Summary:

- Last Wednesday, Nvidia announced that its second-quarter sales rose by a whopping 122.4% to $30.04 billion vs. $13.51 billion in the same quarter last year.

- Last Friday, the Commerce Department announced that the Fed’s favorite inflation indicator, namely the Personal Consumption Expenditure (PCE) index, rose just 0.2% in July and 2.5% in the past 12 months.

- Now that inflation has effectively been tamed, the Fed is belatedly turning its attention to the job market, since the unemployment rate has risen from 3.4% to 4.3% in the past 15 months.

- I should add that the U.S. power grid added 21% in new electricity generating capacity in the first six months of this year via solar, wind and nuclear power.

BING-JHEN HONG

Last Wednesday, Nvidia (NASDAQ:NVDA) announced that its second quarter sales rose by a whopping 122.4% to $30.04 billion vs. $13.51 billion in the same quarter last year. During the same time span, Nvidia’s operating earnings per share rose 151.9% to $19.94 billion or 68 cents per share vs. $7.78 billion (27 cents per share) last year. The analyst community was expecting sales of $28.74 billion and operating earnings of 65 cents per share, so the company posted a 4.5% positive sales surprise and a 4.6% earnings surprise.

For the third quarter, Nvidia provided sales guidance of $32.5 billion (plus or minus 2%), which was 2.5% above the analysts’ consensus estimate of $31.7 billion. In a written statement, Nvidia’s Chief Financial Officer, Colette Kress, said, “We shipped customer samples of our Blackwell architecture in the second quarter,” adding that, “We executed a change to the Blackwell GPU mask to improve production yield. Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal 2026. In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue.”

This was important news, since there had been endless reports that Nvidia was delaying its new Blackwell GB200 by at least three months, so the company’s announcement that deliveries will ramp up in the fourth quarter clarified the situation.

At the same time, Nvidia also posted better-than-expected sales, earnings and guidance on its older AI chip, namely the H100 GPU. Google (GOOG) (GOOGL), Meta (META), and Microsoft (MSFT) are betting billions on Nvidia’s GPUs as the AI arms race escalates. For example, Google has ordered more than 400,000 GB200 chips, an order worth over $10 billion. Meta also has a $10 billion order in, while Microsoft is expecting to have 55,000 to 65,000 GB200 GPUs ready for OpenAI by Q1 of 2025.

The initial delay in the Blackwell GB200 GPU was reportedly due to a Taiwan Semiconductor glitch attaching two GB200 chips together. As a result, Nvidia’s guidance on the delivery of its Blackwell GB200 GPUs and order backlog was more important than its actual quarterly sales and earnings.

It is important to stress that Nvidia is effectively a monopoly, in that they spent approximately $2 billion to develop the Blackwell GB200 GPU. Furthermore, Nvidia is expecting to upgrade its flagship AI chipset every year until the end of the decade. Several years from now, Nvidia may not be able to make its chips much faster, since its transistors will be so tiny they will be approaching the “atomic” level.

Since splitting atoms is not a good idea, the next step to speed up AI calculation will be Quantum computing, which uses both 1’s and 0’s, in its calculations. Anticipating this change, Nvidia already has a Quantum Cloud Simulator up and running to prepare for the future acceleration of AI calculations.

It is also important to mention here that Nvidia’s competitors are making lower-grade AI chipsets. Regenerative AI, which is effectively machine learning, remains Nvidia’s domain. To effectively compete with Nvidia, its competitors would have to spend several billions of dollars over the next several years, which would likely prove to be a futile exercise.

Momentum and market share are important in the world of technology. With Regenerative AI moving so fast, it is hard for any new competitors to Nvidia to emerge, let alone allocate the capital and resources required to try to compete with Nvidia any time soon.

Historically, my strategy has been to invest in monopolies before the inevitable competition could emerge. Some of my best past monopolies include Conair (OTCPK:CNGA) (hair dryers in the 1980s), Tyson Foods (TSN) (McNuggets & chicken tenders in the early 1990s), Hanson Natural (subsequently renamed Monster Beverage, in the mid-2000s) and now Nvidia (first bought back in 2016 through 2018). I recommended Nvidia again in May 2019 and am proud that I am up well over 3,000% from that second purchase.

However, unlike those past monopolies, where competition typically emerged within a few years, I do not anticipate any effective competitors to emerge to disrupt the Regenerative AI monopoly that Nvidia dominates.

