Summary:

- My last two bearish articles about Nvidia Corporation stock did not age well because I underestimated the strength of the momentum caused by the AI frenzy.

- Nvidia stock is overvalued even with wildly optimistic assumptions, and the current market cap is higher than the cumulative revenue over the next decade.

- The significant risk for a bearish thesis is that nobody knows how long the AI mania may last before the bubble bursts.

BING-JHEN HONG/iStock Editorial via Getty Images

Investment thesis

This is my third analysis of Nvidia Corporation (NASDAQ:NVDA); the previous two did not work well, to be honest. My last article about the stock went live just before the latest earnings call. I underestimated the artificial intelligence (“AI”) hype, though I mentioned the risk of a short-term bull run after the earnings release in my last article. Note that the next NVDA earnings report is scheduled for Wednesday August 23rd post-market.

Yes, the company massively upgraded its guidance for the upcoming quarters, and the market’s positive reaction was fair to some extent. But the current situation with Nvidia stock reminds me of the so-called “Greater Fool Theory,” because the current valuation is far above the underlying fundamentals. I know that Nvidia bulls will destroy me in the comments section, but in this article, I want to warn more conservative investors because someone will definitely become the Greatest Fool at the end of the day when this AI-fueled frenzy will terminate. Nothing is infinite, and valuations matter the most in the long run. I reiterate my “Sell” rating because the stock is substantially overvalued even with very optimistic underlying assumptions.

Recent developments

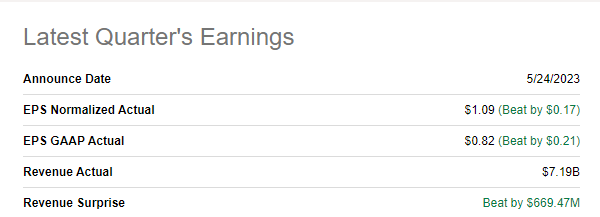

On the 24th of May, the company announced its latest quarterly earnings, delivering above the consensus financial performance.

Seeking Alpha

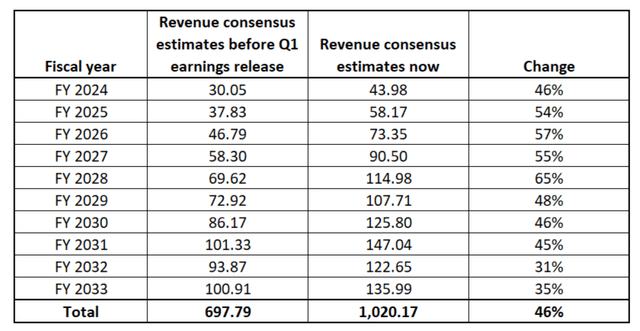

The NVDA stock price surged more than 20% on the day after earnings were released, and the main driver for the growth was the updated guidance for the upcoming quarter. Q2 of FY 2024 revenue is expected by consensus estimates at $11.07 billion, meaning a staggering 65% YoY growth is expected for the upcoming quarter. This was a massive upgrade of revenue guidance and significantly affected the long-term consensus earnings estimates. Below you can see the difference.

I would like to emphasize that Nvidia’s current $1.08 trillion market cap is higher than the cumulative revenue the company is expected to earn over the next decade. Here I would like to add some context: the largest public company in the U.S., Apple (AAPL), is expected by consensus to generate a total of $5.7 trillion in sales over the next decade, which is about two times higher than the current market cap of AAPL. Just an exciting observation.

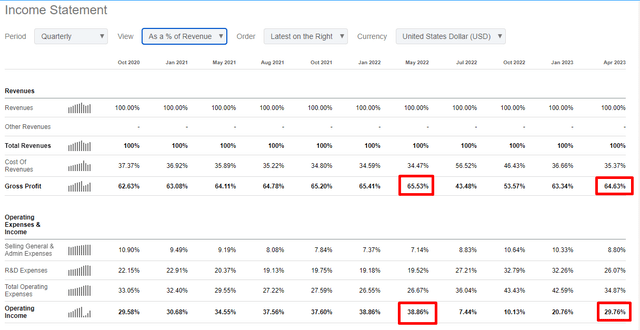

Now let me return to Nvidia’s past quarter’s performance. Revenue delivered a 13.2% YoY decline, and the operating margin declined substantially.

The past quarter’s weakness was mainly due to a substantial decline in the Gaming end market with about a 40% decline. Professional Visualization [PV] market also demonstrated a dramatic drop, where sales more than halved. On the other hand, the increased penetration of AI caused solid growth in the Data Center market. Though, a 14% growth did not outweigh the weakness in Gaming and PV. On the other hand, Gaming demonstrated a solid 22% sequential revenue growth meaning that challenges for this market appear to be in the rear-view mirror.

During the earnings call, Nvidia’s management also announced several new offerings to the market, which are more powerful and address the requirements of the rapidly evolving technological environment. Overall, I look very optimistic about the company’s future performance and consider Nvidia to be one of the main beneficiaries in the AI economy. But expectations about Nvidia’s future profits are very hot, and now let me move to valuation to assess whether the current stock price reflects the fair value of future cash flows.

Valuation update

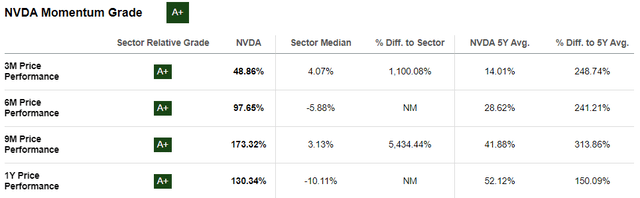

Nvidia stock delivered a staggering 200% price increase year-to-date, significantly outpacing the broad market and all semiconductor competitors. The stock trades about 38% higher than its previous all-time highs of late 2021.

