Summary:

- Nvidia Corporation faces sustained tailwinds and has attractive financials.

- As of the most recent quarter, Nvidia’s gross margins were at 64.63%, operating margins were at 29.75%, and net margins were at 28.41%.

- As of their Jan 2023 report, annual ROIC was at 12.80%, ROCE was at 21.53%, and ROE was at 19.76%.

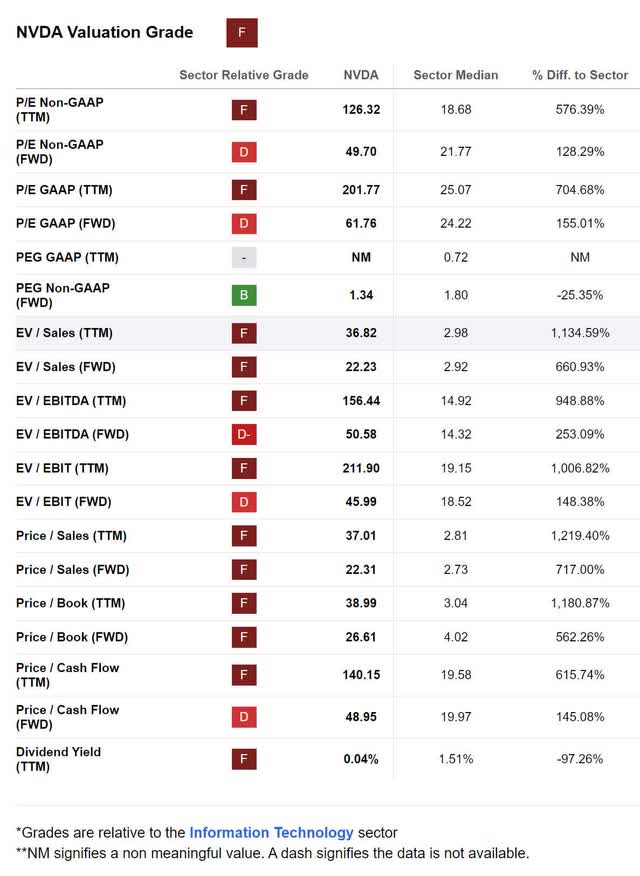

- With a forward P/E of 61.76x, a forward PEG of 1.34x, a forward EV/EBITDA of 50.58x, and a forward Price/Cash Flow of 48.95x, I view the company as overvalued.

- I currently rate NVDA stock as a Hold.

Birdlkportfolio/iStock via Getty Images

Thesis

As macro conditions continue to normalize in the aftermath of the chip shortage, I was hoping that an opportunity would present itself for me to buy Nvidia Corporation (NASDAQ:NVDA) as a long-term hold. I went into the history of the company and their long-term competitive advantages in my last article, but the summary is that I believe they have excellent financials and face sustained tailwinds, so I view them as an excellent long term buy.

Unfortunately, the mania that is driving A.I. stocks into new highs is also affecting Nvidia. The recent valuation improvement caused by forward guidance has pushed an already overvalued company up even further. While I absolutely cannot justify buying at these prices, the buzz around this company might carry its valuation even higher, so I do not feel safe shorting it. I currently rate Nvidia as a Hold.

