Summary:

- NVIDIA Corporation investors suffered a late pullback last week even as NVDA surged to a new high.

- Post-earnings profit-taking likely occurred. Should investors be concerned?

- NVIDIA’s magnificent beat-and-raise is expected to be a thing of the past, but that shouldn’t deter bullish investors from adding on pullbacks.

- NVIDIA is undergoing a critical product transition to its Blackwell AI chips, potentially affecting market sentiments.

- I argue why investors should capitalize on NVDA’s near-term volatility to add more positions in the King of AI.

BING-JHEN HONG

Nvidia: King Of AI Suffered Profit-Taking

NVIDIA Corporation (NASDAQ:NVDA) (NEOE:NVDA:CA) investors are eagerly awaiting the production ramp of its Blackwell AI chips as the King of AI seeks a critical product transition from its Hopper architecture. NVDA has continued to outperform its semiconductor peers (SMH, SOXX) as it navigates a $1T data center infrastructure investment thesis that’s arguably still in the earlier stages. As a full-stack accelerated computing infrastructure provider, Nvidia has demonstrated its capabilities to extract significant value from the AI value chain. In addition, its dominant market leadership has also allowed the company to influence supply chain dynamics in its favor as critical partners seek to benefit from the Nvidia-driven AI growth thesis.

In my previous Nvidia article, I urged investors to maintain their bullish skew on the Jensen Huang-led company. I underscored the market’s confidence in the AI leader’s ability to navigate previous production yield challenges. Hence, the market has already baked in optimism in Nvidia’s Q3FY2025 earnings release. While the company reported another robust quarter as its data center segment continued to bask in the limelight, profit-taking was assessed as most of last week’s gains were lost by the end of the week.

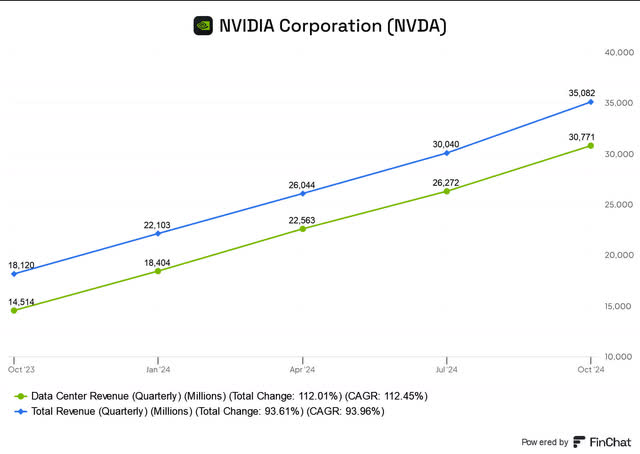

Nvidia: Data Center Growth Thesis Critical

Nvidia data center revenue (FinChat.io)

Bearish Nvidia prognosticators have returned to the fore, arguing against the sustainability of Nvidia’s data center-driven thesis. Their argument isn’t without basis, given the assessed concentration risks in Nvidia’s AI-driven surge. As seen above, data center revenue accounted for more than 87% of the company’s total revenue base in FQ3. On a trailing twelve-month basis, it’s equivalent to 86.5% of its revenue base. Hence, it’s arguable that a slowdown in training and inferencing requirements could lead to a moment of reckoning for Nvidia and its AI infrastructure peers.

I believe Huang and his team have likely anticipated questions relating to the potential slowdown or challenges in AI scaling “law.” Given the recent media reports portraying that AI scaling could have reached its practical limits, Nvidia’s belief and conviction in the ability of AI companies to overcome these challenges is notable. Huang highlighted that “pre-training scaling is intact, and it’s continuing.” Furthermore, the Nvidia CEO telegraphed that it’s “an empirical law, not a fundamental physical law, but the evidence is that it continues to scale.” Coupled with other techniques, including post-training scaling and inference time scaling, Nvidia believes that the recent skepticism observed in the media could have been overstated.

If we consider Nvidia’s commentary surrounding the demand dynamics of its AI chips, I assess that the market’s optimism is justified. Standing in stark contrast to these reported scaling challenges, Nvidia CFO Colette Kress underscored that “Blackwell demand is staggering.” Consequently, the world’s most valuable company (by market cap) is scaling rapidly to meet the “insane” demand from its customers.