As a result, I am planning on holding Nvidia for several more years and hope you are enjoying the ride in this great company that is truly a “once in a lifetime” stock that can transform both your portfolio and lifestyle! That’s the basic story I wrote in an article last Wednesday (“Nvidia has all the pieces in place for a positive quarterly earnings surprise”), before their earnings came out.

I should add that another AI-related stock that is dependent on Nvidia, namely Super Micro Computer (SMCI) was hit last week after a short seller, Hindenburg Research, issued a questionable research report last Tuesday. Since the short attack took place in the week prior to Labor Day, trading volume was light.

Unfortunately, on Wednesday, Super Micro Computer decided to postpone its 10-K filing in order to review its accounting methodology. Specifically, the company said, “Additional time is needed for SMCI’s management to complete its assessment of the design and operating effectiveness of its internal controls over financial reporting as of June 30th.” Ouch! That caused further selling of Super Micro Computer, so what they should do now is provide updated guidance to calm down nervous investors.

Update on Our Stock Data Base Through August 31, 2024

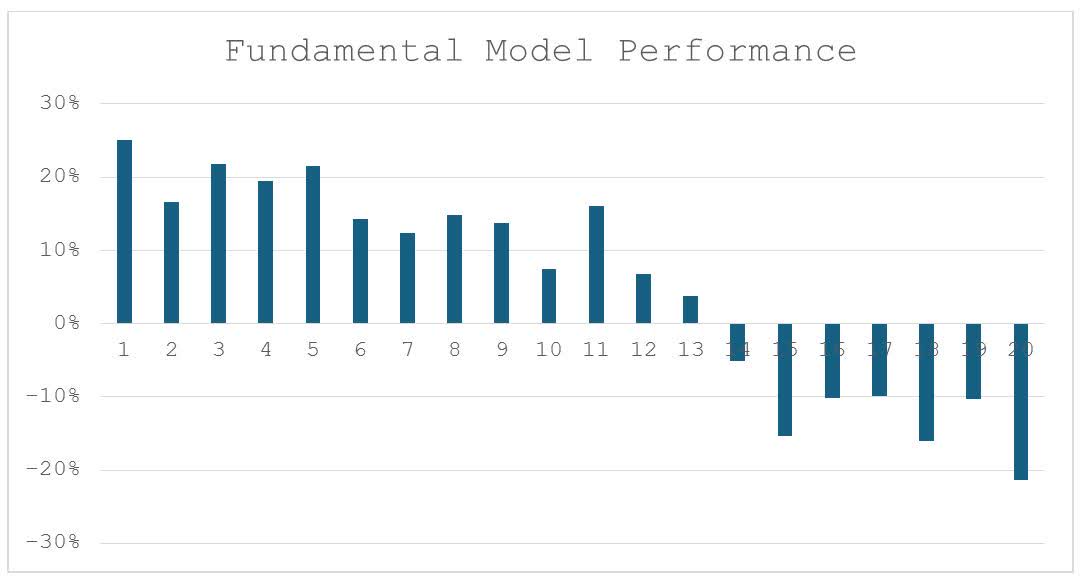

Now that the quarterly announcement season is over, my research team updated the performance of our stock selection models. Here is how my fundamental model performed in the year through August 30th:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

These are performance totals for each 5% segment, from top (left) through bottom (right).