Financials

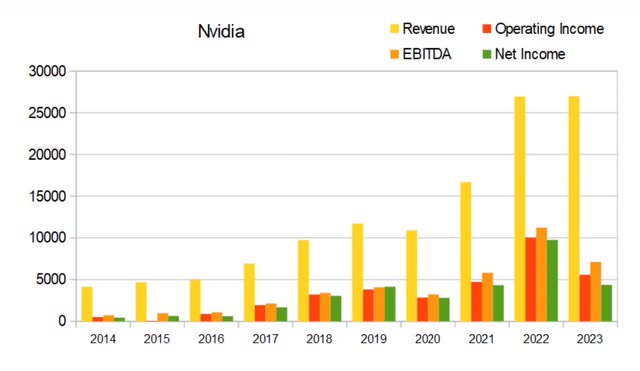

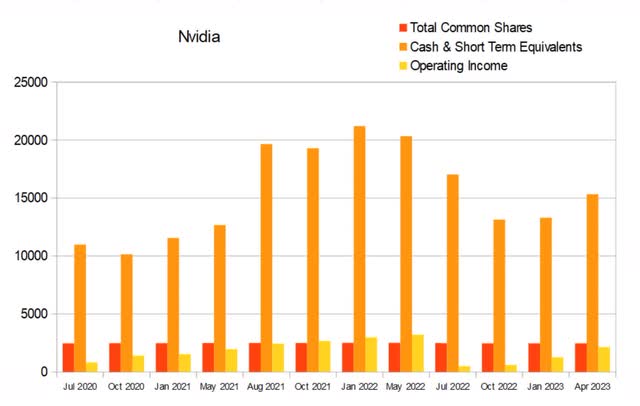

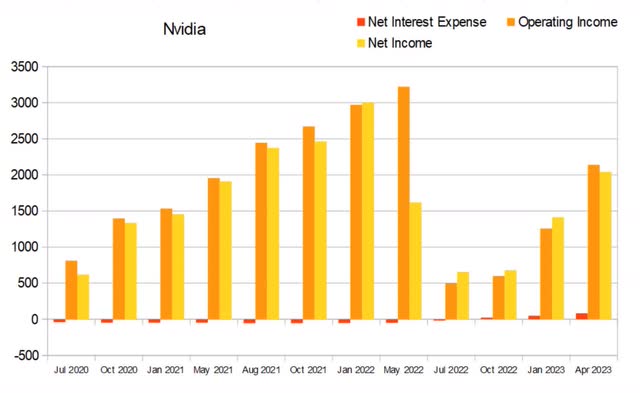

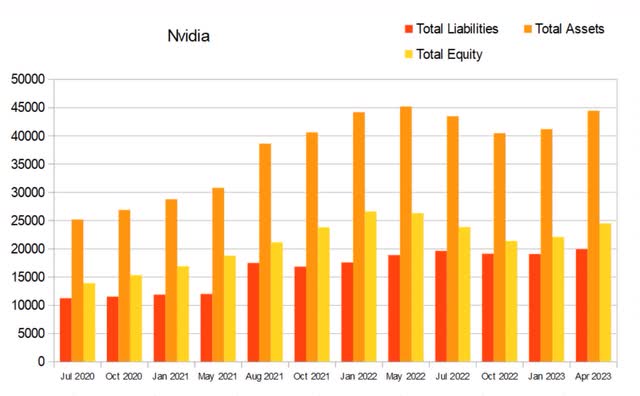

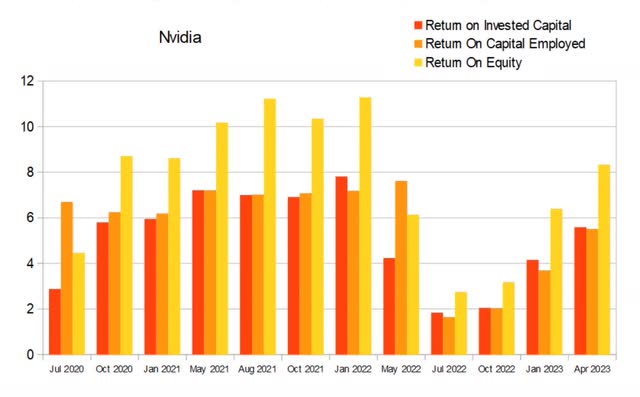

I should note here that each of the annual values for the following charts are from January to January. This means the global pandemic and chip shortage that both occurred during 2020, show up as affecting their 2021 numbers. This also explains why “2023” shows up on these charts; it spans from Jan 2022 to Jan 2023. The references I make in the following analysis are based on the values as labeled on the charts and not how they fall on the calendar year.

Nvidia roughly doubled its revenues in the years leading into the chip shortage. When the chip shortage struck, their annual revenue effectively doubled again.

