Summary:

- Nvidia reported Q3 revenues of $18.12 billion, exceeding expectations and showing a more than 205% increase from the previous year.

- Data Center revenue reached a record $14.51 billion, up 41% from the previous quarter and 279% from a year ago.

- Despite sky-high expectations and surging analyst estimates, Nvidia shares trade at a reasonable valuation.

We Are

After the bell on Tuesday, we received fiscal third quarter results from Nvidia (NASDAQ:NVDA). The chipmaker has been one of the best performing names in recent years, and the stock has been close to an all-time high lately as data center revenues have soared thanks to the beginning of an artificial intelligence revolution. Despite extremely high expectations going into this report, the company again found a way to impress.

For Q3, the company reported revenues of $18.12 billion. Not only was this number nearly $2 billion ahead of the average street estimate, but it was more than 205% higher than the prior year period. The main highlight here was Data Center revenue, coming in at a record $14.51 billion, up 41% from the previous quarter and up 279% from a year ago. Gaming revenues also rose by 81% over Q3 2023 and Professional Visualization saw its sales up 108%.

These results are even more impressive when you consider how the situation here has evolved. A couple of quarters ago was the “jump the shark” moment where the company issued tremendous guidance, surprising everyone. It was this time last year where the average street estimate for the just reported quarter was for less than $8 billion in revenues. That number more than doubled from there and the company still came in well ahead of the street.

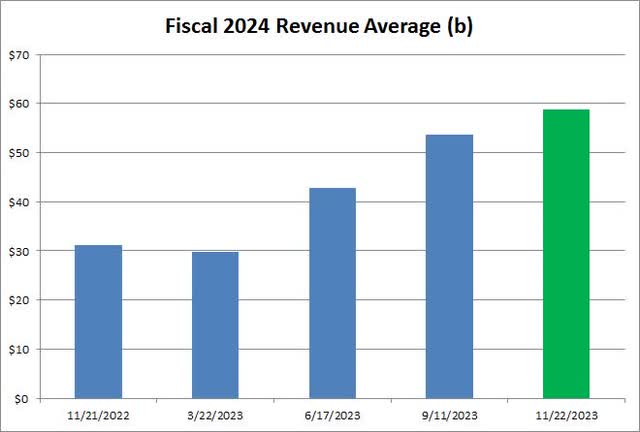

For the 2024 fiscal year, I’m not sure that we have ever seen a large cap company’s estimates move like this before. If you take the reported results from the first three quarters of the year, and add guidance for Q4, you get almost $59 billion for the 12-month period. That number, seen in green in the chart below, would be more than $27.5 billion above where the average street estimate stood just a year ago, a dramatic rise of more than 88%.

Fiscal Year Revenue Average (Seeking Alpha, Nvidia Guidance)

For Q4, management stated that revenue is expected to be $20.00 billion, plus or minus 2%. That guidance was well ahead of the street, which was looking for about $17.82 billion. While I know expectations were high, that’s still a solid forecast, especially since you have to figure the company wouldn’t guide that high if they didn’t think they could deliver the goods. Remember, Nvidia beat its own forecast for Q3 by more than $2 billion.

The revenue surge has been impressive, but things have filtered down to the bottom line even more. Gross margins for Q3 on a non-GAAP basis were 75%, up nearly 19 percentage points from the year-ago period. Despite revenue growth well above 200%, adjusted operating expenses only rose by 13%. As a result, non-GAAP net income came in at more than $10 billion, up nearly 600% from the $1.46 billion reported a year earlier. Non-GAAP EPS of $4.02 crushed the street by $0.63, growing just a little more in percentage terms than net income thanks to some help from share repurchases.

Nvidia’s strong results also helped improve the company’s balance sheet. Free cash flow of more than $15.7 billion has been generated in just nine months, up from about $2 billion in the year ago period. Despite spending more than $7 billion on the buyback and dividends so far in the fiscal year, the cash position here has risen by about $5 billion to $18.3 billion, while total debt is down by more than a billion dollars. Assuming these tremendous cash flow trends continue, the company over the next year or two should be able to meaningfully start lowering its share count should it choose to do so.

Despite shares being near their all-time high, I think investors can still buy in currently. When adjusting for the beat and Q4 guidance, the stock is trading for about 27.5 times its next fiscal year’s non-GAAP EPS. That number is actually lower than fellow large cap tech peer Microsoft (MSFT), which is growing much slower than Nvidia. I think it’s fair to pay this amount for Nvidia, which could grow non-GAAP EPS by another 50% next year after growth this year of close to 250%. Margins don’t even have to improve further, because the revenue growth driving more gross margin dollars combined with more cash now earning around 5% and or buybacks lowering the share count can really help the EPS number.

In terms of the three big chipmakers, Nvidia actually trades at a cheaper valuation than Advanced Micro Devices (AMD). AMD might show comparable earnings per share growth next year, after a down year this year, but it also trades at more than 34 times its expected earnings next year. Intel (INTC), which is on the road to recovery from a down few years, goes for about 25 times its expected 2024 earnings, but those numbers are well off what Intel did a few years ago.

In the end, Nvidia crushed it yet again, with revenues and non-GAAP earnings per share both coming in handily above street estimates. Three of the company’s segments more than doubled year ago revenues, with the Data Center up nearly 280%. With margins expanding on this sales boom, the bottom line is taking off, yet the valuation here is still reasonable. It would not surprise me to see Nvidia shares hit a new high rather soon, and the name is set up for good things moving forward. If this report turns into another “buy the rumor, sell the news” event, I think investors should take a look at this opportunity from a growth story unlike one we’ve seen before.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.