Summary:

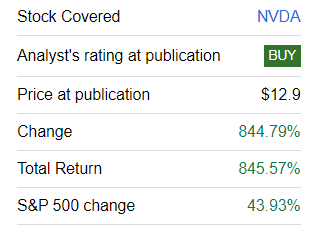

- We’re downgrading Wall Street’s AI darling, Nvidia, to a hold after a +844% run since our upgrade to buy in October 2022.

- We expect NVDA to beat on revenue but guide softer than expected for October quarter.

- With a current market cap of over $3T, NVDA’s stock price is anticipating a July quarter beat and an October quarter guide-up.

- Any softness in its outlook may result in a material pullback, i.e. an air pocket.

- We believe the channel inventory build creates near-term outlook risk in the October quarter and recommend investors trim ahead of the call this quarter and load up on the pullback.

Jon Feingersh Photography Inc

We’re downgrading Wall Street’s AI darling, Nvidia (NASDAQ:NVDA). We’ve been buy-rated on NVDA since our upgrade from sell to buy back in October 2022, titled “Nvidia: Reversing Course, Now Bullish Due To Data Center Demand” after our thesis on NVDA’s crypto-exposure bust played out. The stock is up +844% since, as shown below. Our positive thesis on NVDA being a unique player during the AI moment played out. Jensen had prepared the perfect AI product before he knew its potential TAM, and it did well for him. Since our last article on the stock in late November, “Nvidia Q3 – Still Buy: Another Beat And Raise,” the stock went up from around $492 to above $1,000 pre-split. We’re now downgrading the stock to a hold after the triple-digit growth and would recommend investors trim ahead of next quarter as we see the long-awaited air pocket. We expect a material pullback in management’s guidance for its October quarter.

SeekingAlpha – TechStockPros

We believe there are three factors to take into account when assessing NVDA’s near-term performance: lead times/double-ordering, market expectations, and industry product transition

1. Lead times/double-ordering

Our industry checks confirm that lead times are now relatively nonexistent; to put this into perspective, lead times are down from roughly 12 months early last year to between 36-40 weeks in January, below 20 weeks in April, and below eight in May. NVDA H100 lead times have fallen from more than 50 weeks last year to less than 4 weeks now.

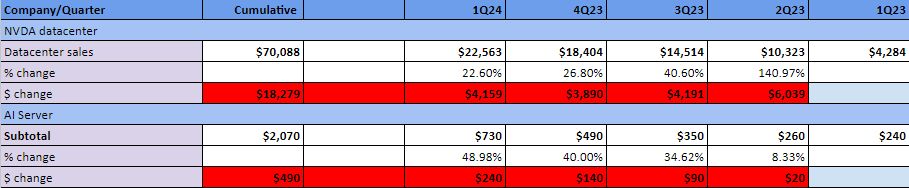

This means that the double ordering will start going away because there is no longer a shortage of H100; remember, a shortage in the supply chain will more often than not be accompanied by double ordering. The issue is that there’s a lot of channel inventory built up at the moment; we ran some numbers to confirm this. As shown below, if you compare NVDA data center sales to the total AI server sales from SMCI (SMCI), DELL, HPE, Lenovo, Inspur, and other East Asia players, the numbers show NVDA data center sales were much higher than the total AI server sales with a ~$10B discrepancy; we think this means there’s a lot of double-ordering that’ll drive July quarter sales but not necessarily a strong October quarter outlook (because customers will stop double ordering now that there is no need to fear the shortage).

TechContrarians

Also, customers will likely slow the ordering of H100 now because of the product transition to the Blackwell series; current data center sales are still mainly H100 sales, but the backlog is already showing B200 orders. Customers need to transition to the Blackwell series to maintain their competitive edge. Our concern is that NVDA sales outlook will not match guidance because investors are unaware of this air pocket risk from the product transition and eased double-ordering.

