Summary:

- Nvidia Corporation posted another strong quarterly earnings but it failed to impress Wall Street.

- The stock will likely remain in the range of $400-$500 for the next few quarters as the market gauges the long-term potential in the company.

- Nvidia likely saw a big boost in sales in the past few quarters as tech companies in China hoarded chips prior to restrictions placed by the U.S. administration.

- Nvidia will also face difficult comps in 2024, which will limit the ability to post good YoY growth numbers.

- Investors looking for an AI play can find better options than Nvidia stock at the current price.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) announced impressive fiscal Q3 earnings with triple-digit growth. However, this did not move Wall Street, and the stock is trading sideways. This trend will likely continue for most of 2024 as the market tries to figure out the long-term growth trajectory in Nvidia.

The chip restrictions on Nvidia have not been priced adequately. It is likely that most of the big tech companies in China hoarded up the latest AI chips from Nvidia in anticipation of the coming chip ban. Even Alibaba Group Holding Limited (BABA) has mentioned that the chip ban is a major reason why it is delaying the spinoff process of its cloud division. This shows the importance of these chips, and most tech players would have made bigger than usual purchases in the previous quarters. This will reduce the demand for chips in 2024. In a previous article, it was mentioned that Nvidia’s performance will not deliver a bullish momentum for the stock.

Nvidia will also face significantly tougher comps in 2024. It is highly unlikely that Nvidia will be able to report triple-digit YoY growth in 2024. Nvidia’s management has been upbeat in the recent earnings and mentioned that they see strong demand even into 2025. However, at Nvidia’s valuation multiple, Wall Street would like to see hard numbers before giving another bullish run to the stock. Despite staggering performance metrics in the last two quarters, the stock has not seen a major upside. This shows that most of the current growth projections have been priced in. Investors looking for an AI investment could consider other options that are trading at more reasonable levels.

Difficult to Impress Wall Street

Nvidia has reported growth numbers which are rarely shown by a company with a similar revenue base. However, this did not help the stock. Over the past six months, the stock has traded in the range of $400-$500. It would be difficult for Nvidia to break this range in the near term due to its sky-high valuation multiple.

YCharts

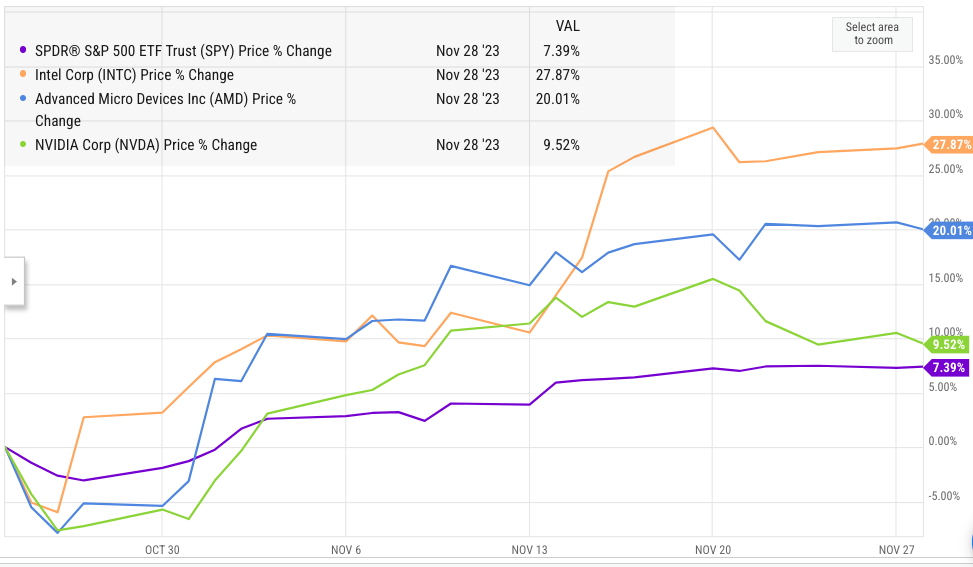

Figure: Price movement in Nvidia and other chip stocks in this earnings season. Source: YCharts

The recent earnings season has shown a clear trend where Intel Corporation (INTC) and Advanced Micro Devices, Inc. (AMD) stock appreciated significantly due to better forward growth potential. On the other hand, Nvidia’s stock has corrected a bit since its earnings.

Wall Street is forward-looking, and all the focus is now on the ability of Nvidia to sustain its growth momentum in 2024. Even in the best-case scenario, it is unlikely that Nvidia will have staggering growth in 2024 as it faces tougher comps. Another major headwind for Nvidia will be market dynamics within the AI chip industry.

