Summary:

- Nvidia Corporation easily beat estimates in the latest earnings season, but Wall Street is not impressed.

- Despite an 8.5% earnings surprise in the third quarter and a 5.6% earnings surprise in the second quarter, the stock has been trading sideways since June 2024.

- Most of the growth has been priced in the stock, while the company continues to see higher competition as new AI chips are being launched.

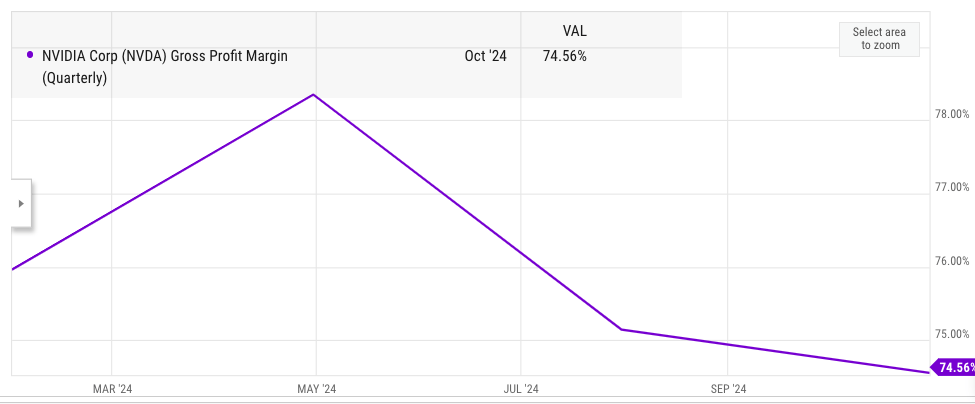

- It is difficult to see how Nvidia will maintain a mid-70s gross margin despite the launch of Blackwell as new AI chip options gain market share in the upcoming quarters.

- Nvidia’s market cap is close to $3.5 trillion, which reduces the upside potential for the stock, despite a very strong AI demand and a huge buyback program.

JHVEPhoto

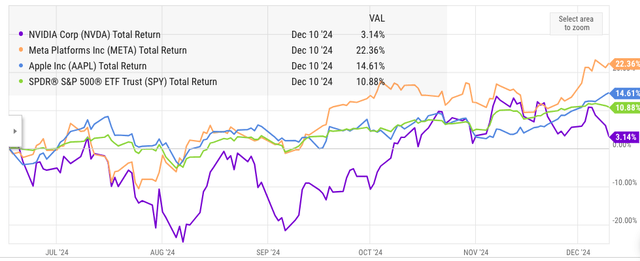

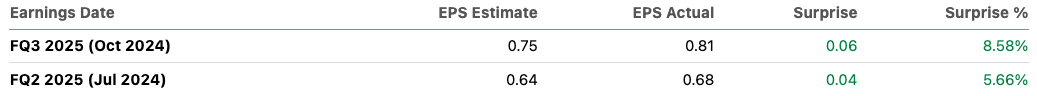

Nvidia Corporation (NASDAQ:NVDA) easily beat the estimates in the recent quarterly earnings report. The company reported EPS of $0.81 which beat estimates by a whopping 8.5%. However, we did not see any positive momentum in the stock. A similar story was repeated in the second quarter earnings release when Nvidia beat EPS estimates by 5.6%, but the stock did not budge. Nvidia stock hit $135 in June 2024 and since then, it has moved sideways. It is likely that Wall Street has assumed that most of the growth potential of Nvidia has already been priced in the stock. In our previous article, it was mentioned that Nvidia is facing new headwinds in the future growth runway.

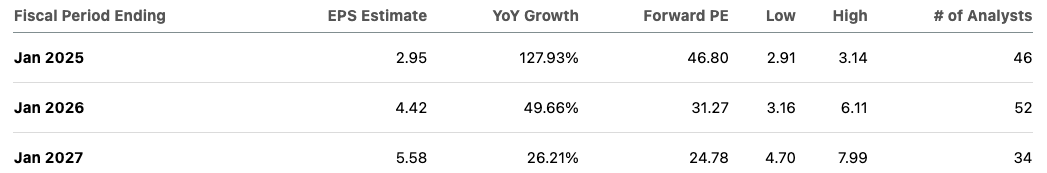

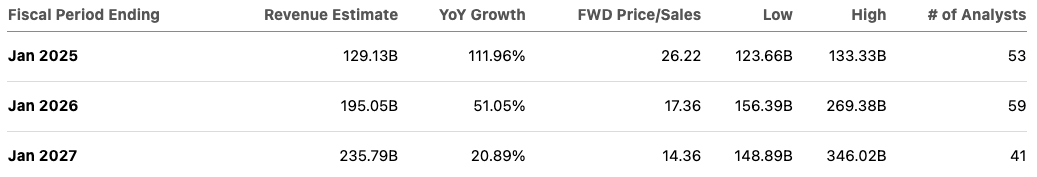

Nvidia’s forward revenue and margin estimates also vary significantly. Analysts have made revenue estimates for the fiscal year ending Jan 2027 between $150 billion and $350 billion. This is a broad range for any company. At the same time, Nvidia will also face margin pressure as new competition enters the market. The forward P/E ratio of Nvidia for the fiscal year ending Jan 2026 is close to 31. Even if Nvidia beats EPS estimates by a few percentage points, it might not be enough to deliver a strong bullish momentum due to the current price. The massive buyback pace of close to $50 billion annualized will also fail to move the EPS needle at the current market cap. Nvidia needs a few quarters to absorb the current valuation, which can lead to sideways stock momentum in the near term and underperform the broader S&P 500 (SP500).

