Summary:

- Nvidia Corporation remains the clear leader in the AI race, as observed in the double beat FQ3 ’25 results and promising FQ4 ’25 guidance.

- While there appears to be a deceleration in growth, readers must note that it is merely attributed to the law of large numbers, as the consensus raise their forward estimates.

- If anything, Nvidia may continue to benefit from this super cycle of cloud computing, as AI adoption accelerates across the Big Tech, SMB companies, and governments.

- The number of AI start-ups have ballooned to 70.71K by 2024, with market analysts expecting the AI market to further grow to $826.70B by 2030 at CAGR of +28.4%.

- While there may be risks from intensified trade restrictions along with reliance on key hyperscaler customers, we believe that NVDA may remain the linchpin during the multi-year generative AI boom.

DNY59/E+ via Getty Images

Nvidia Remains Attractively Valued As The Undisputed Market Leader

We previously covered Nvidia Corporation (NASDAQ:NVDA) in September 2024, discussing its winning position in the AI accelerator race and its robust long-term prospects, as similarly highlighted by Taiwan Semiconductor Manufacturing Company aka TSMC (TSM).

Combined with the management’s robust forward guidance, raised consensus forward estimates, and cheap PEG ratio, we had continued to rate the stock as Buy then.

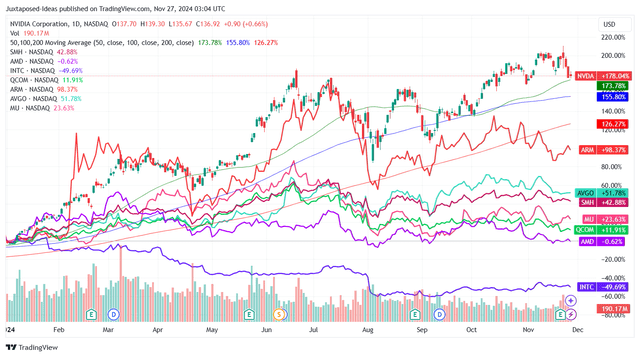

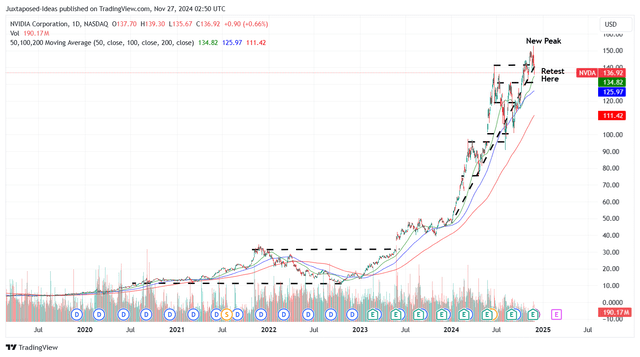

NVDA YTD Stock Price

Since then, NVDA has delivered another +17.2% in overall returns, well outperforming the wider market at +7.2% and its semiconductor peers to a large degree.

Much of the outperformance is naturally attributed to NVDA’s undisputed leadership in the AI accelerator market. Competition likely will only come in the form of custom ASICs currently pursued by deep pocketed hyperscalers, as similarly observed in Advanced Micro Devices’ (AMD) and Intel’s (INTC) underwhelming data center results in the recent earnings calls.

It goes without saying that NVDA’s Blackwell offerings remain the top choice for the top global cloud providers, including Microsoft (MSFT), Google (GOOG), Meta (META), and Amazon (AMZN). The Elon Musk owned xAI also aims to deploy up to $9B worth of AI chips by mid-2025 — with the loyal consumer base likely to trigger the former’s long-term growth.

Combined with the “strong structural AI-related demand” confirmed by the world’s largest global foundry by market share, TSM, it is unsurprising that NVDA has already reported a double beat FQ3 ’25 earnings call, with revenues of $35.08B (+16.7% QoQ/ +93.5% YoY) and adj EPS of $0.81 (+19.1% QoQ/ +101.5% YoY).

Despite the notable moderations from the peak gross margins of 78.4% recorded in FQ1 ’25, the FQ3 ’25 numbers of 75% and the FQ4 ’25 guidance of 73.5% remains more than excellent compared to the FY2019 averages of 61.2%. It underscores the company’s robust pricing power as the undisputed leader of the AI chip market.

