Summary:

- Nvidia continues to be our best buy-rated idea; the stock is now up 266% since our upgrade to buy in October, outperforming the S&P 500 by around 251%.

- We believe NVDA is still best positioned to benefit from the AI boom, driven by current and upcoming new products.

- The company’s results and outlook clearly validate our enthusiasm for the stock.

- We do not see any serious competition on the horizon and think NVDA’s AI GPU will continue to be the solution of choice through 2024.

- We believe NVDA will continue to outperform all the large-cap semiconductor names in our universe as demand for its AI GPU continues to outstrip supply.

Ales_Utovko

Nvidia (NASDAQ:NVDA) takes center stage this quarter, reporting revenue ahead of $11B guidance, growing 88% QoQ and 101% Y/Y to $13,507M; the stock continues to be the best-rated idea in our coverage universe. Management now guides for $16B in revenue next quarter, outpacing consensus estimates at $12.61B, and forecasts a non-GAAP gross margin of 72.5% on higher sales. We think that NVDA remains superiorly positioned to benefit from the A.I. boom; we see no serious competition as hyper-growth demand persists with new product cycles underway and new software partnerships continuing to prove NVDA A.I. GPUs are the solution of choice into 2024 for accelerated computing and generative A.I.

The stock is now up 266% since our upgrade to buy in late October, outperforming the S&P 500 by around 251%. YTD, the stock is up 229%, outperforming the S&P 500 by 213% and substantially outperforming Intel (INTC) and Advanced Micro Devices (AMD), up 27% and 71%, respectively. We continue to see more upside ahead; consistent with our expectations in May, demand continues to outpace supply. Management addressed the imbalance of supply-demand dynamics, noting that the company will continue to ramp supply through lower cycle times and work with supply partners to add capacity, emphasizing their expectation of “supply to increase each quarter through next year.” We understand investor panic regarding NVDA’s capabilities in July, setting off a slight drop after Super Micro Computer, Inc. (SMCI) missed outlook and TWD ODMs (Original Design Manufacturers), who claimed to be in on A.I. server play guided conservatively for next quarter. We think today’s results confirm NVDA’s position to outperform the large-cap semi peer group as demand for its A.I. GPUs expands alongside A.I. TAM. We recommend investors look for entry points to reload at current levels.

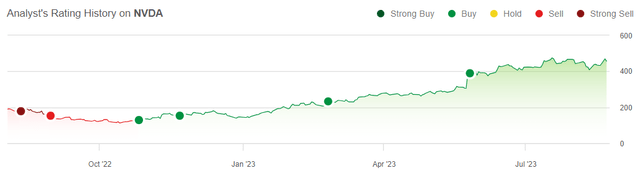

The following graph outlines our rating history on NVDA.

More wallet-share shift to accelerated computing

We see NVDA being the primary benefactor of cloud customers’ shifting more and more wallet-share focus to A.I. over traditional computing- take Meta Platforms (META) as an example; the company cut capex spending on non-A.I. related investments but not on A.I. While the server TAM for 2023 is expected to drop 17% Y/Y, the A.I. server TAM is expanding rapidly. And NVDA is well positioned to take advantage of the latter, driven by new product cycles, including NVIDIA GH200 Grace Hopper Superchip and NVIDIA L40S GPU. We think NVDA will experience tailwinds as cloud providers transition to upgrade “their data center infrastructure for the new era of accelerated computing and AI.” NVDA has easily become the poster child for A.I.

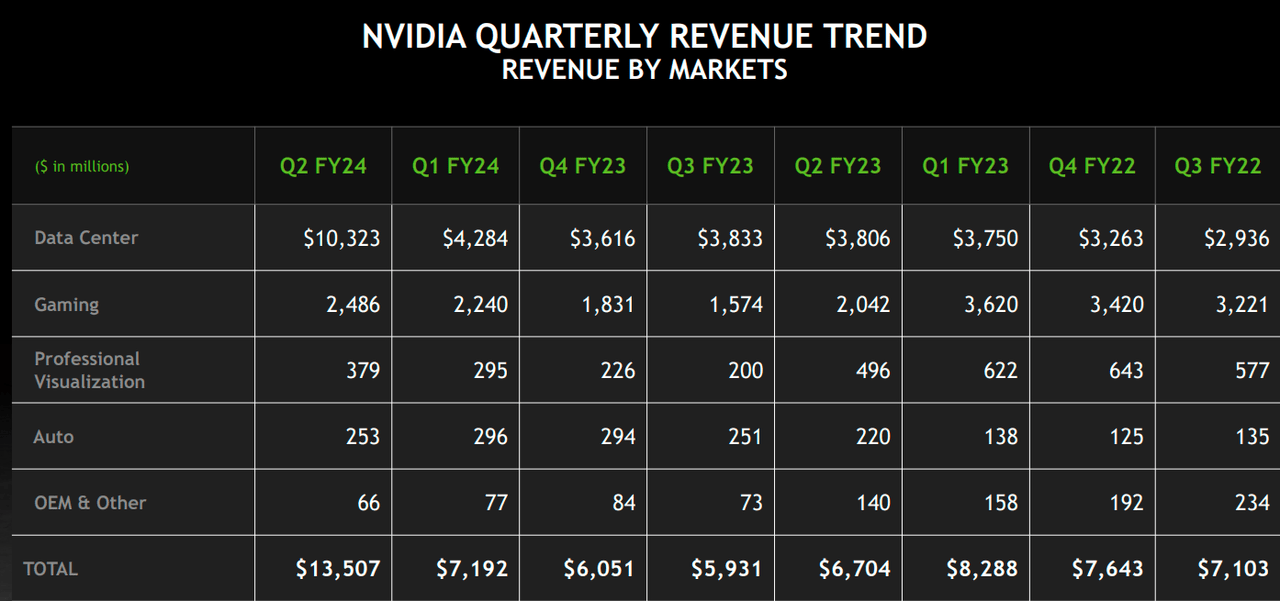

We expect the bulk of revenue growth into 2024 to be driven by NVDA’s data center sales, accounting for 77% of total revenues this quarter compared to 57% in a year ago quarter. Data center sales grew 141% QoQ to $10.4B in Q2FY24. The following chart outlines NVDA’s quarterly revenue trend by market.