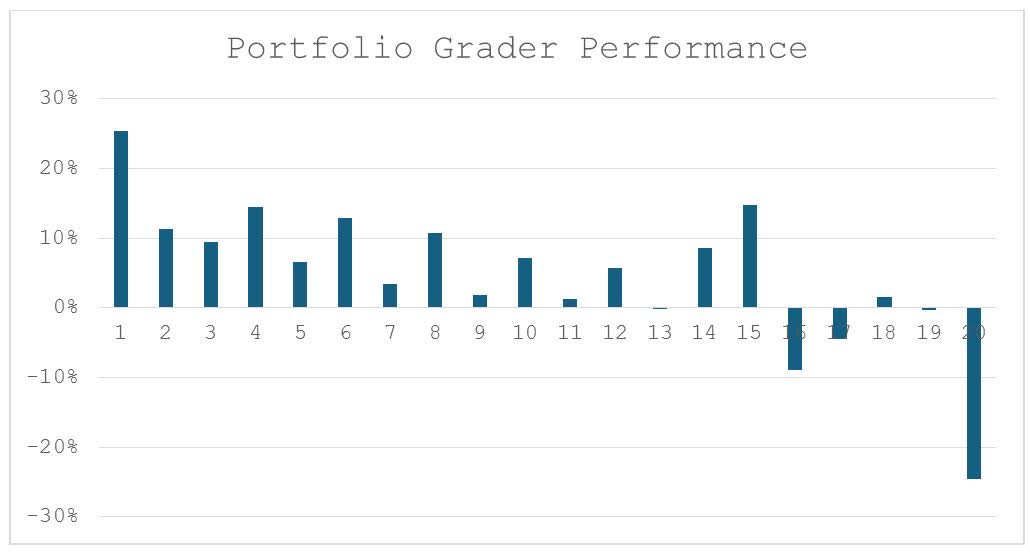

And here is how my Portfolio Grade performed in the past 12 months through August 30th:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

What the first chart illustrates is that the top 55%-rated stocks (the first 11 bar charts), as graded by my 8-factor fundamental model, enjoyed positive relative performance. Furthermore, the Top 5% (the first bar chart) delivered 25% gains in both my fundamental analysis and portfolio grader. I am proud that both my 8-factor fundamental model and Portfolio Grader can identify the best stocks in such a consistent manner.

With PCE Inflation Now Tame, a September Rate Cut Seems Certain

Last Friday, the Commerce Department announced that the Fed’s favorite inflation indicator, namely the Personal Consumption Expenditure (PCE) index, rose just 0.2% in July and 2.5% in the past 12 months. The core PCE, excluding food and energy, also rose 0.2% in July and 2.6% in the past 12 months.

More importantly, in the past three months, the core PCE is trending lower, running at a 1.7% annual pace, so the core PCE is within the Fed’s 2% inflation target. I must add that I was a bit disappointed in the PCE report, since economist Ian Shepherdson was expecting an even lower rate, just 0.13% for July.

At the Kansas City Fed conference at Jackson Hole in the previous weekend, Federal Reserve Chairman Jerome Powell said that the slowdown in the labor market was “unmistakable,” finally echoing comments made by other Fed officials that unemployment concerns are now overshadowing inflation concerns.

In fact, Powell underlined that statement by saying, “We do not seek or welcome further cooling in labor market conditions.” That means a key interest rates of 0.25% on September 18th is virtually certain, and a bad August payroll report this Friday means that the Fed could cut key interest rates by more, by 0.50%.

Now that inflation has effectively been tamed, the Fed is belatedly turning its attention to the job market, since the unemployment rate has risen from 3.4% to 4.3% in the past 15 months. However, the Labor Department recently announced that 818,000 reported payroll job gains in the past year through March 31, 2024, disappeared, due largely to people working multiple jobs and/or not paying withholding taxes.

Goldman Sachs was expecting a downward revision of 600,000 jobs, while JPMorgan was expecting a 360,000 downward revision, so the Labor Department revision came in shockingly high. Instead of the U.S. economy creating 2.90 million payroll jobs in those 12 months through the first quarter, it only created 2.08 million jobs. Ouch! This is the largest annual revision to the payroll data since the recession of 2008-09! Obviously, this downward revision may cause the unemployment rate to rise even further!

Canada, Britain and the European Central Bank (ECB) are also expected to cut their key interest rates soon, so three major central banks may cut for the second time before the Fed cuts rates the first time.

Last Tuesday, the Conference Board announced that its consumer confidence index rose to 103.3 in August, up from a revised 101.9 in July. The present situations component rose to 134.4 in August, up from 133.1 in July, but Dana M. Peterson, the Conference Board Chief Economist was cautious, saying, “Consumers’ assessments of the current labor situation, while still positive, continued to weaken, and assessments of the labor market going forward were more pessimistic. This likely reflects the recent increase in unemployment. Consumers were also a bit less positive about future income.”

Consumer and business confidence continue to decline in Germany. At the heart of Germany’s woes are electricity costs due to their green energy mandates. Germany’s industrial economy was built on cheap Russian natural gas that is no longer available. Although Russia now sells more LNG to the eurozone than the U.S. does, LNG is much more expensive than natural gas from pipelines. According to the Bavarian Industry Association, electricity prices in 2023 were 61% higher than they were pre-pandemic.

