Summary:

- Nvidia Corporation is currently trading at 24.4x EV/Revenue CY 2023, the highest in its peer group, indicating that the stock is overvalued and running ahead of itself.

- The Street consensus hasn’t reflected significant upward revisions yet, despite optimism about AI driving higher demand for Nvidia platforms.

- I’m tactically bearish on Nvidia stock and looking for a better entry point when the multiple approaches its 5-year average.

Sundry Photography

Investment Thesis

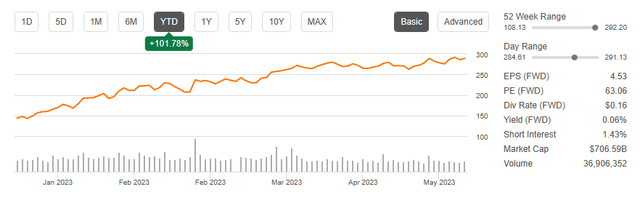

Nvidia Corporation (NASDAQ:NVDA) plays a leading role in AI revolution. As the massive rise of ChatGPT is pouring fuel to the already burning fire, the stock has rallied 102% since the start of the year, indicating its ability to enable AI adoption across a wide range of markets.

While I believe that NVDA’s dominant position is unlikely to be challenged in the near term, I’m concerned about its “flying to Mars” valuation as the stock is currently trading at 66x P/E CY 2023 (compared to TSLA’s 43x), the highest multiple in the technology sector. As a profitable company, this high multiple was only seen during the post-pandemic bull market when the federal fund rate was at its lower bound of 0. However, with the current interest rate at 5.25%, I believe that the recent rally may be ahead of itself. Therefore, despite a robust long-term growth outlook, I’m tactically bearish on Nvidia stock in the near term.

GTC Presentation

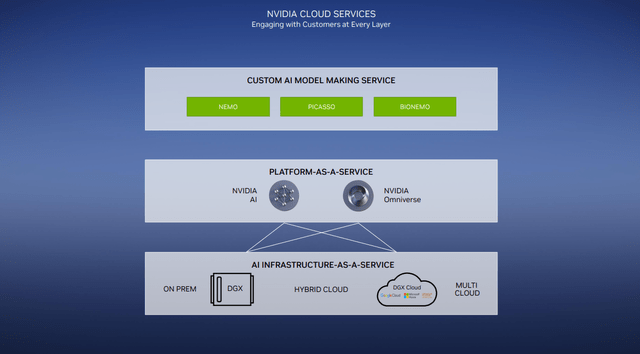

On 03/21/2023, Nvidia held its GTC Financial Analyst Q&A, which highlighted the cloud business model and emphasized its ability to address the increasing demand. The company’s software solutions continue to rise, adding value to customers. Moreover, engaged with customers at every level of the value chain, Nvidia provides platform-as-a-service and AI infrastructure-as-a-service. During the webcast, the CFO also mentioned a surge in AI compute demand in the past month, which was more positive than the previous earnings call outlook, further fueling the recent bullish sentiment.

One of the most exciting announcements at GTC was the company’s cloud-based service offerings, including DGX Cloud, which allows enterprises to train and operate a wide array of current and emerging AI workloads. While the team reiterated its view of seeing an accelerating demand profile for its datacenter business in the near and mid-term, the economic models of some of these new business opportunities remain uncertain. Given the market pricing in multi-year long tailwinds, the current risk and reward profile of the stock is not very attractive.

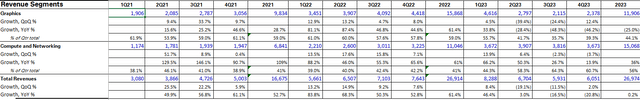

Growth Slowdown but Not Datacenter

The company’s revenue growth has slowed down significantly to 0.2% YoY from 61.4% a year earlier due to the negative effect on pull-forward demand and macro headwinds. However, I believe this was largely due to a high bar basis and weak demand in the semiconductor industry, rather than a specific issue with the company. Particularly, the Graphics segment saw a revenue deceleration of 25% YoY largely due to a PC slowdown in the post-pandemic era, resulting in a CAGR of 15.9% from FY 2020 to FY 2023. On the other hand, the Compute and Networking segment remained resilient and grew 36% YoY, largely driven by a 41.4% YoY growth in the Datacenter subsegment, which reflected the demand resiliency of the company’s cloud services and AI compute. Therefore, I believe that the stock is currently speculating on the future AI mania, with investors pushing up the price to reflect its strong growth outlook, which has already been largely priced in.

