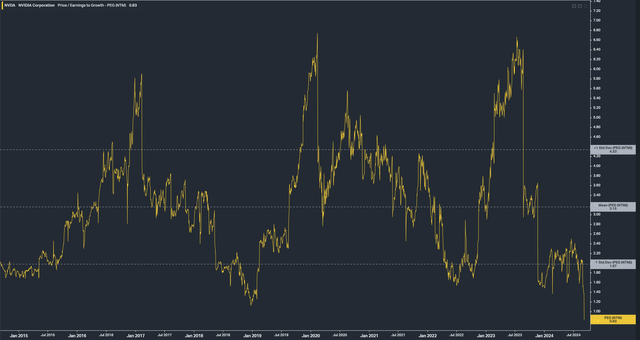

As we can see below, on a PEG basis, Nvidia is the cheapest it has been in a decade. I expect ownership of Nvidia to likely entail much higher volatility than the likes of Apple, a defensive trait that allows the latter to justify such a high multiple despite relatively modest growth. However, I believe if investors have realistic expectations about growth prospects for Nvidia from here, and can stomach a bit of volatility, they should be rewarded with above market performance for holding the stock from here.

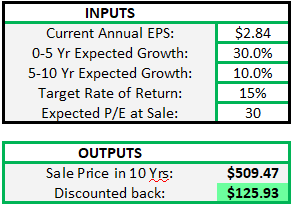

Adopting a discounted cash flow (“DCF”) approach, I model conservatively. The medium term analyst growth forecast for the stock is currently 36%, I have chosen to use 30% for my DCF to give us some margin of error in estimates. Nvidia has tended to beat estimates historically, so I would not be surprised if my forecast proves quite conservative. For the second stage of growth, I selected 10% EPS growth for two reasons. First, as Nvidia grows, the base effect of higher earnings will naturally lead to lower growth due to the law of large numbers. Secondly, 10% growth is akin to the long term EPS growth rate of the broader S&P 500 (SP500). I once again view this estimate as likely conservative, as I would be surprised if in only 5 years’ time Nvidia was growing just at the same pace as the index.

My DCF tells me that when adopting conservative estimates, it looks reasonable for investors to expect a return in the mid-teens from the current entry point. The recent strong sell off in the stock looks to have created a nice spot for investors looking to buy or add to existing positions.

Author

Risks

The first obvious risk to Nvidia’s trajectory is the threat from other chip plays and hyperscale cloud players’ in-house efforts to develop custom chips. As it stands, Nvidia has a clear lead over competitors such as Advanced Micro Devices (AMD), a study from TechInsights showed Nvidia with a market share in the high-90s for data center GPU, which suggests a massive lead ahead of competition. However, such dominance can create uneasiness for customers as they end up locked in to one vendor, creating an uncomfortable over-reliance.

Another risk which Nvidia’s dominance creates is the threat of government antitrust action. Just last week, we saw reports that the Department of Justice had sent a probe to Nvidia, which the company strangely may not have received. Whatever the case may be, it is clear that Nvidia is now in the sights of regulators. Elizabeth Warren, a prominent US senator, has been quick to voice her support for an investigation into Nvidia. The firm claims, rightly in my view, that its dominance of markets is a function of its superior products rather than market manipulation. This risk is newly unfolding. In the short term, I do not expect anything which changes my buy thesis, but it will remain an issue to watch.

Conclusion

Wrapping it all up, I believe that Nvidia now represents a solid buying opportunity for investors, given the recent sell-off has taken some froth out of the stock. The valuation looks fairly reasonable both vs. the firm’s history and vs. some of its Big Tech peers, and adjusting for expected growth rates one could make the case Nvidia is the most attractive in a decade.

The firm does indeed face threats from growing competition and the watchful eye of regulators, but the demand for its chips doesn’t look to have much end in sight. Hyperscale cloud players and others will have no choice but to fork out for Blackwell chips when they become available later this year. Failure to do so would allow competition in the race to develop ever more sophisticated AI models to gain a sizable lead. The performance uplift from Blackwell is simply too great to miss out on, as a result, I expect demand to hold firm for years to come and the stock to perform nicely from here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.