Summary:

- Nvidia Corporation’s stock price has been on a yo-yo string the last three years, with valuations reaching a new apex in the summer of 2023.

- Analyst and investor expectations for Nvidia are aggressively high, and there is no room for disappointment in upcoming quarterly results.

- Shares are selling at 5x to 6x the valuation setup of a decade ago, with almost no future value being generated by underlying results vs. the price paid today.

- A large price decline is now required to bring back a sound, math-based reason to own the company.

Antonio Bordunovi

First, some background. I am the knucklehead that suggested Nvidia Corporation (NASDAQ:NVDA) would tank back to $100 a share, when the quote was around $300 in November 2021, explaining my overvaluation thoughts in a bearish article here. Well, price did collapse all the way down to $108 in October 2022, where I penned my upgrade article to Hold/Buy right at the bottom here.

I will admit to turning bearish again around $220 in February here, as the scope of approaching AI nuttiness was not easy to quantify. I explained how Nvidia was taking the mantle of “most overvalued” U.S. Big Tech stock away from Tesla (TSLA) at the time. And, I still hold this belief today.

YCharts – NVIDIA, 3 Years of Weekly Price Change

Amazingly, Nvidia catapulted to another double in price into July. So, now the company’s stock stands around $440 (reaching $480 last month), more than a +300% investment gain over 10 months of trading. My worry is the explosive rocket-ship ride has reached peak altitude and will now fall back to earth. If gravity takes over (common sense really for investors), the true underlying value of the company could be all the way back to $150 or $200 a share, even with AI tailwinds creating super-sized business growth into calendar 2024.

At 230x trailing EPS and a $1.1 trillion valuation, tremendous growth in sales and EPS better be coming, or there will be “hell to pay” for shareholder value. We’ll get a smarter read on actual results later in the month of August (earnings expected post-market August 23), as quarterly results are announced. Analyst and investor expectations are perhaps higher for Nvidia than any company I can remember since the early 2021 Wall Street boom. There is no room for disappointment.

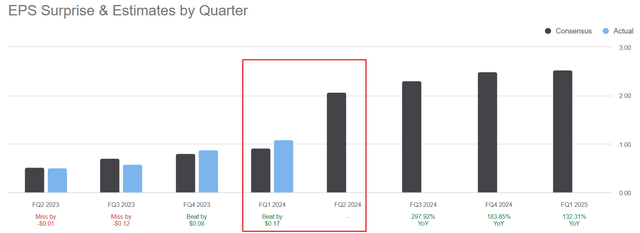

Current estimates for EPS are calling for a near double in income generation vs. last quarter, alongside a 400% increase vs. the year earlier quarter. Below is a graph of the EPS growth projection.

Seeking Alpha Table – NVIDIA, Wall Street Analyst Quarterly Earnings Results & Projections, FY 2023-24

In terms of probabilities, the scheduled August 23rd release date could mark a classic “sell the good news” event, where peak growth rates are achieved. Effectively, the shock and awe of outsized AI-related chip growth will be factored into the quote and valuation, meaning it is all downhill from there, both for actual growth rates and investor sentiment excitement.

Remember, Nvidia may have the clear lead in AI semiconductor chip designs and manufacturing, but competition from Advanced Micro Devices, Inc. (AMD), Qualcomm (QCOM), Intel (INTC) and others is not far behind. Once similar chips hit the market, outsized pricing and profits at the company will not remain, just like the craze for high-end crypto mining chips moved from a boom setup for the business in 2021, right before busting in 2022, halting all sales and income growth in total at Nvidia last year.

Valuation Makes No Sense

The heart of my argument in the historically cyclical semiconductor industry is valuations DO MATTER. Just like 2021’s situation, if you pay too much for growth, you can lose a considerable amount of money on your investment when expansion stalls.