Valuation

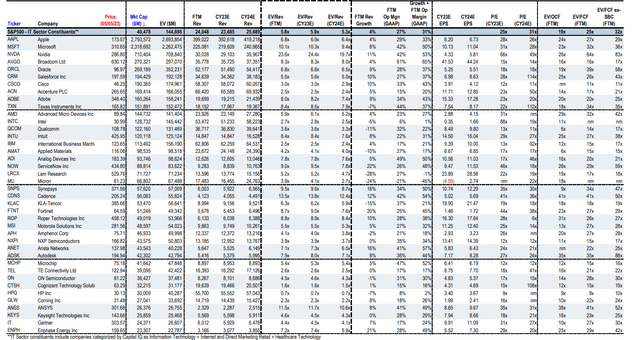

Source: Bloomberg Finance L.P., CapitalIQ, J.P. Morgan estimates

The table from 05/05/2023 shows that NVDA is trading at 24.4x EV/Revenue CY 2023, which is the highest multiple in the group, compared to 5.9x of S&P500 – IT sector average. While some investors may argue that the lofty valuation can be justified by its hypergrowth outlook in the next decade, I find it overstretched, especially considering that the stock is trading at a four times higher EV/Revenue than Advanced Micro Devices, Inc (AMD). If we exclude Intel Corporation (INTC) from the comparison due to its value trap nature, 66x of P/E CY 2023 is still the highest in the group, even higher than Tesla, Inc.’s (TSLA) 43x multiple.

Based on this chart, NVDA’s Blended Forward 12 months (BF) P/E ratio ((Green line)) and P/S ratio ((White line)) is currently trading at 60x and 22.6x respectively, approaching to the pandemic peak when the federal fund rate was at 0. In contract, TSLA is currently trading at 43x BF P/E ((Red line)) and 5x BF P/S ((Blue line)). This indicates that investors are enthusiastic about NVDA’s potential in the AI sector in the long term. However, the current multiples suggest that the stock’s price may not be sustainable in the current environment with a 5.25% interest rate and 5.5% YoY of Core CPI. While the stock could continue to rise over the long term, I remain cautious as the street consensus have not been significantly revised yet.

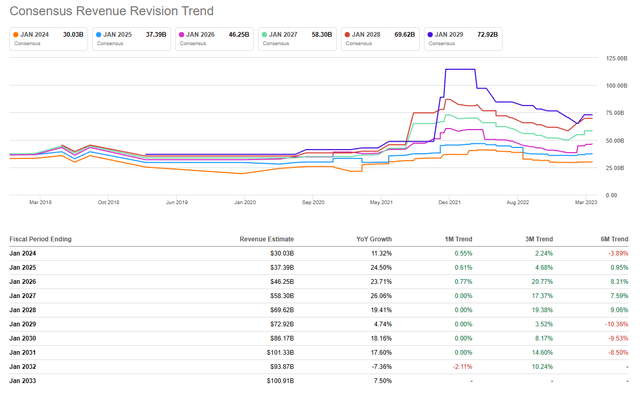

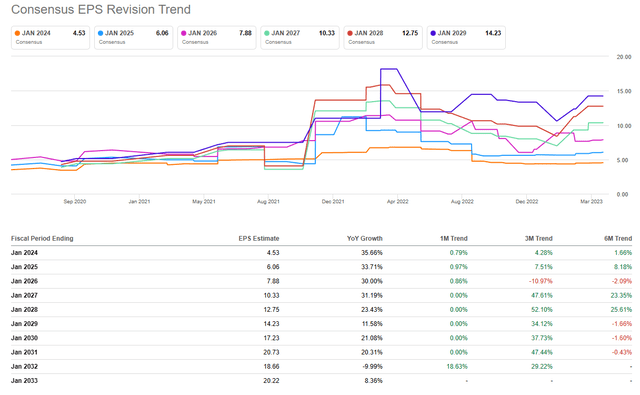

The Street Consensus

Despite the potential for accelerating demand opportunities through AI adoption, the market consensus for NVDA’s revenue growth has not caught up with the current price action. In fact, sell-side analysts have actually decreased their FY 2023 revenue estimates by -3.89% over the past 6 months. While there were slightly upward revisions for revenue in FY 2023 and FY 2024 earlier this year, these estimates still haven’t reached the peak levels of last year. This suggests that the recent 100% rally in the stock is purely speculative, especially given the sharp reduction in long-term revenue estimates.

On the other hand, the near-term earnings revisions have remained stagnant, indicating that the surge in the stock price is not driven by an increase in earnings consensus as well. Earnings estimates for FY 2023 have only increased by 1.66% over the last 6 months. While longer-term earnings estimates are less reliable, they are still important in determining the company’s valuation using the discounted cash flow (“DCF”) model. The market appears to believe that NVDA’s earnings will dramatically improve starting in mid and long term, as the earnings consensus for FY 2026 and FY 2027 has increased by 23% AND 26%, respectively. Therefore, I believe that the doubling of NVDA stock price in 5 months is overreaching.

Conclusion

In conclusion, Nvidia Corporation’s stock price has soared by more than 100% YTD, driven by the market’s enthusiasm for AI and its potential to transform various industries. However, despite the company’s significant opportunities in the future, there are concerns about the current valuation, which appears to be overstretched based on traditional valuation metrics. Furthermore, the lack of significant upward revisions in revenue and earnings estimates by analysts raises questions about the sustainability of the stock’s rally. While Nvidia Corporation may continue to move higher in the long term, investors should be cautious about the potential risks associated with the stock’s high valuation and speculative market sentiment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.