High Expectations

Nvidia’s 8.5% EPS surprise has not been enough for Wall Street, as the stock faces difficulty breaching the $150 level. We saw a similar trend following the second quarter earnings after a 5.6% EPS surprise.

Seeking Alpha

Figure: Earnings surprise of Nvidia in the last two quarters.

Nvidia stock has shown massive returns in early 2024, but over the last six months, the stock has mostly traded sideways. Despite plenty of good numbers and news from Nvidia, Wall Street has not given further bullish momentum to the stock in the past six months. This can be taken as a sign that the company needs a few quarters to absorb the earnings growth and reach a more attractive valuation multiple.

Figure: Comparison of Nvidia stock and S&P500 in the past six months.

Competition will hurt revenue and margin potential

One of the key headwinds for Nvidia is the rapid entry of new companies and chips in this segment. This will inevitably lead to a shrinking of margins and overall market share of the company. It is difficult to see Nvidia maintaining a mid-70s gross margin by the end of 2026. Over the last two quarters, Nvidia has already reported a dip in gross margin from 78% to 74.5%. Two quarters do not make a trend, but this is certainly a negative trajectory for Nvidia and should hurt the bullish sentiment if we continue to see a further dip below 70%.

Ycharts

Figure: Decline in gross margin of Nvidia in the last two quarters.

Bullish analysts have pointed to the CUDA platform as a wide moat for Nvidia. However, we should also note that close to 50% of the Data Center sales for Nvidia come from hyperscalers like the cloud business of Amazon (AMZN), Microsoft (MSFT), and Google (GOOG). All these companies have been trying to build their own AI chip pipeline and are also experimenting with other competitors to reduce their costs.

Nvidia Filings

Figure: Nvidia’s reliance on hyperscalers to drive sales growth. Source: Nvidia Filings.

Advanced Micro Devices (AMD) is also ramping up its AI chip sales. In late 2023, AMD’s management forecasted $2 billion of AI revenue for 2024. In the recent announcement, this has increased to $5 billion. This is still significantly below what Nvidia reports in a single quarter, but we can see a strong growth momentum in this segment. Nvidia has a strong booking pipeline for the next few quarters, but we could see a downward pressure on the price of chips as the competition increases. This is reflected in the forward EPS estimates. For the fiscal year ending Jan 2026, Nvidia’s EPS estimates vary between a low of $3.16 and a high of $6.11. This is a massive variation, which shows that Wall Street is not certain about the ability of the company to maintain its juicy margins.

Seeking Alpha

Figure: Forward EPS estimates of Nvidia.

We can see a similar trend in the revenue projections. The revenue projections for the fiscal year ending January 2027 vary between $148 billion and $346 billion. This is a massive variation in the revenue estimates for 2026.

Seeking Alpha

Figure: Revenue estimates of Nvidia in the next few years.

Can Nvidia stock deliver high returns?

Over the last two years, Nvidia stock has been one of the best-performing stocks and has been instrumental in building the AI hype. However, it is important to ask if this stock momentum can be maintained. Nvidia’s market cap is already $3.5 trillion, which already makes a big chunk of the total stock market valuation. The company also announced a buyback of $11 billion in the previous quarter. However, due to the massive market cap, the share count reduction would be quite small.

The AI chip market is growing rapidly, but there is also a rapid increase in competition. I am not sure if the CUDA platform alone is a good enough moat for Nvidia to keep the competition away. Despite good revenue growth, a dip in market share for Nvidia could increase the bearish sentiment towards the stock. We have already seen a dip in gross margin from 78% in the second quarter of 2024 to 74.5% in the recent quarter.

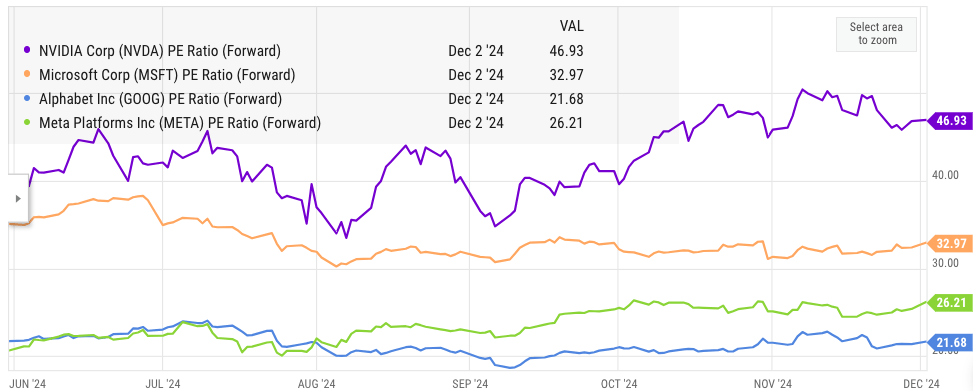

Ycharts

Figure: Nvidia’s forward P/E ratio in comparison to other big tech.

Nvidia’s forward P/E ratio is the highest among the big tech companies. The earnings growth of Nvidia is higher than other tech companies, but the moat is not as strong as Apple or Alphabet. It is inevitable that competitors will increase their market share in Nvidia’s Data Center segment over the coming quarters. We might not see another bullish momentum in Nvidia unless the future revenue and margin numbers become clearer.

Investor Takeaway

Nvidia has reported excellent numbers in the latest earnings, but Wall Street has not been impressed. The stock has traded sideways for the last six months despite a massive buyback program by the company. The margins and market share for Nvidia will continue to be under pressure in the upcoming quarters as new AI chips are launched.

The earnings growth for the company is strong, but most of this is already priced in as the stock trades at a premium compared to other big tech companies. The market cap of Nvidia is close to $3.5 trillion, which reduces the upside potential if margins continue to decline, or we see stronger competition in the upcoming quarters.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.