NVDA Annual Revenue (By Author)

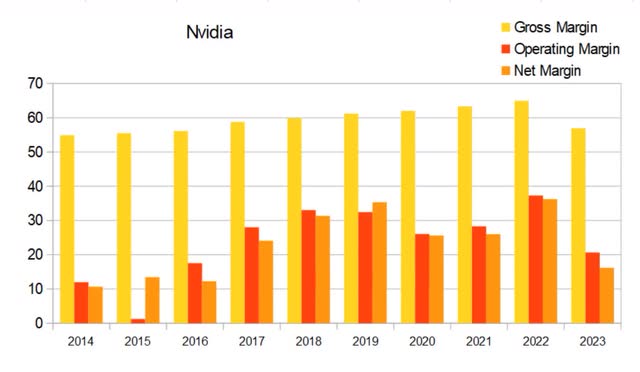

Gross margins are consistently excellent. Operating and net margins both experienced an expansion from their 2015 and 2016 values. Up until the most recent year, both operating and net have consistently stayed at or above 25.6%. Most of the last year has been characterized by the company pulling back its output, so it is likely an outlier year. As of the most recent annual data, gross margins were at 56.93%, operating margins were at 20.68%, and net margins were at 16.1%.

NVDA Annual Margins (By Author)

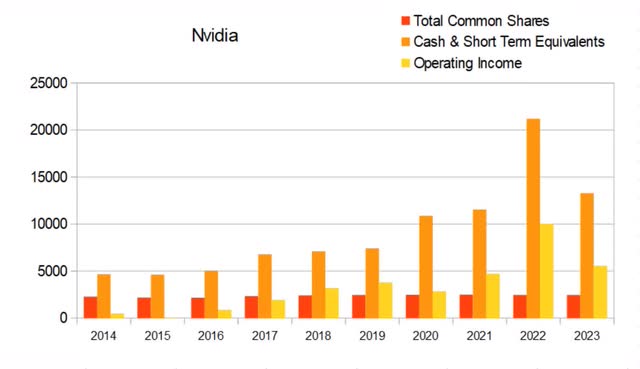

It is difficult to see on the chart, but the share count has been rising. As of 2014, there were 2.272B shares outstanding. By 2023, that had grown to 2.466B. This represents a 8.54% rise in share count. Over this same time period, operating income grew from 496M to 5.577B, representing a 1024% rise. This dilution has been highly accretive and so should not be viewed as a detriment for long-term investors.

NVDA Annual Share Count vs. Cash vs. Income (By Author)

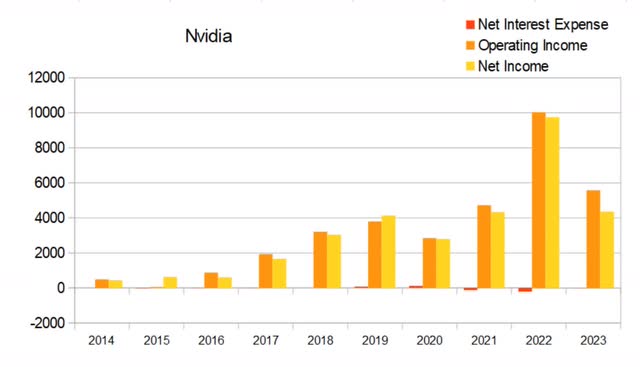

Annual net interest expense is consistently quite small. Like many companies, Nvidia attempts to cancel out their interest expenses with interest and investment income. With a ttm operating income of $4,496M and a total debt of $12,080M, Nvidia currently has a debt to income ratio of 2.68x.

NVDA Annual Net Interest Expense (By Author)

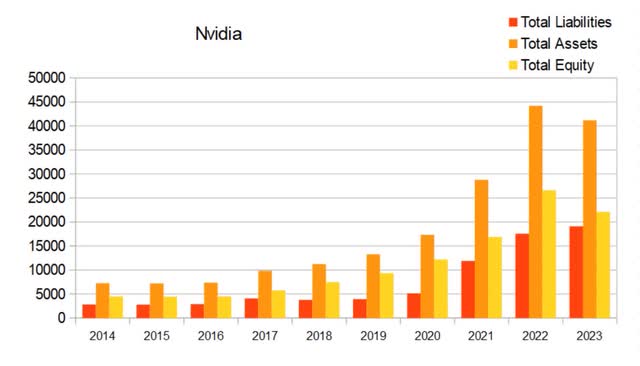

Their annual total equity has risen significantly since its previous levels from 2014 through 2016. Their 2022 value appears to be an outlier caused by the chip shortage. 2023’s total equity value appears to fall in line with the trend that had been established from 2017 through 2021.