Moving forward, we believe that NVDA may continue to benefit from this super cycle of cloud computing, as AI adoption accelerates across the Big Tech, SMB companies, and governments, as similarly reported by numerous SaaS players, particularly Palantir (PLTR) and AppLovin (APP).

The number of AI start-ups have also ballooned to 70.71K by 2024, with market analysts expecting the AI market to further grow from $184B in market value in 2024 to $826.70B by 2030, expanding at an accelerated CAGR of +28.4%.

These developments continue to point to the durability of AI demand, with sales growth naturally gated by supply, in this case, the AI chips’ computing power. This perhaps underscores why NVDA has introduced its next-gen chips after Blackwell, namely Rubin, with the latter set to commence mass production from Q4 ’25 onwards and commercially launched in 2026.

This naturally builds upon the Blackwell’s improved performance at 2.2x gain in MLPerf v4.1 AI training benchmarks compared to Hopper, while being 4x cheaper in the long-run.

Therefore, while there may be risks from intensified trade restrictions along with reliance on key hyperscaler customers, we believe that NVDA remains the linchpin of the generative AI boom. There remains a high barrier of entry for those looking to unseat the market leader.

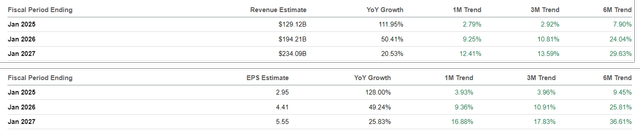

The Consensus Forward Estimates

If anything, NVDA continues to offer promising FQ4 ’25 revenue guidance of $37.5B (+6.8% QoQ/ +69.6% YoY), despite the tougher YoY comparison, thanks to the Blackwell currently is in full production along with the staggering consumer demand.

These reasons may also be why the consensus forward estimates remain promising, with NVDA still expected to chart an accelerated top/ bottom-line growth at a CAGR of +56.6%/ +62.4% through FY2027.

While the law of large numbers may have caught up to NVDA’s growth profile, we believe that it may continue to deliver robust performance moving forward. This is observed in the raised estimates compared to the original numbers of +38%/ +40.7% and the historical growth at +39.1%/ +50.8% between FY2019 and FY2024, respectively.

This is on top of its increasingly richer balance sheet at a net cash position of $30.02B by FQ3 ’25 (+14% QoQ/ +249.8% YoY), with it allowing the company to strategically invest in its long-term growth opportunities.

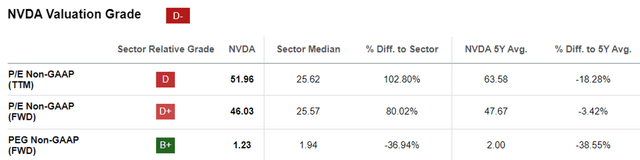

NVDA Valuations

These accelerated growth prospects are also why we believe that NVDA remains attractively valued at FWD P/E non-GAAP valuations of 46.03x, compared to its 5Y mean of 47.67x, the 10Y mean of 36.80x, and the SMH P/E ratio of 40.55x.

The same may be observed in NVDA’s reasonable FWD PEG non-GAAP ratio of 1.23x. This compares to the 5Y mean of 2x, the 10Y mean of 0.75x, the sector median of 1.94x, and its direct peers, including AMD at 1.00x and Broadcom (AVGO) at 1.72x, with it offering interested investors with an excellent margin of safety.

So, Is NVDA Stock A Buy, Sell, or Hold?

NVDA 5Y Stock Price

For now, NVDA continued to chart new heights as it remains well-supported at its 100-day moving averages, with it signaling the stock’s robust bullish support.

For context, we had offered a fair value estimate of $84.30 in our last article, based on the LTM adj EPS of $2.21 ending FQ2 ’25 (+316.9% sequentially) and the 1Y P/E mean valuations of 38.15x.

Based on the LTM adj EPS of $2.62 ending FQ3 ’25 (+201.1% sequentially), it is apparent that the stock has run away from our updated fair value estimates of $99.90.

Even so, based on the consensus FY2027 adj EPS estimates of $5.55, there remains an excellent upside potential of +54.6% to our long-term price target of $211.70, with it resulting in our reiterated Buy rating for the NVDA stock.

For now, given the recent profit taking and the stock’s inability to break out of the $148s resistance levels, interested investors may want to monitor the stock price movement for a little longer before pulling the trigger. This would preferably be upon a bounce from the $130 support level for an improved margin of safety.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AVGO, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.