Summary:

- I am bullish on Nvidia Corporation due to its robust growth levers in AI, data centers, and the rising Nvidia Omniverse.

- Nvidia’s market dominance in GPUs and continuous innovation, such as the Blackwell B200 chip, ensures sustained competitive advantage and pricing power.

- The Data Center Segment, driven by AI chip demand, now accounts for roughly 88% of Nvidia’s revenue, showing significant growth.

- Nvidia’s Omniverse platform, with its unique features and integration with generative AI, opens new revenue streams and positions it well for future growth.

Antonio Bordunovi

Thesis

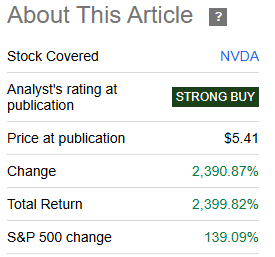

I am bullish on Nvidia Corporation (NASDAQ:NVDA) and regard it as a good investment opportunity over the long run considering its robust growth levers. I find the company to be trading below its fair value, offering a discounted entry to potential investors with a significant upside by 2026. In March 2020, I published a bullish article on Nvidia where I discussed at length why its venture into cloud gaming alongside the acquisitions it was pursuing then that were going to be the revolutionary force in its growth. Since then, the stock has soared dramatically, beating the S&P (SP500) at an unimaginable rate.

Seeking Alpha

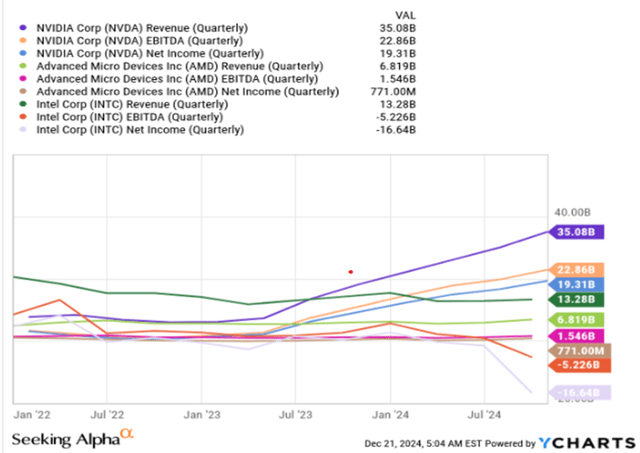

Over the last three years, its financial performance has been nothing short of impressive, with exponential revenue growth and profitability. Indeed, its net income and EBITDA have grown above its competitor’s revenue.

After such a dramatic gain following my initial publication, I am writing this follow-up coverage at a time when most call this stock a sell. Over 83% of the most recent articles on SA are bearish at the time of my write-up. Most investors are citing competition as the major reason behind their bearish view, especially following Amazon (AMZN) and Google’s (GOOG) chips and the fear of Advanced Micro Devices’ (AMD) rise. In this analysis, I will comprehensively discuss why Nvidia is still a star and why the existing competition doesn’t warrant bearish sentiments. I will compliment this with its growth levers and undervaluation case.

Growth Catalysts

Albeit setting the tone of this article under the thesis section, I would like to draw your attention to the growth-share matrix, specifically the BCG matrix. I want to use this concept in the context of the broader IT sector to classify Nvidia in relation to several traits it possesses. Upon several considerations, I comfortably classify Nvidia as a star in the IT sector. The rationale behind it is the traits that stars as described under the BCG matrix have that I find inherent in Nvidia. This includes a high market share, strong growth, and significant investments. I set this precedent because it will be core to my analysis. Having laid that foundation, it’s pertinent to note that strong growth and strong market share are key traits of stars. This brings me to what I see as Nvidia’s growth levers, which is the theme of this section.

A massive market opportunity with a 30% CAGR

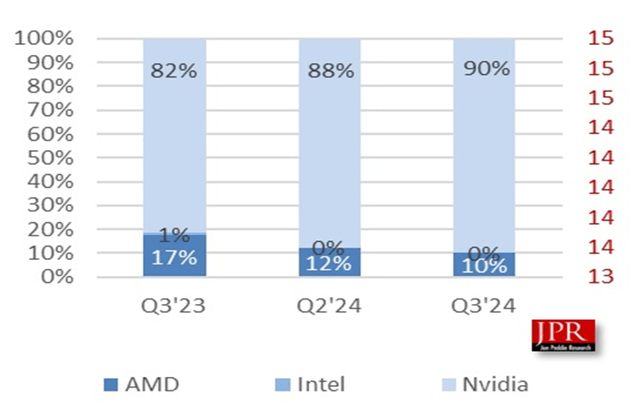

When we talk of growth, we must begin from the market perspective before we narrow down to the individual company measures or catalysts. One of this company’s driving forces is its market dominance, which I believe serves as a major competitive advantage. Nvidia enjoys stunning market dominance in the GPU market, having sustained a market share above 80% for a while now, way above its major competitors Intel (INTC) and AMD being less than 20% combined. With such a commanding market share, it is pleasing to note that the AI GPU market is projected to grow significantly by 2031 in what would be a major growth catalyst for this company. According to Cognitive Market Research, the market is projected to grow by a CAGR of 30.6% between 2024 and 2031.