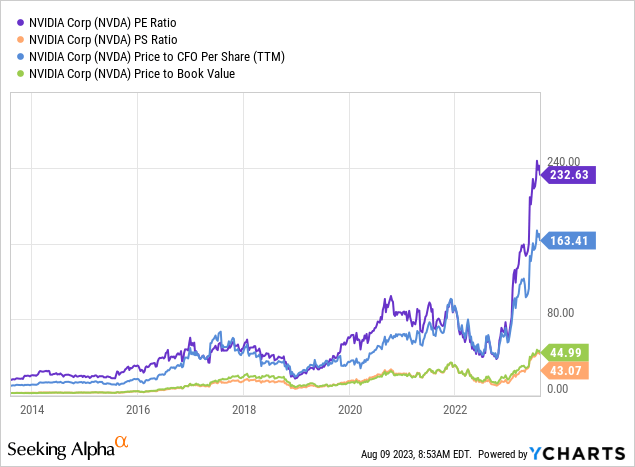

Here are the facts, whether you understand them or like them is up to you. For bargain hunters and math-based investors, you will notice the valuation position of a decade ago looked nothing like today.

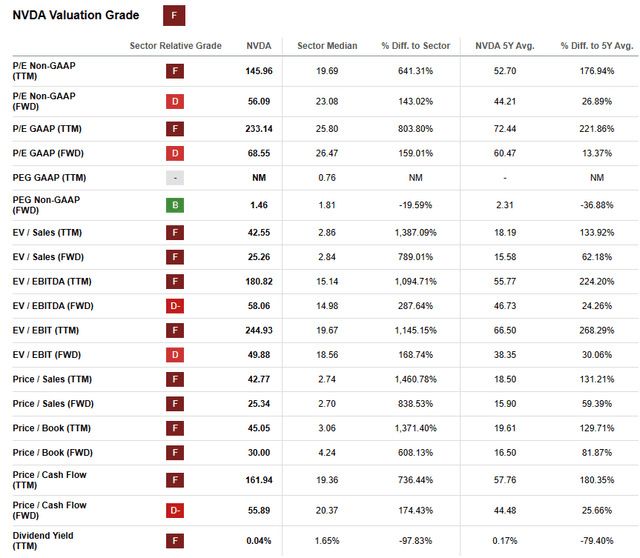

On basic fundamental ratio analysis, Nvidia is not only the most overvalued Big Tech stock today, but one of the most overvalued equities since the Dotcom stock boom of the late 1990s, in my estimation. Price to trailing earnings, sales, cash flow and book value have reached epic proportions, far above the previous 2021 peak.

YCharts – NVIDIA, Price to Trailing Fundamental Ratios, 10 Years

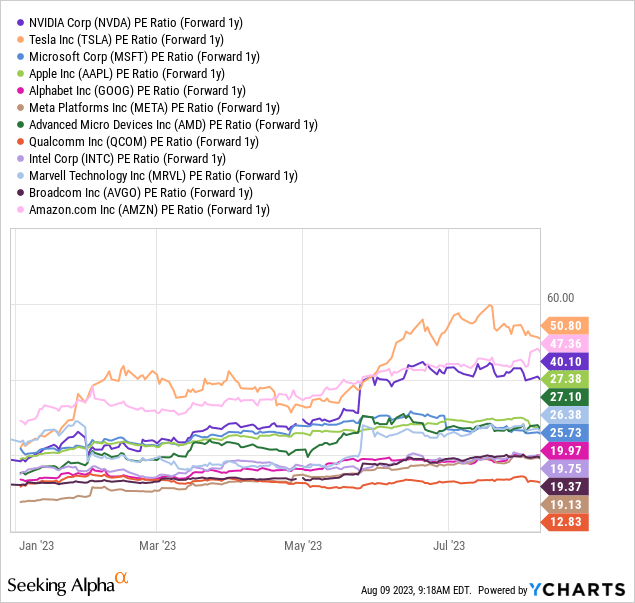

Yet, the stock market is a forward-looking machine. Investors are more concerned about future results. I get that. But, even rosy analyst estimates for next year (in my opinion, results will not be as positive after new competition enters the AI field) leave the stock incredibly overvalued. Below I have graphed a comparison of forward valuations to the largest Big Tech names and chip competitors most likely to introduce improved AI components.

The 40x share price multiple on forward 1-year EPS estimates is DOUBLE the level for this stat at the start of the year, while battling continually profit-less Amazon (AMZN) and electric vehicle-leader Tesla for the top spot regarding lofty company worth. I am currently bearish for a rating on Apple (AAPL), Tesla, Amazon, and Nvidia as a function of underlying business returns on investment making no logical sense vs. high inflation and interest rates. Keep reading for more on this concept.