Further confirming the concern over inventory build-up were the results when we checked the inventory levels of the AI server players mentioned above and found that inventory levels have been on the rise from ~$30,530M in 3QCY23 to $32,417M in 2QCY23 to $40,892M in 1QCY24. This inventory build-up can be attributed to AI GPUs rather than PCs, smartphones, or other end markets because everything but AI has already undergone an inventory correction cycle in the post-pandemic environment. This is cause to trim ahead of the July quarter earnings call. We expect the channel inventory build will create a near-term risk for the outlook. We anticipate NVDA will beat consensus expectations on revenue but are less confident that it’ll be able to raise guidance materially above consensus.

2. Market expectations

Keep in mind that soft for NVDA is not what soft is for the rest of the semis; NVDA is priced to beat and raise guidance, not to meet expectations. We’ve already seen how hot the market’s AI-related expectations are from the reaction to Micron Technology’s (MU) outlook, which slightly beat guidance but failed to fulfill the AI hype priced in.

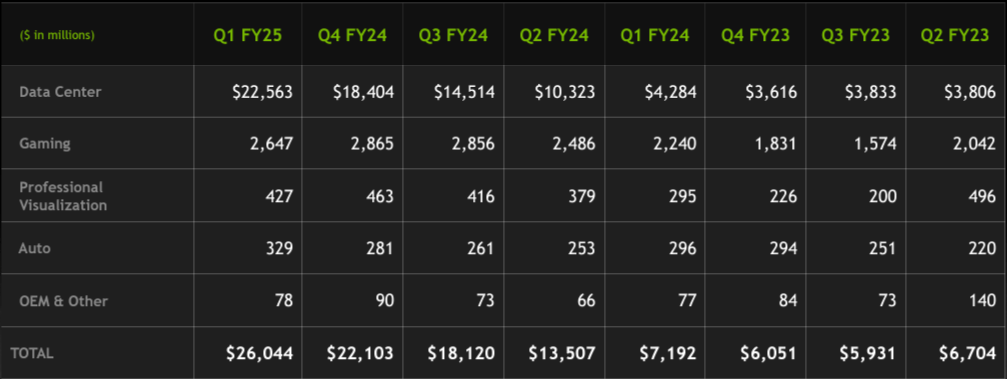

NVDA is now a three trillion dollar company; considering the current market cap, NVDA’s stock price is anticipating a July quarter beat and the October quarter guide up. Any softness in its outlook may result in a material pullback for the stock, especially considering the May and June rally. Just to put into perspective how much the company’s data center revenue has expanded, in a year ago quarter, the company first showed the market what true AI exposure means, reporting sales of $7.19B versus a consensus of $6.5B at the time and guiding for 53% Q/Q growth to $11B in sales for Q2, beating consensus at $7.15B. The following graph outlines NVDA’s data center business hypergrowth.

NVDA 10Q

3. Industry product transition

The double ordering for its hopper series will still result in the July quarter beat, but the October quarter product transition creates risk. The third factor mentioned above is the industry product transition. NVDA is preparing the industry to transition to B100, B200, and GB200 NVL72 next year. We see some near-term risk due to platform transition because NVDA must get the supply chain (power station, mechanical/liquid cooling, data center re-tooled) in line to ramp up the next-gen platform. CEO Jensen Huang has already begun preparing the supply chain with our industry research, indicating that he met over dinner with different supply chain players in Taiwan at Computex this year. NVDA is leading the industry on Moore’s Law, the same way Intel (INTC) used to, but this takes time. So, this adds to the risk on this quarter’s outlook for October.

There’s also a lot of noise around in-house ASIC from Amazon, Microsoft, Meta, and Google, replacing demand for NVDA’s AI GPU offerings. In-house ASIC or application-specific Integrated Circuit that acts as an IC customized for a specific market, application, or customer as mentioned with the following definition from an old issue of Analog Dialogue stating “[A]n integrated circuit designed for a specific customer, application, or market using cell-based techniques, where the necessary functional blocks are taken from a cell library, interconnected, and simulated to provide the desired system functions and level of performance.” Amazon, Microsoft, Meta, and Google are developing their own in-house ASIC for AI workloads and use cases. We would warn investors against feeding into the market panic around this eliminating NVDA because there will still be a need for GPUs. We expect the low to medium complexity inference to be done on the in-house because it won’t require that much GPU power but we expect all high complexity inference to be on NVDA’s offerings.