Market Leadership & Pricing Power Through Innovation

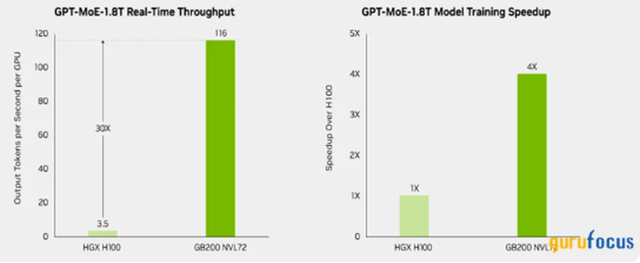

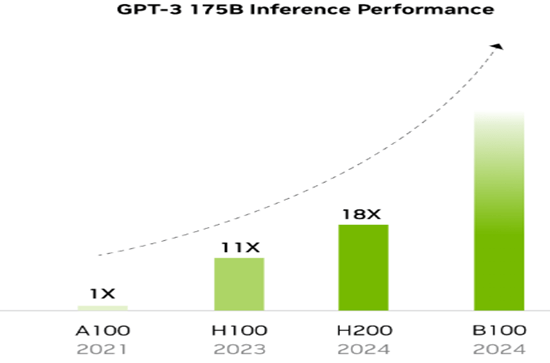

Amid this strong projected market growth, I find this company to be in a better position to leverage the opportunities arising from the market. I believe so when I look at the company’s AI chip dominance and data center expansion. The main reason why I think Nvidia is set to maintain its market dominance as the AI chip market grows is its market leadership in innovation. For instance, its Blackwell B200 chip, which is one of the most recent innovations, has superior features to those of the competition. It has 208 billion transistors, and it’s designed to reduce AI inference costs and energy consumption by up to 25x when compared to the H100 chip. In addition, it is rated 1,200 watts, thus creating a balance between high performance and energy efficiency. This company is also not an underdog on the hardware front, especially when considering its GB200 NVL72 GPU 30X improvement in real-time throughput.

Over the recent years, Nvidia has owned the most recent innovations in its industry, marking it as a revolutionary force. As we speak, months after launching the Blackwell chip, they announced their next innovation, Rubin. This means that it always stays ahead of the competition, something that gives them pricing power, a major strength for its revenue growth and sustainability. For example, its Blackwell GPU costs about $30,000-$40,000 per unit. A fully equipped server can cost as much as $3 million. Its pricing is much above AMD’s Ryzen with a price range of $200-$500. In my view, this explains why the company’s revenue has been surging way above its rivals.

Data Center as the driving revenue force

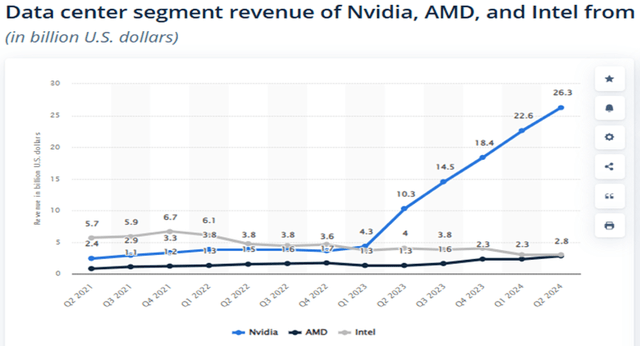

In light of its market leadership in the GPU market through innovation, it is no surprise that its Data Center Segment has grown to be a major driving force, accounting for roughly 88% of its total revenue as of Q3 2025. In the recent past, its Data Center revenue has soared dramatically, both in absolute and comparative terms.

This trend has been sustained in Q3 2025 with its data center revenue soaring to a record $30.8 billion a 17% QoQ growth and a massive 112% YoY growth. This was primarily driven by the surging demand for AI chips.

The Omniverse Platform shows strong potential

Another growth catalyst for Nvidia is the Omniverse platform, which opens new revenue streams across various industries. It is designed to optimize and enhance 3D projects, thus making it a powerful tool for industrial digitization. It enables companies to create virtual worlds and advanced workflows. The recent integration with generative AI and the OpenUSD framework allows developers to create more complex and realistic simulations, improving its capabilities. I am thrilled to note that this company is investing in one more high-growth market, something that illustrates the management’s ability to seize emerging opportunities for sustainable growth. It is estimated that the global metaverse market will grow by a CAGR of 51.5% between 2024 and 2029. This offers Nvidia massive growth opportunities in its Omniverse investment. In light of this tremendous growth opportunity, I believe Nvidia’s Omniverse unique features such as comprehensive SDK and APIs, generative AI integration, omniverse cloud, OpenUSD, and RTX technology set it apart. They position it in a better place to leverage the projected market growth. The company is committed to future growth and innovation as seen through its consistently growing R&D investment improving from $1,797 million in 2018 to $11,665 million in the TTM, more than 6X growth.