YCharts – NVIDIA vs. Big Tech & Chip Peers, Price to Forward 1-Year Estimated Earnings, Since January 2023

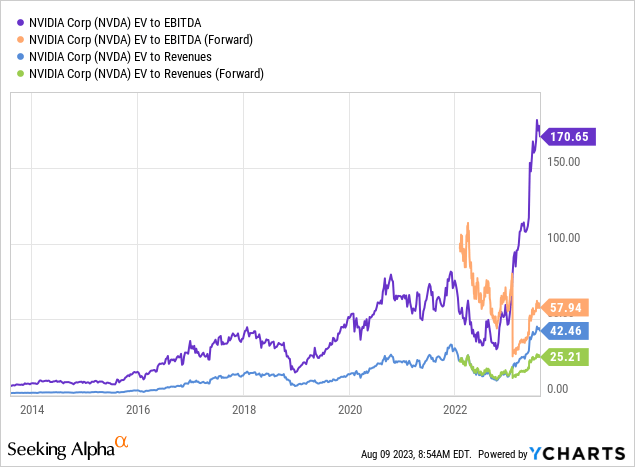

Even when we review enterprise valuations (accounting for debt and cash held on the balance sheet), shares are absolutely in nosebleed territory, very high up a mountain where it will be next to impossible to climb to greater elevations that do not exist.

EV to trailing EBITDA and sales have reached for exceedingly rich, new all-time highs for Nvidia this summer. Looking ahead, forecasts of dramatic business growth still leave the enterprise valuation at a level 5x to 6x the level of a decade ago! 58x future EBITDA and 25x sales, from a company of mammoth size, is somewhat unparalleled in my 37 years of trading.

YCharts – NVIDIA, Enterprise Value to EBITDA & Revenue Stats, 10 Years

The most damning evidence of how expensive Nvidia has become is pictured below vs. risk-free alternatives in the bond market. If you buy a 1-year Treasury security today, you are guaranteed to get 100% of your upfront investment PLUS 5.1% for interest. However, if you purchase Nvidia around $440 you risk all 100% of your investment to get just 0.4% in trailing earnings yield, and “maybe” 2% annually by calendar 2025, if current EPS forecasts prove correct while we avoid a major recession in the economy.

You are effectively taking on incredible risk in the “hopes” of getting relatively minor business returns on your money. Today’s -4.69% relative yield vs. short-term Treasuries is the EXACT opposite of the financial setup of 10 years ago, when Nvidia shareholders were reaping a +6% business yield on investment vs. equivalent bond market rates.

YCharts – NVIDIA, Earnings Yield vs. 1-Year Treasury Bills, 10 Years

Seeking Alpha’s computer ranking on valuation is giving the stock an “F” grade, which I believe is generous. An “F-” might be more appropriate when you contemplate the distance from industry-wide valuations in combination with Nvidia’s long-term history.

Seeking Alpha Table – NVIDIA Valuation Rank, Made August 8th, 2023

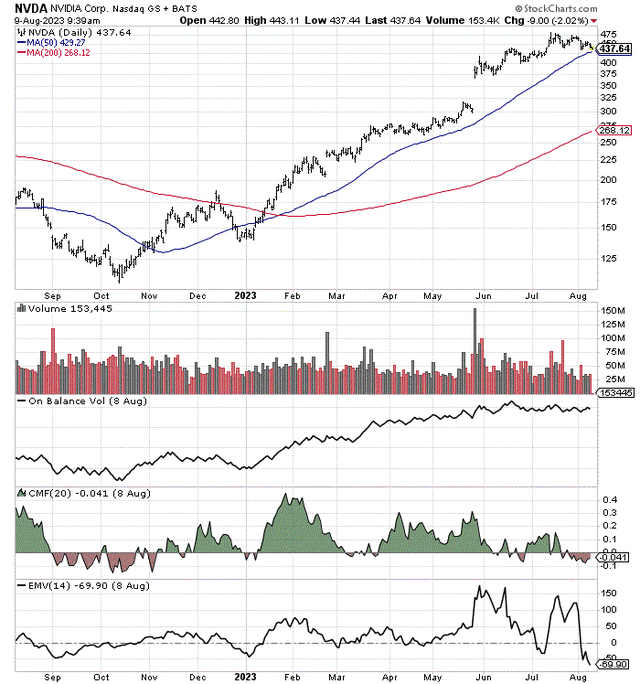

Technical Trading Chart

The daily chart over the last year has been bullish without doubt since October. Nevertheless, some warning signs of buyer exhaustion have been appearing since late July. For starters, On Balance Volume peaked in June, and has been highlighting a lack of new money entering the stock, despite the upward drift in price.