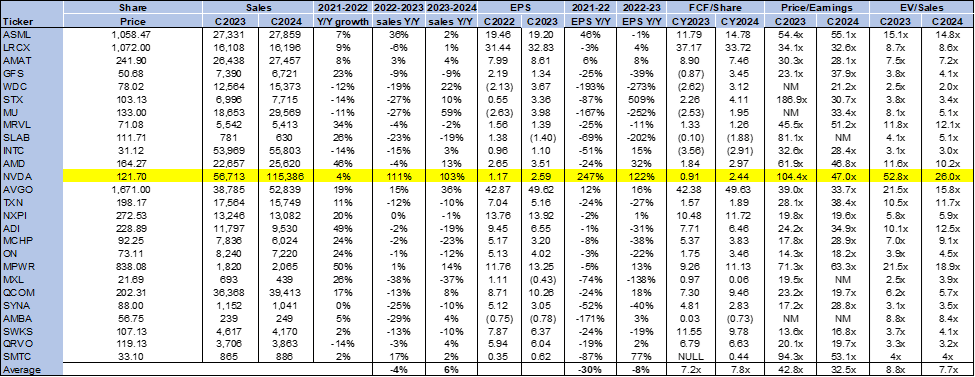

Valuation & Word on Wall Street

NVDA is expensive, but the higher multiple can be justified considering the company’s AI-led hyper-growth. The stock is trading at 26.0x EV/C2024 sales, higher than the ratio of 23.0x it held when we last wrote about it in late November and the current peer group average of 7.7x. We’ve seen NVDA’s multiples expand over the past several months as the market prices in expectations of future earnings in its data center business, particularly given NVDA’s whisper numbers. The whisper number refers to Wall Street’s unofficial consensus forecast for future earnings or revenue. NVDA’s whisper numbers reflect for 2024 and 2025 reflect “one of the strongest growth rates on Wall Street.” This is what supports such a high multiple for the stock. NVDA’s P/E ratio CY2024 is also above the peer group average at 47.0x compared to 32.5x but relatively in line with its ratio of 48.0x back in November. Our neutral rating is based on our belief that NVDA won’t be able to materially beat the consensus outlook for its October quarter, causing an air pocket considering the current high growth expectations. Still, we do believe the company will be able to comfortably surpass Street expectations in 2025 as demand for the Blackwell series kicks into top-line growth and expectations adjust.

The following chart outlines NVDA’s valuation against the peer group average.

TechStockPros

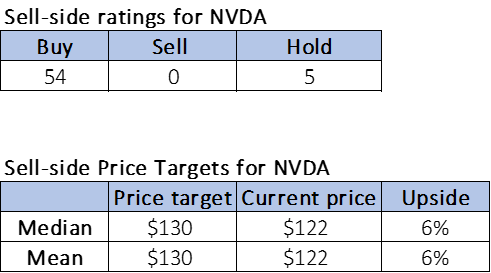

Wall Street is overwhelmingly positive on NVDA, which is no surprise. Of the 59 analysts covering the stock, 54 are buy-rated, and the rest are hold-rated. The stock is currently priced at $122 after the split early last month. The median and mean sell-side price targets are $130 for a 6% upside compared to an expected upside of 24% to 28% in November. The following charts outline NVDA’s sell-side ratings and price targets.

TechStockPros

What to do with the stock?

We think NVDA will see another boost in data center sales in its December quarter and through CY2025 because of GB200 NVL72, which will be able to rack up 72 GPUs in a single server and necessitate liquid cooling. What is important for data center sales is that the product “supports 36 and 72 GPUs in NVLink domains.” We think this will be NVDA’s next big thing. We recommend investors trim their positions ahead of the July quarter call and load up on the anticipated pullback.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2 week free trial of Tech Contrarians, our Investing Group service.