Summary:

- Nvidia reported strong first quarter earnings results with strong revenue growth.

- Nvidia will also split its shares, but the impact of that shouldn’t be over-interpreted.

- Nvidia is a strong performer, but shares are pricey right now.

Antonio Bordunovi

Article Thesis

NVIDIA Corporation (NASDAQ:NVDA) reported its most recent quarterly earnings results on Wednesday afternoon. The company beat estimates once again, showcasing excellent business growth and great profitability. Shares reacted positively to these results, although the share price reaction was a lot more muted compared to some of the company’s past earnings beats. The company’s decision to split its shares makes sense, but does ultimately not change the value of the company.

Past Coverage

I have covered Nvidia Corporation in the past here on Seeking Alpha, most recently in February, following the release of Nvidia’s Q4 results. I analyzed the company’s excellent quarterly results but gave the company a “Hold” rating back then as I thought that the valuation was far from low and that buying following a huge run-up would not be ideal. As it turns out, buying additional shares of Nvidia in February would have worked out well, as shares continued to rise over the following three months – but those who held on to shares without buying additional shares also benefited from these gains, of course. I had given the company a “Buy” rating before, in 2022, when enthusiasm was less pronounced – shares gained 460% since then.

What Happened?

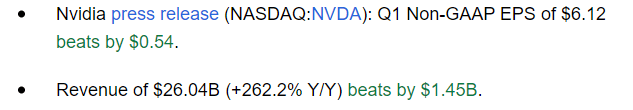

Nvidia’s earnings results: The headline numbers can be seen in the following screencap from Seeking Alpha:

NVDA results (Seeking Alpha)

We see that Nvidia recorded strong revenue growth, but that was, of course, not a surprise as the recent momentum and management’s guidance had all but guaranteed that the company would show a strong year-over-year revenue gain once again.

The magnitude of the revenue growth was still a surprise as the company outperformed expectations once again. A 260% revenue increase made Nvidia generate revenues that were around 5% higher than what the analyst community had expected. While this was a positive result for sure, the beat was less pronounced compared to the previous two quarters when revenue estimates were beaten by more than 10%, respectively. I believe that this “smaller” revenue beat explains why Nvidia’s shares did not rise much in after-hours trading, at least at the time of writing, where shares are up 2%. In some of the last couple of quarters, Nvidia experienced a much more enthusiastic share price reaction following its earnings releases.

Profits were higher than expected as well, but here, like with the revenue number, the beat was “smaller” compared to what investors got used to over the last couple of quarters. In Q4, Nvidia beat earnings per share estimates by 11%, while the company beat earnings per share estimates by an even better 19% in the third quarter, with the Q2 beat being extraordinary, at more than 20%. During the first quarter for which we got results just now, the beat was in the high single digits. That’s still good, of course, but maybe some investors were expecting even better results – after all, the company had delivered bigger beats in the recent past.

Nvidia’s Results

When we take a closer look at Nvidia’s sales performance, we see that Nvidia, unsurprisingly, benefited massively from the ongoing AI frenzy. Data center revenue, where most of the AI revenue is recorded, hit a new record high of more than $22 billion. This means that the Data Center group now contributes close to 90% of the company’s overall sales. This is great news as long as the unit keeps growing, but if the unit were to stall at some point in the future, company-wide revenue growth would most likely stall as well. The other business units are just not large enough, on a relative basis, to have a major impact on Nvidia’s company-wide results any longer. This used to be different when consumer GPUs contributed a larger portion of revenues, but Nvidia has now (almost) turned into an AI data center pure play – for those looking for maximum AI exposure, that’s not a bad thing, of course.

Growth in the AI data center space remains not only strong on a year-over-year basis, but also on a sequential basis. Compared to the previous quarter, revenues grew by another 23%. While that’s excellent, the sequential data center growth rate suggests that the year-over-year growth rate will come down in the foreseeable future – the quarter-to-quarter growth rate, annualized, is a little less than 130%, while the Q1 year-over-year data center growth rate was much higher, at more than 400%. The fact that growth is decelerating is not surprising, however, as no company can grow at a very high growth rate forever. It’s basically guaranteed that Nvidia’s data center growth rate will continue to slow down in the future, as maintaining a 20%-plus sequential growth rate forever is impossible.

Profits benefit from higher revenues, of course, but Nvidia also has seen profit tailwinds from margin expansion in the recent past. It looks like most of the easy gains have been made, however, as the quarter-to-quarter gross margin improvement was not very pronounced, at around 200 base points, while the year-over-year gross margin improvement was way higher, at 1,400 base points.

We see the same principle at work when we look at Nvidia’s operating profits, which were up by a massive 690% year over year, more than doubling the revenue growth rate. On a quarter-to-quarter basis, however, operating profits grew just slightly more than revenues. It thus looks like Nvidia’s margins are nearing their top – the company can’t grow its margins at a hefty pace forever, and margins are now so high that growing them further has become quite hard. In the future, profit growth will thus likely be more or less in line with revenue growth, I believe – it’s unlikely that Nvidia will report additional quarters where its profit growth more than doubles its revenue growth.

Nvidia’s Stock Split

Along with its earnings results, Nvidia also announced a stock split and a dividend increase. The company plans to split its shares at a 10-for-1 ratio, meaning each shareholder will receive nine additional shares for each share they own right now. The share price would, all else equal, be in the $90 to $100 range following the split.

Stock splits used to be more important in the past when fractional share buying was uncommon or even impossible. When a stock’s price was too high back then, investors with modest amounts of money weren’t able to buy an entire share. But today, fractional share buying is very common, thus even someone who wants to invest $500 in Nvidia and who can’t afford an entire share can easily buy a position even though NVDA trades at more than $500 per share. A stock split thus doesn’t change much when it comes to investors’ ability to buy shares. Stock splits can make shares “look cheaper” from a psychological perspective, which may result in some additional buying, but the valuation doesn’t change. After all, a 10-for-1 stock split will make Nvidia’s earnings per share decline at the same ratio, thus the earnings multiple (or revenue multiple, cash flow multiple, EV/EBITDA ratio, and so on) will stay the same.

A stock split could result in Nvidia getting included in the Dow Jones Index as this index is price-weighted. Amazon.com, Inc. (AMZN) was included once it split its stocks, and since Nvidia is one of the largest companies in the world by market capitalization, the same could happen following the upcoming NVDA stock split. In case Nvidia gets included in the Dow Jones Index, there would be some forced buying by ETFs replicating the index, which could have a positive impact on Nvidia’s share price. But overall, I believe that the impact of the stock split shouldn’t be overinterpreted – it will not be a game-changer for the company.

The dividend will be increased by 150% following the stock split, to a post-split $0.01 per share (or $0.10 per pre-split share). While a 150% dividend increase is massive on a relative basis, the yield will still be very low, at less than 0.1%. From an income investors’ point of view, Nvidia thus remains unattractive.

Takeaway

Nvidia remains the dominant AI player and a key beneficiary of the ongoing AI hype. Growth during the first quarter remained strong, although there are signs that peak growth has passed and that forward growth will be less pronounced. The share price reaction is rather modest, which likely can be attributed to the fact that the earnings beat wasn’t as extraordinary as during recent quarters. Trading at close to 40x net profits, Nvidia is pricey, and waiting for a better buying opportunity might pay off, which is why I give Nvidia a Hold rating today.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!