As a result, Germany’s massive manufacturing operations are increasingly moving to Hungary, Poland and Slovakia, since those nations have cheaper electricity as well as more reasonable labor costs. I should add that the German statistics office, Destatis, on Thursday announced that consumer price inflation declined to a 1.9% annual pace in August, down from a 2.3% annual pace in July, which will help encourage the European Central Bank (ECB) to cut key interest rates again in early September.

Energy and Inflation (Especially in Pennsylvania) are a Big Key to the 2024 Election

The Presidential election cycle is now in full swing. Historically, the stock market rallies into Presidential election day, since the candidates are promising voters everything and anything. No taxes on tips and Social Security benefits are very popular, as are larger child tax credits, plus aid for first time home buyers. I should add that whoever wins Pennsylvania is likely to win the electoral college vote.

The Biden Administration’s January 2024 executive order that banned LNG expansion alienated western Pennsylvanians, since it is a big natural gas producer. Furthermore, Kamala Harris’ comments that she was opposed to fracking and offshore drilling further alienated western Pennsylvanians. Although the Harris campaign has hit the “reset” button and is suddenly pro-fracking, Pennsylvania remains skeptical.

Donald Trump wants to double electricity generation in the U.S. to support AI demand for power-hungry cloud computing centers. To do this, Trump needs cheap U.S. natural gas that is so inexpensive that it is often flared, which is not ideal for the environment.

Instead, Trump would rather use natural gas for electricity generation rather than merely waste it. If Trump wins Pennsylvania and becomes the next President, then I expect our cloud computing-related stocks, like CrowdStrike Holdings (CRWD), Eaton (ETN), Emcor (EME), Nutanix (NTNX), Parsons (PSN), Quanta Services (PWR), Super Micro Computer and Vertiv Holdings (VRT) to prosper!

In the meantime, I should add that the U.S. power grid added 21% in new electricity generating capacity in the first six months of this year via solar, wind and nuclear power. Solar accounted for 59% of this increase, battery storage accounted for 21%, wind accounted for 12% and an expansion at Georgia’s Vogtle nuclear power plant to four reactors accounted for the remaining increase in nuclear power.

Arizona, California, Florida and Nevada dominated battery and solar expansion, while Texas dominates wind expansion. Natural gas, which still dominates electricity generation in the U.S. is not expanding, since the Biden Administration implemented regulations demanding that new natural gas power plants implement carbon dioxide capture, which has caused commercial natural gas plant expansion to halt.

Crude oil prices have risen 3.3% this year. The latest catalyst for higher crude oil prices was the fighting between Israel and Hezbollah after Israel used more than 100 fighter jets to strike targets and Hezbollah launched over 200 missiles as well as drones.

In the meantime, Libya is now essentially two countries after a civil war there. Eastern Libya is calling for all crude oil shipments to cease as a fight over control of the country’s central bank escalates. Finally, Russia fired over 200 missiles and drones into Ukraine to disable its power grid and water supply. One drone reportedly landed in Poland.

Furthermore, Ukraine lost one of its six F-16 Fighter jets during a Russian missile barrage. I should add that Russia’s crude oil exports continue to sputter. Despite these supply disruptions, crude oil demand often peaks during Labor Day weekend, so do not be surprised if crude oil prices moderate in September as seasonal demand drops.

Navellier & Associates owns Nvidia Corp. (NVDA), Super Micro Computer, Inc. (SMCI), Microsoft Corporation (MSFT), Alphabet Inc. Class A (GOOGL), Meta Platforms Inc. Class A (META), CrowdStrike Holdings (CRWD), Eaton (ETN), Emcor (EME), Nutanix (NTNX), Parsons (PSN), and Quanta Services (PWR), in managed accounts. We do not own Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR (TSM). Louis Navellier and his family own Nvidia Corp. (NVDA), Super Micro Computer, Inc. (SMCI), Microsoft Corporation (MSFT), CrowdStrike Holdings (CRWD), Eaton (ETN), Emcor (EME), Nutanix (NTNX), Parsons (PSN), and Quanta Services (PWR), via a Navellier managed account, and Nvidia Corp. (NVDA), in a personal account. They do not own Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR (TSM), Alphabet Inc. Class A (GOOGL), and Meta Platforms Inc. Class A (META), personally.

All content above represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.