Other momentum indicators like the 20-day Chaikin Money Flow and 14-day Ease of Movement creations are now signaling more sellers than buyers, really for the first time since last fall. So, it is entirely possible the $480 July price was the top for this move, and perhaps forever, if serious competition and a deep recession are approaching into 2024.

StockCharts.com – NVIDIA, 12 Months of Price & Volume Changes

Final Thoughts

I have argued with Nvidia investors over the years about the cyclicality of its business over the decades. Sure, management has put the company in an enviable growth position time and again. But we haven’t had to deal with a deep recession in technology demand since 2009, a good 14 years ago. Believe it or not, in a prolonged recession, Nvidia EPS could evaporate and turn negative! Such an outcome is definitely not priced into the single greatest overvaluation of a company on Wall Street in August 2023.

What could change my mind and convince me to turn bullish on Nvidia? Fair question, but you won’t like my answer. There are only two ways I can envision myself flipping to a bullish rating. One is time. If in 3-5 years, the company has grown at rates now projected, and the stock price does not rise much over that span, an honest valuation proposition could again become reality.

The other way for Nvidia to morph into a buy would be through an oversized price dump. If the stock quote crashes and burns back to $150-$200 in a deep recession, a reasonable bullish argument may reappear.

Yet, at current pricing and valuations, this stock has zero interest from me. Should you short Nvidia? I am not doing so, because the greater fool theory is at play, where record overvaluations could expand a few months longer if the AI sentiment boom inflates a bit more. My view is investors should sell (or lighten up at a minimum) if they own a position, or just avoid the stock until the math makes sense again. The risk/reward setup is materially skewed toward risk today, especially when other stocks are nowhere near this expensive.

The Nvidia price drop from $330 to $108 over less than a year, between late 2021 and late 2022, should be enough of a cautionary tale for overly enthusiastic investors. Competition is a hallmark of American capitalism, and the company does not own a monopoly on innovation. If peers and competitors come up with stronger AI chip designs at lower cost for tech OEMs during 2024, we may look back at the Nvidia price boom of 2023 as the best time to sell its shares, maybe ever.

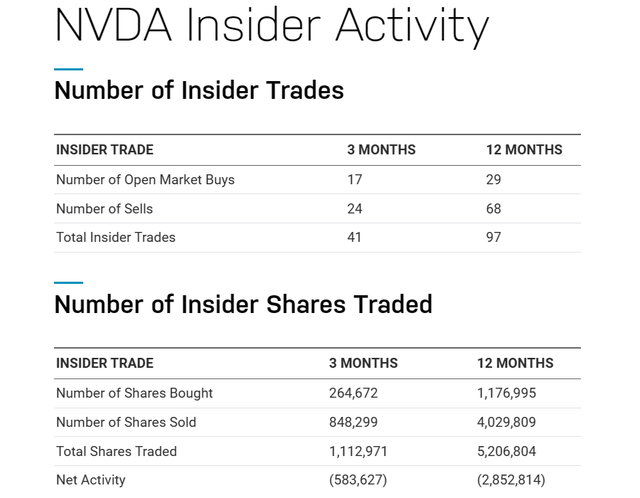

Nvidia management and insiders have sold nearly $1 billion in net stock value over the last 12 months. They are very willing to lock-in the extraordinary gains of the Tech Boom 2.0 move over the last decade. Long-term thinkers and stock allocators should view the extraordinary 2023 strength as an excellent opportunity to run for the exits.

Nasdaq.com – NVIDIA, Insider Trading Reported to SEC, Past 12 Months

You may disagree with my level-headed, math-based analysis in the comment section. But, for the company to be “worth” $400+ a share, with risk-free interest rates of 5% available for investment over the next 2-3 years, Nvidia would have to be generating $40 billion in after-tax profits soon to justify $1.1 trillion in company value. Unfortunately, revenues on a trailing basis are $26 billion.

Conceptually, calendar 2023 earnings will have to double the level of 2022, then double again in 2024, then double again in 2025! That would be the highest rate of growth in human history for an enterprise already sized in the Top 10 of market capitalizations globally. Sounds like a huge stretch to me, even for Nvidia Corporation perma-bulls and complete AI chip optimists.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.