Headwinds in 2024

Most of the big tech companies in China were already warning over possible restrictions on chip access in the first half of 2023. An increase in geopolitical tensions between China and the U.S. has hit the advanced AI chip sales very hard. It is very likely that these big tech companies had made advanced purchases in the first few quarters of 2023 in anticipation of a chip restriction. This allowed Nvidia to sell its latest AI chips at a premium and gain massive margins. These advanced purchases should limit the demand in the next few quarters.

The early AI hype is also starting to become less dominant. We have seen slower cloud growth in Amazon (AMZN) AWS and Google (GOOG) Cloud in their recent quarterly earnings. It will be a while before the monetization of AI tools gathers pace, and during this time we could see more prudent purchases of the latest AI chips.

Change in Competitive Landscape

In early 2023, Nvidia’s latest AI chips were the only game in the town. This allowed the company to charge a big premium on these chips and gain huge profits. However, this is now changing as new chips are being tested by other competitors. AMD will soon launch its MI300 chips in early December. Amazon’s AWS has also announced Trainium2 chips, which it claims to be 4 times faster and twice as energy efficient as the predecessor. Microsoft (MSFT) has also launched its AI chip called Maia to provide custom AI services.

All of the big tech companies have massive resources to scale up their development efforts rapidly. They also have their own cloud service where the chips can instantly be used instead of waiting for outside clients. This completely changes the competitive landscape, and we could see lower prices from Nvidia as it tries to retain the market share for its own AI chips.

Future Trajectory of Nvidia Stock

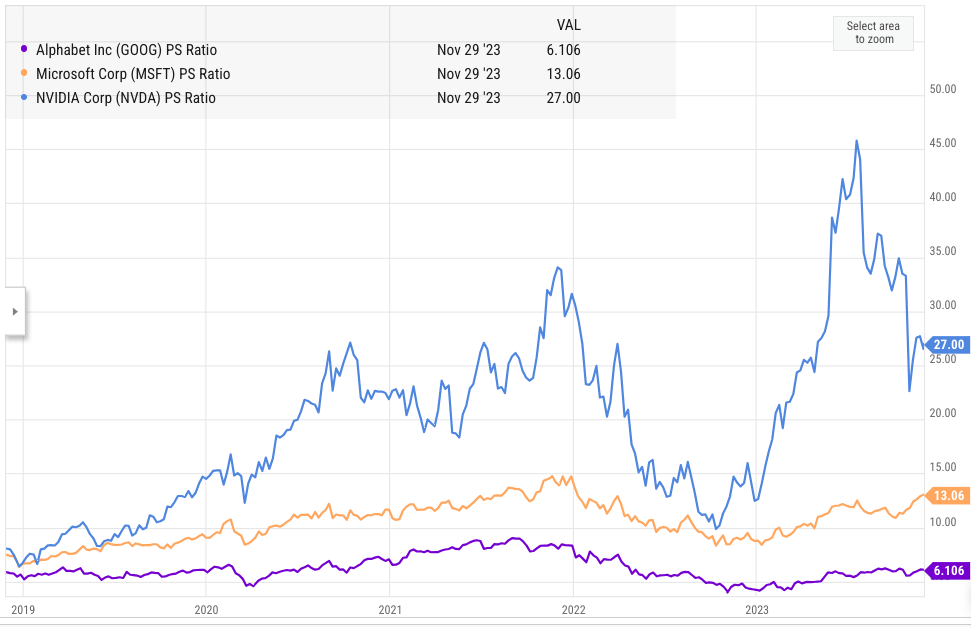

Nvidia stock saw an unprecedented bull run in the first half of 2023. This has increased the P/S ratio significantly. It is currently trading at a P/S multiple of 27 compared to 13 for Microsoft and 6 for Alphabet. Nvidia’s business is also very cyclical, and we have already had big swings in the stock price over the last few years. This adds another risk premium to the stock compared to more stable earnings stocks like Microsoft and Google.

YCharts

Figure: Nvidia’s P/S ratio compared with Microsoft and Google. Source: YCharts

We are likely to see significant headwinds for Nvidia in 2024. In the best-case scenario, the stock will have a sideways momentum as it absorbs the price jump of 2023 and the valuation multiple reaches more reasonable levels. If the performance of AMD’s chips beat expectations, we could even see a big correction in Nvidia stock.

Investor Takeaway

Nvidia stock has not responded to the strong earnings result reported by the company recently. This shows that Wall Street has already priced in most of the anticipated growth of the company. 2024 will be a very tough year for Nvidia as it faces tougher comps and a more modest demand environment for its premium AI chips. The launch of competitive products by rivals will also be a key factor closely watched by investors.

Nvidia stock is trading at a significant premium to other big tech stocks, which limits a further bull run in the stock unless there is a major AI breakthrough in monetization. The current Nvidia Corporation price levels are too risky to make an entry. Investors looking for an AI play could look at other big tech companies with strong moats which are launching their own AI chips and services.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.