Summary:

- Nvidia Corporation’s stock has surged, briefly making it the world’s largest company by market capitalization.

- Nvidia’s data center business has quadrupled year over year, with CEO Jensen Huang predicting an additional $1 trillion in data center investment in the next four years.

- Despite Nvidia’s extraordinary growth, there is room left to run, as the global data center rush has only just begun.

- We explore the booming data center industry, focusing on forward developments and Nvidia’s market dominance.

LauriPatterson/iStock via Getty Images

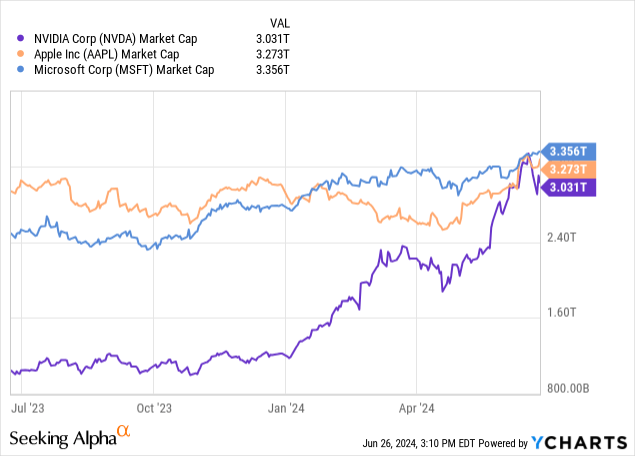

Over the past several years, the rise of Nvidia Corporation (NASDAQ:NVDA) stock has been one of the most significant financial representations of the artificial intelligence gold rush. With the benefits of AI espoused far and wide, it comes as no surprise that the largest manufacturer of data center chipsets is benefiting symmetrically. No piece of NVDA’s story was more impressive than last week, when NVDA briefly became the world’s largest company by market capitalization.

As NVDA surges past the largest businesses in the world, including Apple (AAPL) and Microsoft (MSFT), the company’s success comes under increasing scrutiny as the valuation balloons. Behind the company’s obvious dominance as the world’s largest producer of critical chipsets for next-generation computing is a critical piece of global AI infrastructure. Looking to the future ahead, NVDA’s rapidly expanding business has begun to segment into different verticals, led by the data center enterprise.

The company’s data center business grew 409% year over year in the final quarter of last year. Quickly, data centers have become NVDA’s largest business unit as the growth of AI creates an unprecedented demand wave for GPUs. Today, we will explore NVDA’s data center business in greater depth and explain why new development and forecasted growth in power demand will benefit the chipmaker.

Nvidia’s Data Center Business

According to NVDA CEO Jensen Huang, more than $1 trillion in data center infrastructure and hardware will be built over the next four years, doubling the current global supply of computing power. Despite increases in efficiency over the long term, Huang believes that the extraordinary rise of AI means data center spending is likely to skyrocket, marking the “beginning of this new era.” NVDA has already begun to benefit as this prediction unfolds, and the data center business begins to skyrocket over the past twelve months.

NVDA’s data center business logged $18.4 billion in gross sales in the fourth quarter alone, marking an increase of over 400%, year over year. Additionally, the figure surpasses consensus estimates of $17 billion by nearly 10%. Total unit sales for 2023 data center GPUs were estimated at 3.76 million, estimated by TechInsights.

Forward forecasts are strong for the data center segment on all fronts. In first quarter earnings, Huang was extraordinarily optimistic about the growth of the data center business. NVDA reported $22.6 billion in data center revenue for the first quarter, up 23% from the fourth quarter and 427% from the comparable quarter of the prior year. Huang commented on the explosive growth.