NVDA Annual Total Equity (By Author)

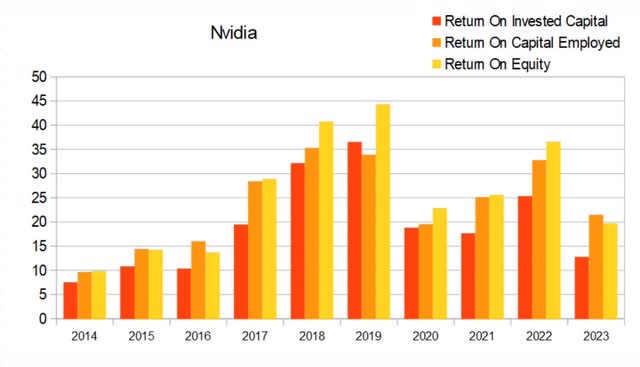

While annual returns do vary significantly, the company has managed to achieve truly impressive values in the past. Because of the significant lag time between increases in demand and our ability to meet that demand, I believe the semiconductor industry is more cyclical than not. Both their margins and their returns are subject to significant variance because of changes in demand. As of their Jan 2023 report, annual ROIC was at 12.80%, ROCE was at 21.53%, and ROE was at 19.76%.

NVDA Annual Returns (By Author)

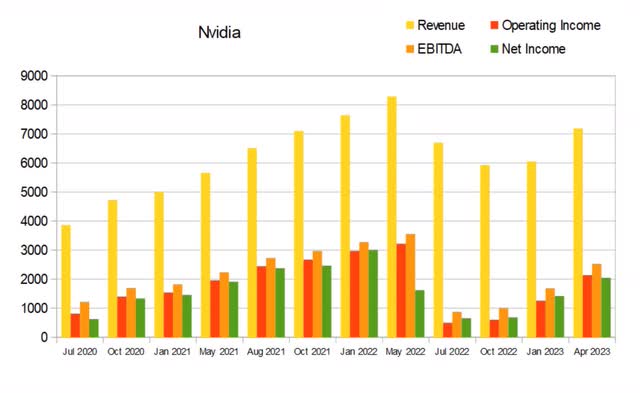

In mid-2022, Nvidia took a significant hit to their revenue which affected their income. The last three quarters have seen noticeable improvements to both revenue and income.

NVDA Quarterly Revenue (By Author)

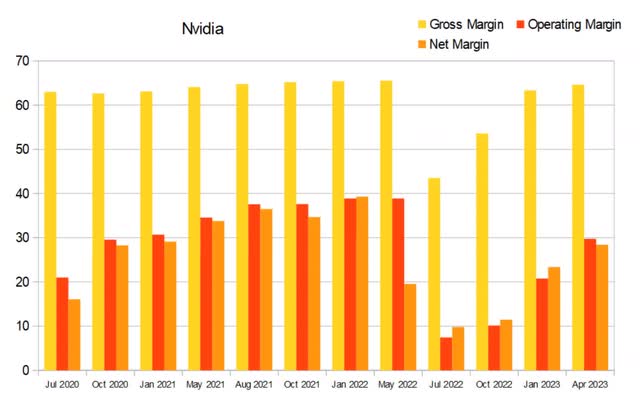

The significant drop in revenue that affected the above chart also caused a margin contraction. Gross, operating, and net margins have each been recovering for the last four quarters. As of the most recent quarter, gross margins were at 64.63%, operating margins were at 29.75%, and net margins were at 28.41%.

NVDA Quarterly Margins (By Author)

Their cash situation improved from January to April.

NVDA Quarterly Share Count vs. Cash vs. Income (By Author)

Their net interest expense has been positive for the last three quarters. It is rising, but still appears quite manageable when compared to their operating income.

NVDA Quarterly Net Interest Expense (By Author)

The above average returns caused by the chip shortage are re-normalizing their quarterly total equity curve. The most recent three quarters have total equity falling in line with the trend it was establishing in 2020 and 2021.

