Summary:

- After a long-overdue cool off, Nvidia Corporation stock is back charging towards its previous high of $140.

- Identifying a breakout at $96 pre last quarter earnings for this equity, the company has now resumed its march towards that initial target.

- Nvidia did experience a selloff in the last month, and that selloff has now paved the way to $210.

Alones Creative

People have been asking lately my opinion on not only what is happening with the overall market, but particularly the state of play with the of late, lucrative AI equities.

My answer is as always when a market or markets are in overall bullish formation until technically confirmed otherwise: Taking a bit of a cool off, especially in the AI sphere, after an extreme period of bullish action. I have been able to chart Nvidia Corporation’s (NASDAQ:NVDA) future price both in bearish and bullish formation in the past few years, until now…

By that, I mean that Nvidia is still in a wave to $160 and possibly $210 if this equity breaks $140, which could happen sooner rather than later.

One of the reasons as to why this stock has seen such a meteoric rise in the past 18 months is not just because of the dominance it has in terms of market share. The company’s earnings have been surprising to the upside during this turnaround bull period. With the latest earnings due on August 28th, the whole market will be watching to see if that dominance continues and. More importantly, this company could blow Wall Street away yet again with fruitful numbers.

Nvidia, one could say, has been largely but proportionally responsible for dragging the wider market with it.

It has not been the only AI stock that has experienced massive gains, either. There have been others which I will look to cover in the upcoming weeks.

I have seen a lot of analysis suggesting that the run may be over for Nvidia Corporation stock. However, the technical fact remains, the run could be just starting to a new stratosphere with the key set up already in place.

Earnings:

According to Zacks, August 28th earnings are expected to come in at 0.63 EPS, which would be a year-on-year jump of +133% with revenue expected at just over $28 billion, a 109% jump from the same period last year.

For our readers that follow my analysis, I have been extremely bullish on Nvidia so far. It is up over +500% since I identified a breakout pattern at $187 in January 2023. Before earnings last quarter, I identified an additional breakout pattern at $965 that would see $1600 as a next stop.

Nvidia subsequently announced it would be initiating a stock split and has so far topped out at $1400 or $140 pre-split.

Let’s now move over to the monthly charts to examine where this latest set up can take the AI giant price wise.

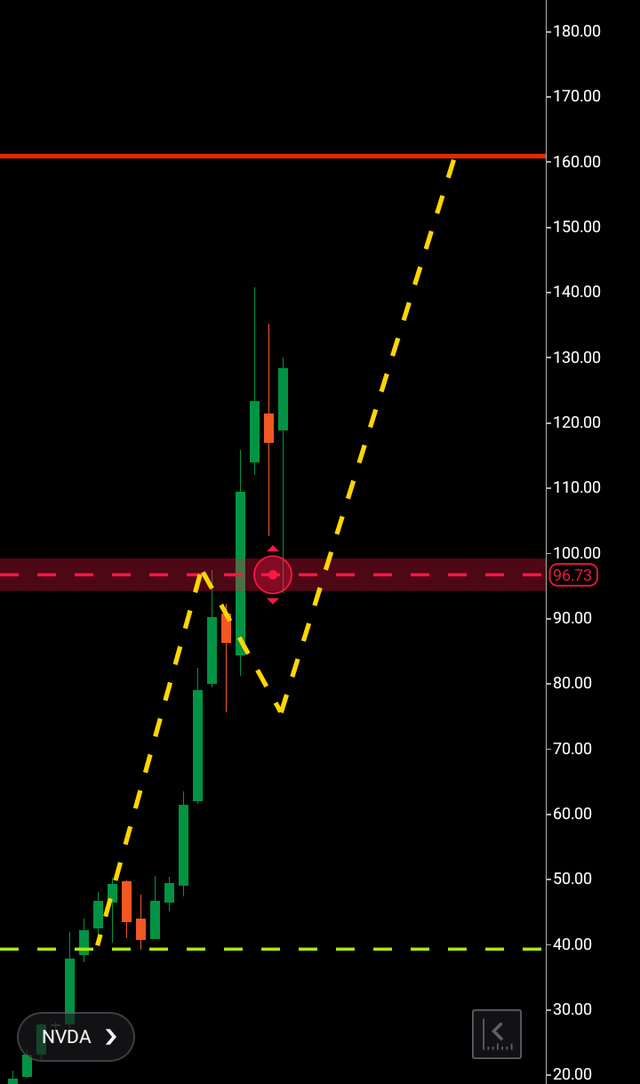

Firstly, we will quickly go through the structure this stock remains in. We can see the wave one from $40-$96 that shows real demand for this equity containing five months of buying, the wave two, $96-$75 with only one month of selling in this whole structure before the breakout.