Our data center growth was fueled by strong and accelerating demand for generative AI training and inference on the Hopper platform. Beyond cloud service providers, generative AI has expanded to consumer internet companies, and enterprise, sovereign AI, automotive and healthcare customers, creating multiple multibillion-dollar vertical markets…

We are poised for our next wave of growth. The Blackwell platform is in full production and forms the foundation for trillion-parameter-scale generative AI. Spectrum-X opens a brand-new market for us to bring large-scale AI to Ethernet-only data centers. And NVIDIA NIM is our new software offering that delivers enterprise-grade, optimized generative AI to run on CUDA everywhere — from the cloud to on-prem data centers and RTX AI PCs — through our expansive network of ecosystem partners…

Since the introduction of generative AI software including ChatGPT, demand for NVDA chipsets, including the H100, has increased significantly. Following the success of ChatGPT, other software giants including Meta Platforms (META) and Alphabet (GOOG) have introduced competing AI-based software to compete with ChatGPT’s growing platform.

These programs require enormous amounts of electricity and computing power to facilitate basic operations. For example, according to research from EPRI, a Google search uses just 0.3 watt-hours while a query using ChatGPT requires 2.9 watt-hours, nearly 10x the power.

According to HPCwire, NVDA maintains near complete dominance over the data center GPU market, capturing 98% of total market share.

Nvidia had a dominant 98% market share in data-center GPU shipments in 2023, similar to market share numbers in 2022.

When including AMD and Intel, the total data-center GPU unit shipments in 2023 totaled 3.85 million, growing from about 2.67 million units in 2022, according to TechInsights.

Nvidia also had a 98% revenue share of the data-center GPU revenue market with $36.2 billion, more than three times the growth from $10.9 billion in 2022.

While other manufacturers including Intel (INTC) and Advanced Micro Devices (AMD) are pursuing competing technologies, NVDA has won the early stages of the war, establishing a dominant position in the industry and segment. For example, Mark Zuckerberg has commented that META’s computing infrastructure will include over 350,000 H100 graphics cards by the end of 2024. Based on an estimated commercial price of $25,000 to $30,000 per unit.

Data Center Demand

Recently, we authored an article taking a critical and in-depth look at rising power demand around the world. As AI contributes to the global, “once in a lifetime” computing gold rush, demand for electricity is surging. Despite increases in efficiency which have historically held steady with elevating demand, the power demand of AI is sufficient to move the needle.

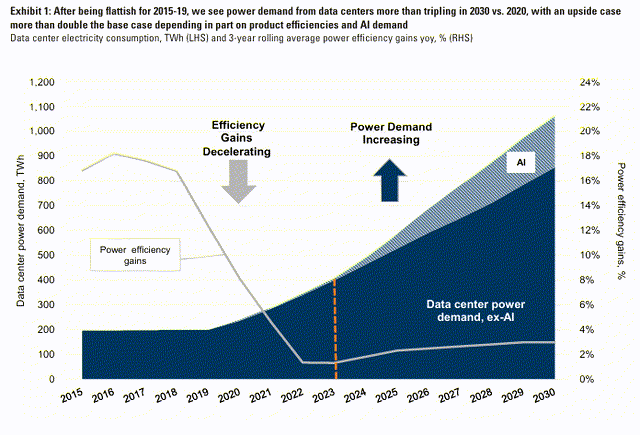

Over the next five years, global data center power demand is forecasted to more than double, expanding to nearly 10% of total power demand in the US. This is a significant divergence from the past ten years, which has seen virtually zero movement in energy demand for data centers.

Research from large financial institutions including Goldman Sachs (GS) forecasts a significant increase in power demand across the United States. Through 2030, GS forecasts a 15% forward compound annual growth rate in raw power demand for data centers through the end of the decade.

Should forecasts prove correct, data centers will then comprise nearly 10% of aggregate US power demand, a significant increase from current estimates of around 1%-2%. Increasing demand points to a divergence in total power demand for the nation. Over the past decade, demand was largely offset by increasing efficiency. This meant power demand change remained at a net-zero over the span of decades. Data center demand could become the largest demand driver, increasing the net growth rate by 2.4%.