NVDA Quarterly Total Equity (By Author)

The mid-2022 revenue drop and margin contraction showed up as affecting both their ROIC and ROE the preceding quarter. The last three quarters have seen steady improvements to their returns. Although they are presently improving, I believe they are unlikely to trend past their 2021 values in the near future.

NVDA Quarterly Returns (By Author)

Valuation

As of Jun 7th, 2023, NVDA had a market cap of $955.96B and traded for $374.75 per share. With a forward P/E of 61.76x, a forward PEG of 1.34x, a forward EV/EBITDA of 50.58x, and a forward Price/Cash Flow of 48.95x, I view Nvidia stock as dramatically overvalued.

NVDA Valuation (Seeking Alpha)

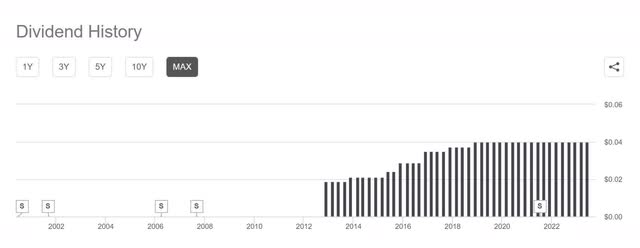

The company currently pays an annual dividend of $0.16. Using a discount rate of 9% and assuming their dividend stays stable for the next 20 years, a discounted cash flow calculator produces a fair value of $1.78 per share. This implies that no one is buying shares for today’s dividend value.

NVDA Dividend History (Seeking Alpha)

Risks

Nvidia faces continued competition from Taiwan Semiconductor Mfg. Co. Ltd. (TSM), AMD (AMD), Intel (INTC), Alphabet (GOOG) (GOOGL), Micron Technology, Inc. (MU), and others.

I believe the present rally that is affecting the A.I industry is unsustainable and when the euphoria wanes, valuations will drop significantly. As NVDA has benefited from the industry wide rally, it is also very likely to be affected from its decline.

Insiders have been selling Nvidia. I found a recent article detailing the activity. The number of sellers and the amount of insider selling can be used as a gauge to estimate insider sentiment.

Catalysts

The current wave of A.I euphoria could shift into an even higher gear. The rally A.I. companies have been experiencing is likely to continue for as long as the pace of A.I. adoption stays in the public eye.

Even though the woes caused by the global chip shortage have been abating, they could get worse. If say, another major fire were to break out at a competitors manufacturing facility, or a significant rise in demand were to occur, it would be a boon for Nvidia.

Conclusions

I believe Nvidia Corporation is a fantastic long-term hold, but I refuse to buy at today’s valuation. When I wrote my last article on Nvidia a month and a half ago, I concluded that the company was significantly overvalued. It has since gained an additional 35% in market capitalization.