NVDA remains ahead of the competition in the design win cycle, being the go-to solution for accelerating demand from cloud service providers and large consumer Internet companies, including Alphabet (GOOG) (GOOGL), Microsoft (MSFT), and Amazon (AMZN) AWS, among others. We see the stock outperforming the semi peer group into next year. In spite of the macro uncertain environment and cost-cutting measures we’re seeing across the board this quarter, we think the demand for AI-related sales will continue to be not only resilient but grow.

Other aspects of the business

Shifting to gaming, consistent with our expectations, gaming is returning to typical seasonal levels after last year’s slowdown, up 11% QoQ this quarter to $2.49B. We also saw a recovery in professional graphics sales, up 28% QoQ to $379M, while weaker end demand, specifically from China, negatively impacted automotive-related sales, which dropped 15% QoQ to $253M. We’re not concerned about the weaker automotive-related sales as NVDA’s data center segment’s hypergrowth will be able to offset weakness elsewhere in 2H23.

Management also touched on the export restrictions to China, reassuring investors again that “we do not anticipate that additional export restrictions on our Data Center GPUs, if adopted, would have an immediate material impact on our financial results.” China remains within the historical range of 20-25% of data center revenue for NVDA. Given the strong current demand for NVDA AI GPUs, we’re not too concerned about regulations against China impacting NVDA’s financials materially in the near-term.

Valuation

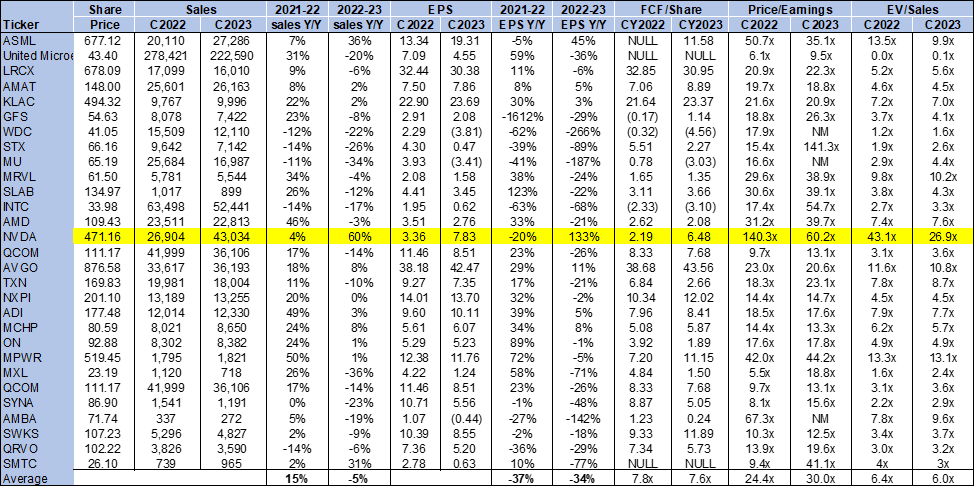

The stock is trading well above the peer group, but we don’t think this is a reason not to buy. Looking at NVDA’s multiples relative to growth, the valuation doesn’t look too high. On a P/E basis, the stock is trading at 60.2x compared to the peer group average of 30.0x. The stock is trading at 25.9x EV/C2023 Sales versus the peer group average of 6.0x.

The following chart outlines NVDA’s valuation against the peer group.

TSP

Word on Wall Street

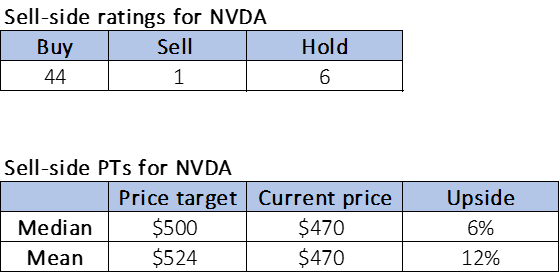

Wall Street seems to share our bullish sentiment on the stock. Of the 51 analysts covering the stock, 44 are buy-rated, six are hold-rated, and the remainder is sell-rated. The stock is currently priced at $470 per share. The median sell-side price target is $500, while the mean is $524, with a potential upside of 6-12%.

The following charts outline NVDA’s sell-side ratings and price targets.

TSP

What to do with the stock

We remain buy-rated on NVDA post-Q2FY24 earning results; we believe NVDA is the best top-line growth and margin expansion story in tech at the moment. NVDA continues to be the clear winner of the A.I. accelerator market in 2H23, and this quarter’s results and outlook validate our enthusiasm for the stock. We upgraded NVDA to a buy when the stock was trading at $128.96 per share; now, NVDA is priced at $470. We see an increasingly favorable risk-reward profile for NVDA due to the expansion of the A.I. TAM and the company’s stretched-out visibility driven by current and upcoming products. We recommend investors explore entry points at current levels as the upside is not over yet in our opinion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2 week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2 week free trial so we hope to see you in our group soon.