Summary:

- Nvidia Corporation’s stock has dipped to $134.25 despite record highs post-Q3 results; analysts suggest buying the dip, but I see risks.

- Corporations such as Apple will always seek multiple suppliers to avoid overreliance, which could pressure Nvidia’s future profitability despite current demand.

- Many big tech companies are developing AI chips, potentially breaching NVDA’s market dominance and impacting its margins.

- Individual investors should consider reducing exposure to manage risk, as the stock price will likely decline substantially before Nvidia’s loss of market dominance becomes public consensus.

hapabapa

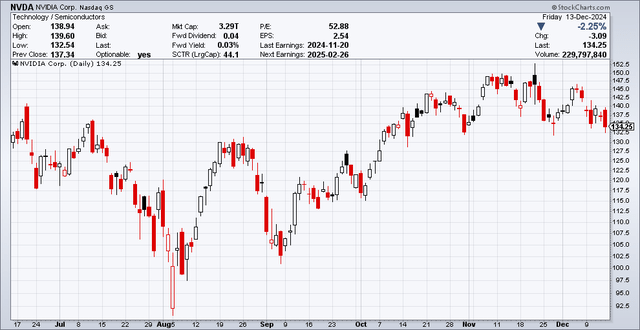

Nvidia Corporation’s (NASDAQ:NVDA) stock has dipped in the past few weeks since its Q3 financial results were announced on November 20, 2024, despite briefly reaching record highs shortly after the Q3 financial results, the stock price is now down to $134.25 as of December 13, 2024.

NVDA Recent Stock Price (StockCharts)

Many analysts (both on Seeking Alpha and on Wall Street) are suggesting this is a time to buy the dip. Recent news indicates otherwise to me.

Just like the proverbial barbarians knocking at the gates of Rome (for many times during Rome’s history before the fall of the Western Roman Empire in 476 AD), there are many indications of competitors making fervent attempts at breaching NVDA’s moat and my assessment is that they are more likely than not to get through.

On December 11, 2024, news reports began circulating that AAPL is working with Broadcom (AVGO) to develop an AI chip. For example, per Reuters:

“AAPL is working with AVGO to develop its first server chip specially designed for artificial intelligence processing, which would align the iPhone maker with other big technology companies that have developed their own chips to power compute-heavy AI services and reduce reliance on NVDA’s pricey and short-in-supply processors. Apple’s AI chip is internally code-named Baltra and is expected to be ready for mass production by 2026.”

While many are still marvelling at NVDA’s strong market position in AI chips, I think the fundamental dynamic eventually will still be driven by the below:

- While customers are often happy with just one vendor, corporations almost always develop multiple sources for every key ingredient, which I discussed at length previously.

- It doesn’t matter if the vendor is the best or only one in the world, a corporation like Apple has to have backup plans and contingencies and redundancies built into to absorb any potential shocks (Apple typically sources several suppliers for each widget to ensure backup supply in case anything happens and control costs). Otherwise, if NVDA has a supply chain disruption, Apple’s CEO will be held accountable by the board and shareholders for whether he was negligent for not being prepared. And if that day comes, Apple’s CEO is not going to get off the hook by saying “NVDA is the best in the world, we’re all-in NVDA and that’s our strategy!”

- Even NVDA intuitively understands this, note how CEO Jensen Huang said TSMC (TSM) was not its only fab and there could be other fabs if needed. This just further showcases how the mentality of always exploring alternative options and avoiding overreliance on vendors is ingrained into the fundamental logic of how modern corporations and their captains think and operate.

Below is a summary of examples of major tech companies developing alternatives to NVDA’s GPUs:

|

Company |

Effort made in AI chips |

|

Amazon (AMZN) |

In-house developed AI chips to position as a viable alternative to NVDA |

|

Google (GOOG) |

In-house developed TPUs though still major users of NVDA chips |

|

AMD (AMD) |

AMD forecasts $5 bn revenues from AI chips in 2024 and are used by MSFT and META |

|

OpenAI |

Designing custom-made chip by 2026. Also using AMD chips as well |

I find it surprising that there has been minimal discussion on Seeking Alpha about these new announcements to supplant the dominance of NVDA chips. The discussion appears to revolve around how powerful NVDA’s new Blackwell chips are expected to be and how they are sold out for the next 12 months, and how to project future NVDA sales/profits based on this.

However, considering that NVDA has a P/E of 50, the next 12 months or even 5 years isn’t really good enough. During the COVID-19 pandemic, there were many items that were sold out or in tight demand for the near future, but supply/demand deteriorated far faster than anyone expected. So far, at least one analyst has publicly observed that custom silicon could potentially gain share from GPUs. Moreover, the above efforts don’t even have to succeed to negatively impact NVDA: a credible alternative could give big tech companies enough leverage to pressure NVDA’s margins. In the end, NVDA might still retain a leading market share, but if the gross margins are down substantially, then it will have difficulty meeting future expectations.

Risks to Bearish Thesis

AVGO touted AI as a massive opportunity during its latest earnings call. Advanced Micro Devices (AMD) made similar remarks a few weeks earlier, estimating AI chips to have a total market of $500 billion by 2028. So maybe the TAM really is so big (and the author is just being narrow-minded) that a little competition doesn’t matter. It could be possible that NVDA meets the financial projections from Wall Street indefinitely, even with all the competition and in-house measures taken by big tech giants.

Regarding Shorting

Some commentators on previous articles have dared me to short NVDA. I would like to stress again that I do not advocate shorting anything (and am not short NVDA), especially for the average individual investor, much less a stock that has had strong upward momentum. This is due to the venerable adage, “markets can stay irrational longer than you can stay solvent.” For the average individual investor, there are probably better ways of obtaining risk-adjusted returns than hazardous plays such as picking tops.

The purpose of this article is not to pick NVDA’s tops per se but to show the warning signs when they appear and the reader can judge his risk appetite for holding NVDA shares. While NVDA is all the rage now, it will probably fade away at some point. Does anyone still remember what was the hottest stock in 2021? 2019? 2016? In the heat of the moment, NVDA seems inexorable but 5 years down the road it’ll just be another stock, or worse, just another Intel (INTC) or railroad.

Conclusion

I continue to believe that NVDA faces far larger risks to the downside than to the upside with its current $3 trillion+ market cap, and individual investors should be very cautious.

Again, I would strongly caution investors who are investing money they cannot afford to lose (e.g., retirement savings) to be careful with NVDA, or at least consider keeping risk exposure to a manageable level. If an individual investor has significant sums of money in NVDA, he or she may consider selling at current prices near record highs and get out with a small profit or breakeven, rather than hoping the gravy train continues. It’s very plausible that there are strong indications that NVDA’s gravy train is coming to an end. These include, e.g., credible alternatives are near being developed or deployed to supplant NVDA. Big institutions will have gotten the news and the stock price will have sold off long before the news hits the wires and the individual investor is aware of it.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.