Hyperscalers are expected to continue investing aggressively as they seek to achieve and maintain their AI competitive advantages against their peers. In addition, the AI agentic value proposition is expected to gain more prominence as leading enterprise SaaS companies seek to achieve more robust AI monetization. Hence, it seems unlikely that Nvidia’s AI-driven growth inflection on its data center segment could face a significant digestion.

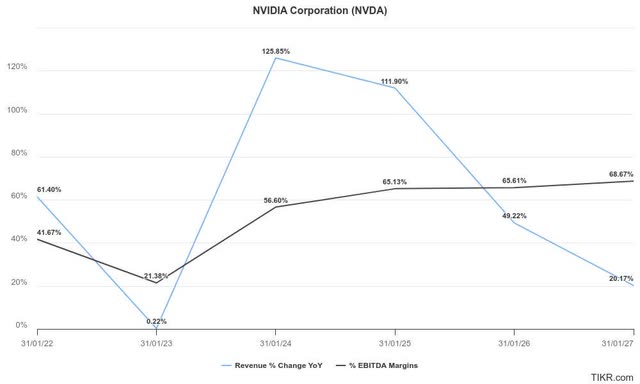

Nvidia: Law Of Large Numbers Could Affect Beat-And-Raise Prospects

Wall Street’s estimates on Nvidia have been upgraded as analysts reassessed the company’s opportunities in Blackwell. Management has assured that Blackwell’s production ramp is on track, anticipating shipments to continue through 2025. While near-term supply constraints and initial gross margin dilution could impact its profitability metrics, they aren’t expected to be structural.

Despite that, even bullish Wall Street analysts aren’t confident that the AI leader can overcome the “law of large numbers” as Nvidia moves into the second phase (enterprise AI, sovereign AI) of its AI growth prospects. Unless management can offer a more substantial beat-and-raise, Nvidia investors should anticipate near-term volatility as the market assesses its critical architectural transition to Blackwell.

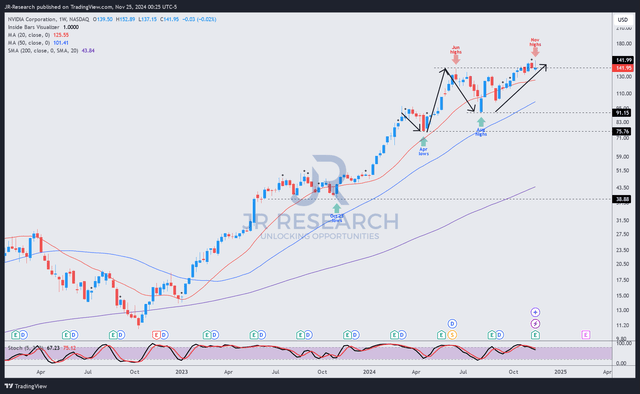

Is NVDA Stock A Buy, Sell, Or Hold?

NVDA price chart (weekly, medium-term, adjusted for dividends) (TradingView)

NVDA’s price action remains bullish. Its bullish uptrend has also been bolstered by robust dip-buying at its April and August 2024 lows. While the recent price action suggests profit-taking last week as NVDA reversed from its highs, I’ve not ascertained a decisive bearish reversal.

I assess that the market is likely to take some time to reassess Nvidia’s production ramp profile as it seeks to overcome the near-term supply constraints. Hence, we could face a momentary pullback as potentially higher execution risks have been determined while Nvidia undergoes its pivotal product transition. Despite that, Hopper demand isn’t assessed to face significant downside risks, given the company’s confident outlook in the next fiscal quarter.

However, the magnitude of Nvidia’s past significant beat-and-raises could be behind us, lowering the market’s optimism in its growth thesis. Despite that, NVDA’s forward adjusted PEG ratio of 1.28 is more than 30% below its tech sector (XLK) median, suggesting the market hasn’t gone FOMO over its bullish thesis. While near-term volatility could persist, I believe it could represent a solid buying opportunity for investors waiting for a pullback before adding more positions.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, SMH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!