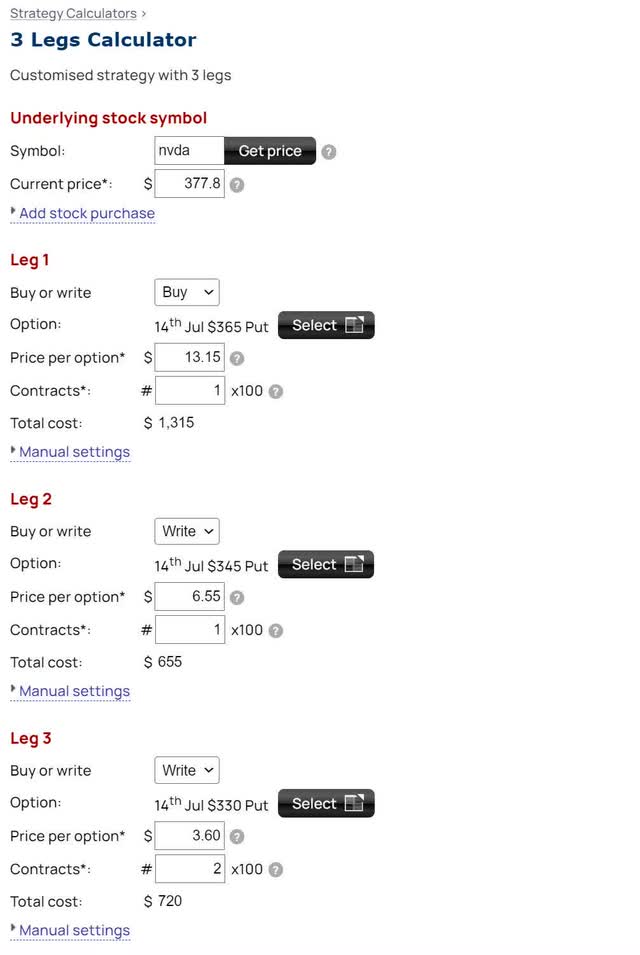

While I would consider buying at today’s prices to be a mistake, I also don’t believe NVDA is safe to short. If I was determined to make a play on Nvidia today, I would be forced to look at some form of front put ratio spread.

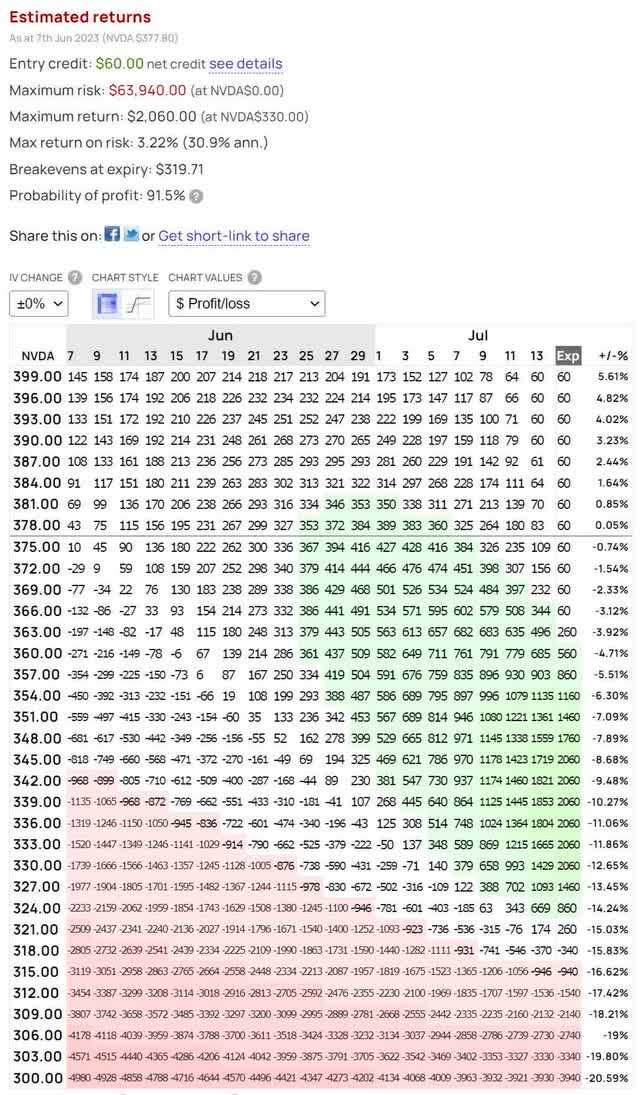

After playing around with several 2-leg spreads I decided to switch to a 3-leg spread in order to push the break-even lower. The put that you buy is paid for by the 3 puts that you sell. The way I set this one up, it has a max profit of $2060, extending through a range from $330 per share to $345 per share. The position has a 91.5% chance of ending up profitable at or above its break-even at $319.71 per share.

NVDA Options Trade 1 (Optionsprofitcalculator.com) NVDA Options Trade 2 (Optionsprofitcalculator.com)

A significant appeal to front put ratio spreads are that they end up earning profit even if the share price continues going up. If NVDA spends the next several weeks rising, it can still be closed for a small gain and a new front put ratio spread position can be entered.

Similarly, if Nvidia Corporation trades sideways until the expiry on July 14th, you would net $60 for your efforts and be able to immediately redeploy the capital into a new spread. With no way of telling when it will end, I consider this style of spread far safer than trying to short a fantastic company during a mania driven sector-wide rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.