Guided by the above background, Nvidia is indeed a star given its large market share, significant growth potential backed by solid projected market growth, and innovation leadership amid growing expenditure in research and development.

Competition

Although I have slightly touched on competition in the previous section, the main focus here is the growing concern of some of Nvidia’s customers manufacturing their own chips. Before addressing that, I would like to emphasize that as for the major rivals AMD and Intel, Nvidia has crushed them in Q3 of this year, significantly beating the market share of Q3 2023.

Shifting the focus to Nvidia’s customers, AMZN and GOOG who have invested in developing their own AI chips, I have several reasons why I believe this is not a major threat. The first consideration is market dominance and performance. Nvidia commands about 90% of the AI chip market share, underscoring its firm market position. In terms of performance, Nvidia GPU specifically the Blackwell architecture offers unmatched performance for AI training and inference.

FutureTimeline

Its high-performance capability is essential for complex and large-scale AI models, a feature that GOOG and AMZN have yet to match.

Another consideration is the complementary usage. Nvidia GPUs are applicable in a wider scope ranging from AI training, high-performance computing, gaming, and inference. Inversely, GOOG’s TPUs and AMZN’s Trainium/Inferentia chips are designed to meet specific workloads within their cloud infrastructure. Meanwhile, cloud computing still requires the highest performance for tasks covering deep learning and generative AI workloads. This implies that these companies are still reliant on Nvidia’s high-performance chips, and it may take time before breaking the reliance, should that be the motive.

Lastly, Nvidia’s continuous innovation pushes them ahead of competition with new architectures, keeping them at the cutting edge of AI technology, which guarantees its superior market position. Above all, the company has a strong relationship with the so-perceived new competitors, something that, in my view, lessens the tension. For instance, Amazon’s CEO emphasized that they have a deep partnership with Nvidia and that they expect it to be long-lasting, with AMZN being one of the major partners for Nvidia’s new chips.

In a nutshell, GOOG and AMZN’s in-house chips are designed to meet specific tasks within their ecosystem, and therefore they are complimenting Nvidia’s chips rather than competing with them. This is backed by their reliance on Nvidia’s high-performance chips and their deep partnerships. Given Nvidia’s strong market dominance and broader AI chip usage amid their high performance, AMZN and GOOG offer no significant threat here.

Valuation

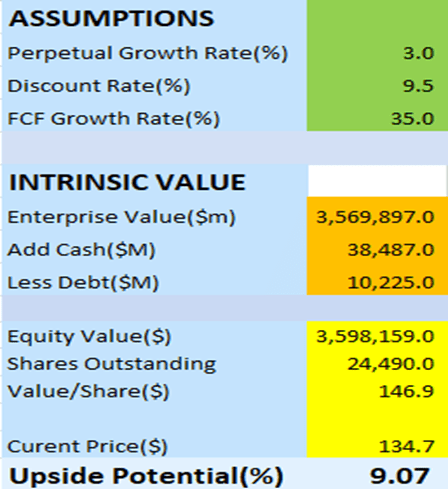

I valued this company using a DCF model whose assumptions were as follows:

- Perpetual Growth rate: I used a rate of 3% which is in line with the global projected GDP growth of about 3.3%.

- Discount rate: My discount rate was set at 9.5% which is the company’s WACC according to alpha spread.

- FCF growth rate: Having considered the company’s FCF 5-year CAGR of 72% and 15-year CAGR of 41.73%, I adopted a growth rate of 35% which is conservative to mitigate the major drawback of a DCF model which is its reliance on assumptions.

Given the above assumptions, below is my model output which estimates a share value of $146.9 implying a 9% discount in the current stock price.

HedgeMix

Given Nvidia’s current valuation, I think potential investors have a cheap entry point to leverage this company’s massive growth potential. Also, with a TTM P/E ratio of 53.19 and an estimated EPS of $4.43 by January 2026. I estimate a price target of $236 by January 2026. Comparing this to its estimated fair price of $146.9, I see a 60.4% premium gain by January 2026. Consequently, Nvidia is a buy at the moment.

Risks

The main risk to my bullish thesis is the company’s heavy reliance on AI and data center markets. While this has been and will keep being a strong growth lever in the future, a significant portion of its revenue arises here speaking about high-risk concentration. In case of any adversity in this growth center, the company’s financial health could be affected significantly, altering my bullish thesis.

Takeaway Message

Since our last coverage of Nvidia, the stock has had an incredible run, and we believe there is still room to grow. This is because Nvidia has such a massive economic moat gained through its impeccable execution, staying at the forefront of innovation in the AI chip market. Although some Big Tech companies are making strides towards developing their own chips, their application is restricted to specific use cases and would not alter Nvidia’s dominance in the market.

All in all, Nvidia is a star in the IT sector with tremendous growth potential. Seize the discount and board this dominant force.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Business relationship disclosure: This article was written in collaboration with HedgeMix.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.