Summary:

- Nvidia Corporation has soared in 2023, first due to hype – then due to incredible financial results.

- Management has indicated unprecedented demand with expectations for growth to persist in years to come.

- I was wrong here, I’ll admit that. But after the large run-up, the Nvidia valuation is looking precarious.

- I discuss the assumptions needed to make this a market-beating investment.

Cylonphoto

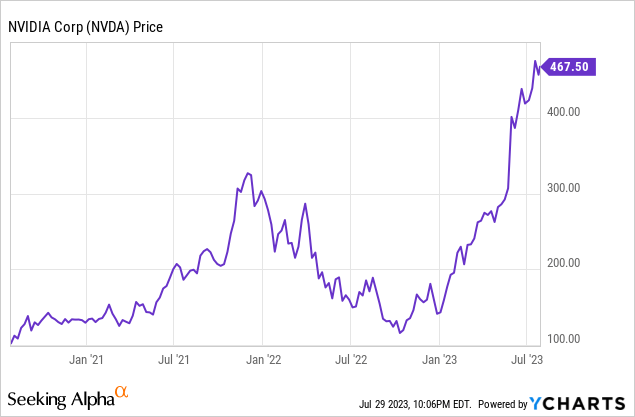

Perhaps no other tech stock has surprised investors as much this year as Nvidia Corporation (NASDAQ:NVDA). The stock headed into the print with a strong AI-driven rally, leading many (including yours truly) to view the valuation as getting stretched. The company proceeded to blow estimates out of the water, with the stock continuing its rally ever since.

In this report, I discuss exactly which I detail I believe are driving this stock rally and whether I view it to be sustainable. I reiterate my neutral rating, as the valuation appears very stretched in spite of what is likely to be strong tailwinds in the decade to come.

Nvidia Stock Price

It appears that the tech rally has a new leader in NVDA, with the stock soaring to all-time highs.

I last covered NVDA in May, where I warned about the rich valuation. That warning has proven premature, with the stock soaring since then. Even so, I am concerned that the stock is reflecting irrational exuberance.

NVDA Stock Key Metrics

In its most recent quarter, NVDA delivered results which destroyed guidance. Revenue came in at $7.2 billion, ahead of $6.5 billion guidance, and adjusted net income was $2.7 billion, ahead of guidance for $2.2 billion. I note that non-GAAP net income primarily excludes $1.4 billion in acquisition termination costs related to the failed acquisition of Softbank’s Arm.

NVDA saw strong growth in data center revenues as well as some sequential recovery in gaming.

On the conference call, management credited the strength in data center revenues to growing demand for generative AI. Management cited demand “from large consumer internet companies and cloud service providers.”

NVDA ended the quarter with $15.32 billion in cash versus $11 billion in debt. It is worth noting that the company did not repurchase any stock – perhaps management did not anticipate the pre-earnings rally to sustain.

Looking ahead, management delivered incredible guidance. Whereas consensus estimates called for $6.7 billion in revenue and $1.3 billion in net income, management instead guided for $11 billion in revenue and around $5 billion in net income.

This marks a return to strong upside surprises and the strongest such surprise in recent history.

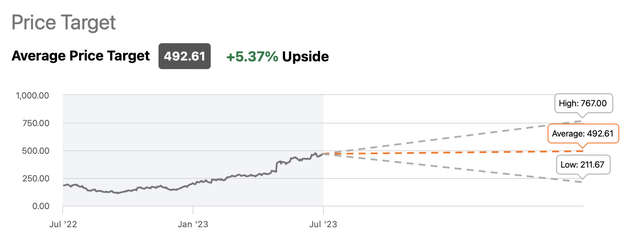

Analysts have quickly upsized their price targets to calibrate to the stock rally.

What is driving this rally? Management touted their products as having “the lowest TCO approach to train and deploy AI.” Management went on to state that “the world’s $1 trillion data center is nearly populated entirely by CPUs today,” all of which would need to be re-built with accelerated computing in order to support generate AI over the next 10 years.

When asked about full year guidance, management took the opportunity to even further stoke the fire, first saying that they are “not here to guide on the second half of that,” but that they do “do plan a substantial increase in the second half compared to the first half.” Management is making some big promises, and Wall Street appears quick to believe the story.

Is Nvidia Stock A Buy, Sell, or Hold?

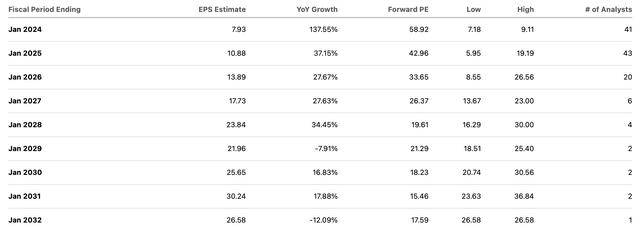

After the rally, NVDA finds itself trading at 59x earnings.

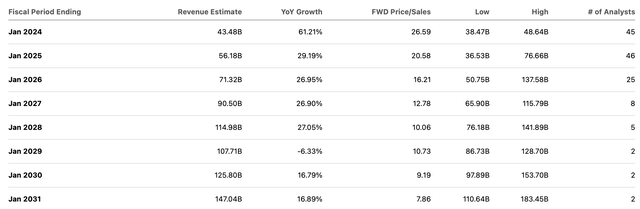

The rich valuation is better illustrated by the 26x price to sales multiple.

Yes, revenue growth should be strong from here, but I am doubtful that they will be in the 40% range after this year (and even then the valuation would still be rich). If anything, being able to sustain 25% revenue growth moving forward would already be great achievement, given the already-large size of the revenue base. Consensus estimates call for an aggressive 51% net margin by January 2028, yet the stock is trading at 20x those earnings estimates. Based on 15% projected growth following that year, the stock is already looking fully valued at around a 1.3x PEG ratio, implying that the stock might be “dead money” over the next 4.5 years.

There is a narrow path for market-beating upside ahead, but it relies on large beats to consensus estimates. If we assume that the company can sustain 40% revenue growth through January 2028 and generate a 51% net margin, then we arrive at $167 billion in revenues and $66 in 2028e EPS. The stock would be trading at 7x that estimate. If we assume that the company sustains 20% growth thereafter and trades at a 1.5x PEG ratio, then the stock might trade at $1022 per share, implying around 19% potential annual upside over the next 4.5 years (perhaps around 15% inclusive of the earnings yield). That would mosts definitely beat the market, but I find the assumptions to be overly aggressive and the potential return to be arguably modest.

The biggest risk to the bullish thesis is clearly valuation. It is unclear how long the hype for AI can sustain, and how tolerant the market will be of the stock if the company only delivers “strong growth.” Moreover, I expect competition to catch up rapidly given the large opportunity, as well as many customers to delay upgrade plans due to the tough macro environment. I also wonder if NVDA can fulfill so many orders given that foundry partners are already maxed out on capacity.

The rally in the NVDA stock price is not necessarily a bubble, but it looks more and more like a bubble the more I try to justify it. I reiterate my neutral rating on Nvidia Corporation, as the necessary assumptions are too aggressive to get to market-beating returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!