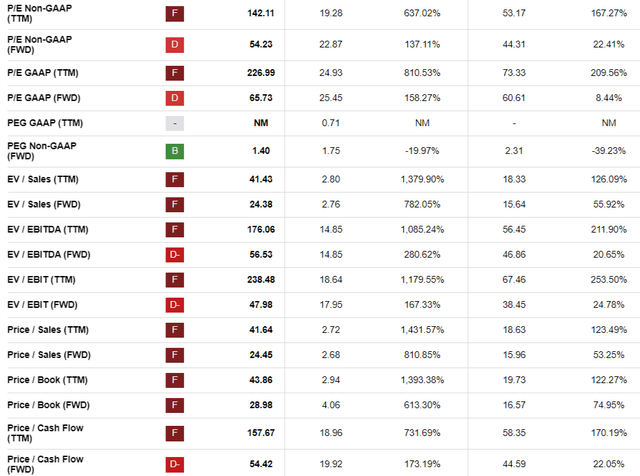

Seeking Alpha Quant assigns NVDA stock the lowest possible “F” valuation rating. Look at these ridiculous valuation multiples: about 54 forward FCFs and 24 forward sales. Current valuation multiples look unrealistic even for an inherently overvalued stock like Nvidia. If you had trillions of dollars available in your bank account to buy full ownership of any company, would you pay fifty-four times next year’s free cash flow to get 100% control of such a company?

Now, let me update my valuation analysis because consensus estimates changed significantly since I wrote my last article. I will simulate different very optimistic scenarios to demonstrate that NVDA stock is overvalued even under ridiculously optimistic assumptions.

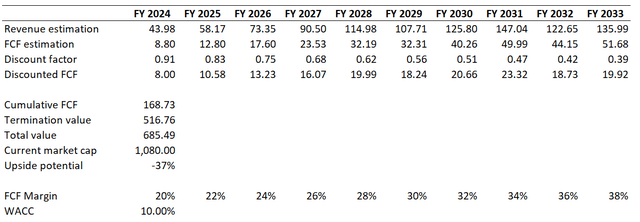

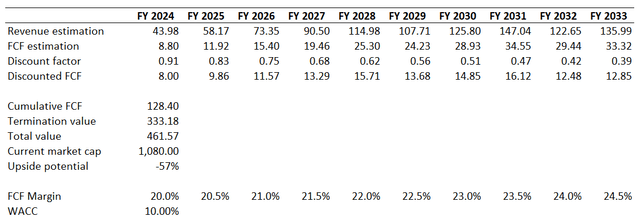

First, let me start with a revenue growth trajectory expected by consensus estimates. In this case, revenue CAGR is about 13% for the next decade. I use a ten percent WACC as I usually do for U.S.-based semiconductor companies. I use a very optimistic free cash flow (“FCF”) margin dynamic, starting at 20% in the current FY and expanding by two percentage points yearly. If the company sustains this FCF margin expansion path, it will achieve a 38% FCF margin by FY 2032. Let me remind you that over the past decade, neither Apple (AAPL) nor Microsoft (MSFT) ever achieved even a 30% annual FCF margin. That said, my FCF margin estimations are massively optimistic. But even under these unrealistic profitability metrics, the stock is still about 37% overvalued.

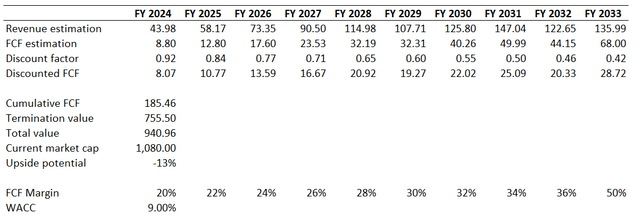

Special for Nvidia fans and bulls: I would like to go even further for a more optimistic scenario with a 9% WACC and 50% [not a typo] FCF margin for the termination value calculation. Even with these extremely favorable assumptions, my DCF model suggests the stock has about 13% downside potential.

Finally, let me simulate a DCF with reasonable assumptions for investors unwilling to become the “Greatest Fool.” I will use the exact consensus revenue growth estimates and a 10% WACC but will implement a 50 basis points yearly FCF margin expansion. Under these assumptions, the business’s fair value is more than twice lower than the current market cap.

Overall, various optimistic DCF valuation simulations together with multiples suggest that NVDA stock is massively overvalued, especially after the last three-months bull run.

Risks update

A single major risk for my bearish thesis is the robust Nvidia stock’s momentum fueled by the AI craze.

Please don’t understand me wrong. I do admit that AI is a real breakthrough for humanity. AI is a game changer for individuals and businesses, and I am also an AI bull. But did we not know about AI and its advantages before this year? Actually, we did, and we used multiple AI features for several years. Therefore, the extent of this year’s AI craze looks unreasonable to me.

History taught us that when an asset’s price surges 200% within a relatively short period, the “Greater Fool Theory” part of such a bull run is significant. We have seen it a lot of times, especially during the “Dot-com bubble.” And I consider this a short-term risk for my bearish thesis. You never know how big the bubble can ultimately become before it bursts. The timing of a burst is also very hard to predict. Therefore, there is a significant risk that the rally may last in the short term.

Bottom line

Overall, Nvidia Corporation stock is massively overvalued, even under wildly optimistic assumptions. We are highly likely in an “AI bubble,” and the risk and the problem with bubbles is that it is hard to predict the timing of a burst. The AI frenzy might last for the next couple of months. But nothing is infinite and every day, the risk of a new NVDA investor becoming the “Greatest Fool” in this craze is increasing. The history of several other bubbles of the past taught us that any bubble will burst sooner or later. Therefore, I reiterate a “Sell” rating for the NVDA stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.