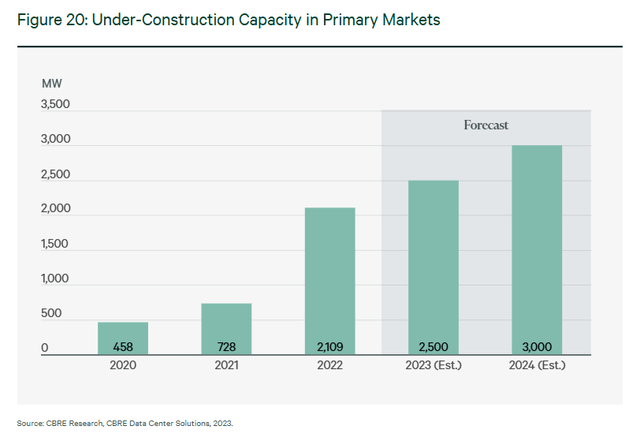

A recent report from CBRE outlines the growing outlook of data center demand across the world.

Demand for new data center development likely will attract more institutional investment in 2024, as investors are under-allocated to digital infrastructure by 1.5% to 3% compared with other asset classes. Power supply in primary markets increased by 19.2% year-over-year in H1-2023, leading to a 25% increase in new data center construction activity. We expect construction activity in primary markets to surpass 3,000 MW in 2024.

Construction completion timelines have been extended by 24 to 72 months due to power supply delays. We believe that Austin-San Antonio and Omaha will continue to see significant interest from investors and developers due to land availability, power infrastructure development and tax incentives.

However, increasing demand has been met with a critical issue for data center operators. Ongoing capital expenditure to modernize quickly aging data centers is proving an extraordinary cost for data center landlords like Equinix (EQIX). For example, older facilities cannot accommodate the necessary cooling systems demanded by modern data centers. What appears as an issue for some data center owners is a near certain opportunity for NVDA. Larry Ellison, Chairman of Oracle (ORCL) recently commented on the complexities of upgrading legacy assets.

This AI race is going to go on for a long time. It’s not a matter of getting ahead, just simply getting ahead in AI, but you also have to keep your model current. And that’s going to take larger and larger data centers. … The data centers we are building include the power plants and the transmission of the power directly into the data center and liquid cooling. And because these modern data centers are moving from air cooled to liquid cooled, and you have to engineer them from scratch. And that’s what we’ve been doing for some time. And that’s what we’ll continue to do.

NVDA continues to innovate across their data center product line. This past quarter saw the introduction of several new products in the data center segment, including the Quantum and Spectrum X800 series switches. As NVDA continues to innovate across the segment, these new products will become critical for operators looking to maintain a competitive position. Data center operators like EQIX are critical partners for NVDA and their ongoing requirement for new chips to either open new facilities or upgrade existing facilities is a significant tailwind.

Outlook & Conclusion

As data center demand continues to grow at a rapid pace, NVDA stands to be one of the most significant beneficiaries. With 98% of the current market share, no competitor is positioned to seriously compete with NVDA to supply the rising global data center demand. As NVDA continues to innovate, data center operators are pushing to build new facilities and adapt existing facilities to the next generation of customer expectations.

Increasing power demand, combined with the raw demand for computing power, continues to power extraordinary demand for data centers looking forward. As CBRE continues to forecast extraordinary growth in data center output, NVDA is the most likely candidate to provide the physical components necessary to make the prediction a reality.

Over the past two years, NVDA’s data center segment rose to become the largest individual component of the company’s business. Markets and Markets forecasts that the data center GPU market is expected to grow by 35% annually over the next five years, quadrupling annual demand by 2030. As forward demand is forecasted to grow exponentially, NVDA has more upside left in the tank for new and existing products. As the company grows to occupy the seat briefly as the largest in the world, new and growing demand could act as a further driver for the technology giant.

NVDA has laid aggressive plans, including the path to a “million-plus GPU” data center. As technology aligns to the GPU renaissance, there is one market participant that stands head and shoulders above the rest.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.