Summary:

- Nvidia Corporation stock has been on a tear the last 7 months.

- Would you believe Nvidia stock is almost as overvalued here as the Cisco Systems, Inc. of 2000?

- I present a few reasons why I sold out my entire position in Nvidia Corporation stock and preview the upcoming earnings.

Justin Sullivan

I wrote this article on Nvidia Corporation (NASDAQ:NASDAQ:NVDA) a while ago, providing 8 reasons why I trimmed my position in NVDA stock. Since then, the stock has gone up a further 21%, outperforming the S&P 500 Index (SP500) by a handy margin of 3:1. I ended getting rid of my entire position in Nvidia Corporation, as I believe the risk-reward is no longer in my favor, especially with an earnings report coming up on Wednesday, May 24th post-market.

Before we preview the earnings, since I love throwing out numbers, let us put Nvidia’s overvaluation in context.

- Since reaching a low of ~$108 in October 2022, a mere 7 months ago, NVDA stock has almost tripled. We are not talking about a startup being recognized for its potential or a biotechnology company cracking a hard-to-solve disease. We are talking about a $250 billion company turning into a $750 billion company in 7 months. Granted, you can also say this was a nearly $1 trillion company that just had a detour to $250 billion before making its way back to $750 billion. But the fact that all this happened in such a short span by and off itself should concern the ones sitting at massive gains here at $312.

NVDA Stock (Google Finance)

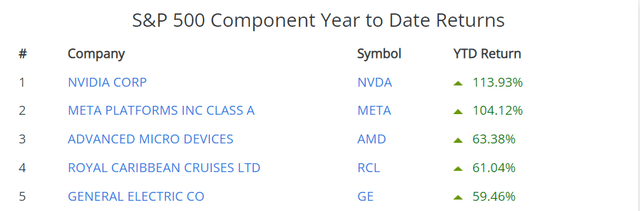

- The stock is up nearly 120% YTD and is the best-performing name in the S&P 500 index. The time to buy cyclical stocks like NVDA, in my opinion, is when the stock doesn’t have supporters and not when everyone is throwing their weight behind it. At this juncture, I am glad to report that I was fairly bullish on the stock in October 2022, when I called its reversal.

S&P 500 Top Stocks (slickcharts.com)

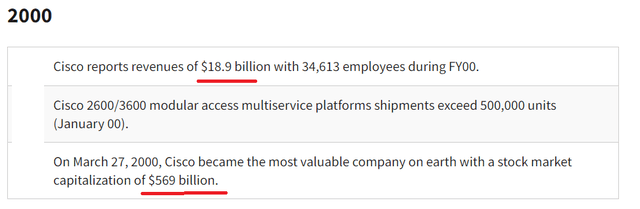

- It is often said “Those who cannot remember the past are condemned to repeat it.” It is also easy to fool ourselves with the “Not-Me” syndrome. Let’s play an honest game. Knowing what you know now about how hard Cisco Systems, Inc. (CSCO) crashed in 2000 and how it failed to ever recover that mojo, would you have invested at its now-famous lofty valuations? That’s a rhetorical question. Cisco, the poster child of the Internet bubble, traded at a price-sales multiple of 30 at its peak valuation. Nvidia, the poster child of the AI movement along with Microsoft Corporation (MSFT), is currently trading at 26 times 2024 sales estimate of $30 billion. (I am not accusing Microsoft of being in a bubble as bad as Nvidia, although it is easy to make a case for its overvaluation, too).

CSCO Multiple (networkworld.com)

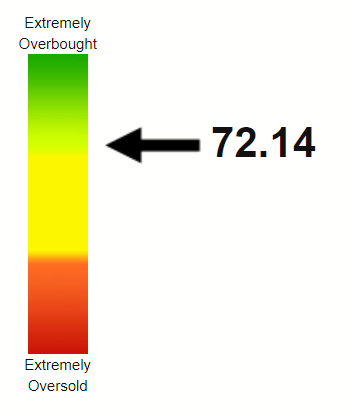

- From a technical perspective, the stock is not as overheated as it is on the fundamental side. NVDA stock’s Relative Strength Index (“RSI”) is approaching 75, and anything above 70 is overbought by textbook definition. But textbooks rarely work in the stock market, and I fully expect the RSI to strengthen further in the short term. However, the higher NVDA goes, the quicker and riskier the reversal is likely to be.

NVDA RSI (Stockrsi.com)

Earnings Preview

Nvidia Corporation is expected to report earnings of 91 cents per share and about $6.50 billion in revenue in Q1 2024. Given the company’s recent history, it seems fairly safe to expect them to beat on both top and bottom lines. Estimates have gone up consistently across the board as shown below, aided by the fact that Nvidia guided up when they reported Q4 results

NVDA Estimates (Yahoo Finance)

But that may not be good for longs for three reasons:

- Higher bar to beat and NVDA stock may be priced for beyond perfection. A simple earnings beat by a cent or two or by a few millions in revenue is likely to disappoint investors. At this point, it appears like the market is expecting Nvidia Corporation’s AI technology to solve world hunger or pollution overnight.

- Exhaustion selling, meaning given the recent run to almost $320, many will be eager to take their profits off the table.

- Even if the numbers are met or slightly bettered, fundamental investors should not forget the valuation story. Let’s say NVDA betters revenue by 10% (its highest is 7% in the last 4 years), that’s still $7.15 billion/qtr, which is short of the average $7.5 billion needed each quarter to meet the $30 billion revenue estimate for 2024. Granted, there will be seasonal fluctuations and not every quarter is equal, but you get the drift. In short, merely meeting or even beating by 10% may not mean much, given the expectations. AKA multiple/valuation compression is bound to hit the stock sooner than later.

From a business perspective, I expect recovery signs from the Gaming segment, with desktop Graphical Processing Unit (“GPU”) being weak to go with industry trends. In the Q4 report/call, the CEO had no qualms about where he believes the future is, AI. While I am sure Q1 will be no different, it remains to be seen if more details are provided by the “operating systems of AI.” I will also be looking forward to hearing about more AI related partnerships and details of already announced ones.

Conclusion

I am not suggesting that everyone should sell Nvidia Corporation stock. You may be sitting in massive gains that you want to defer taxes on. Or you got in late and would like to see if the euphoria continues a bit longer. You do you.

I still like Nvidia as a company. I still admire the CEO Jensen Huang, who strikes me as someone with the unique combination of being honest, a visionary, and respected by one and all. But that does not make me a fanboy of the stock at any and all prices. I was almost glad to suffer when the stock went to almost $100 because deep down I knew the selloff was unjustified and the stock would recover. I cannot believe that a mere 7 months later, not only has the stock recovered but has gone in the other direction where the current price is not justified due to overvaluation.

One thing for sure. I will be back in Nvidia Corporation stock at the right price at the right time. The price may not be perfect when I get back, but it is unlikely to be in the middle of a frenzy. The actual Nvidia Corporation price does not matter to me, but the valuation and the overall tone around the company do.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.