Nvidia Current Monthly Structure (C trader)

The third wave has broken above the $96 area and onwards towards $160 as a third wave completion. According to my theory, a third wave will look to replicate the numerical parameters of the wave one once it has broken above waves one and two. We can gauge this by identifying the numerical length of the wave one, before it encountered selling. Once the financial market has broken its price above both the buying and selling waves, we have an expected target that it will look to copy those preceding waves before pausing again.

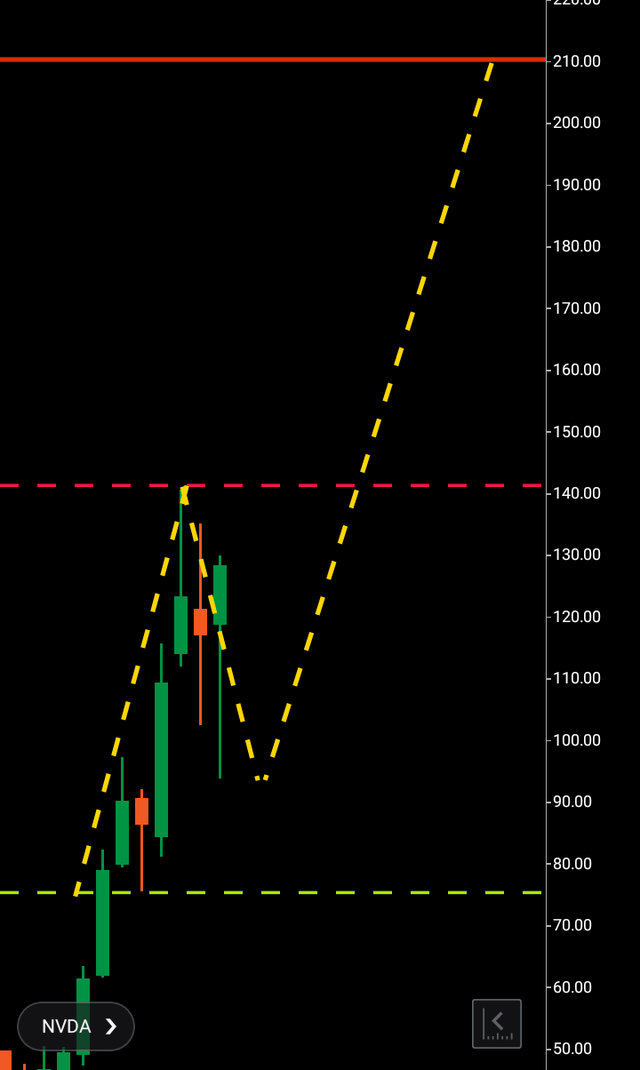

Let’s move to the new structure in play. As with the last $96 breakout I identified pre-earnings last quarter, it was a massive beat that really catapulted Nvidia out of the blocks. If earnings come in better than expected this time round, we could see a march towards $210 initiated.

Within the structure towards $160, an additional wave pattern has emerged here on the monthly chart, with the global sell-off last month, this has actually created the path to new highs for many financial markets. Nvidia included.

Nvidia Potential Structure Monthly Chart (C trader)

In this case, the wave one is between $75-$140, the wave two $140-$92 with the third wave set up to look for $210 should $140 be broken above taking out the original target of $160 along the way.

Bearish case:

Currently, there is not much in the way of a bearish case. Obviously, If earnings were not to the market’s liking, Nvidia could fall off these highs. However, if this is the case, given the company’s dominance, it would have to be a significant miss to put an overall stop to the upward movement we have seen as AI evolves. As with any financial market, a geopolitical situation or domestic issue regarding the US economy could trigger a sell-off, to which Nvidia would not be immune.

To finalize:

On past earnings history, particularly in the last twelve to eighteen months, I would expect Nvidia to surprise the market yet again with an earnings beat. If this is the case, we could see this stock bypass my original target from last quarter and look for $210 within the next 180 to 220 days.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.